What Is an Invoice Number and How to Generate It?

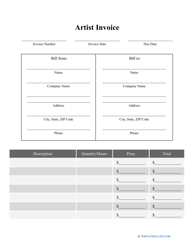

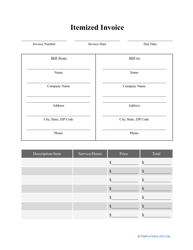

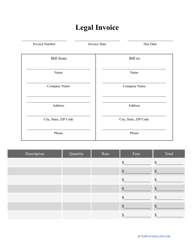

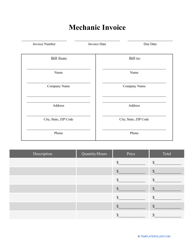

Every business should make sure they do not fail to comply with their obligations to their buyers, compose correct financial reports based on the internal documentation of the company, and establish the best possible communication with the client base. One of the most important accounting statements used by large vendors and small entities alike is the invoice - an itemized list of goods and services sent to the client to ask them for payment. To identify the transaction described in an invoice, you have to assign a number to every invoice you draft and send to your customers.

What Is an Invoice Number?

An Invoice Number is a unique code that appears on the invoice to differentiate this document both for the vendor and the buyer. An essential part of any invoice, this number will allow you to maintain a proper filing system for your documentation which may be crucial when the time comes to file taxes. Additionally, you will have a chance to track outstanding invoices, reply to clients that can refer you to the transaction in question by simply naming an Invoice Number, and match bank statements to the invoices you have created during the reporting period in order to carry out invoice reconciliation.

What Invoice Number Should I Start With?

Whether you assign Invoice Numbers manually for both printed and digital invoices or prefer an Invoice Number generator embedded in an accounting software you use for bookkeeping, traditionally the number of every new invoice should increase. It is up to you to decide how many zeros precede the unique number - you can choose simple "1, 2, 3" or "00001, 00002, 00003". However, it may be preferable for a small business making its first steps in the industry to start with the number 1000 - this way, you will be able to perform Invoice Number tracking without any difficulties and your clients will not think the invoice they receive is the first ever document of this kind you draft.

How to Generate an Invoice Number?

There are several ways to label every invoice:

- Opt for sequential invoice numbering starting with 1, 100, 1000, or 10000 depending on how many digits you prefer. The next Invoice Number will be, respectively, 2, 101, 1001, or 10001.

- Select chronological invoice numbering - this Invoice Id Number would contain several elements: the date, the number assigned to a buyer, and the unique number of the invoice if there are several issued to one client in one day. For example, the first invoice prepared for customer number 236 on July 27, 2020 would have a number 20200727-236-01. Alternatively, you can start with a customer number - 236-20200727-01.

- Use letters and abbreviations to identify clients and projects. For instance, a client called Prime Tech can receive an invoice with a number PT1, and future invoices will continue from there (PT2, PT3, etc.).

Related Topics: