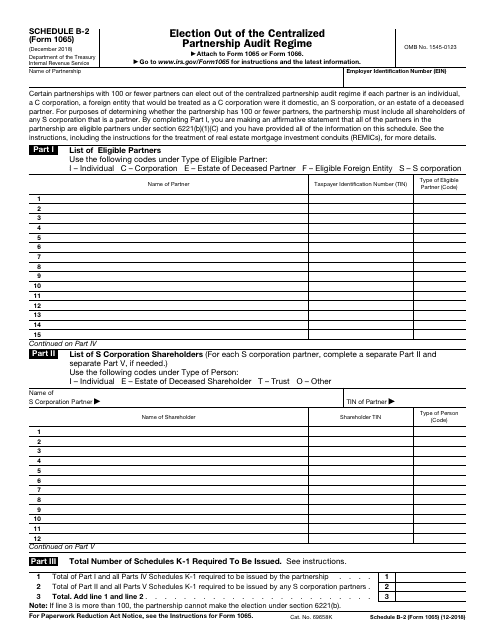

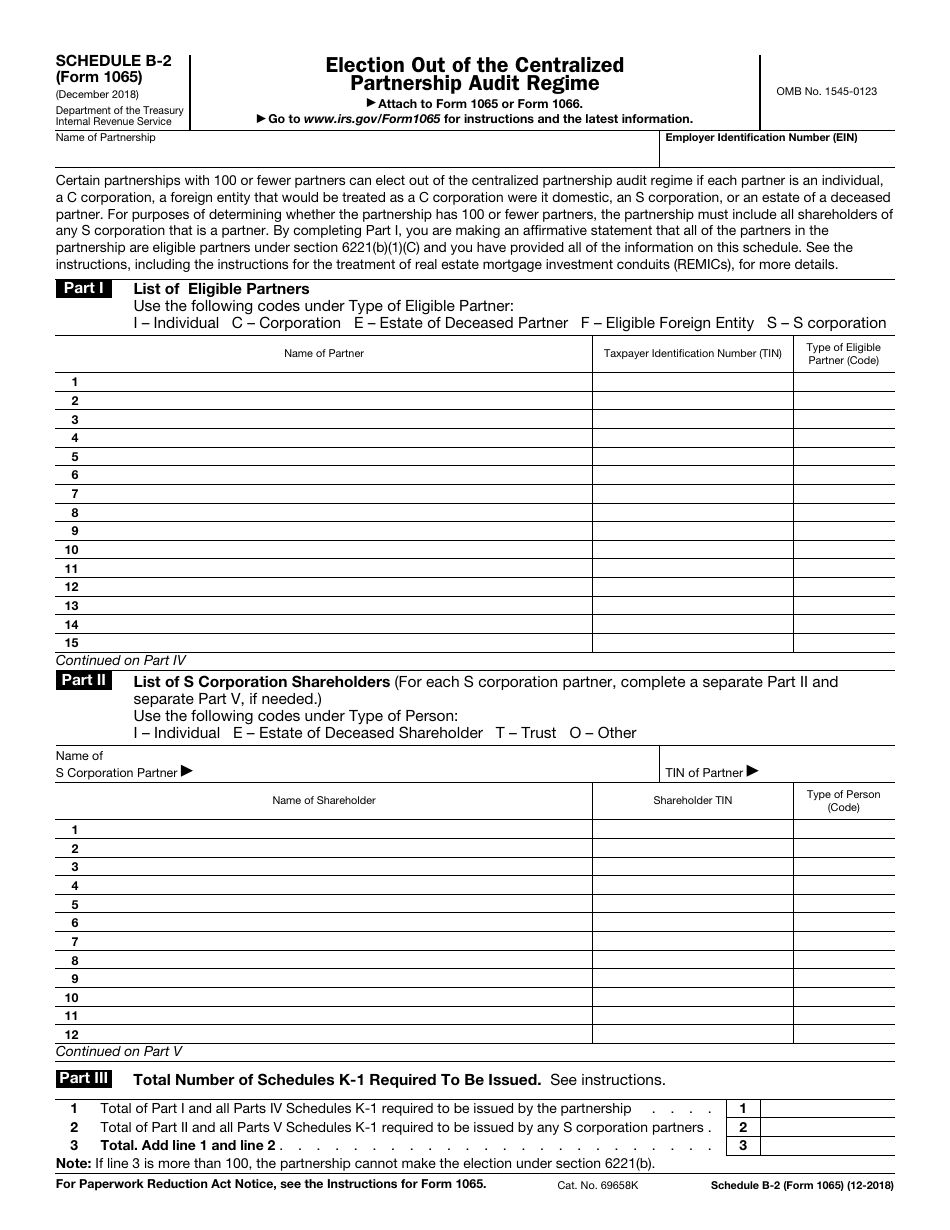

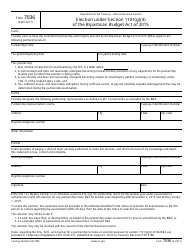

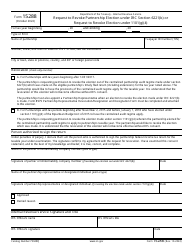

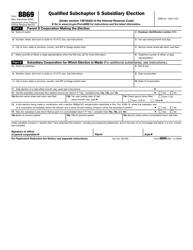

IRS Form 1065 Schedule B-2 Election out of the Centralized Partnership Audit Regime

What Is IRS Form 1065 Schedule B-2?

IRS Form 1065 Schedule B-2, Election out of the Centralized Partnership Audit Regime , is a formal instrument used by partnerships to inform the tax authorities they choose not to be subject to a partnership audit regime prescribed by current fiscal legislation. If your partnership has a hundred or fewer partners, it is permitted to elect out of this obligation.

This schedule was issued by the Internal Revenue Service (IRS) on December 1, 2018 - previous editions of the form are now outdated. An IRS Form 1065 Schedule B-2 fillable version can be found via the link below.

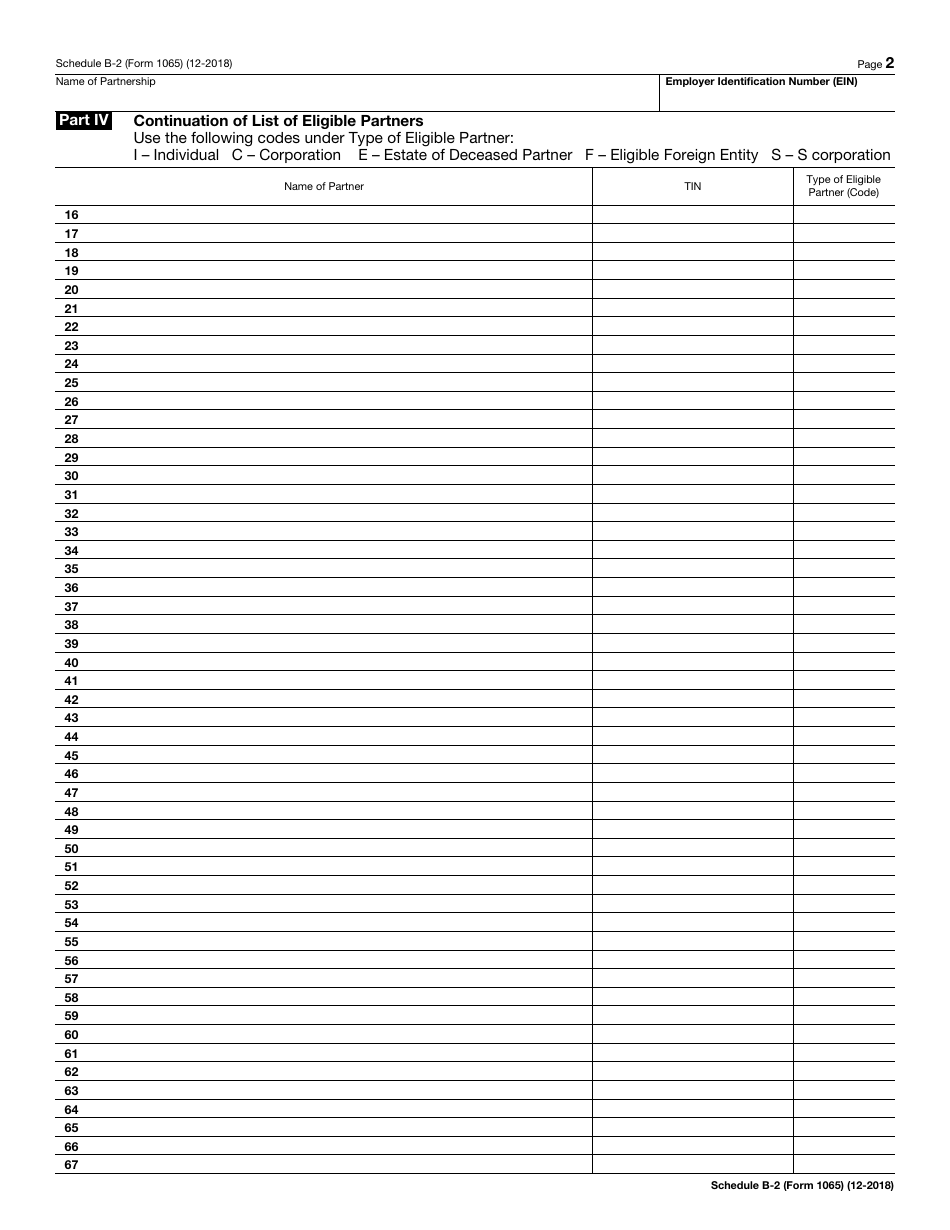

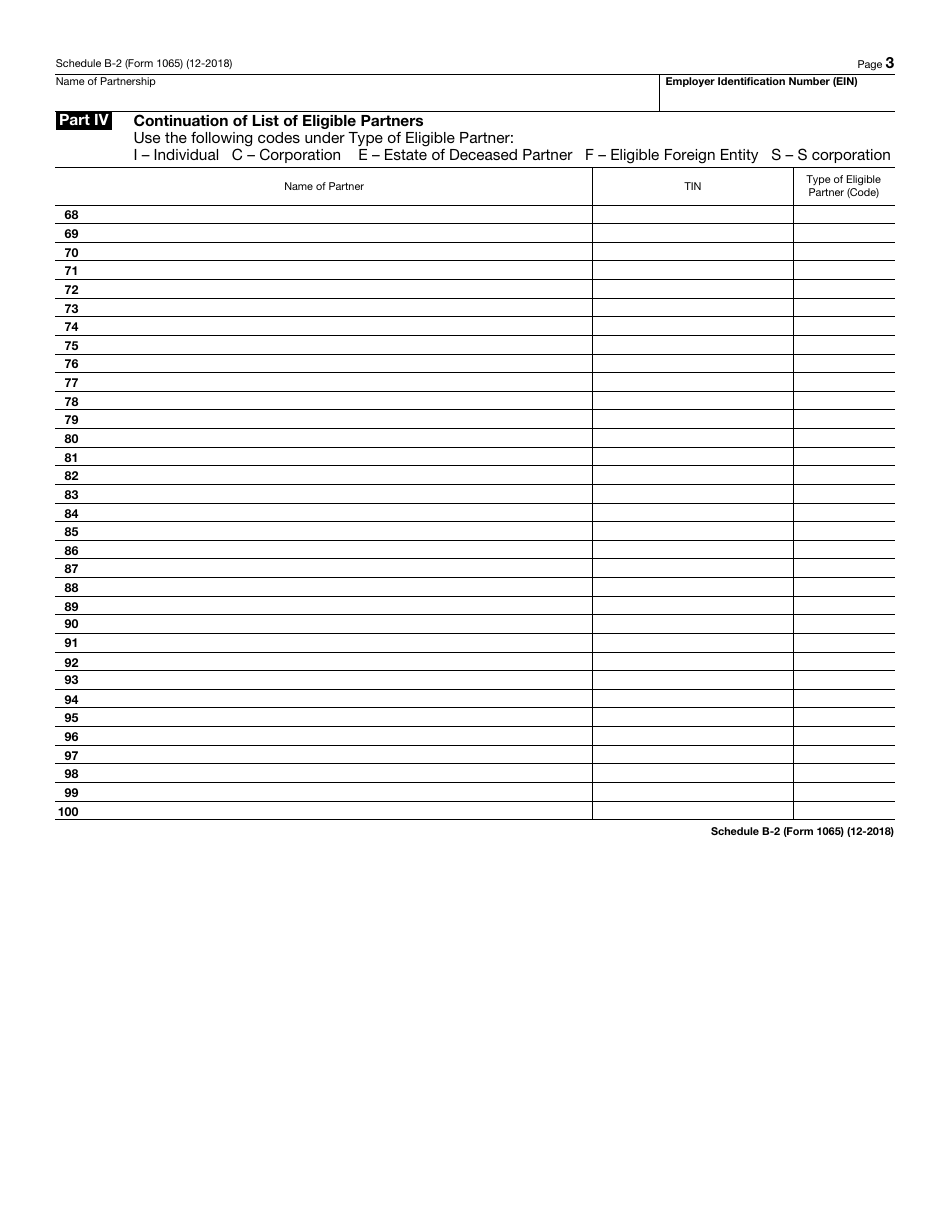

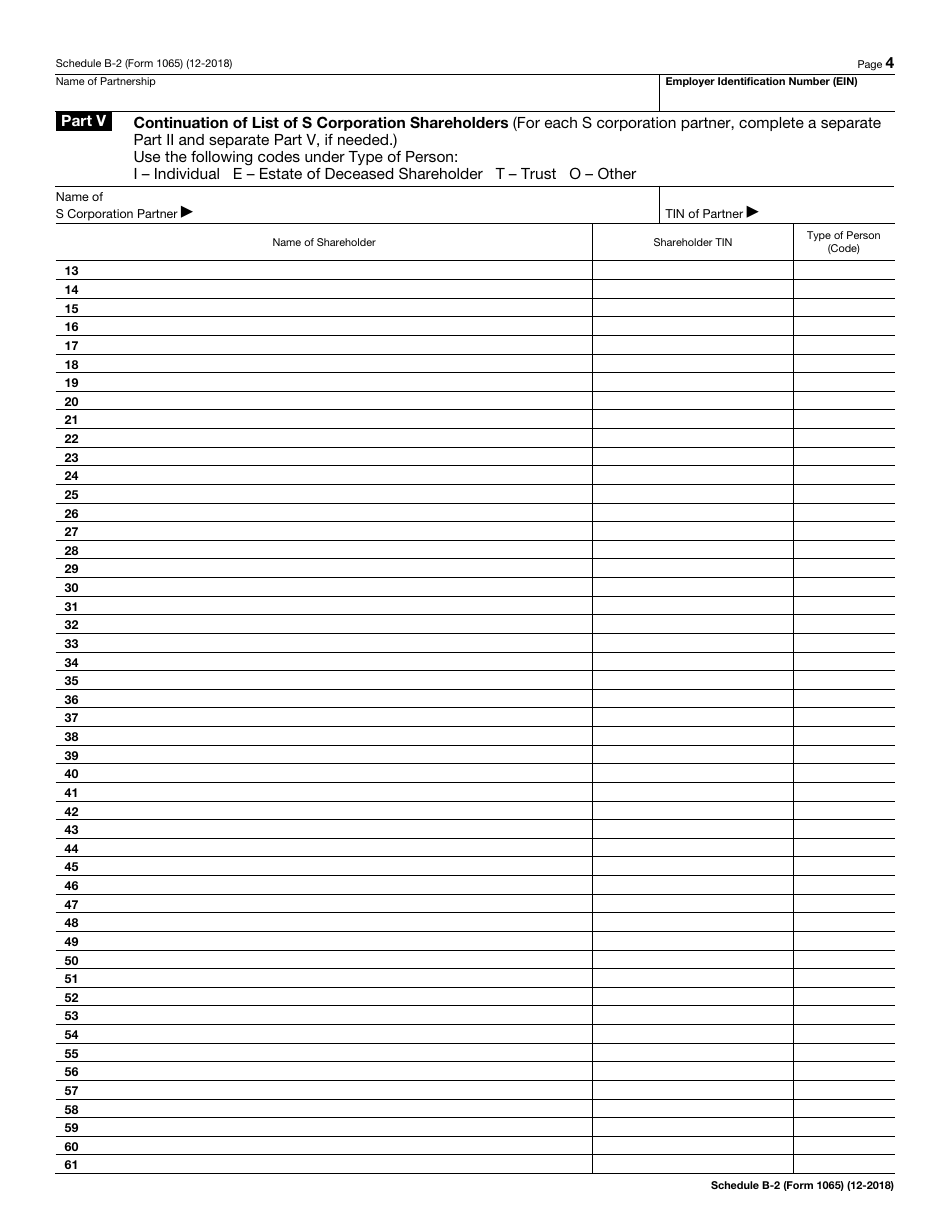

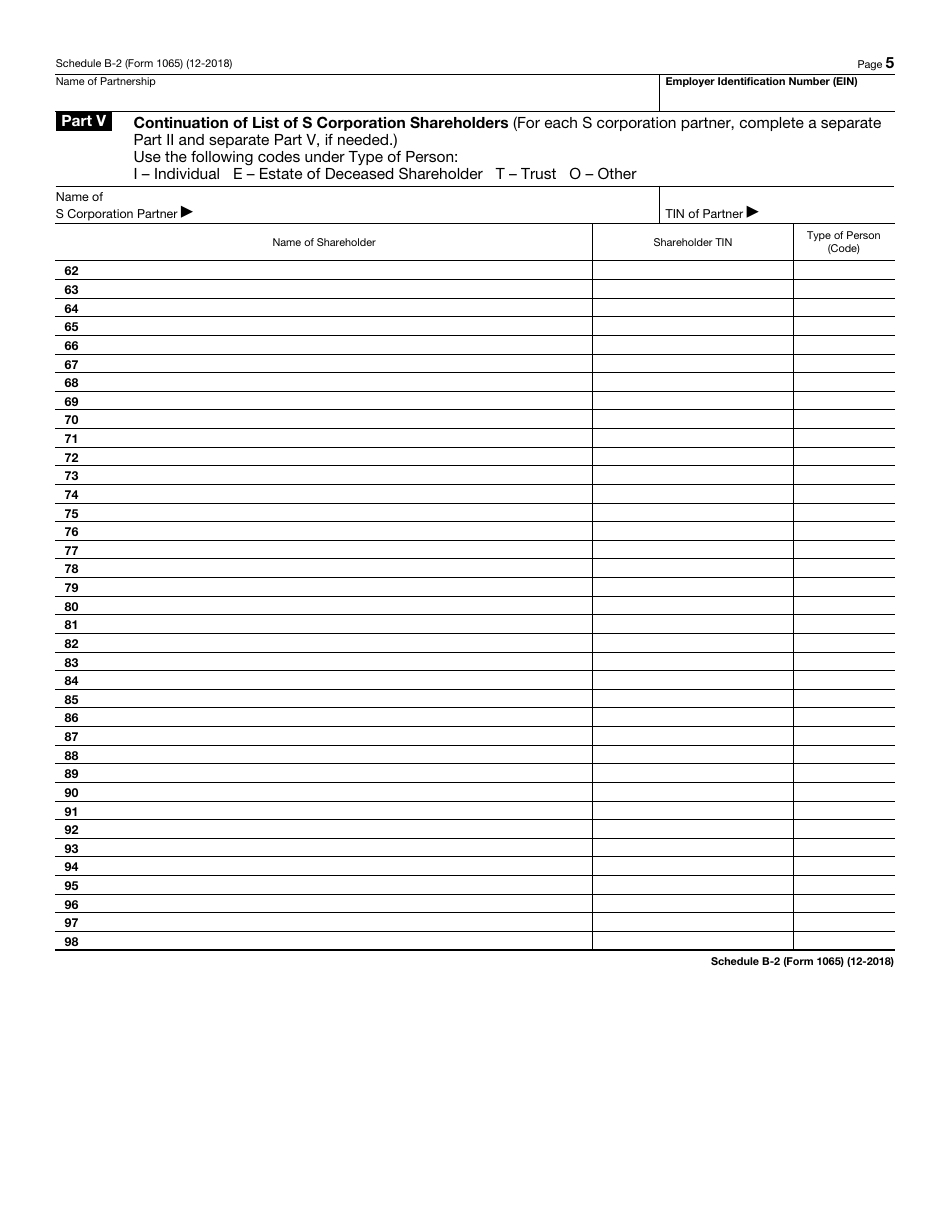

Identify your entity by its legal name and employer identification number, list eligible partners indicating their names, taxpayer identification numbers, and codes provided by the form, write down the names and taxpayer details of shareholders if any of the partners represent S corporations, and record how many instances of Schedule K-1 your entity will release for the tax year covered by the form. The document contains a hundred empty fields for you to identify all the partners properly.

Once Form 1065 Schedule B-2 is completed, attach it to the partnership return you are required to file annually in the name of your entity - ensure you check the box on the main income statement you prepare to confirm this schedule is enclosed with it and you decided separate audits for every partner and different results of them are preferable in your case.