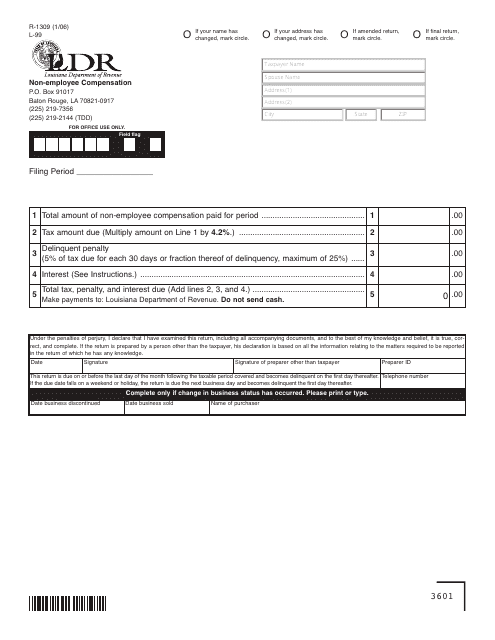

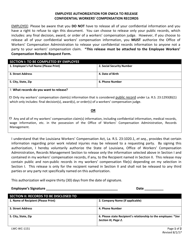

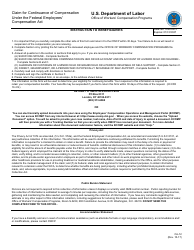

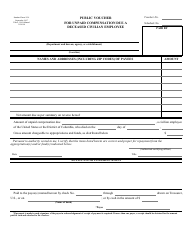

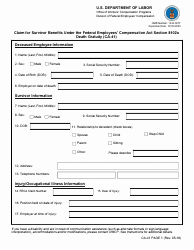

Form R-1309 (L-99) Non-employee Compensation - Louisiana

What Is Form R-1309 (L-99)?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form R-1309 (L-99)?

A: Form R-1309 (L-99) is a form used in Louisiana for reporting non-employee compensation.

Q: What is non-employee compensation?

A: Non-employee compensation refers to income received by individuals who are not employees but are instead independent contractors or self-employed.

Q: Who needs to file Form R-1309 (L-99)?

A: Individuals who receive non-employee compensation in Louisiana need to file Form R-1309 (L-99).

Q: What information is required on Form R-1309 (L-99)?

A: Form R-1309 (L-99) requires information such as the recipient's name, address, and Social Security Number, as well as details of the non-employee compensation received.

Q: When is the deadline for filing Form R-1309 (L-99)?

A: The deadline for filing Form R-1309 (L-99) in Louisiana is January 31st of the following year.

Q: Are there any penalties for not filing Form R-1309 (L-99)?

A: Yes, there can be penalties for not filing Form R-1309 (L-99) or for filing it late. It is important to comply with the filing requirements to avoid any penalties.

Form Details:

- Released on January 1, 2006;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-1309 (L-99) by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.