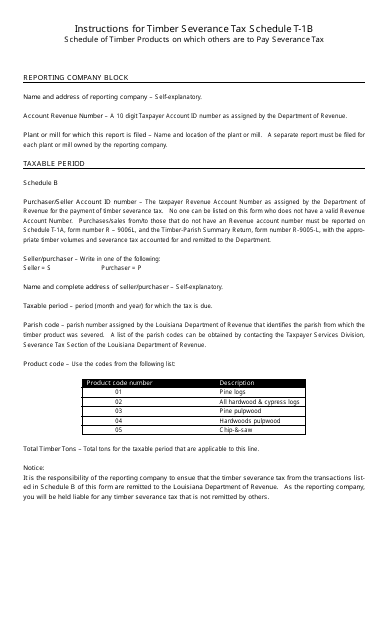

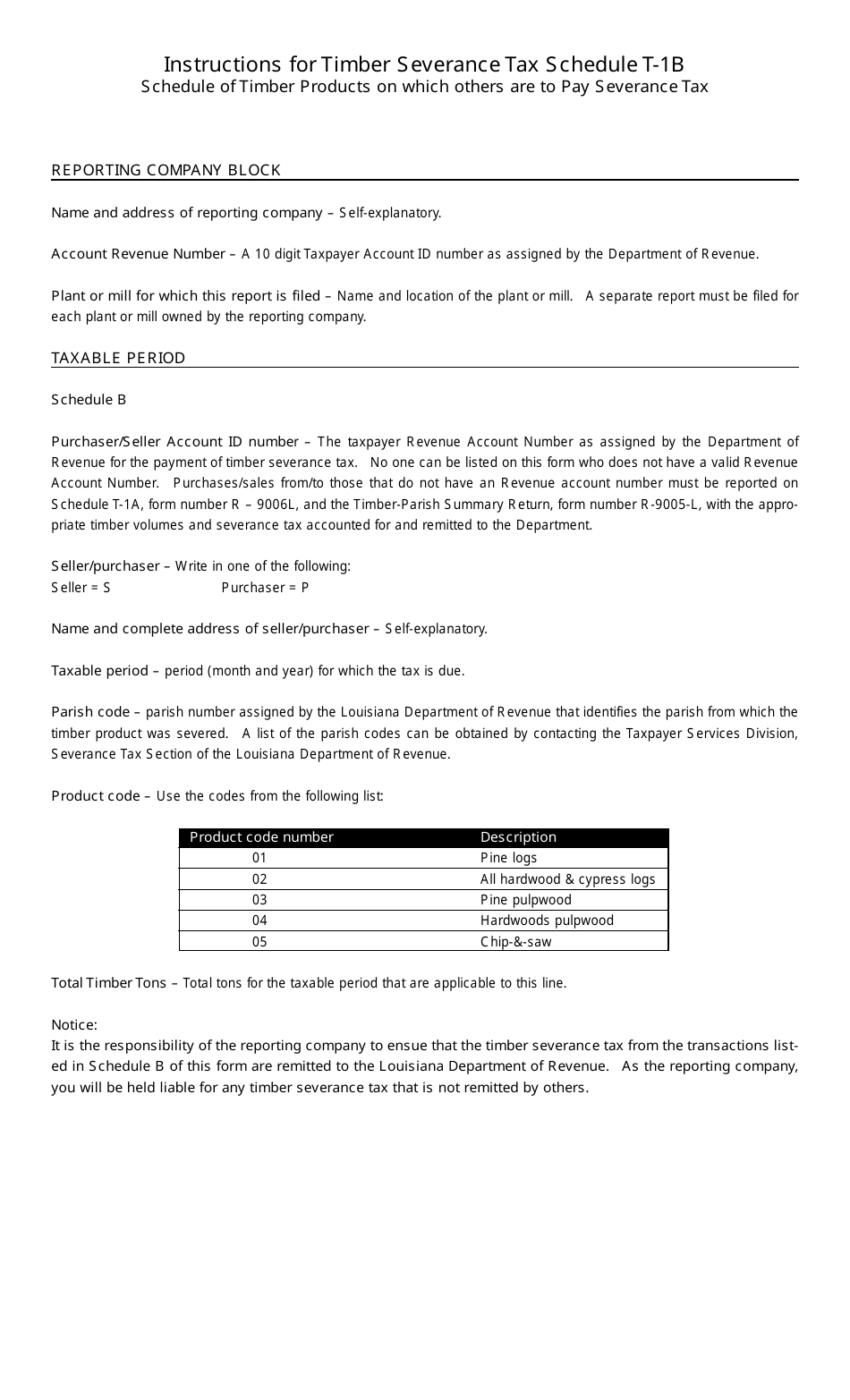

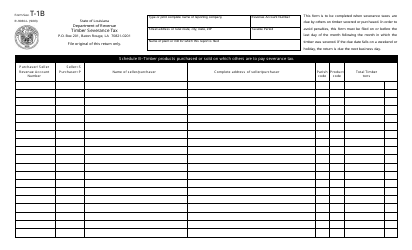

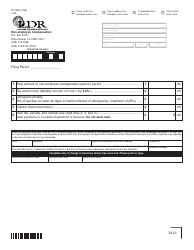

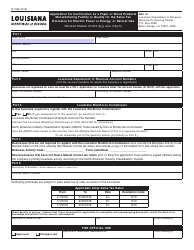

Instructions for Form R-9030-L Schedule T-1B Schedule of Timber Products on Which Others Are to Pay Severance Tax - Louisiana

This document contains official instructions for Form R-9030-L Schedule T-1B, Schedule of Timber Products on Which Others Are to Pay Severance Tax - a form released and collected by the Louisiana Department of Revenue.

FAQ

Q: What is Form R-9030-L?

A: Form R-9030-L is a document used in Louisiana to report timber products subject to severance tax.

Q: What is Schedule T-1B?

A: Schedule T-1B is a specific schedule within Form R-9030-L that is used to report timber products on which others are responsible for paying the severance tax.

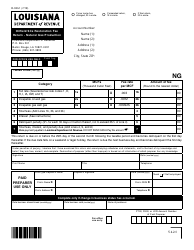

Q: What is severance tax?

A: Severance tax is a tax imposed on the removal of natural resources, such as timber, from the state.

Q: Who is responsible for paying severance tax on timber products?

A: The Schedule T-1B is used to report timber products on which others are responsible for paying the severance tax.

Q: Why is it important to file Form R-9030-L Schedule T-1B?

A: Filing this form ensures that the proper amount of severance tax is paid on timber products on which others are responsible for paying the tax.

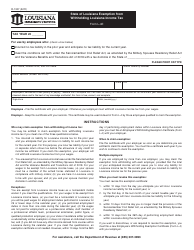

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Louisiana Department of Revenue.