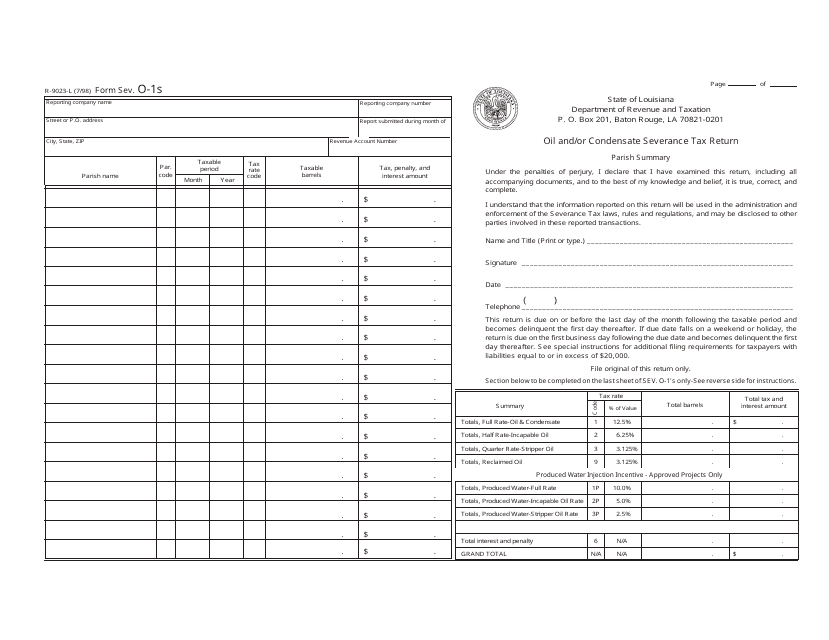

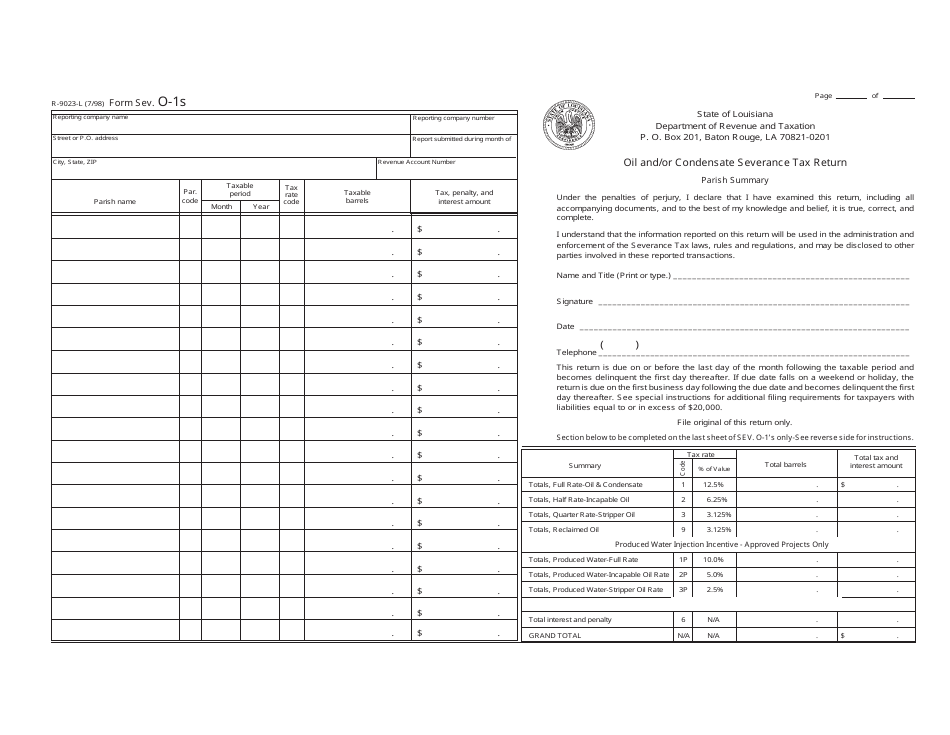

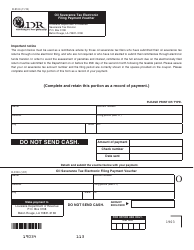

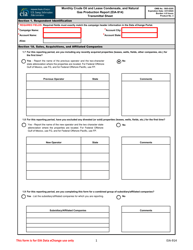

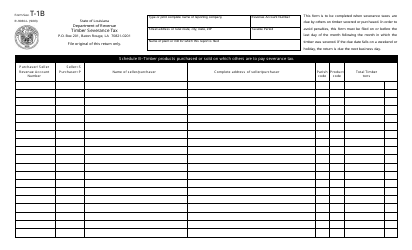

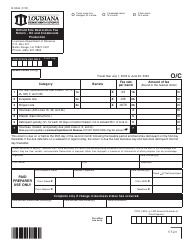

Form R-9023-L (SEV. O-1S) Oil and / or Condensate Severance Tax Return - Louisiana

What Is Form R-9023-L (SEV. O-1S)?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-9023-L?

A: Form R-9023-L is the Oil and/or Condensate Severance Tax Return for Louisiana.

Q: Who needs to file Form R-9023-L?

A: Any individual or company engaged in the production of oil and/or condensate in Louisiana needs to file this form.

Q: What is the purpose of Form R-9023-L?

A: The purpose of this form is to report and pay the severance tax on oil and/or condensate extracted in Louisiana.

Q: When is Form R-9023-L due?

A: Form R-9023-L is due on the 25th day of the month following the month in which the oil and/or condensate was produced.

Q: Are there any penalties for late filing or non-compliance?

A: Yes, there are penalties for late filing or non-compliance, including fines and possible legal action.

Form Details:

- Released on July 1, 1998;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form R-9023-L (SEV. O-1S) by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.