Fill and Sign Internal Revenue Service (IRS) Forms

Related Articles

Documents:

4644

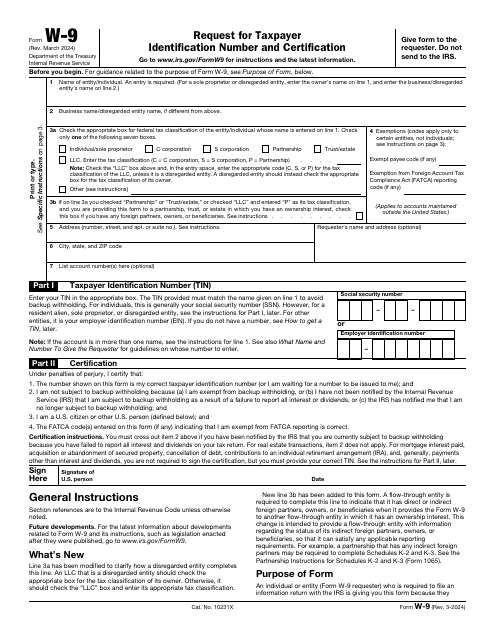

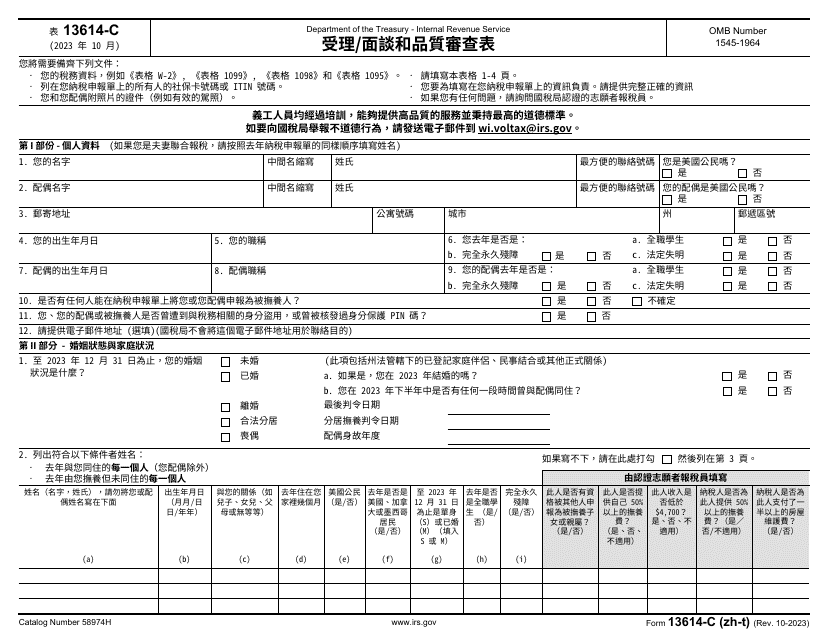

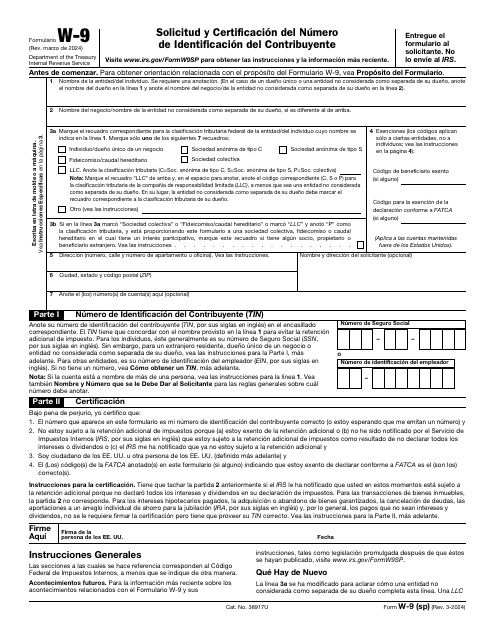

This is a formal instrument completed by a taxpayer to list their full name, contact details, and taxpayer identification number when requested by a party they worked with.

Download this form to report the interest amount paid on a qualified student loan during the past calendar year in cases when the amount exceeded $600.

This form is completed by federal, state, and local government units (payers) and sent to the Internal Revenue Service (IRS), state tax department, and taxpayers (recipients) if certain payments were made over the previous year.

This is a formal IRS document business entities need to file with the fiscal authorities to outline the income they received during the tax year via methods that involve third parties.

Download this form if you are an educational institution and need information about qualified tuition and related fees paid during the tax year. The information can be used by the paying student to calculate their education-related tax deductions and credits.

Use this document as a compilation or a summary information sheet to physically transmit paper Forms 1097, 1098, 1099, 3921, 3922, 5498, and W-2G to the Internal Revenue Service (IRS). If you opt to file the forms electronically, you are not required to submit a 1096 transmittal form.

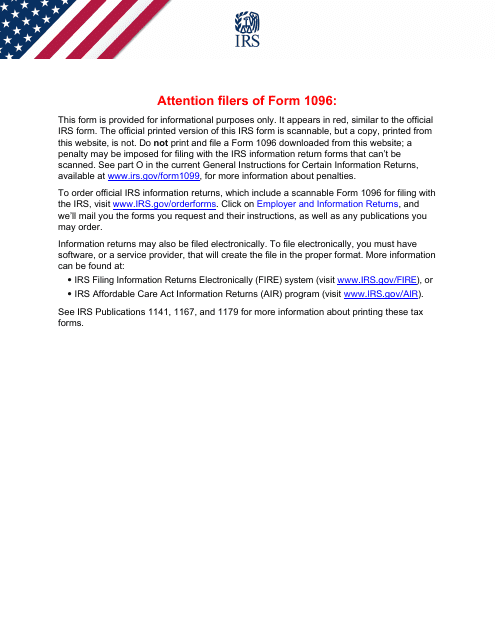

Download this form if you are an issuer of the savings account called Achieving a Better Life Experience (ABLE). This form is used to report the rollover contributions and program-to-program transfers, as well as other types of contributions made to an ABLE account.

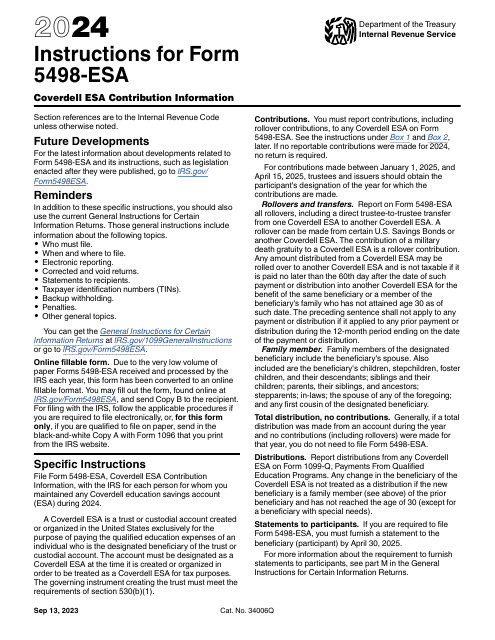

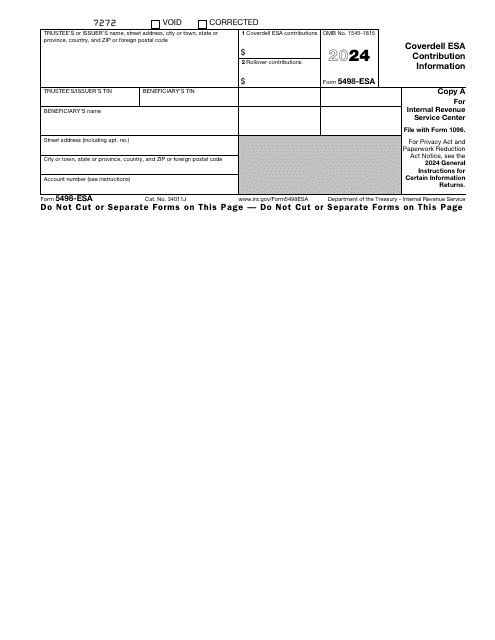

This is a fiscal document completed by a taxpayer to describe their financial contributions to the qualified education expenses of other people.

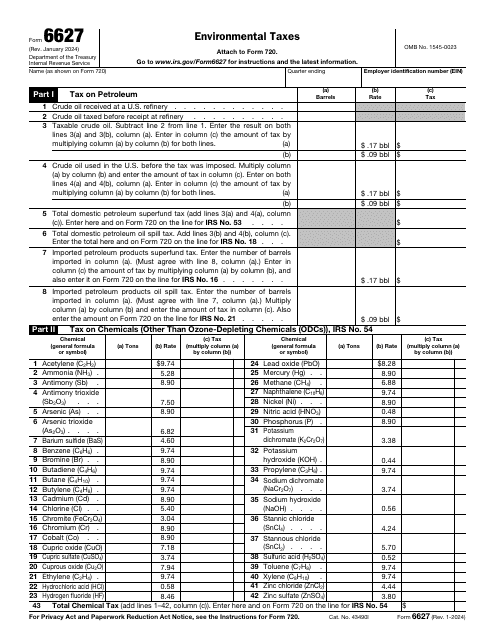

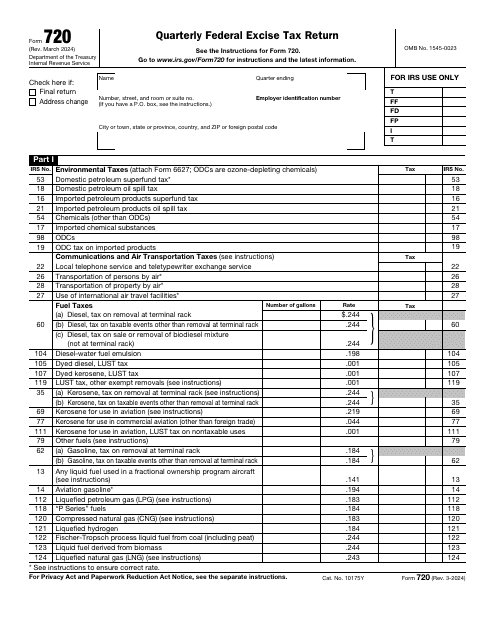

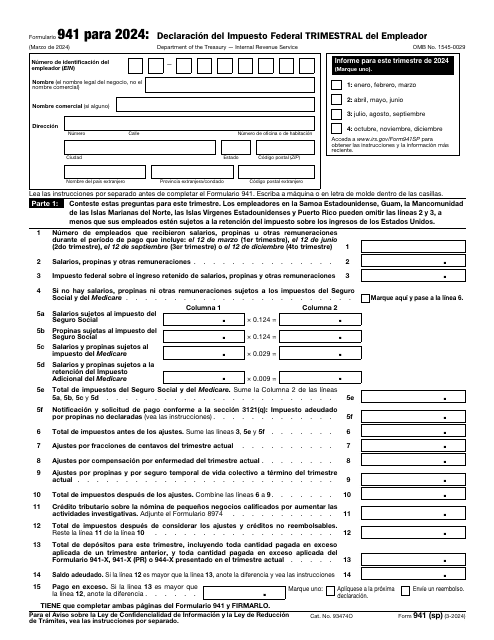

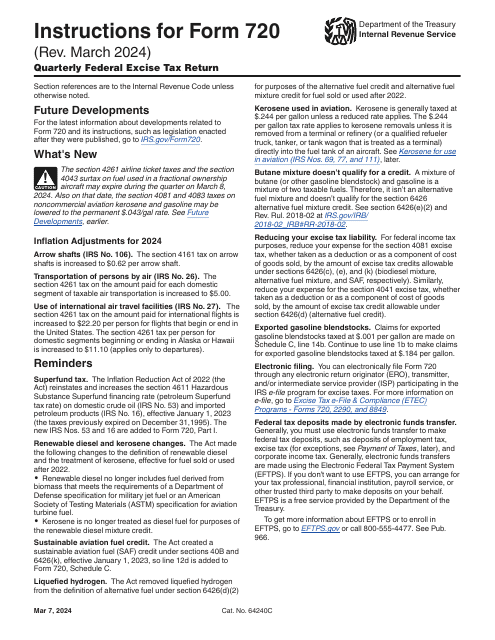

This is a fiscal document used by taxpayers to outline the excise taxes charged on certain services and goods.

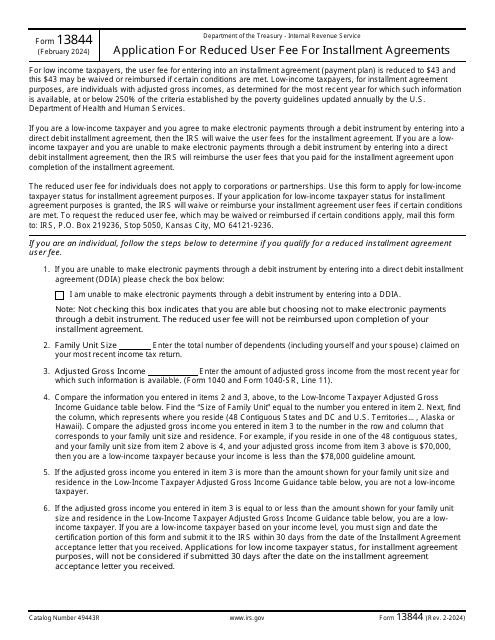

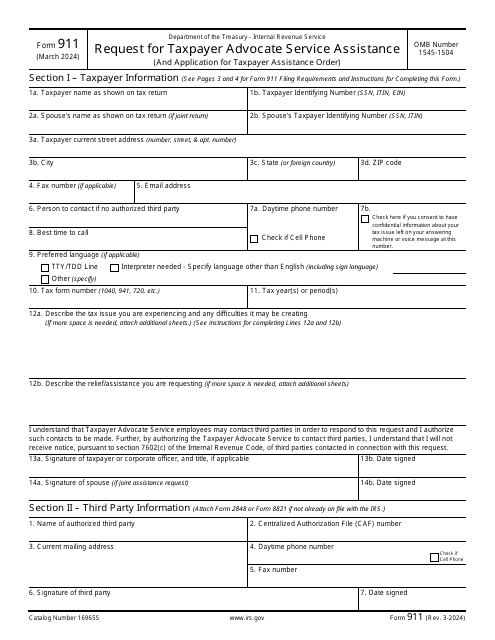

This is a fiscal form used by taxpayers that have already exhausted all other options when dealing with a tax issue.

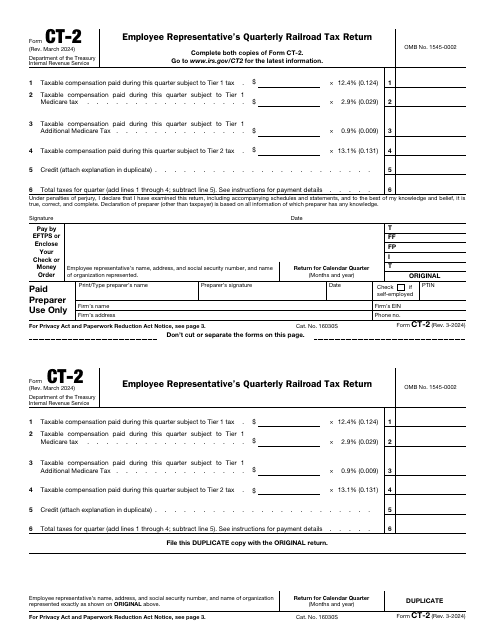

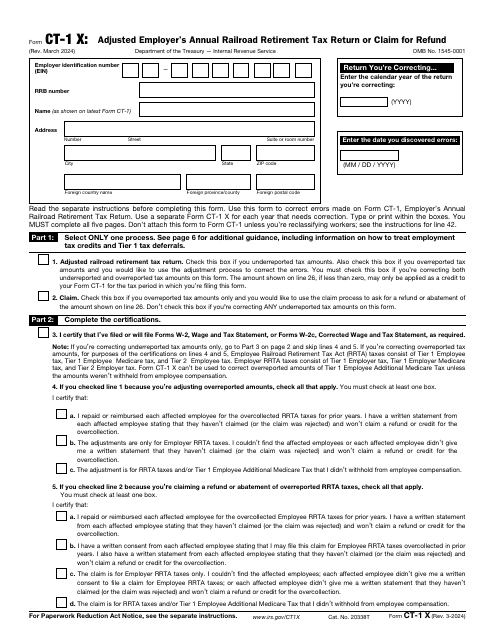

This is a formal document used by railroad industry employers to correct errors they have noticed upon filing IRS Form CT-1, Employer's Annual Railroad Retirement Tax Return.