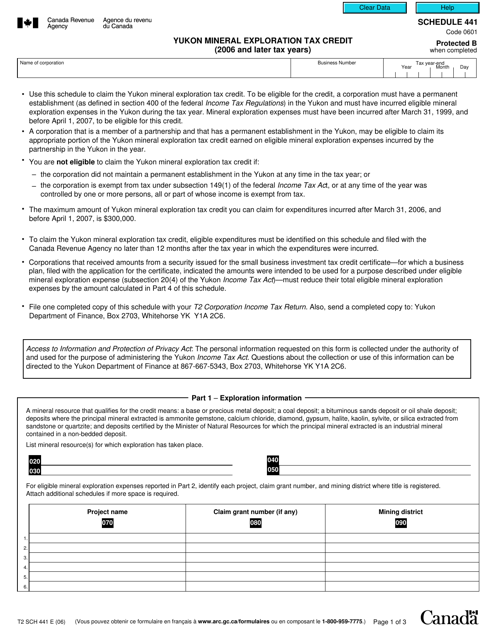

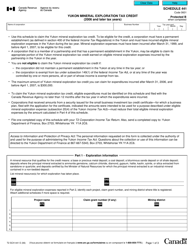

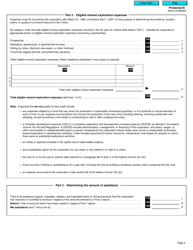

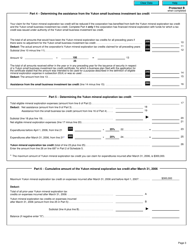

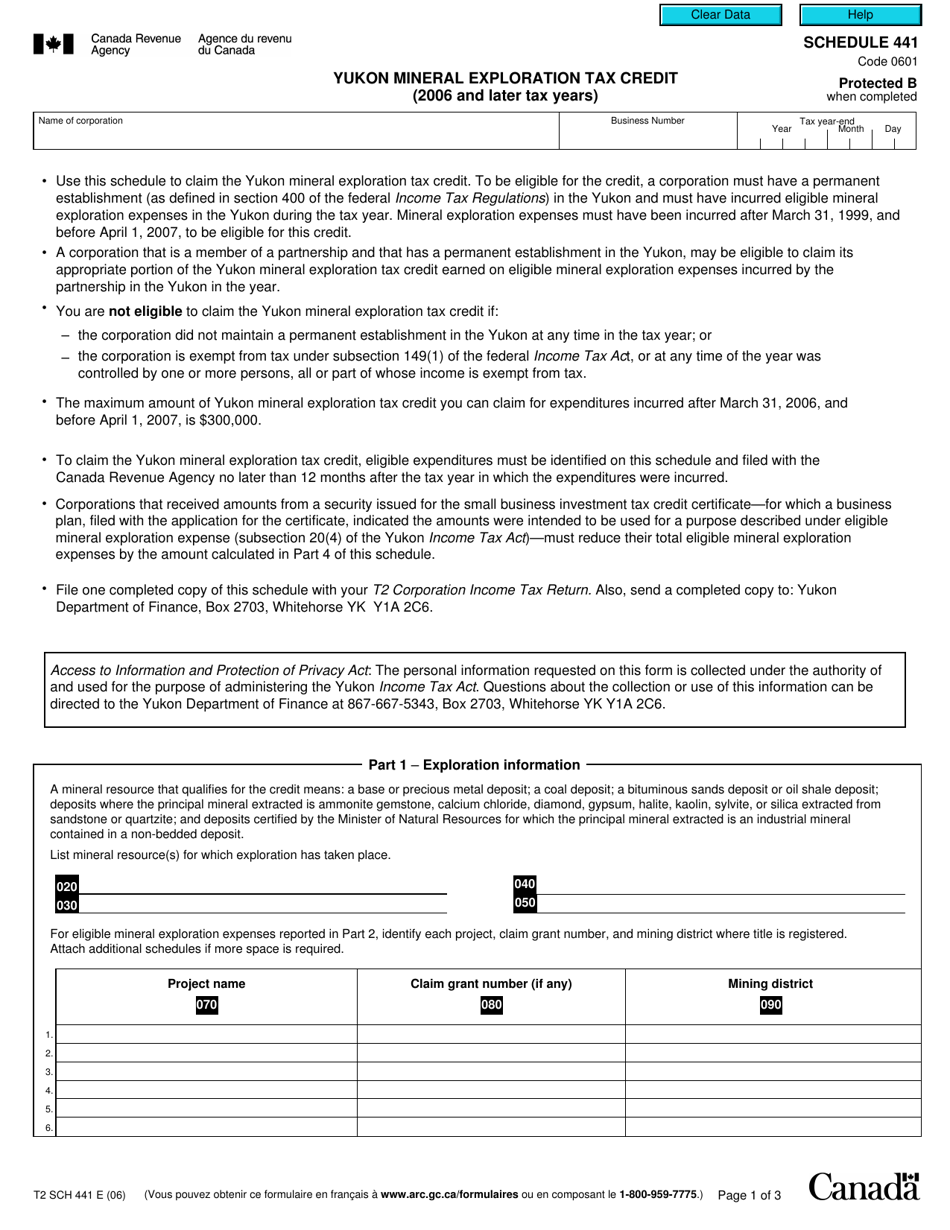

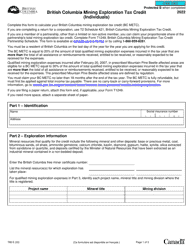

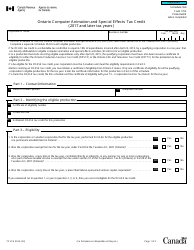

Form T2 Schedule 441 Yukon Mineral Exploration Tax Credit (2006 and Later Tax Years) - Canada

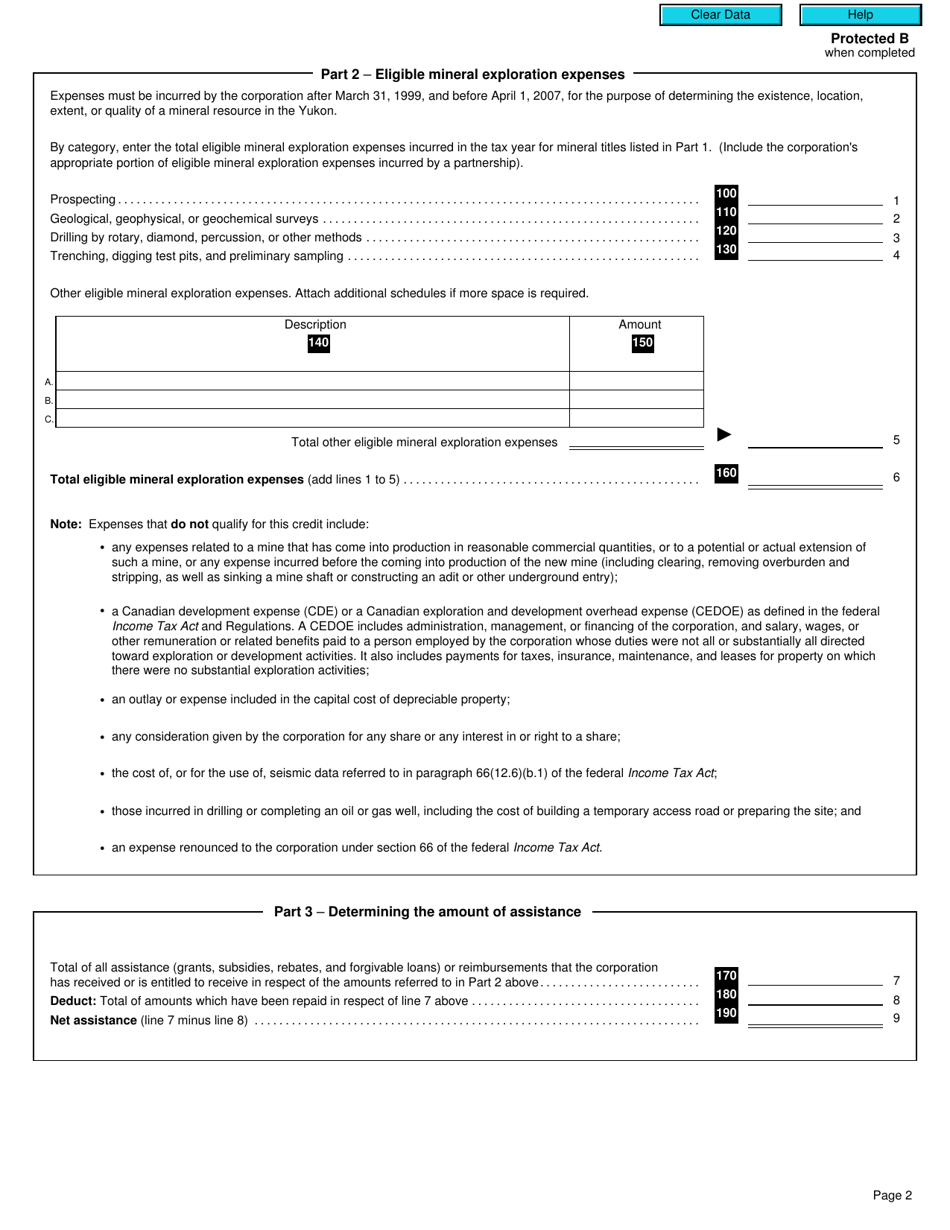

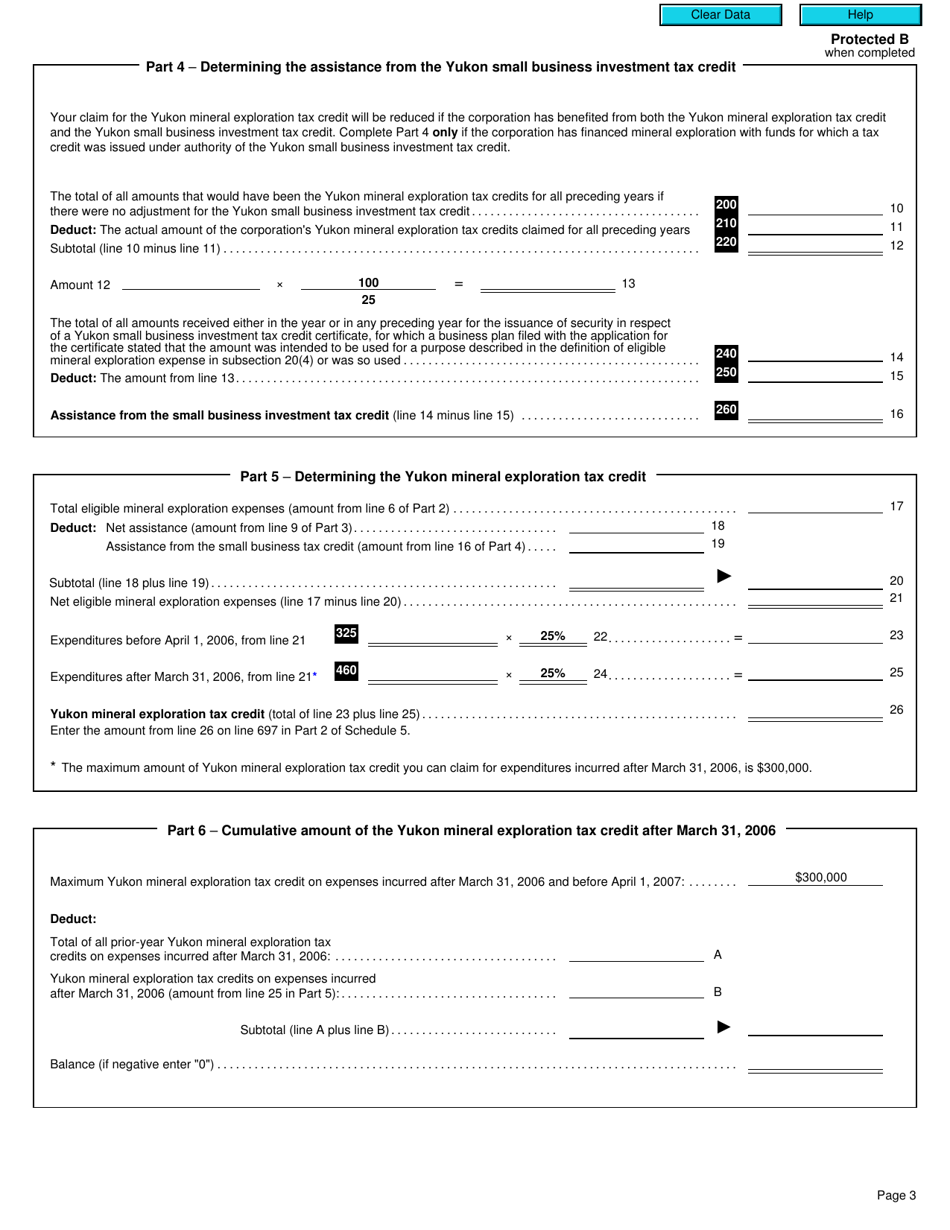

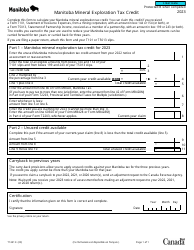

Form T2 Schedule 441 is used in Canada for claiming the Yukon Mineral Exploration Tax Credit for the tax years 2006 and later. This credit is available to corporations involved in mineral exploration activities in Yukon.

FAQ

Q: What is Form T2 Schedule 441?

A: Form T2 Schedule 441 is a tax credit form specifically for Yukon Mineral Exploration Tax Credit.

Q: Who is eligible to use Form T2 Schedule 441?

A: Companies engaged in mineral exploration activities in Yukon are eligible to use Form T2 Schedule 441.

Q: What is the purpose of the Yukon Mineral Exploration Tax Credit?

A: The purpose of the tax credit is to provide incentives for mineral exploration activities in Yukon.

Q: Is Form T2 Schedule 441 applicable for tax years before 2006?

A: No, Form T2 Schedule 441 is applicable for tax years starting from 2006 onwards.