Instructions for IRS Form 1065 Schedule B-2 Election out of the Centralized Partnership Audit Regime

This document contains official instructions for IRS Form 1065 Schedule B-2, Election out of the Centralized Partnership Audit Regime - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 1065 Schedule B-2?

A: IRS Form 1065 Schedule B-2 is a form used for making an election out of the Centralized Partnership Audit Regime.

Q: What is the Centralized Partnership Audit Regime?

A: The Centralized Partnership Audit Regime is a set of rules and procedures that govern the auditing of partnerships by the IRS.

Q: When should I use Form 1065 Schedule B-2?

A: You should use Form 1065 Schedule B-2 if you are a partnership that wants to elect out of the Centralized Partnership Audit Regime.

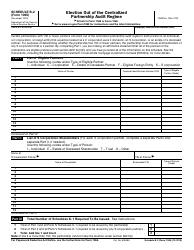

Q: How do I elect out of the Centralized Partnership Audit Regime?

A: To elect out of the Centralized Partnership Audit Regime, you need to file Form 1065 Schedule B-2 with your partnership tax return.

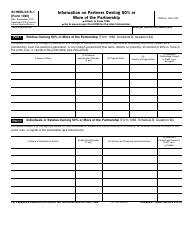

Q: What information do I need to provide on Form 1065 Schedule B-2?

A: On Form 1065 Schedule B-2, you need to provide the name, address, and taxpayer identification number of the partnership, as well as the name, address, and taxpayer identification number of the partnership representative.

Q: Are there any deadlines for filing Form 1065 Schedule B-2?

A: Yes, Form 1065 Schedule B-2 should be filed with your partnership tax return by the due date of the return, including extensions.

Q: Can I change my election out of the Centralized Partnership Audit Regime?

A: No, once you have made the election out of the Centralized Partnership Audit Regime, it cannot be changed.

Instruction Details:

- This 2-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.