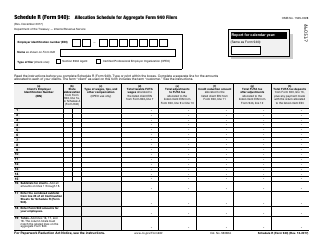

Instructions for IRS Form 1065 Schedule C Additional Information for Schedule M-3 Filers

This document contains official instructions for IRS Form 1065 Schedule C, Additional Information for Schedule M-3 Filers - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 1065 Schedule C is available for download through this link.

FAQ

Q: What is IRS Form 1065?

A: IRS Form 1065 is the Partnership Return of Income form.

Q: What is Schedule C?

A: Schedule C is a supplemental form that provides additional information for Schedule M-3 filers.

Q: Who should file Schedule C?

A: Schedule C should be filed by partnerships that are required to file Schedule M-3.

Q: What is the purpose of Schedule C?

A: The purpose of Schedule C is to provide additional information about the partnership's income, deductions, and other items for Schedule M-3 filers.

Instruction Details:

- This 1-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.