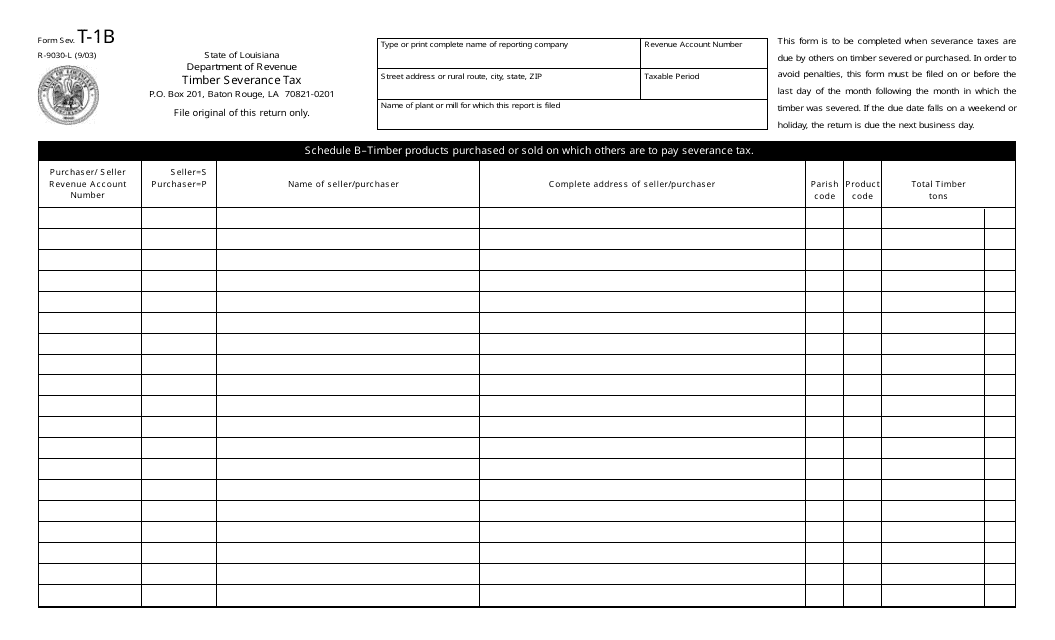

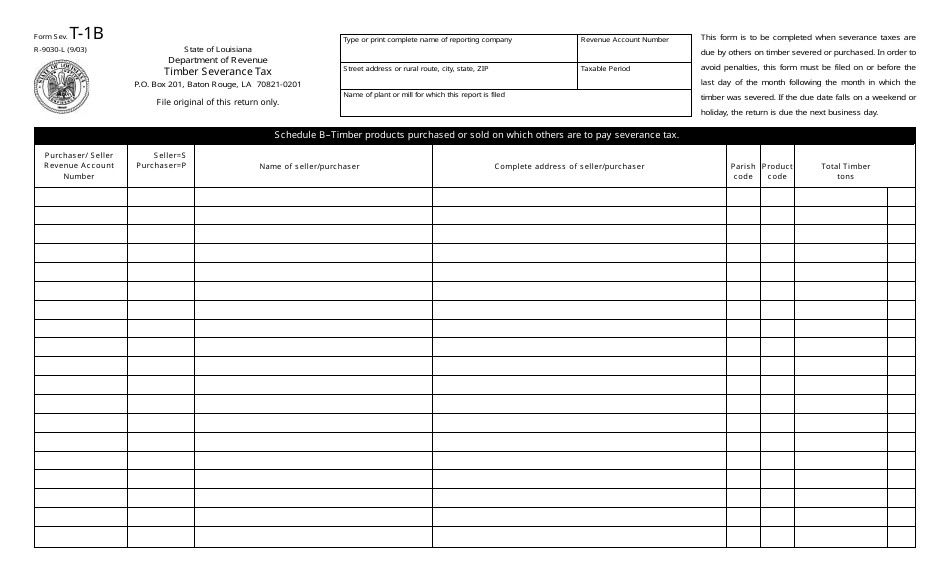

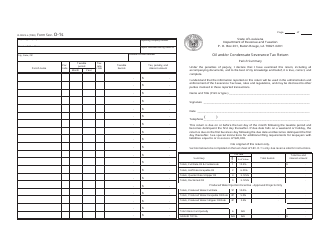

Form R-9030-L (SEV. T-1B) Timber Severance Tax - Louisiana

What Is Form R-9030-L (SEV. T-1B)?

This is a legal form that was released by the Louisiana Department of Revenue - a government authority operating within Louisiana. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form R-9030-L?

A: Form R-9030-L is the Timber Severance Tax form used in Louisiana.

Q: What is the purpose of Form R-9030-L?

A: Form R-9030-L is used to report and pay the Timber Severance Tax in Louisiana for the severance of timber.

Q: Who needs to file Form R-9030-L?

A: Any person or business engaged in the severance of timber in Louisiana must file Form R-9030-L.

Q: When is Form R-9030-L due?

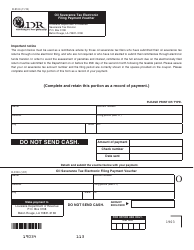

A: Form R-9030-L is due on a monthly basis, with the tax and return due by the 20th day of the following month.

Q: Are there any penalties for late filing or payment?

A: Yes, penalties may apply for late filing or payment of the Timber Severance Tax, including interest charges.

Form Details:

- Released on September 1, 2003;

- The latest edition provided by the Louisiana Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form R-9030-L (SEV. T-1B) by clicking the link below or browse more documents and templates provided by the Louisiana Department of Revenue.