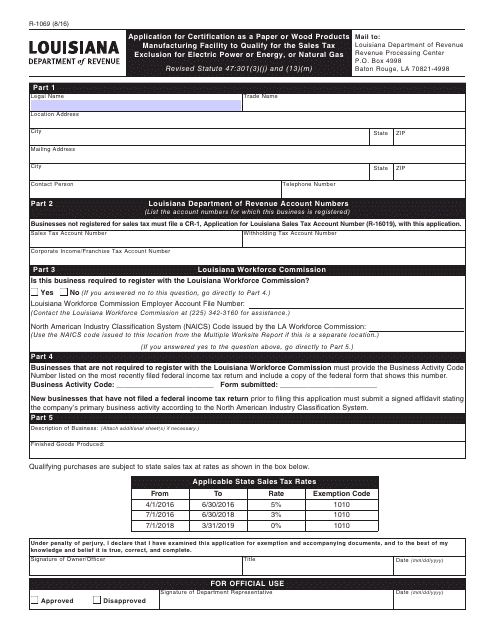

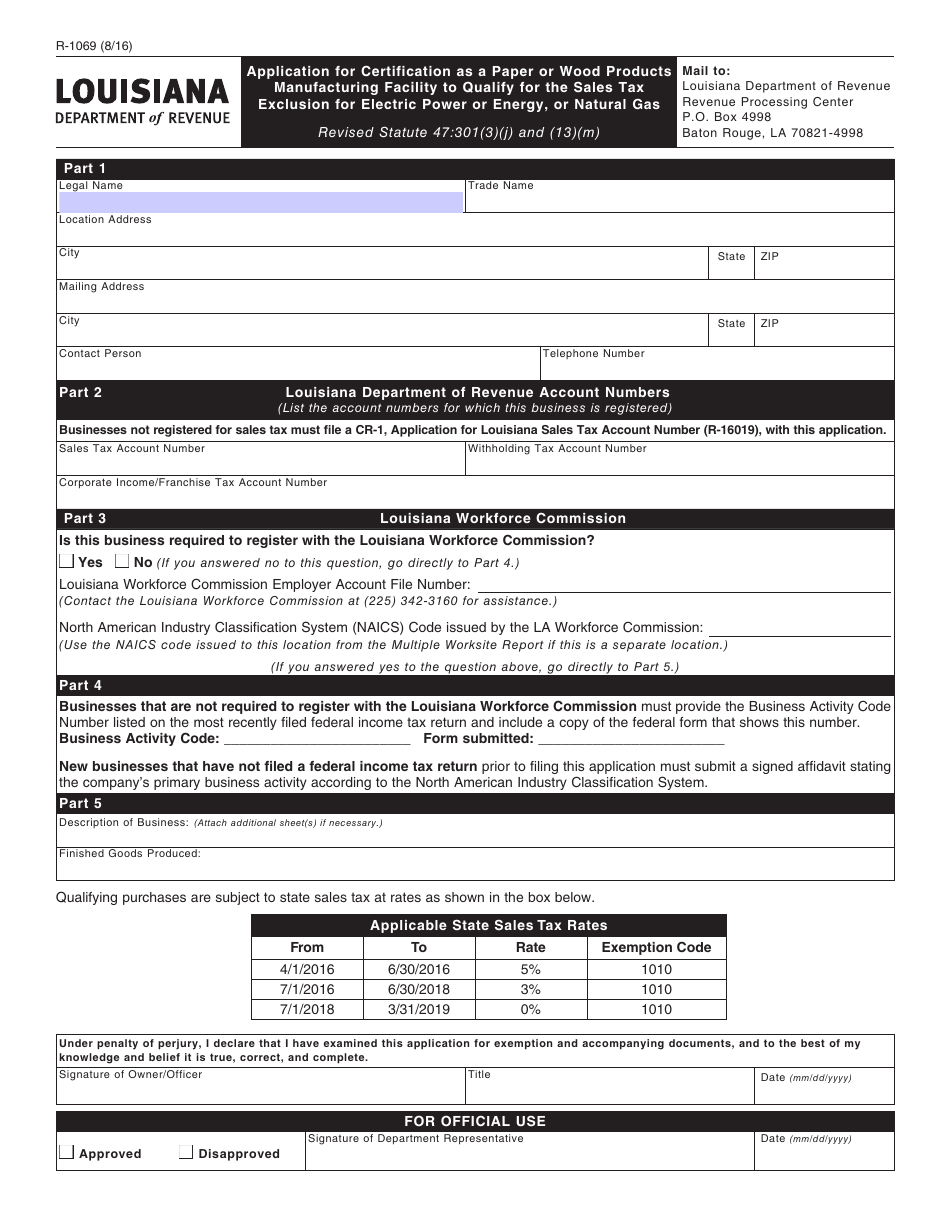

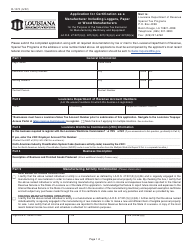

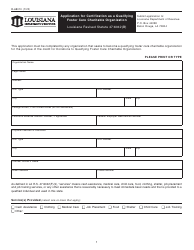

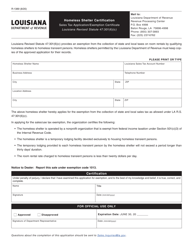

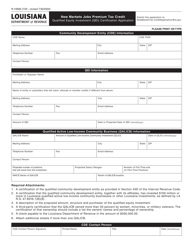

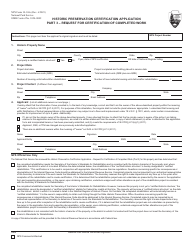

Form R-1069 Application for Certification as a Paper or Wood Products Manufacturing Facility to Qualify for the Sales Tax Exclusion for Electric Power or Energy, or Natural Gas - Louisiana

What Is Form R-1069?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-1069?

A: Form R-1069 is an application for certification as a paper or wood products manufacturing facility in Louisiana.

Q: What is the purpose of Form R-1069?

A: The purpose of Form R-1069 is to qualify for the sales tax exclusion for electric power or energy, or natural gas.

Q: Who can use Form R-1069?

A: Paper or wood products manufacturing facilities in Louisiana can use Form R-1069.

Q: What is the sales tax exclusion for electric power or energy, or natural gas?

A: It is an exemption from sales tax for paper or wood products manufacturing facilities on electric power or energy, or natural gas used in their manufacturing processes.

Q: Are there any fees associated with Form R-1069?

A: There are no fees associated with Form R-1069.

Q: Are there any deadlines for submitting Form R-1069?

A: There is no specific deadline mentioned for submitting Form R-1069. It is recommended to submit the form as soon as possible.

Q: What happens after submitting Form R-1069?

A: After submitting Form R-1069, the Louisiana Department of Revenue will review your application and notify you of the certification status.

Q: Can I claim the sales tax exclusion before receiving certification?

A: No, you cannot claim the sales tax exclusion before receiving certification as a paper or wood products manufacturing facility.

Form Details:

- Released on August 1, 2016;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1069 by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.