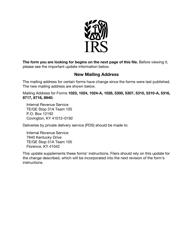

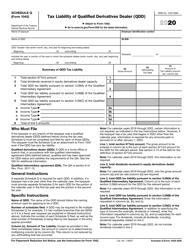

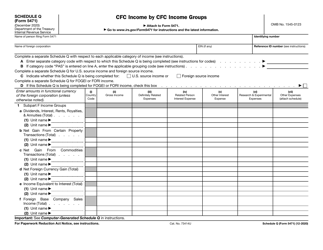

Instructions for IRS Form 5300 Schedule Q Elective Determination Requests

This document contains official instructions for IRS Form 5300 Schedule Q, Elective Determination Requests - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 5300 Schedule Q?

A: IRS Form 5300 Schedule Q is a form used for Elective Determination Requests.

Q: What are Elective Determination Requests?

A: Elective Determination Requests are requests made to the IRS for a determination on certain employee benefit plans.

Q: Who needs to file IRS Form 5300 Schedule Q?

A: Employers who maintain or are considering establishing an employee benefit plan may need to file IRS Form 5300 Schedule Q.

Q: What information is required on IRS Form 5300 Schedule Q?

A: IRS Form 5300 Schedule Q requires information about the plan, the employer, and the requested determination.

Q: When is the deadline for filing IRS Form 5300 Schedule Q?

A: The deadline for filing IRS Form 5300 Schedule Q depends on the specific situation and should be carefully reviewed.

Instruction Details:

- This 6-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.