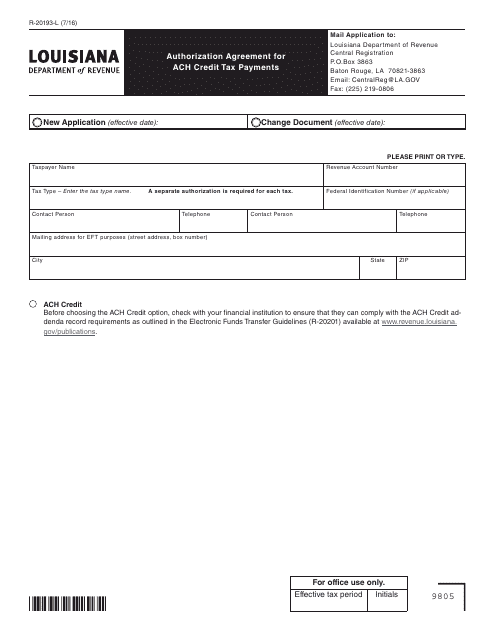

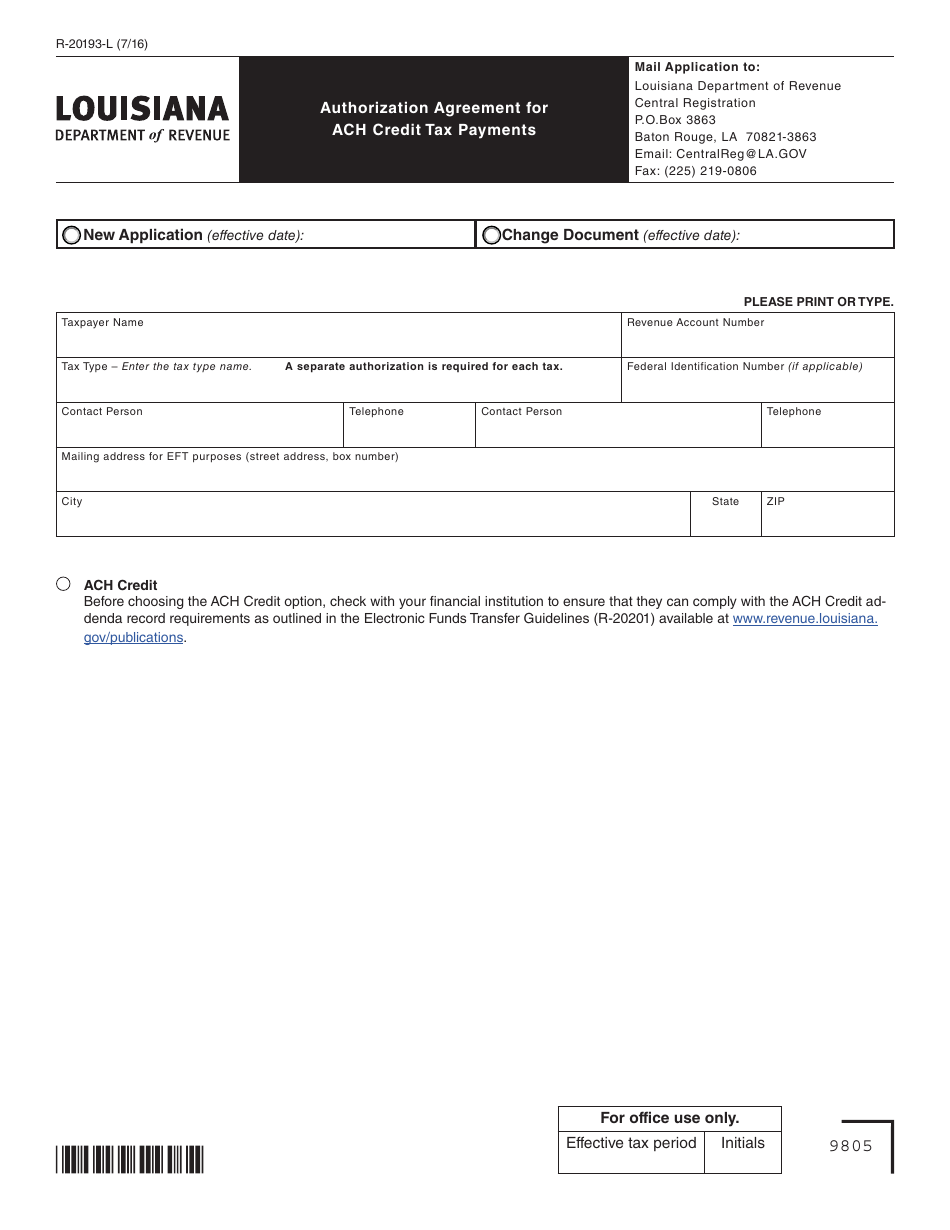

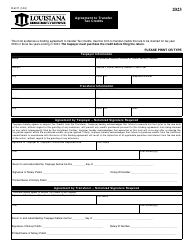

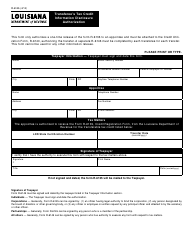

Form R-20193-L Authorization Agreement for ACH Credit Tax Payments - Louisiana

What Is Form R-20193-L?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form R-20193-L?

A: Form R-20193-L is an Authorization Agreement for ACH Credit Tax Payments specific to Louisiana.

Q: What is ACH?

A: ACH stands for Automated Clearing House, which is an electronic payment system.

Q: What is the purpose of Form R-20193-L?

A: The purpose of Form R-20193-L is to authorize the Louisiana Department of Revenue to automatically withdraw tax payments from your bank account.

Q: Is Form R-20193-L only applicable for tax payments in Louisiana?

A: Yes, Form R-20193-L is specific to tax payments in Louisiana.

Q: How do I use Form R-20193-L?

A: To use Form R-20193-L, you need to provide your bank account details, including the routing number, and sign the form to authorize the Louisiana Department of Revenue to withdraw tax payments.

Q: Can I cancel the authorization on Form R-20193-L?

A: Yes, you can cancel the authorization by submitting a written request to the Louisiana Department of Revenue.

Q: Are there any fees associated with using Form R-20193-L?

A: There are no additional fees for using Form R-20193-L to make tax payments.

Q: Who can I contact for more information about Form R-20193-L?

A: For more information about Form R-20193-L, you can contact the Louisiana Department of Revenue.

Form Details:

- Released on July 1, 2016;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-20193-L by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.