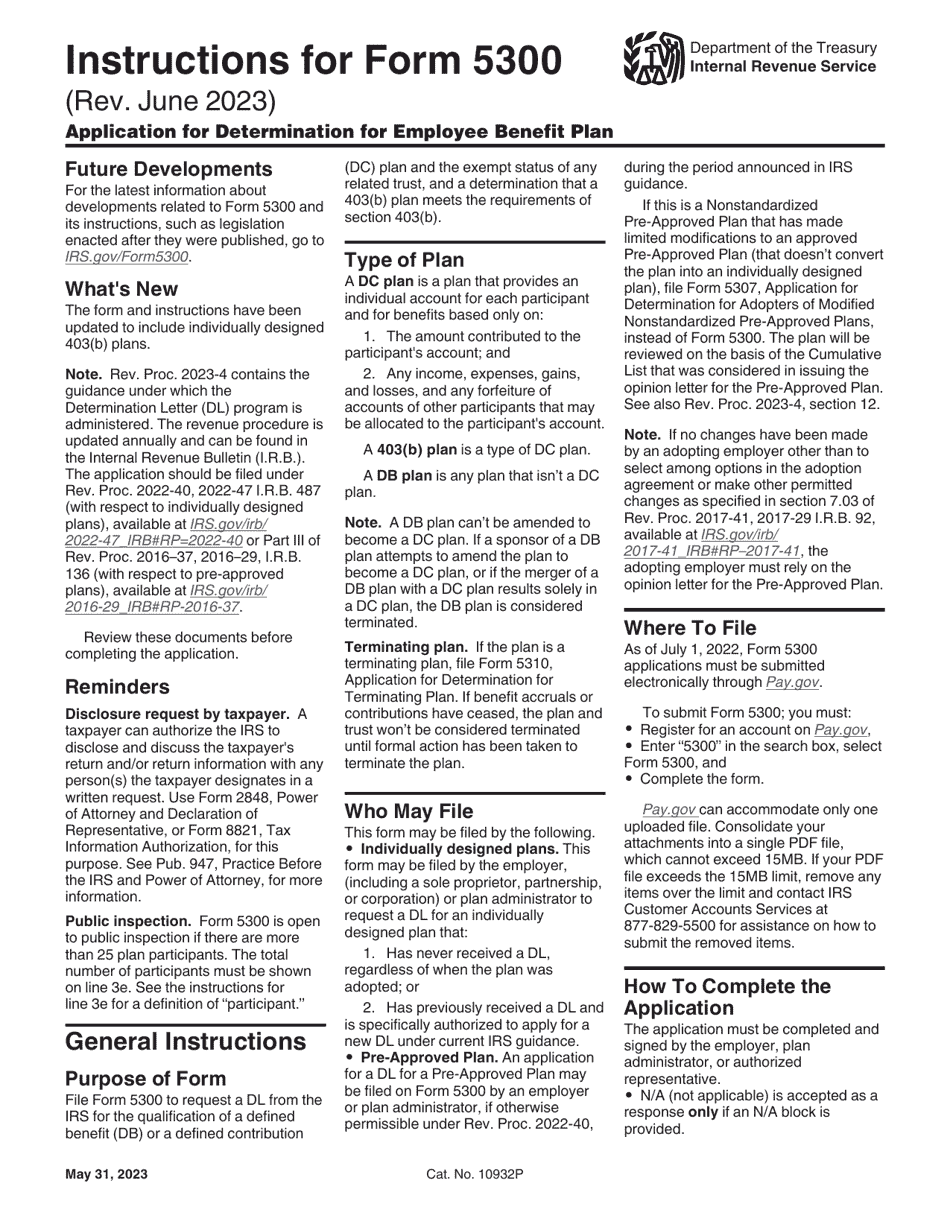

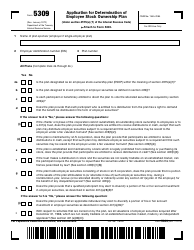

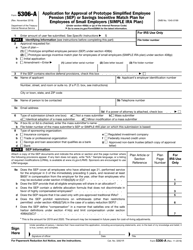

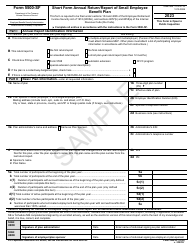

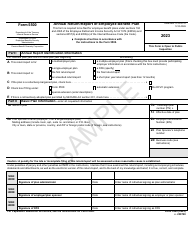

Instructions for IRS Form 5300 Application for Determination for Employee Benefit Plan

This document contains official instructions for IRS Form 5300 , Application for Determination for Employee Benefit Plan - a form released and collected by the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 5300?

A: IRS Form 5300 is an application for determination for Employee Benefit Plan.

Q: Who needs to file IRS Form 5300?

A: Employee Benefit Plans need to file IRS Form 5300.

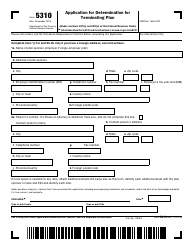

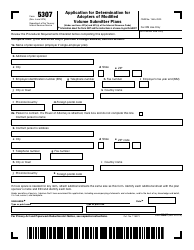

Q: What is the purpose of filing IRS Form 5300?

A: The purpose of filing IRS Form 5300 is to request a determination letter from the IRS regarding the tax-exempt status of the Employee Benefit Plan.

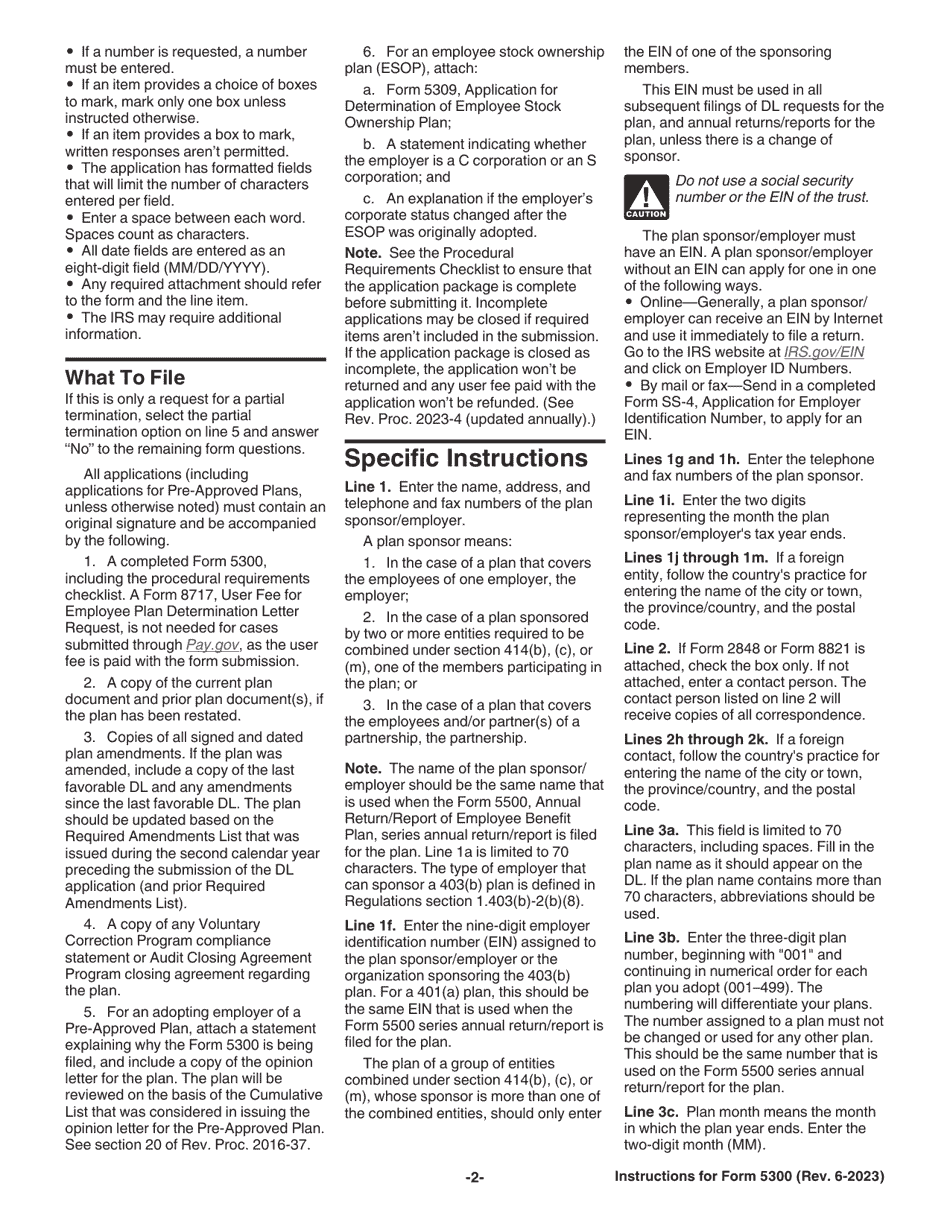

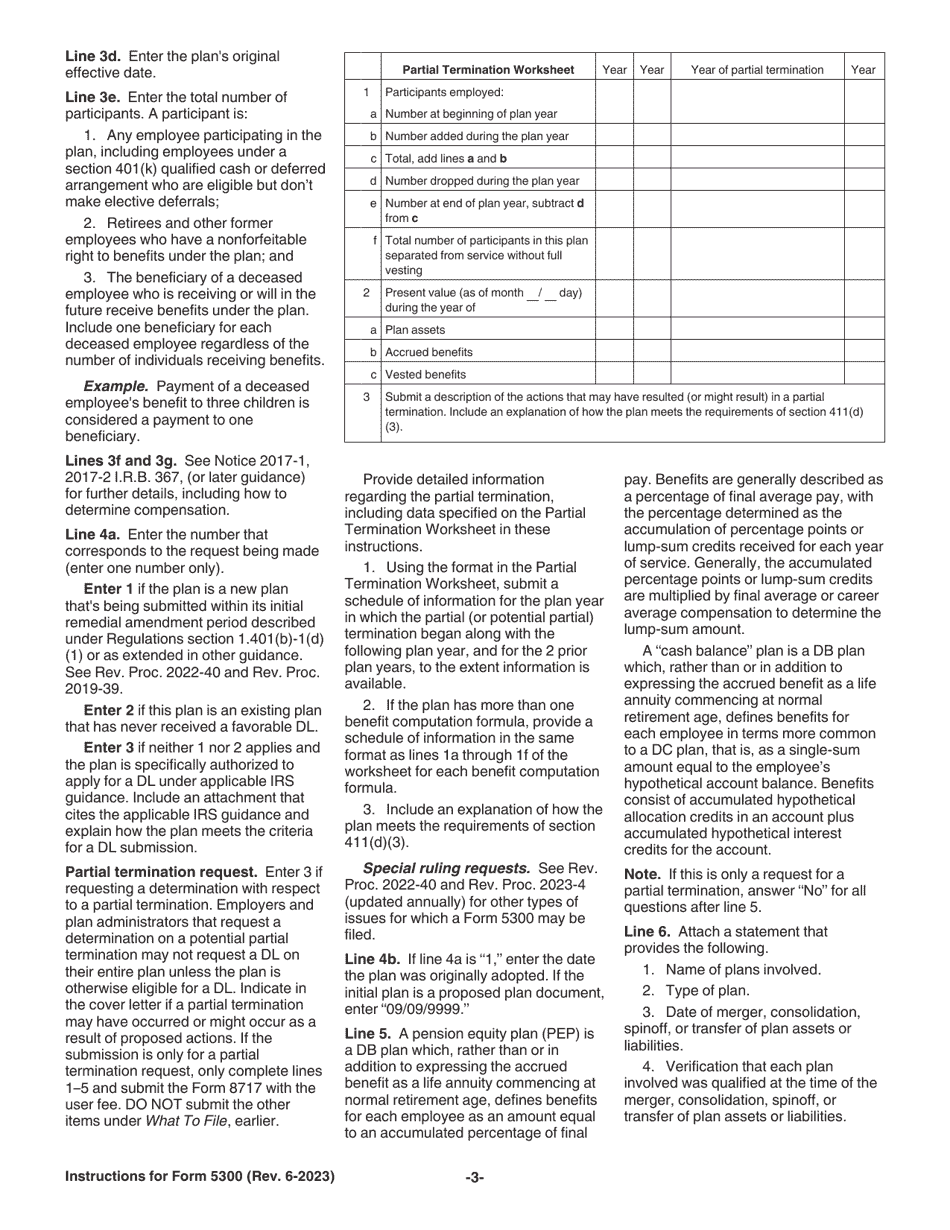

Q: What information is required when filing IRS Form 5300?

A: When filing IRS Form 5300, you will need to provide information about the Employee Benefit Plan, including its structure, operations, and compliance with relevant laws and regulations.

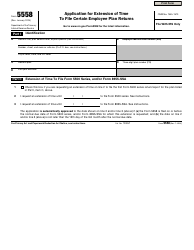

Q: Are there any filing fees associated with IRS Form 5300?

A: Yes, there are filing fees associated with IRS Form 5300. The fees vary depending on the type and size of the Employee Benefit Plan.

Q: Is there a deadline for filing IRS Form 5300?

A: Yes, there is a deadline for filing IRS Form 5300. The deadline is generally the last day of the plan's third full calendar month.

Q: Can I file IRS Form 5300 electronically?

A: No, you cannot file IRS Form 5300 electronically. It must be filed in paper format.

Q: How long does it take to receive a determination letter after filing IRS Form 5300?

A: The time it takes to receive a determination letter after filing IRS Form 5300 can vary, but it typically takes several months.

Q: What should I do if I have questions about IRS Form 5300?

A: If you have questions about IRS Form 5300, you should consult with a tax professional or contact the IRS directly for assistance.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the U.S. Department of the Treasury.