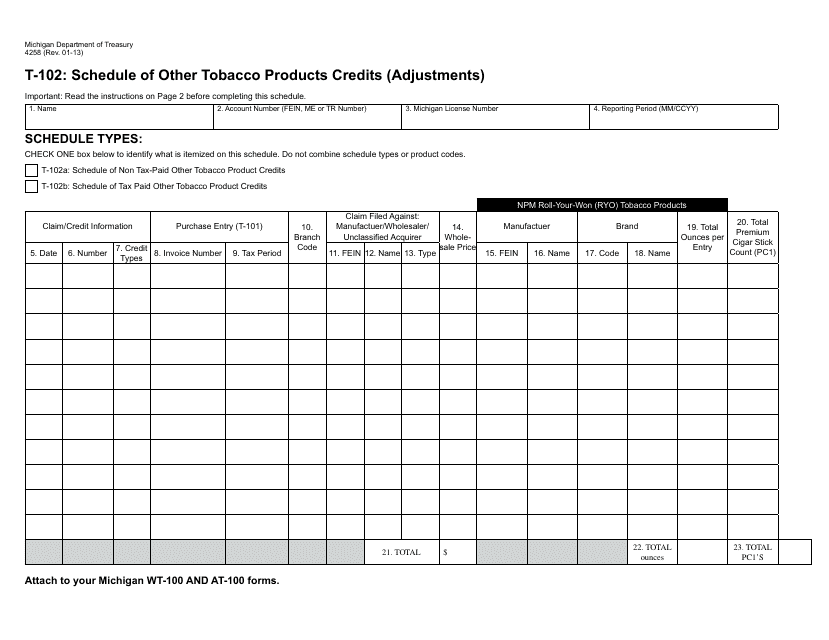

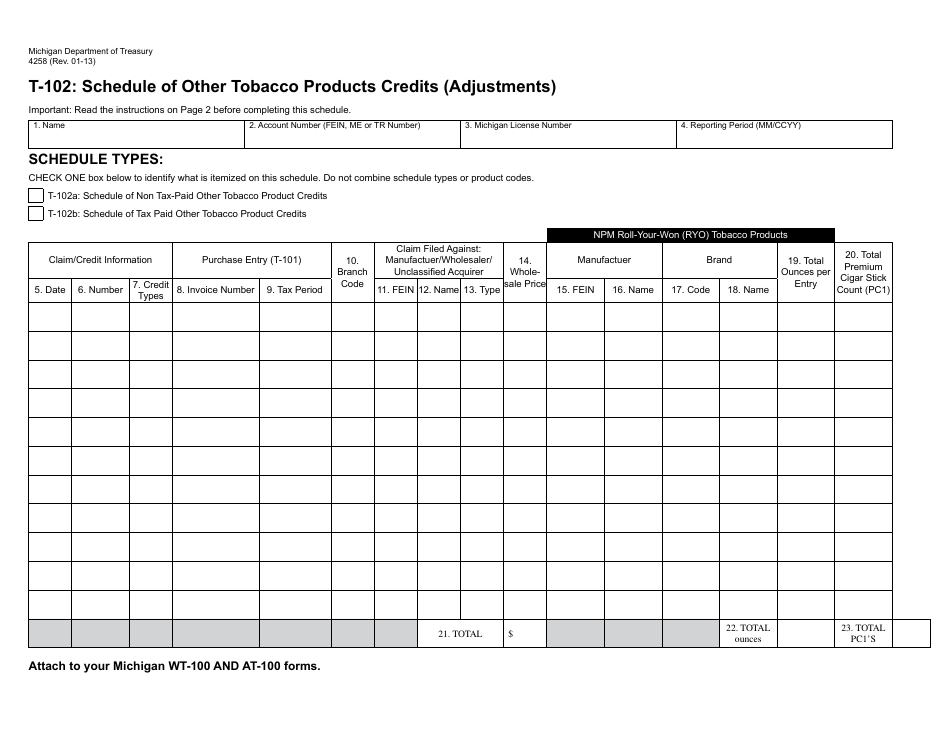

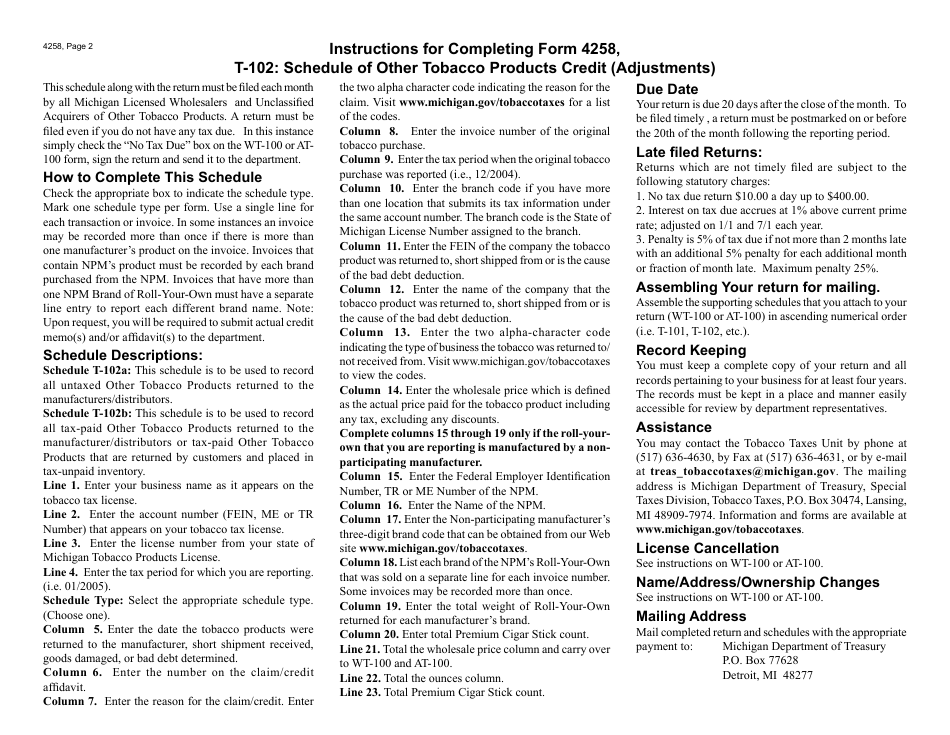

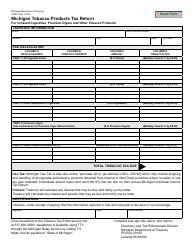

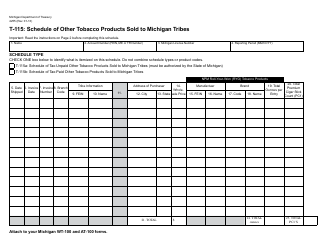

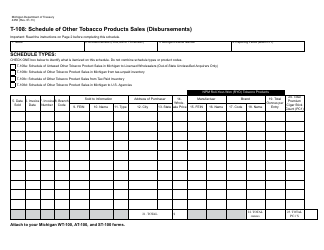

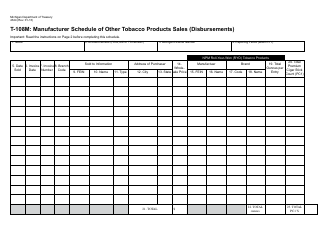

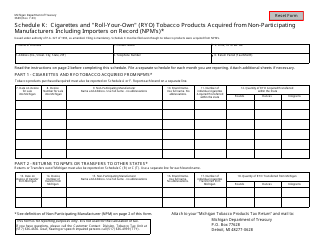

Form 4258 Schedule T-102 Schedule of Other Tobacco Products Credits (Adjustments) - Michigan

What Is Form 4258 Schedule T-102?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4258 Schedule T-102?

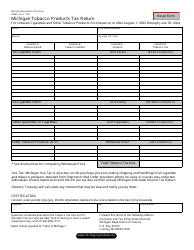

A: Form 4258 Schedule T-102 is a schedule used in Michigan to report Other Tobacco Products Credits (Adjustments).

Q: What are Other Tobacco Products Credits?

A: Other Tobacco Products Credits are credits related to the sale and use of tobacco productsother than cigarettes.

Q: Why do I need to file Form 4258 Schedule T-102?

A: You need to file Form 4258 Schedule T-102 to report and claim any credits or adjustments related to other tobacco products in Michigan.

Q: Are there any specific instructions for filling out Form 4258 Schedule T-102?

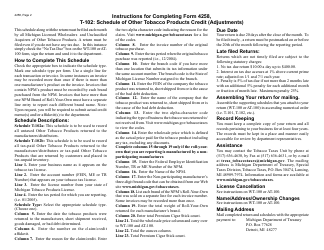

A: Yes, you need to carefully follow the instructions provided on the form to accurately report the Other Tobacco Products Credits and adjustments.

Q: When is the deadline for filing Form 4258 Schedule T-102?

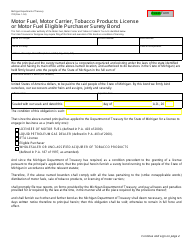

A: The deadline for filing Form 4258 Schedule T-102 in Michigan is determined by the tax filing deadlines set by the Michigan Department of Treasury.

Q: Is there any penalty for not filing Form 4258 Schedule T-102?

A: Failure to file Form 4258 Schedule T-102 or reporting incorrect information may result in penalties imposed by the Michigan Department of Treasury.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 4258 Schedule T-102 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.