Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

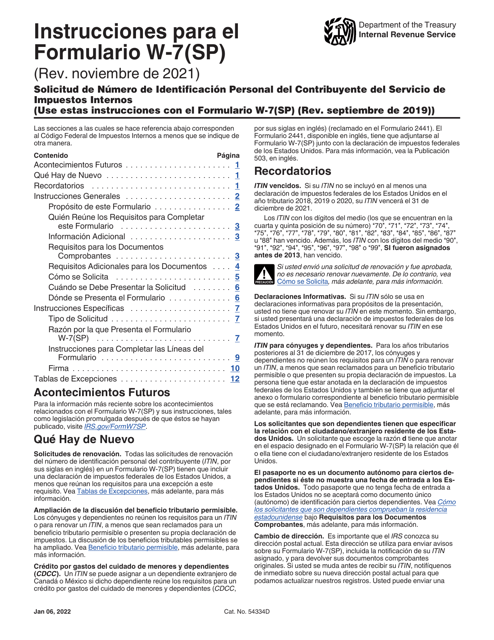

These are the IRS-issued Instructions for the IRS Form W-7, Application for IRS Individual Taxpayer Identification Number - also known as the individual tax identification number application.

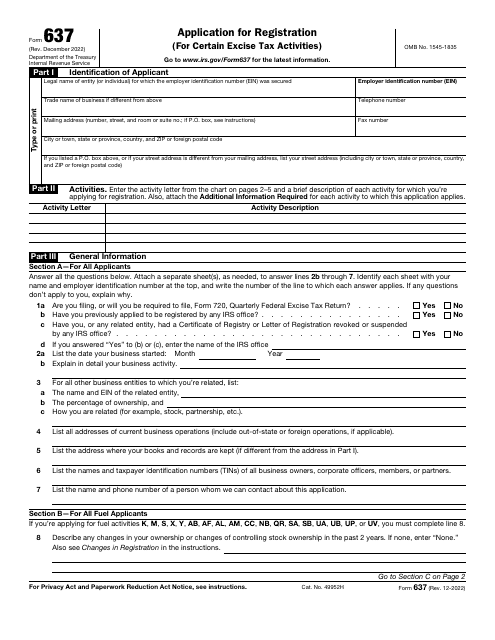

The purpose of this form is to provide filers with a Certificate of Registry or a Letter of Registration issued by the Internal Revenue Service (IRS), which they will then receive after the IRS processes and approves their application.

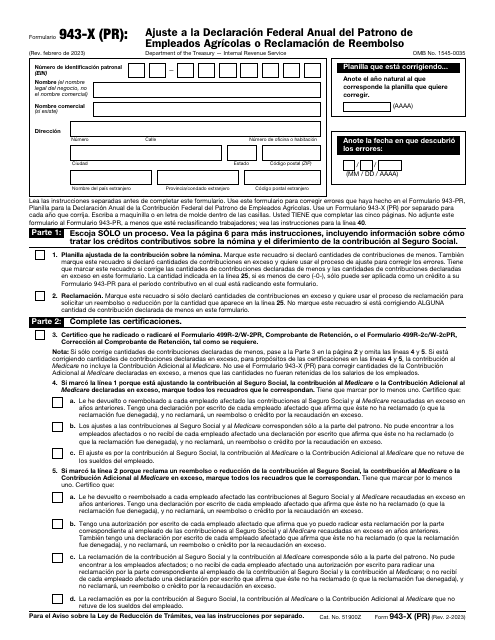

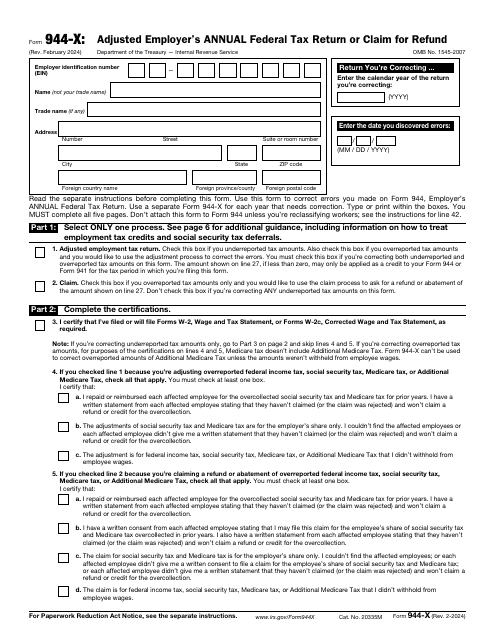

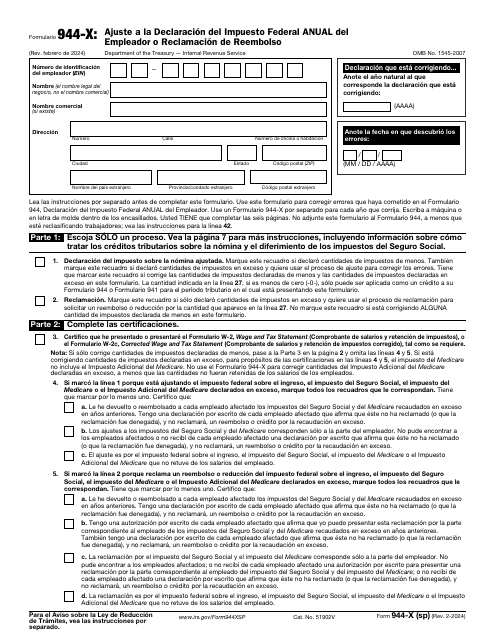

This is a fiscal form used by employers that learned about the need to correct a previously filed IRS Form 944, Employer's Annual Federal Tax Return.

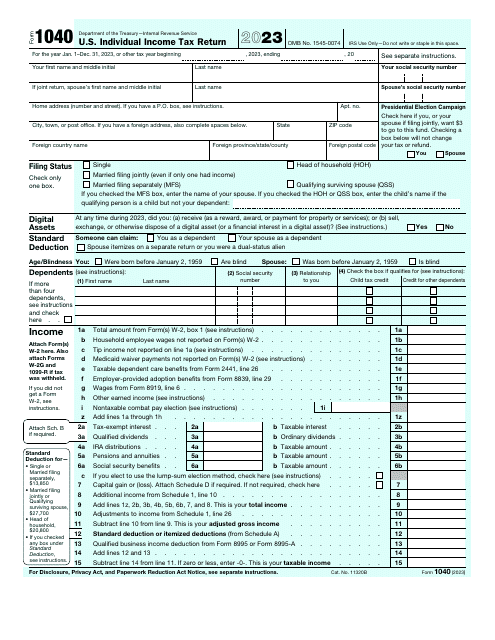

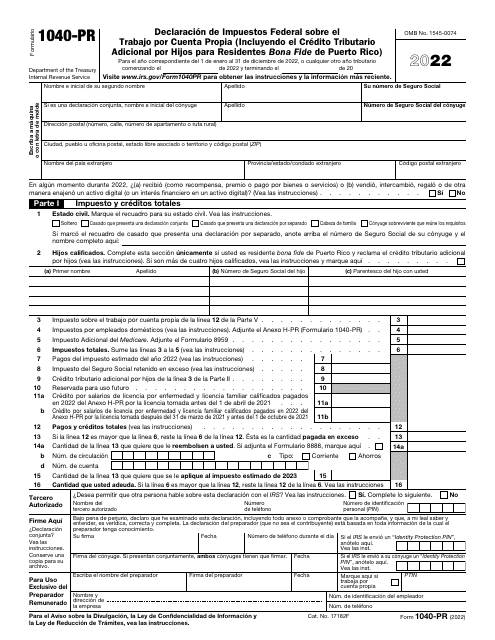

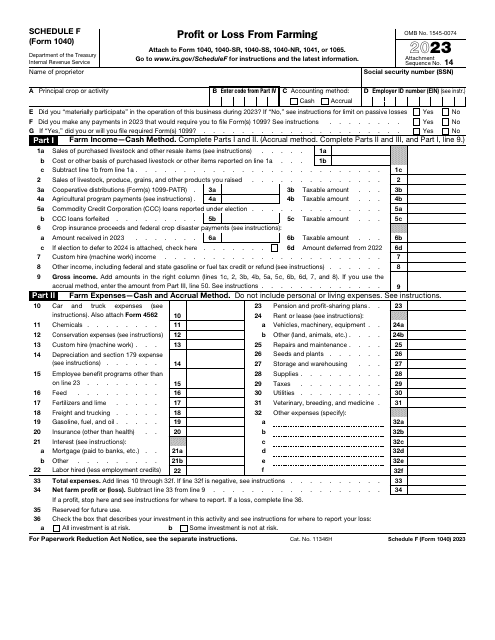

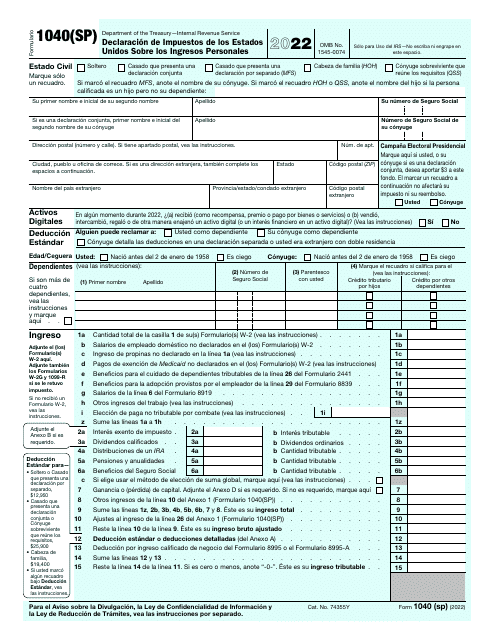

Use this basic form if you are an American taxpayer and wish to submit an annual income tax return. This form is also known as the Individual Income Tax Return Form.

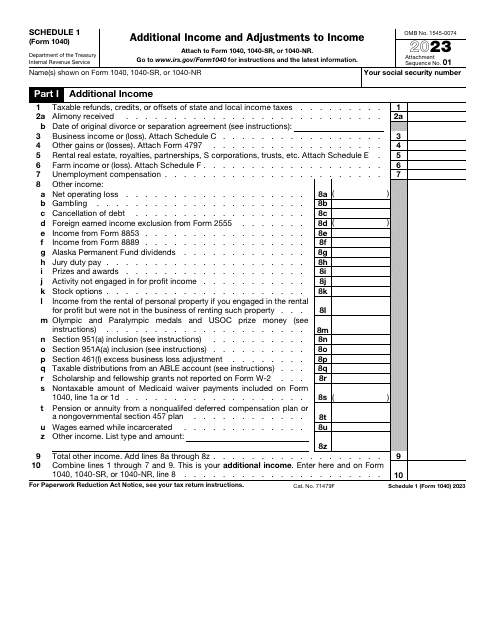

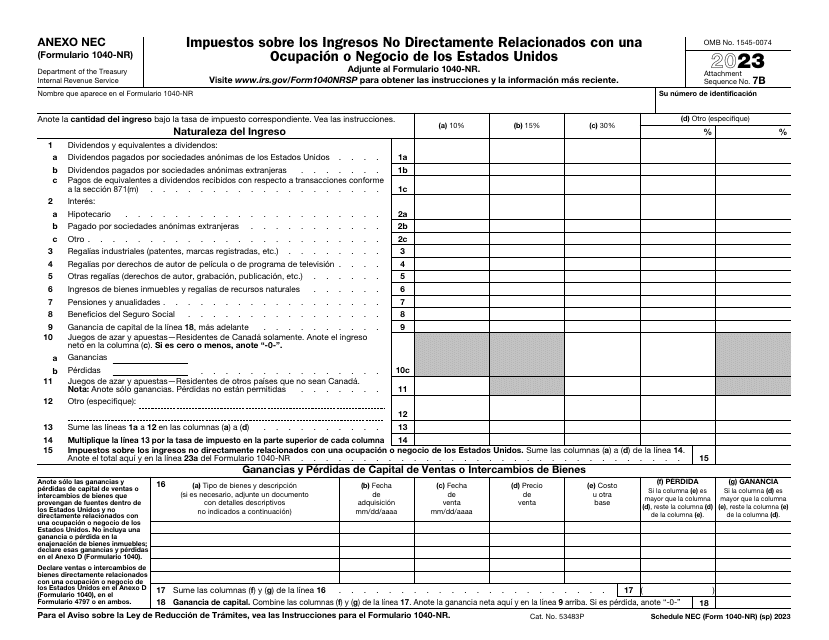

This is a supplementary form used by taxpayers to list income they did not include on the main income statement they file.

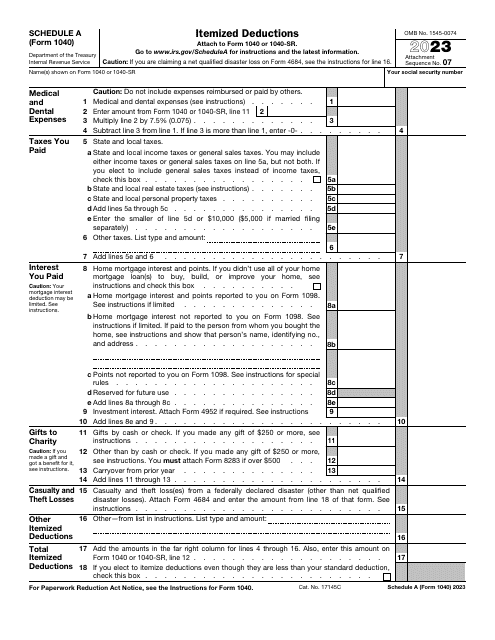

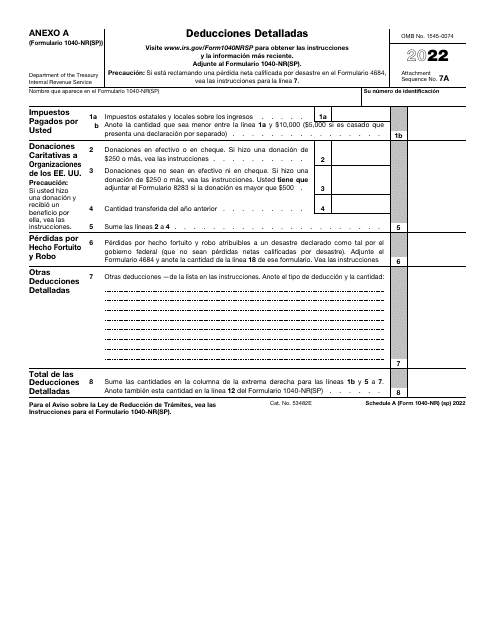

This form is also known as the IRS itemized deductions form. It belongs to the IRS 1040 series. This document is used in order to calculate the amount of your itemized deductions.

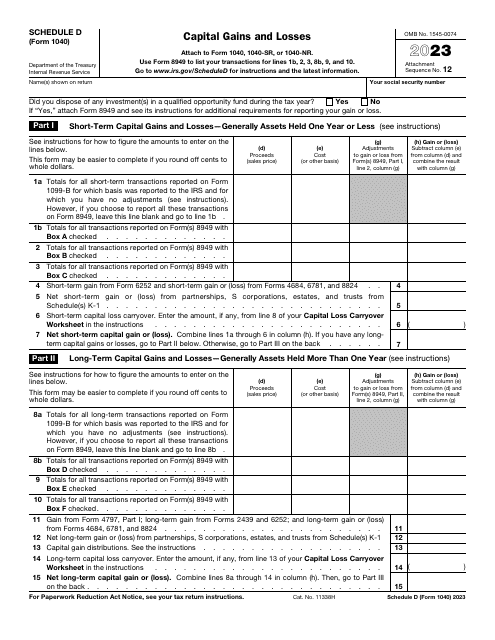

This is a supplementary document taxpayers have to attach to their tax return to outline capital gains and losses that were the result of property sales.

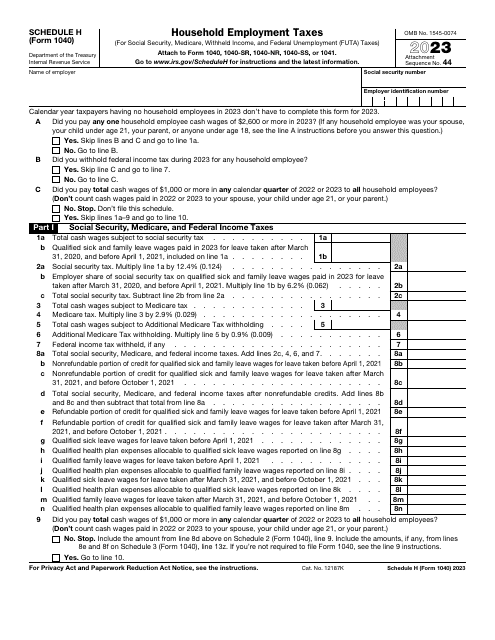

This is a supplementary document that has to be attached to a tax return, if the taxpayer employed people that worked in their house helping the owner to manage the place in a certain capacity.

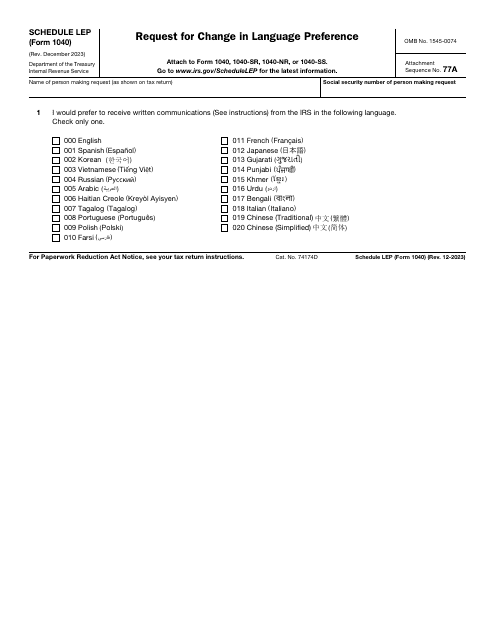

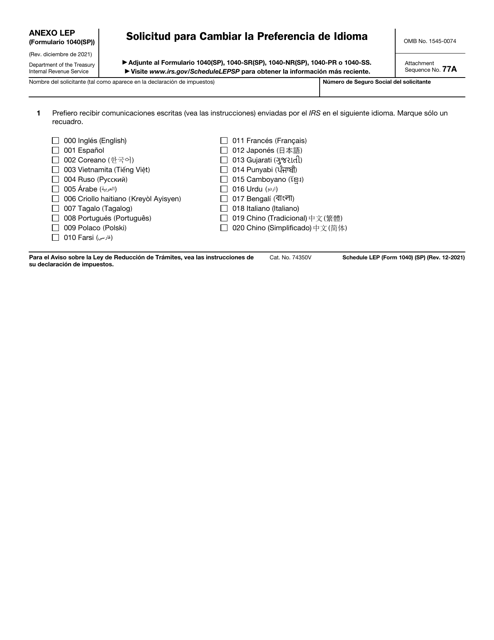

This Form is used for requesting a change in language preference.

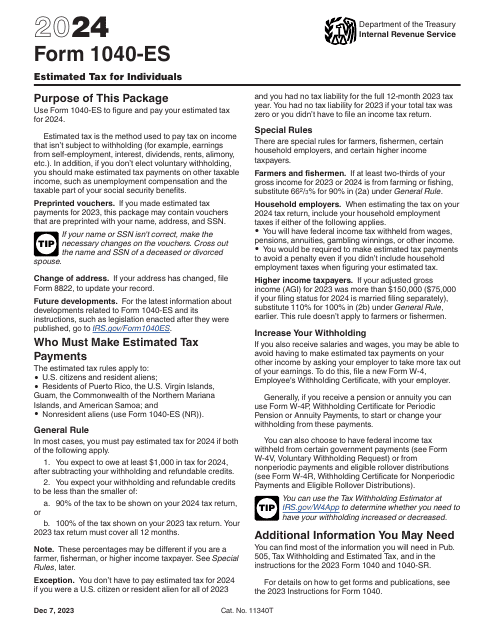

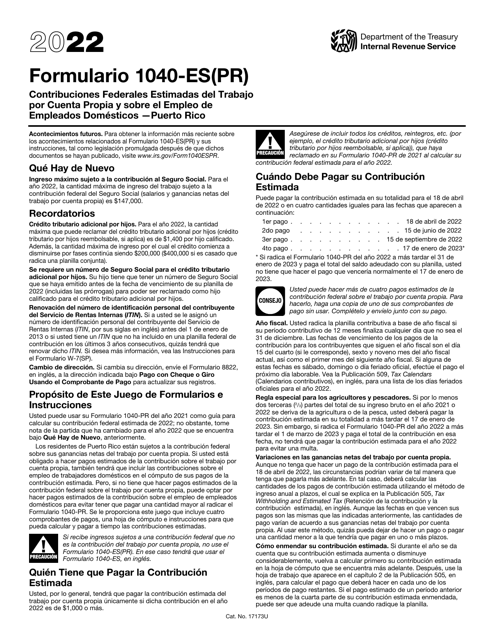

This is a fiscal form that lets individual taxpayers pay taxes based on their own calculations before the government provides them with the request to pay.

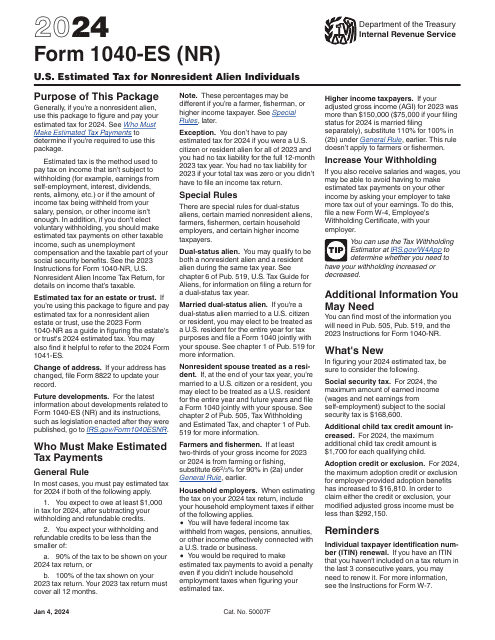

This is a form used to calculate and pay estimated tax on income by nonresident aliens that isn't subject to IRS withholding.

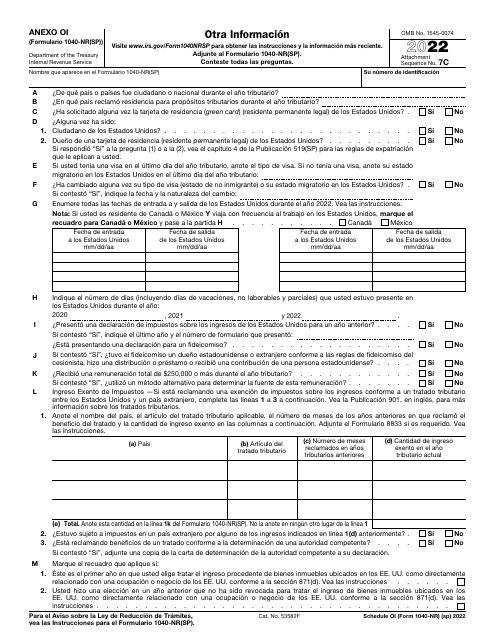

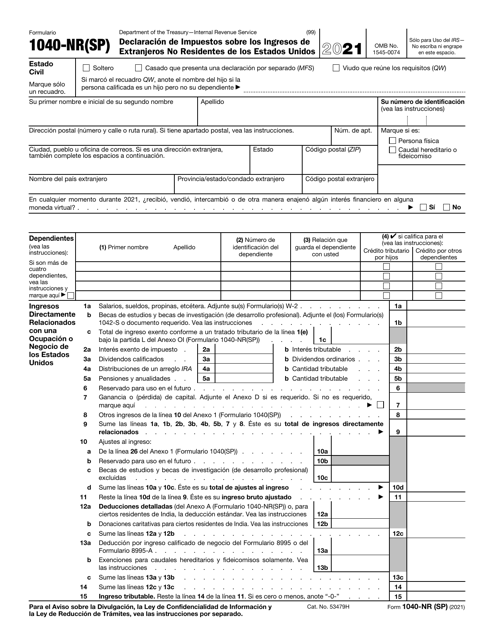

This document is used for submitting income tax returns by non-resident aliens in the United States.

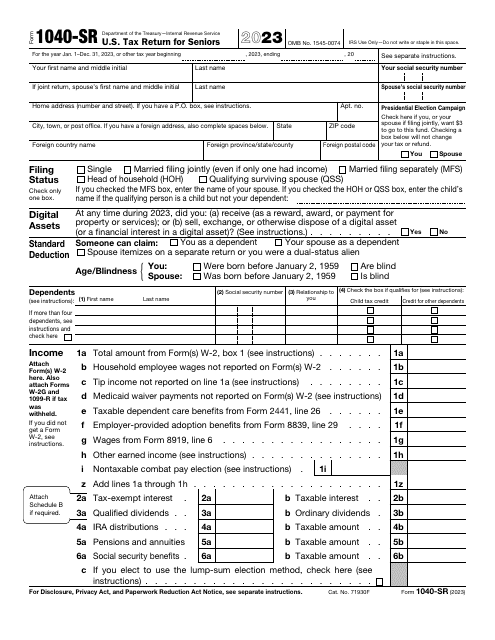

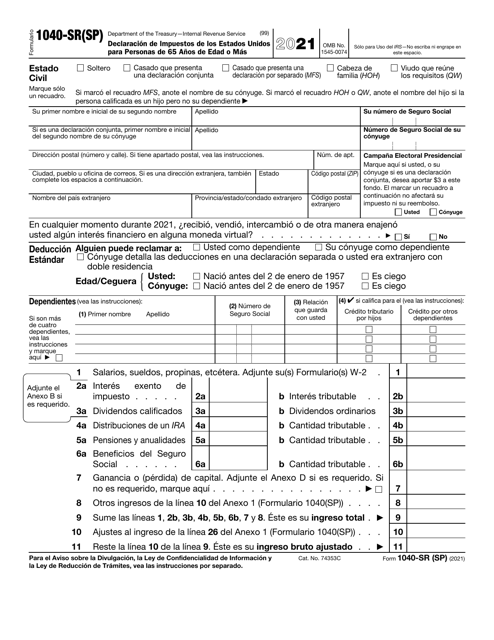

The purpose of this IRS application is to make the process of filing a federal income tax return easier for seniors - the document features larger print, but contains the standard deduction charts.

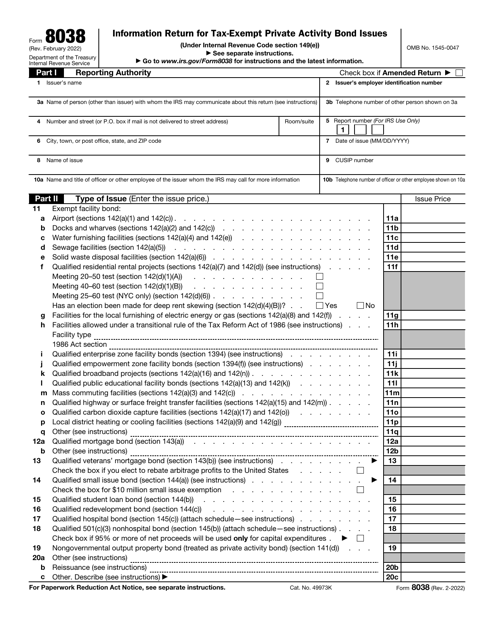

This is a formal IRS document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.

This is a fiscal document used by organizations that made payments to individuals and companies that were not treated as employees over the course of the tax year.

This is a fiscal IRS form filled out by the cooperative that paid patronage dividends during the tax year.

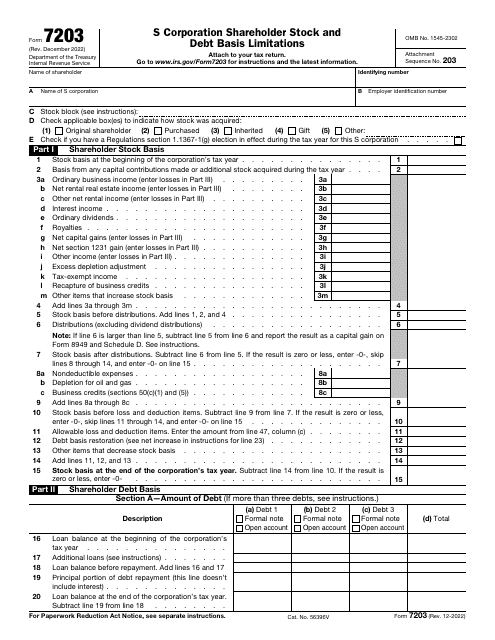

This is a fiscal document prepared and submitted by every S corporation stockholder to inform the government about their share of the entity's credits, deductions, and other items that will be up for deduction on their annual income statement.