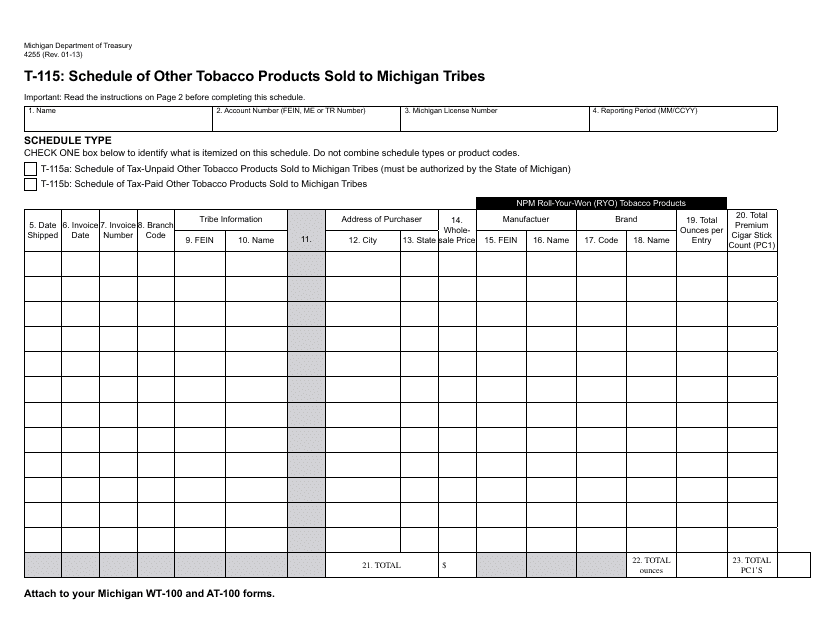

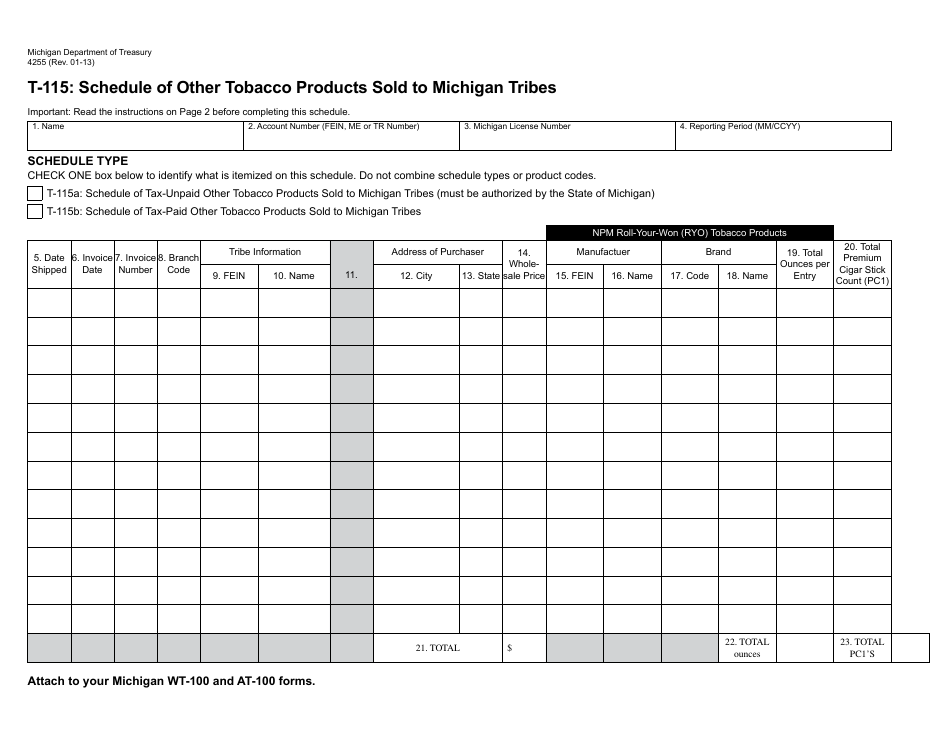

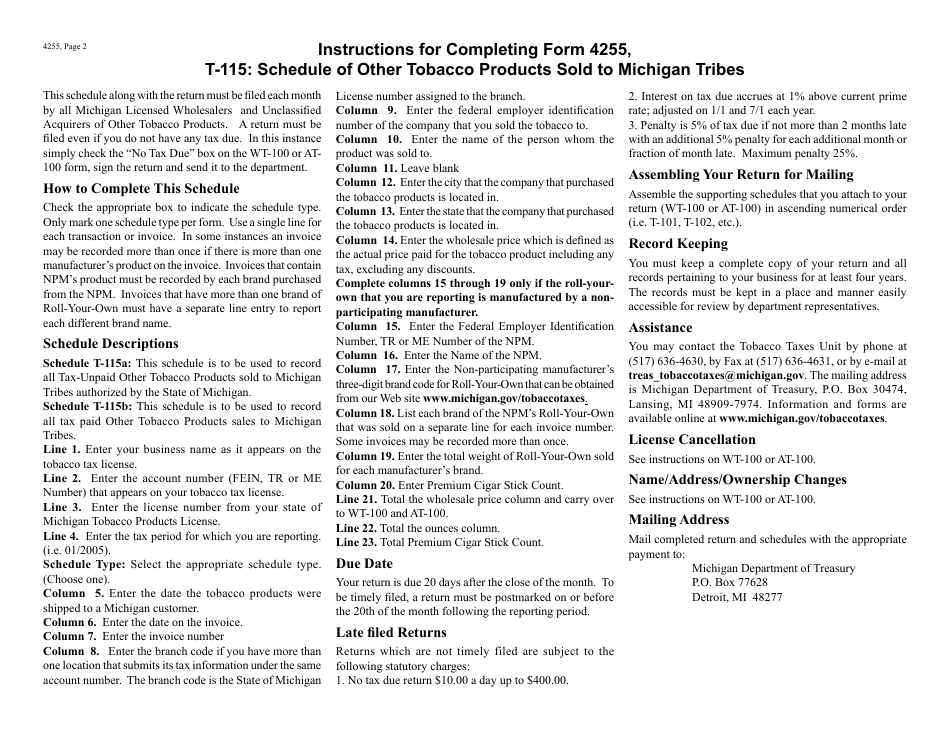

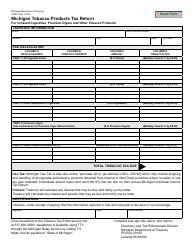

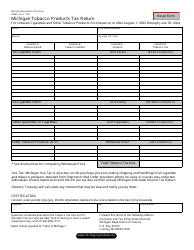

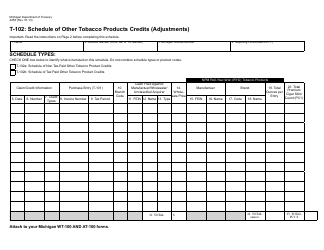

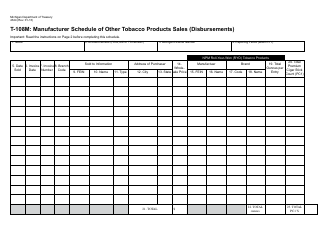

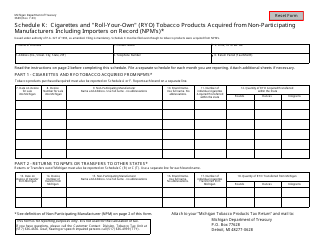

Form 4255 Schedule T-115 Schedule of Other Tobacco Products Sold to Michigan Tribes - Michigan

What Is Form 4255 Schedule T-115?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4255 Schedule T-115?

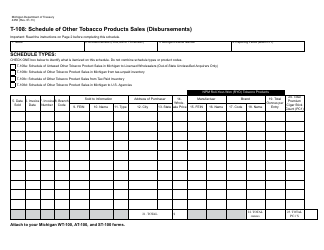

A: Form 4255 Schedule T-115 is a schedule used to report the sales of other tobacco products to Michigan tribes.

Q: What are other tobacco products?

A: Other tobacco products refer to tobacco products other than cigarettes, such as cigars, pipe tobacco, snuff, and chewing tobacco.

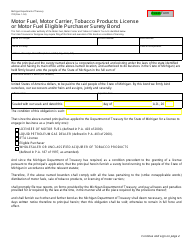

Q: Who is required to file Form 4255 Schedule T-115?

A: Any entity that sells other tobacco products to Michigan tribes is required to file Form 4255 Schedule T-115.

Q: What is the purpose of filing this form?

A: The purpose of filing Form 4255 Schedule T-115 is to report the sales of other tobacco products to Michigan tribes.

Q: Are there any exemptions or thresholds for filing this form?

A: No, there are no exemptions or thresholds for filing Form 4255 Schedule T-115. All sales of other tobacco products to Michigan tribes must be reported.

Q: When is Form 4255 Schedule T-115 due?

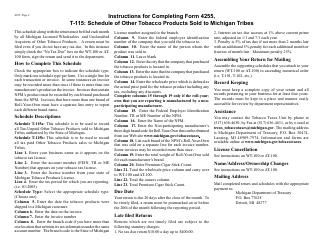

A: Form 4255 Schedule T-115 is due on or before the 20th day of the month following the end of each reporting period.

Q: What happens if I fail to file Form 4255 Schedule T-115?

A: Failure to file Form 4255 Schedule T-115 or filing it late may result in penalties and interest.

Q: How can I get more information or assistance with Form 4255 Schedule T-115?

A: For more information or assistance with Form 4255 Schedule T-115, you can contact the Michigan Department of Treasury.

Form Details:

- Released on January 1, 2013;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form 4255 Schedule T-115 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.