Tax Forms and Templates

Tax forms are official government documents used to report and calculate the amount of tax an individual or business owes to the government. These forms typically require taxpayers to provide information about their income, deductions, credits, and other relevant financial details. Tax forms are essential for complying with tax laws and regulations and accurately reporting one's tax liability. The specific purpose of tax forms can vary depending on factors such as the type of tax being reported and the jurisdiction in which the taxpayer resides.

Related Articles

Documents:

197

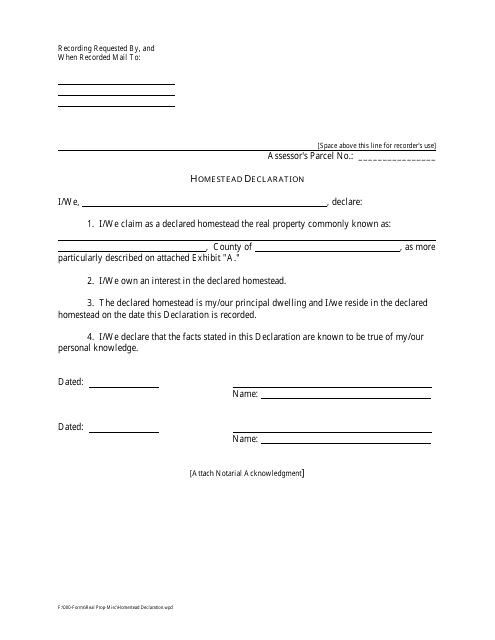

This Form is used for declaring a property as a homestead, offering certain legal protections to the homeowner in the event of financial hardship or personal crisis.

This form is used for individuals in India to declare their eligibility for a tax exemption on interest income or income from units without deduction of tax.

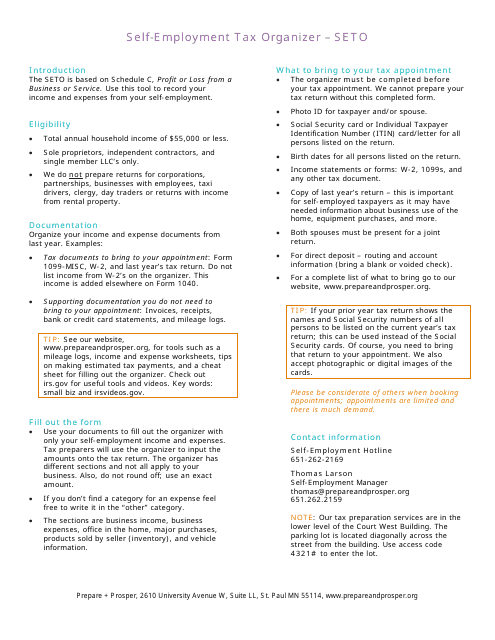

This document is a template used for organizing self-employment taxes. It helps self-employed individuals keep track of their income, expenses, and deductions for tax reporting purposes.

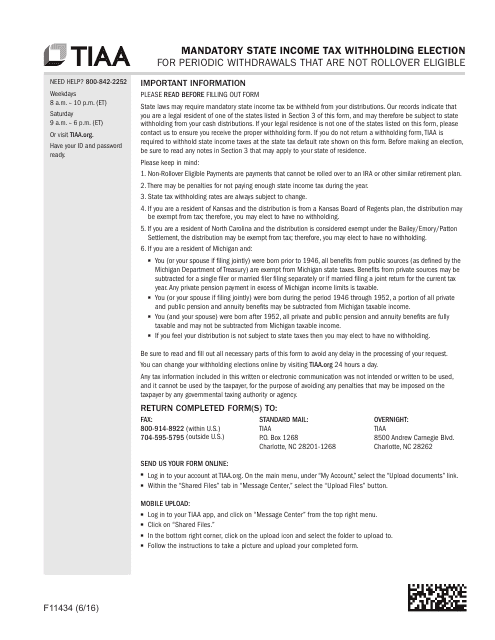

This form is used for making a mandatory state income tax withholding election for periodic withdrawals that are not rollover eligible with TIAA.

This document certifies the tax status of a property transfer in Stanly County, North Carolina. It verifies that all taxes related to the property have been paid or are up to date.

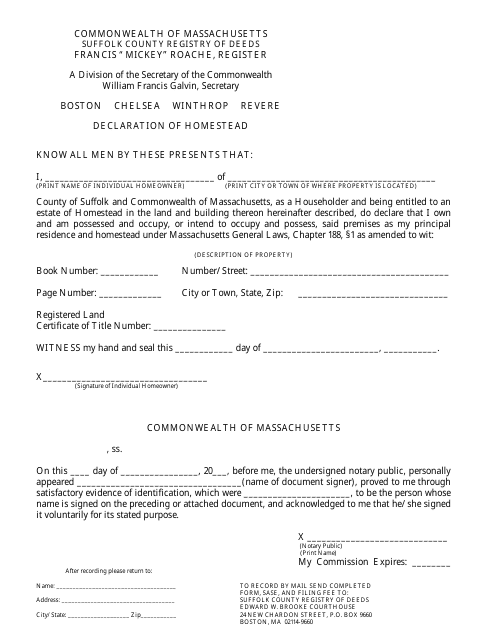

This form is used for declaring a homestead exemption in Suffolk County, Massachusetts. A homestead exemption is a legal protection that helps homeowners protect a portion of their home's value from creditors in case of bankruptcy or other financial hardships.

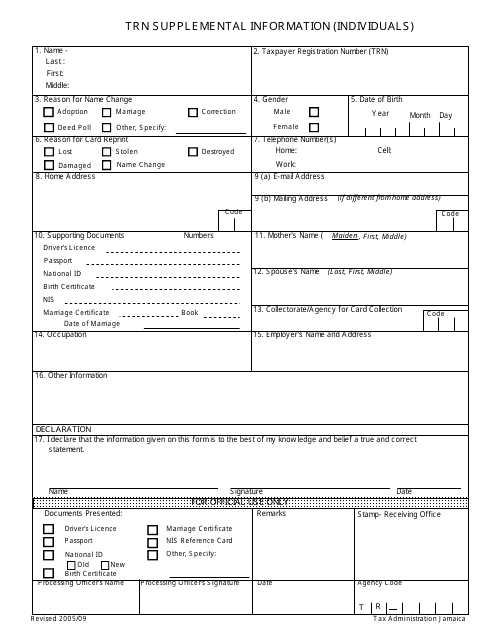

This document provides additional information for individuals applying for a TRN (Taxpayer Registration Number) in Jamaica. It includes supplemental details required for the TRN application process.

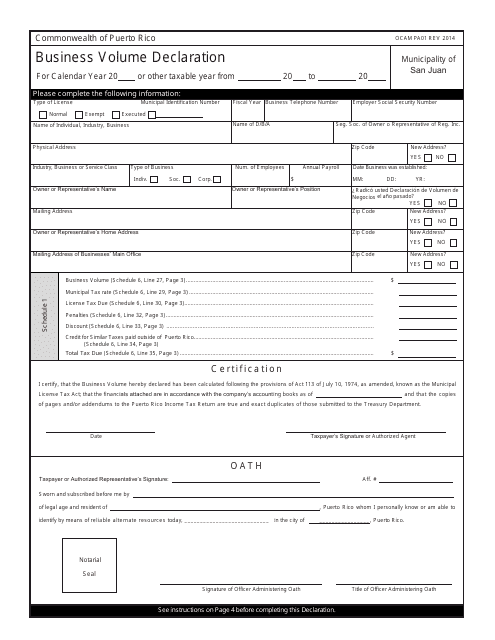

This form is used for declaring the business volume in Puerto Rico.

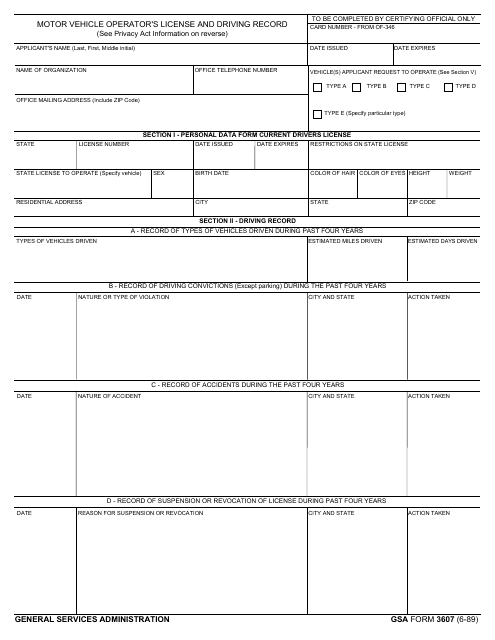

This form is used for obtaining a motor vehicle operator's license and driving record. It is typically required for individuals who need to operate a vehicle as part of their job duties. The form collects information about the applicant's driving history and verifies their eligibility to drive.

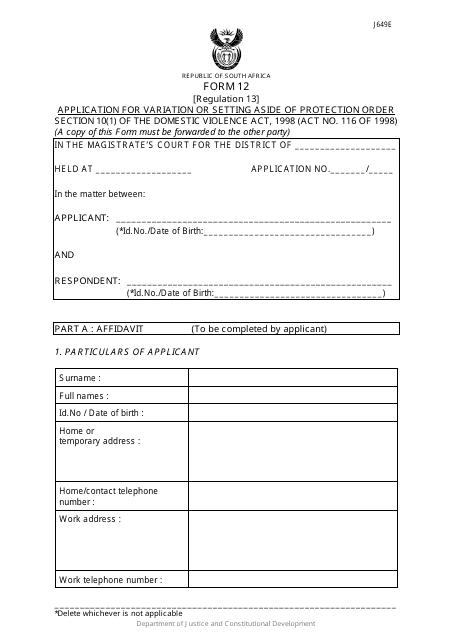

This form is used for applying to vary, set aside, or obtain a protection order in South Africa.

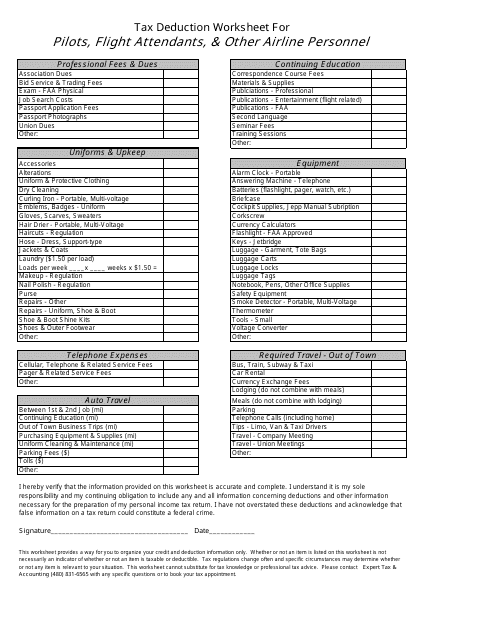

This form is used for calculating tax deductions specific to pilots, flight attendants, and other airline personnel. It helps ensure that eligible expenses related to work in the aviation industry are properly accounted for.

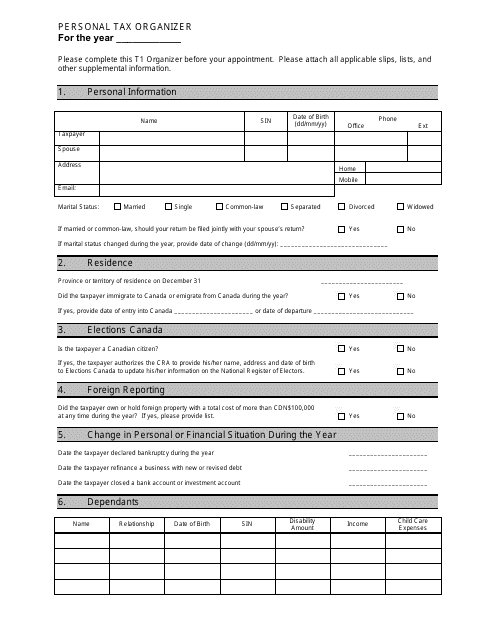

This document is a template that helps individuals organize their personal tax information for filing taxes. It provides sections to record income, expenses, deductions, and other relevant details. Using this template can help simplify the tax filing process.

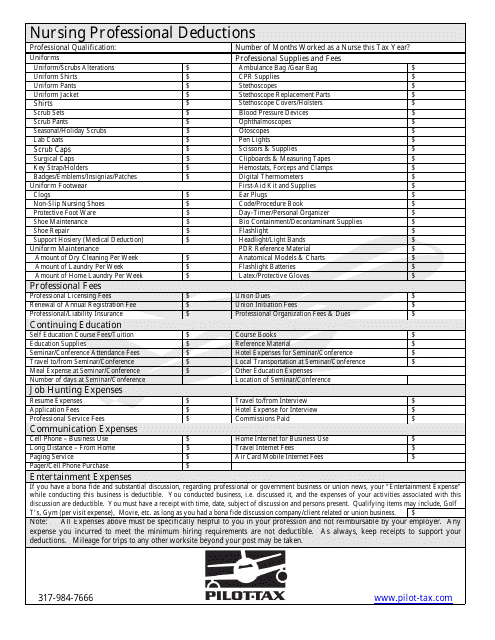

This form is used for nursing professionals to claim deductions related to their profession on their taxes, specifically for pilots.

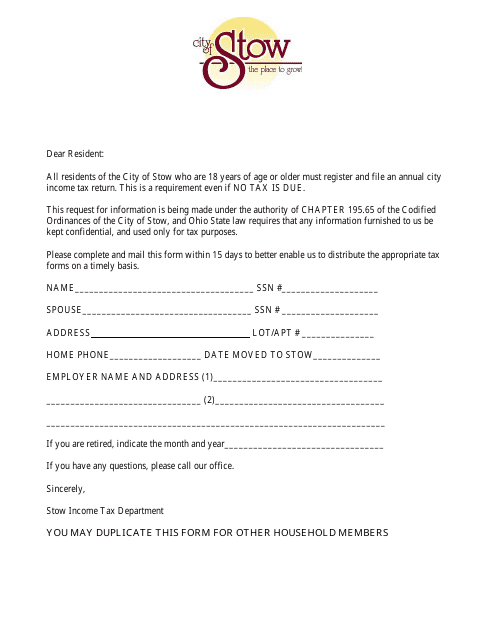

This Form is used for filing your income tax return in the City of Stow, Ohio.

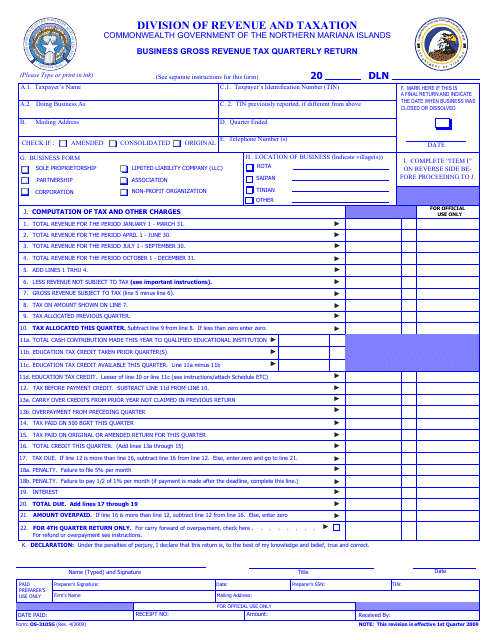

This form is used for filing the Business Gross Revenue Tax Quarterly Return in the Northern Mariana Islands.

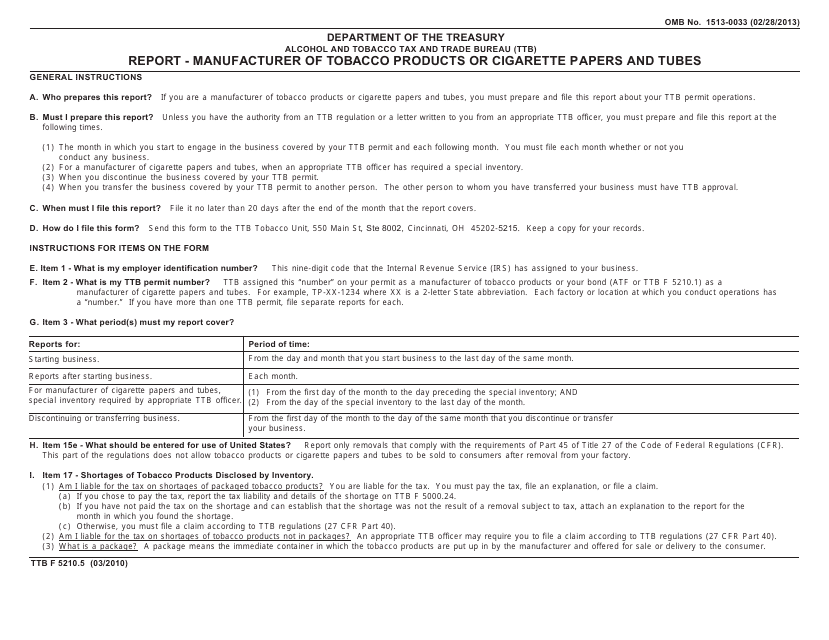

This document is used for reporting the information of manufacturers of tobacco products, cigarette papers, and tubes.

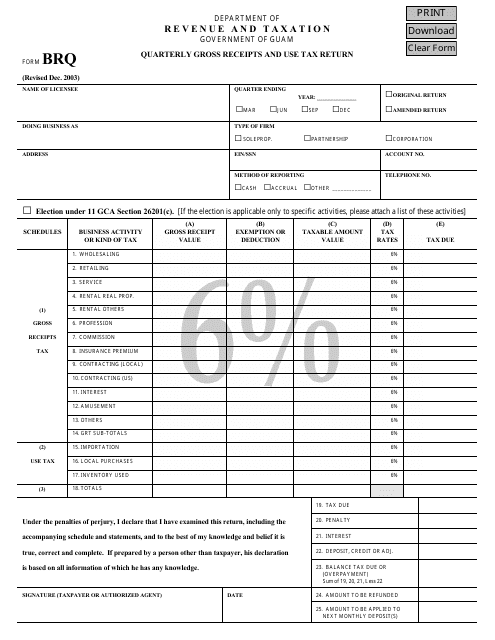

This form is used for reporting quarterly gross receipts and use tax in Guam.

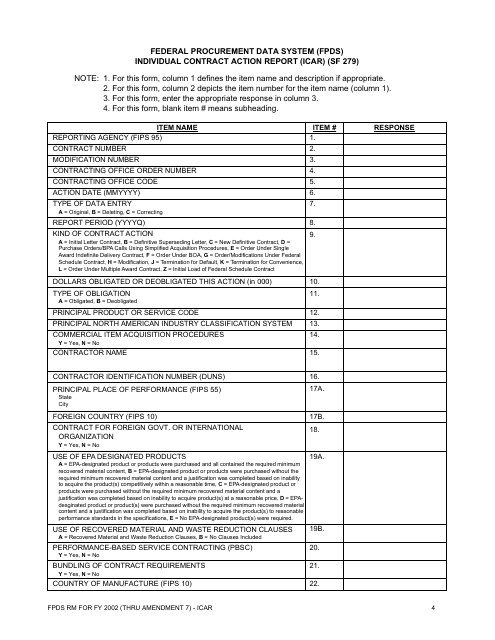

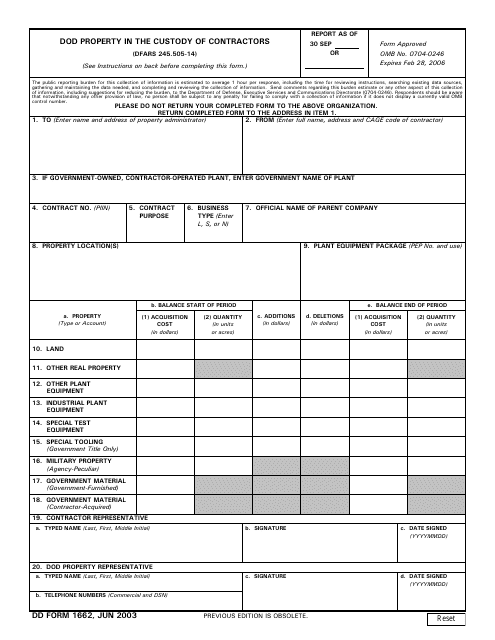

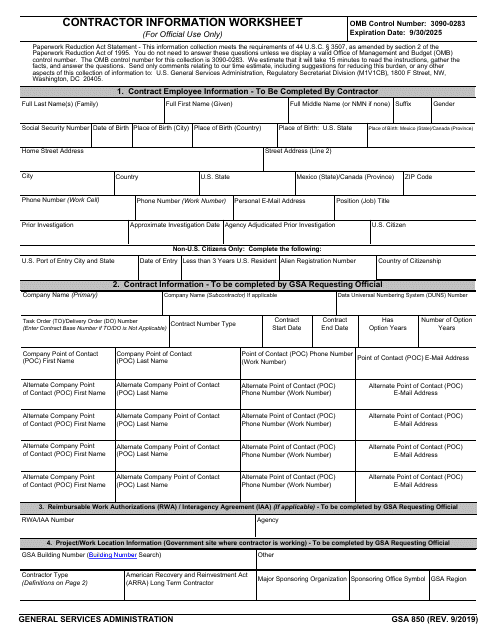

This form is used for reporting individual contract actions in the Federal Procurement Data System (FPDS). It provides detailed information about the contracts awarded by the federal government.

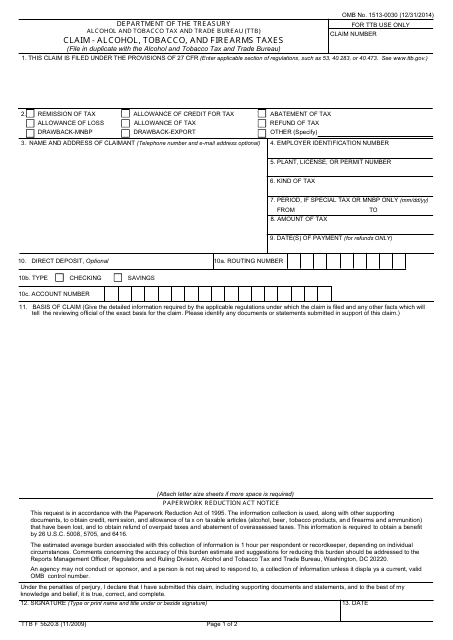

This form is used for claiming refunds for alcohol, tobacco, and firearms taxes in the United States.

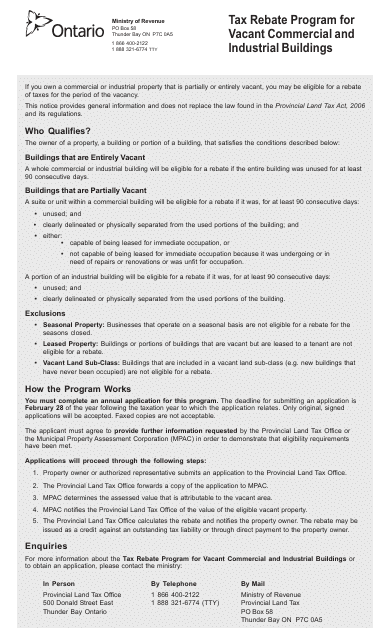

This document is an application for tax rebates available for vacant commercial and industrial buildings under Section 8 of the Provincial Land Tax Act in Ontario, Canada.

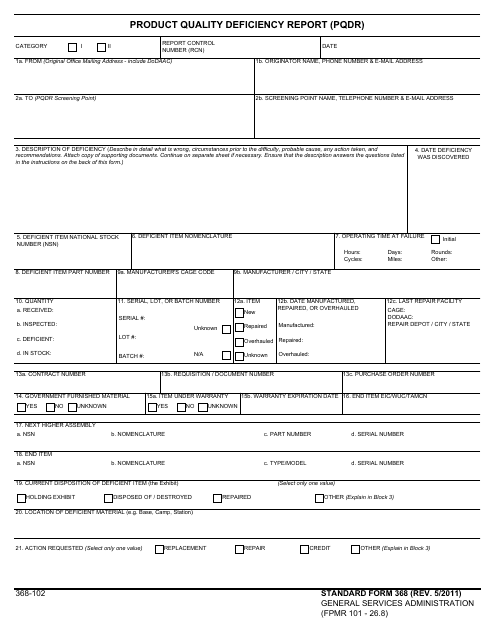

This form is used to report any issues or defects with a product's quality. It helps track and address any deficiencies to improve product quality.

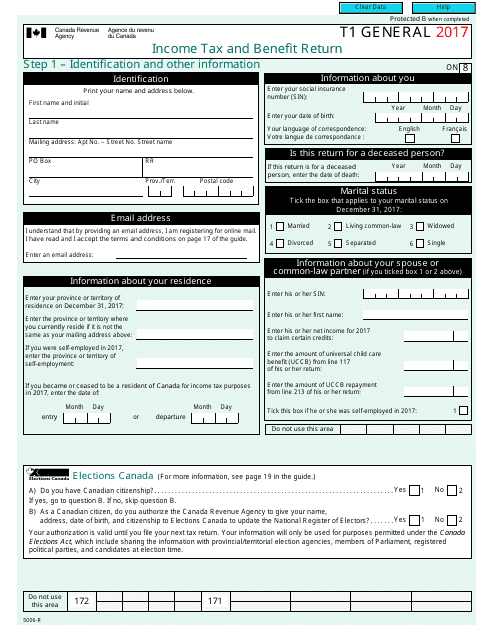

Canadian residents may use this official statement to report their income tax and list all sources of their personal income.

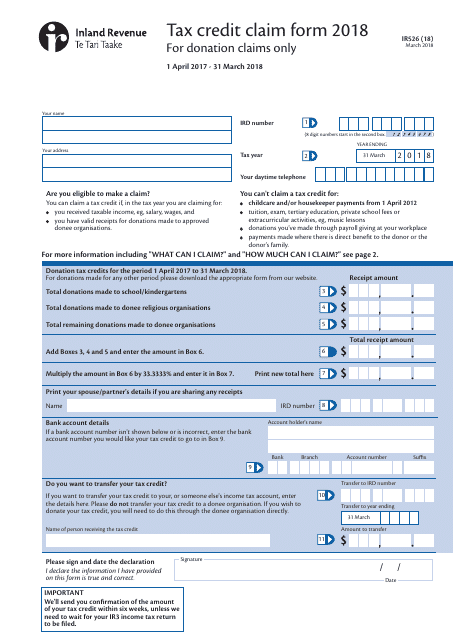

This form is used for claiming tax credits in New Zealand.

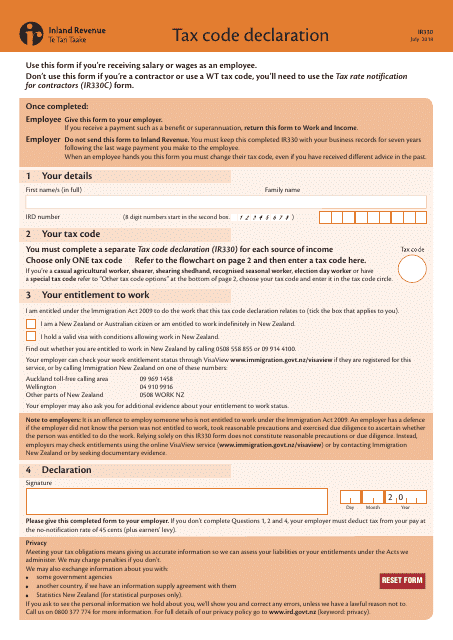

This Form is used for declaring your tax code in New Zealand.

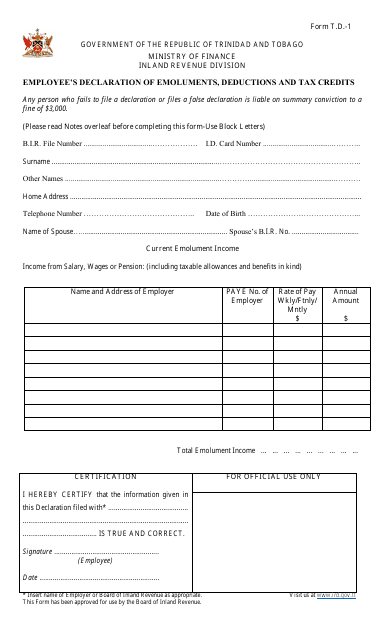

This Form is used for employees in Trinidad and Tobago to declare their income, deductions, and tax credits to the tax authorities.

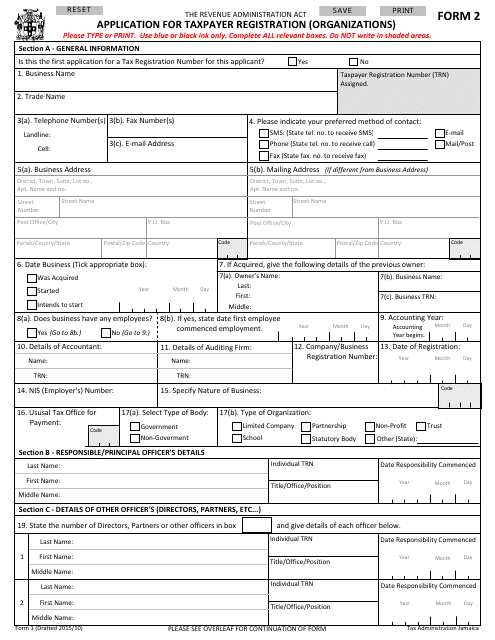

This document is used for organizations in Jamaica to apply for taxpayer registration.

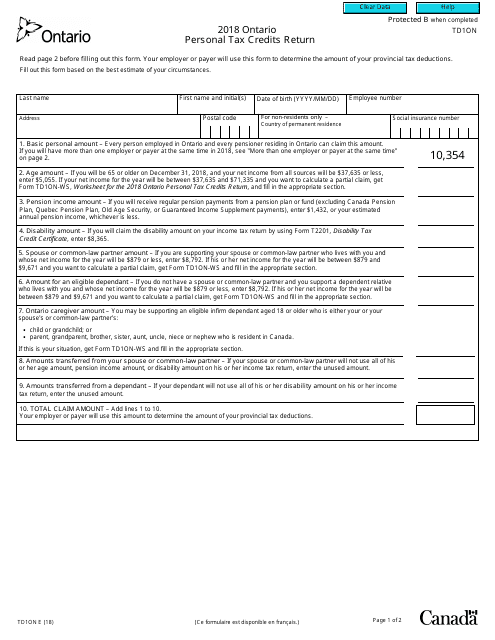

This form is used for reporting personal tax credits and deductions in the province of Ontario, Canada. It is specifically meant for individuals who reside in Ontario and want to claim tax credits that are unique to the province.

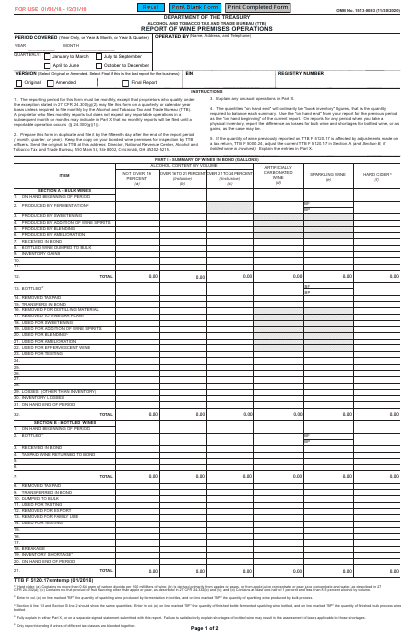

This form is used for reporting wine premises operations.

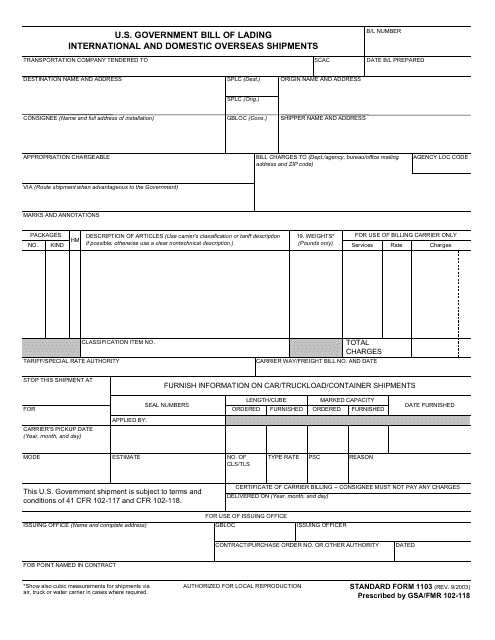

This form is used for creating a U.S. Government Bill of Lading for both international and domestic overseas shipments.

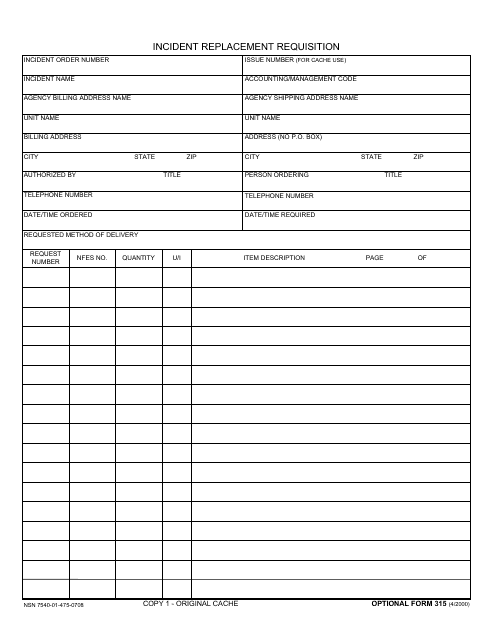

This Form is used for requesting a replacement for lost or damaged items resulting from an incident.

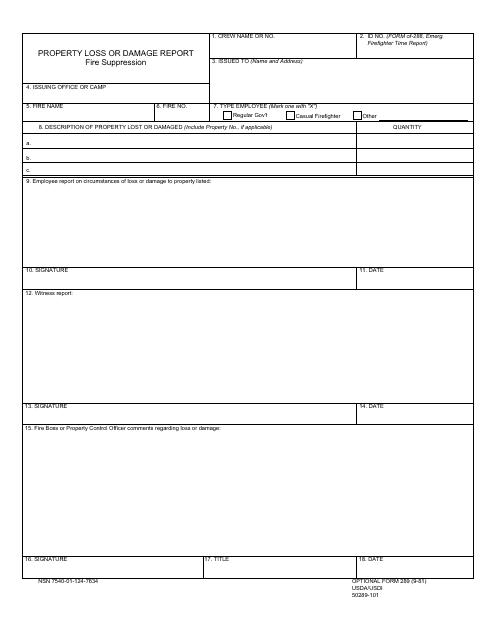

This Form is used for reporting property loss or damage caused by fire suppression.

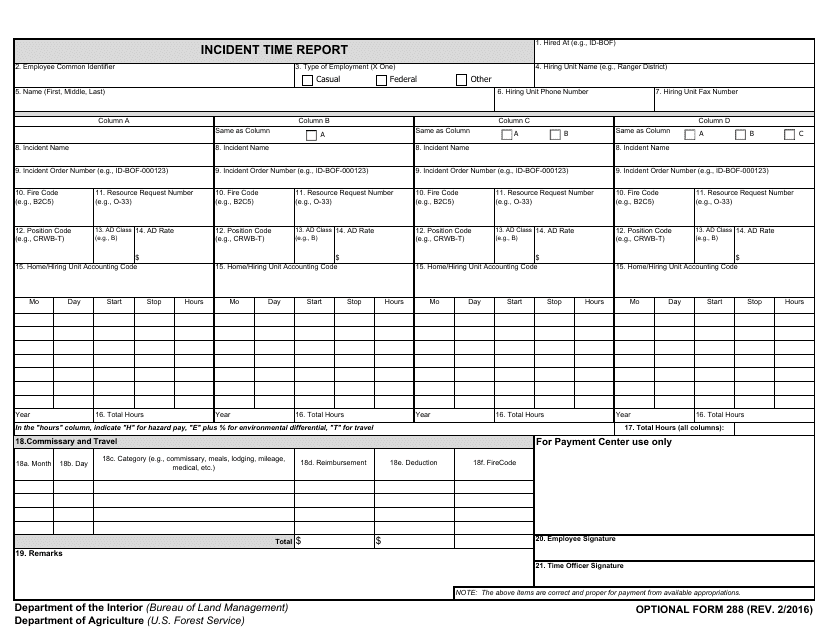

This Form is used for reporting the time of an incident. It contains information about when the incident occurred and is used for record keeping and analysis purposes.

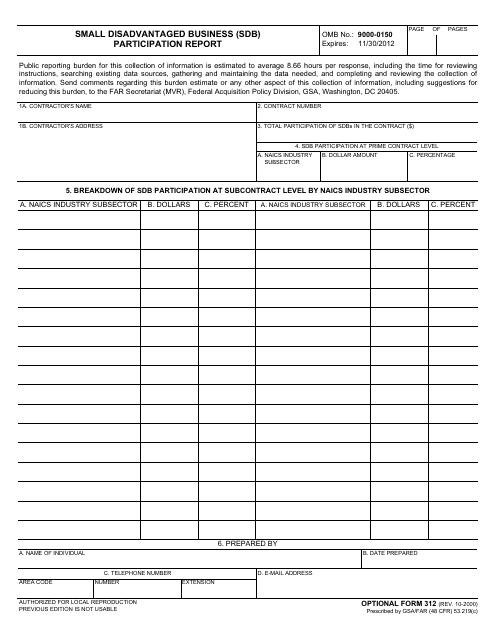

This Form is used for reporting the participation of Small Disadvantaged Businesses (SDBs) in government contracts.

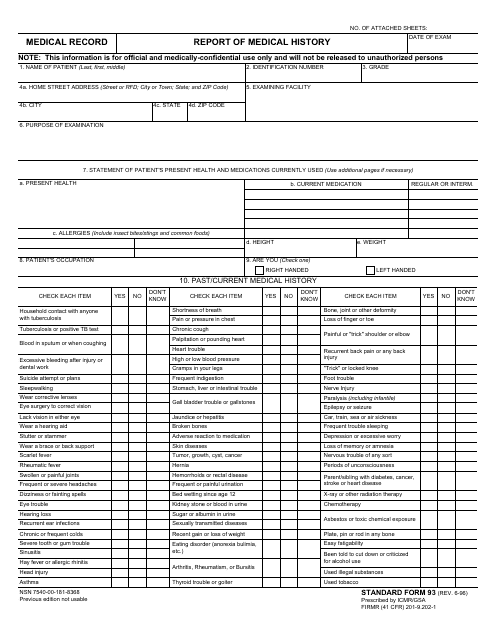

This form is used for gathering information about a person's medical history. It is commonly used by medical professionals to assess an individual's health condition.

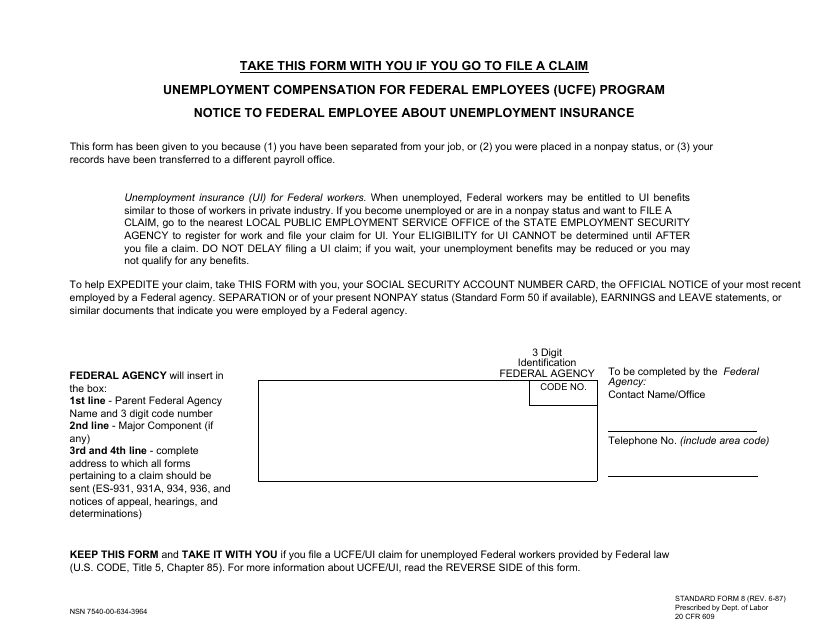

This form is used for notifying federal employees about their eligibility for unemployment insurance under the Unemployment Compensation for Federal Employees program.

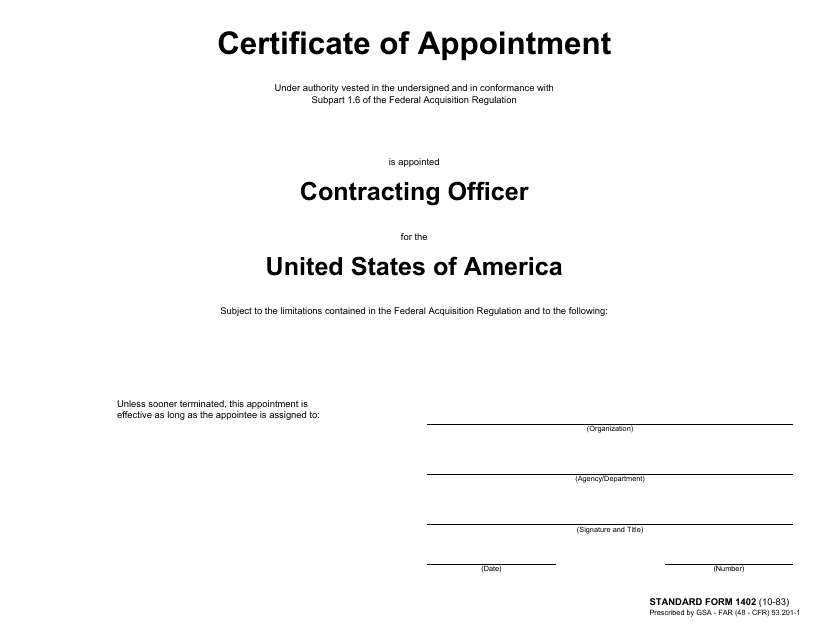

This form is used for certifying an individual's appointment to a federal position.

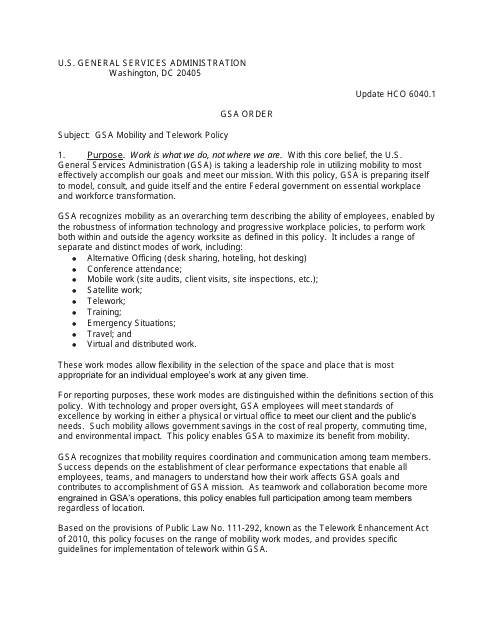

This document is a contract between an employee and the General Services Administration (GSA) regarding remote work arrangements. It outlines the terms and conditions for teleworking, including work hours, responsibilities, and equipment. Use this form to establish an agreement between the employee and the GSA for telecommuting.

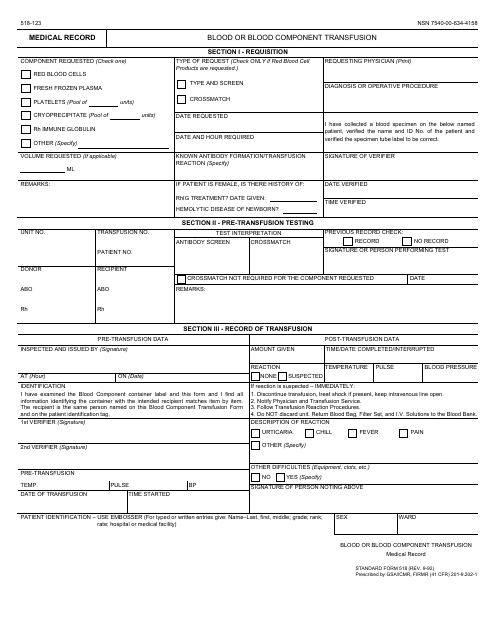

This Form is used for documenting and tracking blood or blood component transfusions.

![Form 15H Declaration Under Section 197a (1a) of the Income Tax Act, 1961 to Be Made by a Persons [not Being a Company or a Firm] Claiming Receipt of Interest Other Than "interest on Securities" or Income in Respect of Units Without Deduction of Tax - India](https://data.templateroller.com/pdf_docs_html/32/322/32275/form-15h-declaration-under-section-197a-1a-the-income-tax-act-1961-to-be-made-by-a-persons-not-being-a-company-or-a-firm-claiming-receipt-interest-other-than-interest-on-securities-or-income-in-respect-units-without-deduction-tax-india_big.png)