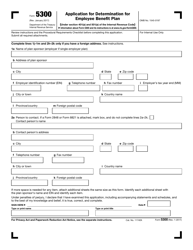

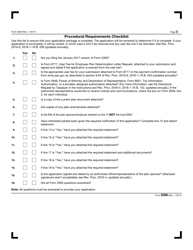

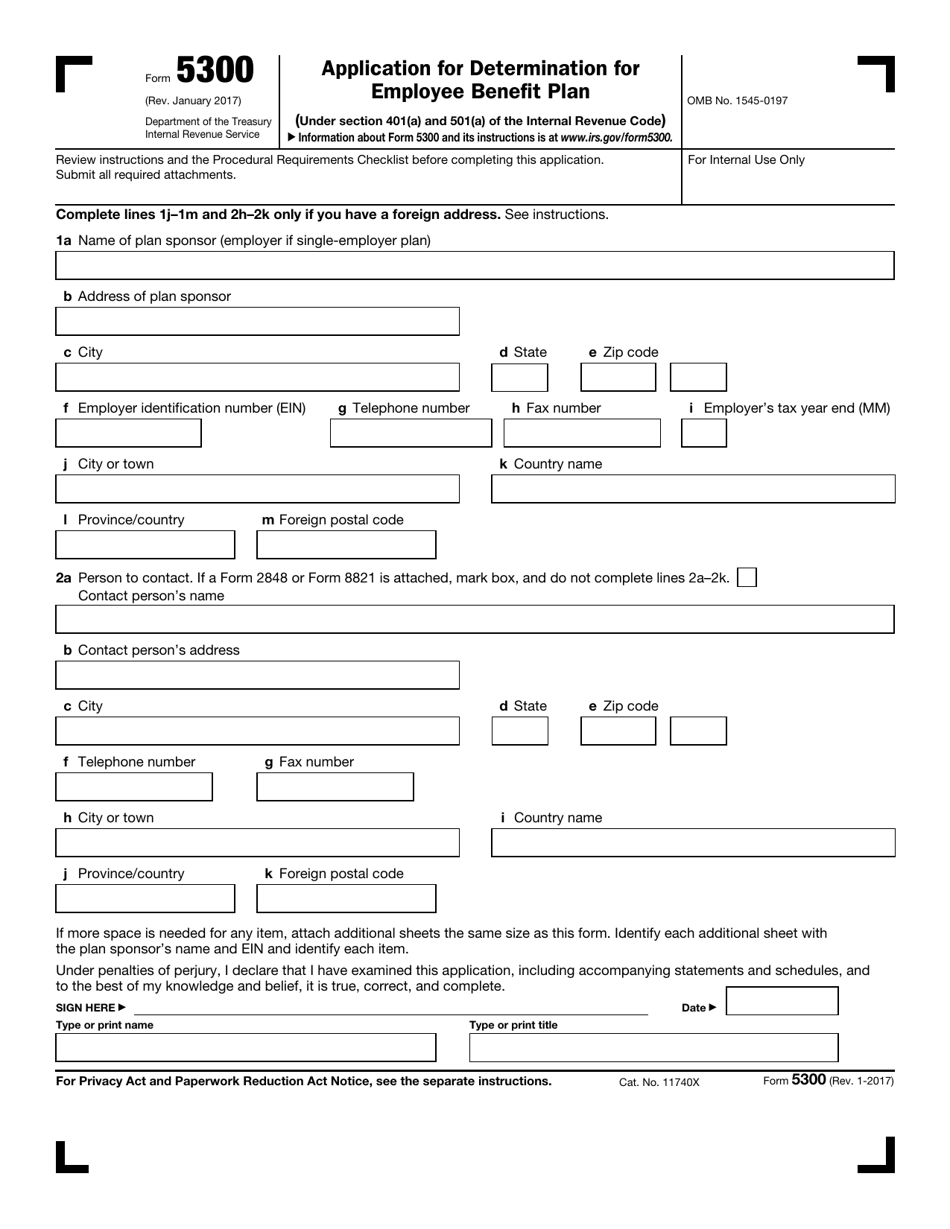

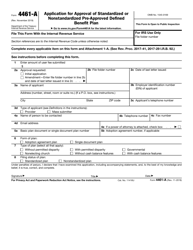

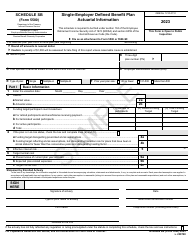

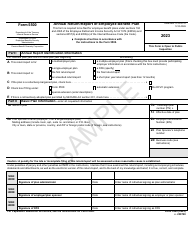

IRS Form 5300 Application for Determination for Employee Benefit Plan

What Is IRS Form 5300?

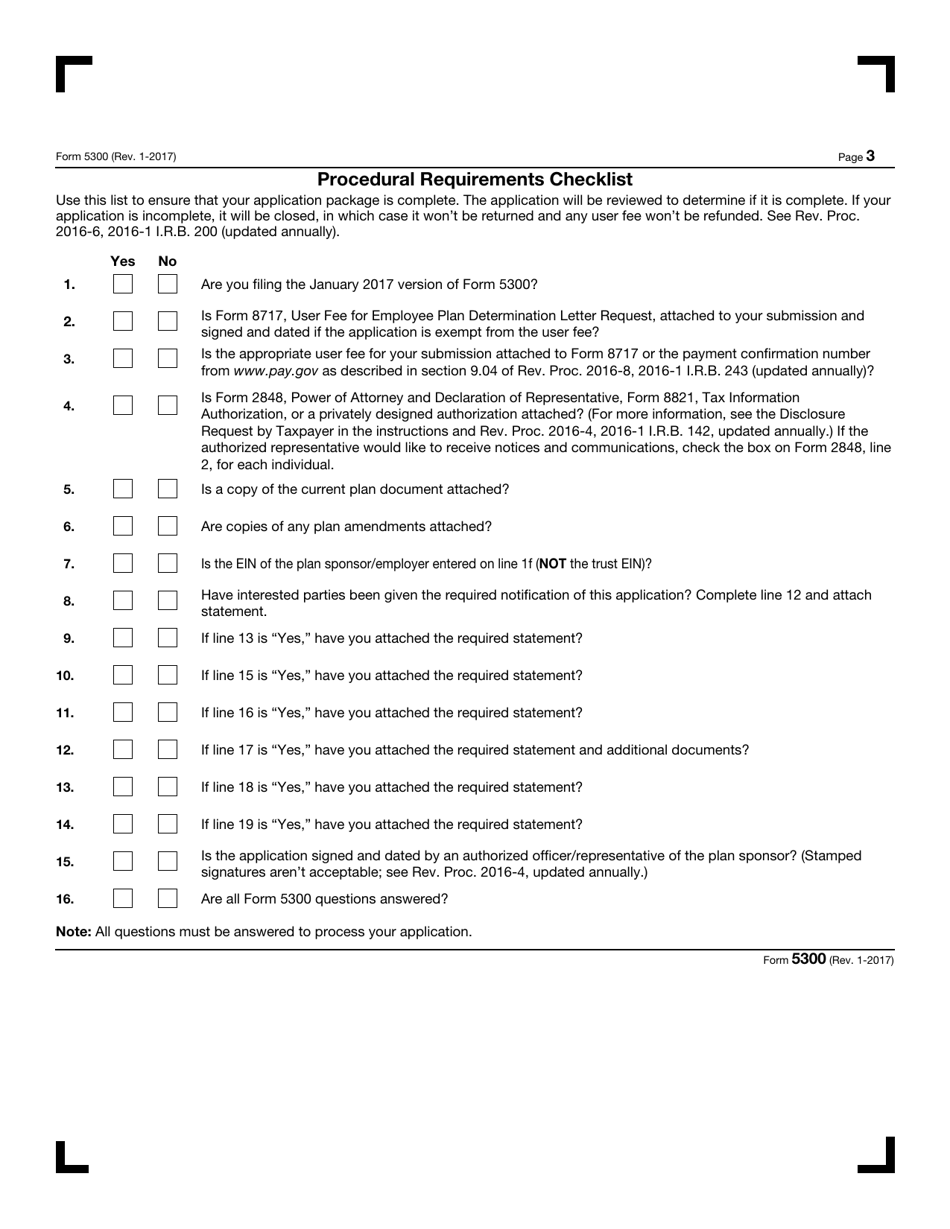

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on January 1, 2017. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 5300?

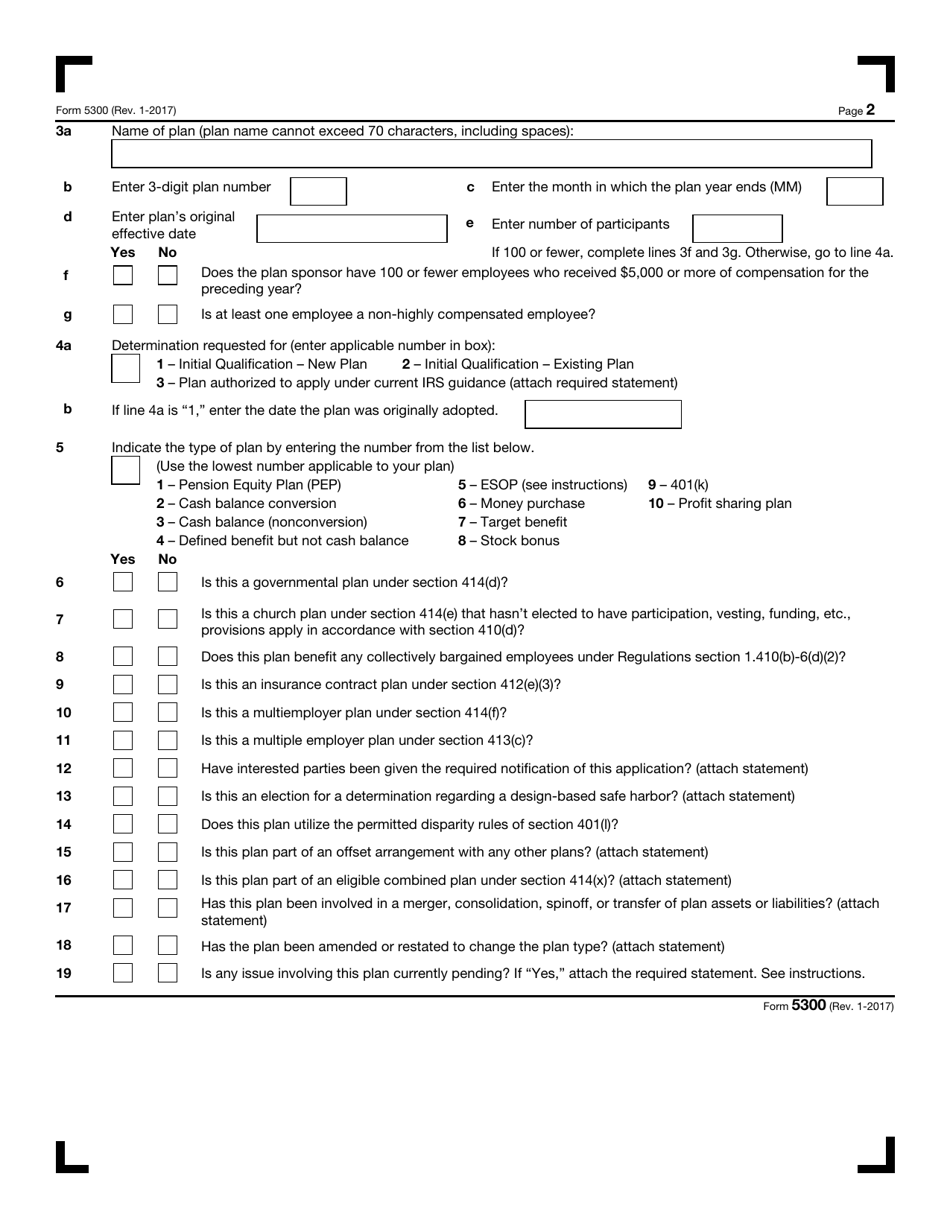

A: IRS Form 5300 is an application for determination for employee benefit plan.

Q: What is the purpose of IRS Form 5300?

A: The purpose of IRS Form 5300 is to request a determination letter from the Internal Revenue Service regarding the qualification of an employee benefit plan.

Q: Who needs to file IRS Form 5300?

A: Employers or plan sponsors who maintain employee benefit plans need to file IRS Form 5300.

Q: Are there any fees associated with filing IRS Form 5300?

A: Yes, there are fees associated with filing IRS Form 5300. The amount of the fee depends on the type and size of the employee benefit plan.

Q: What is a determination letter?

A: A determination letter is a formal written statement from the IRS that confirms the tax-exempt status and qualification of an employee benefit plan.

Q: What happens after I file IRS Form 5300?

A: After you file IRS Form 5300, the IRS will review your application and issue a determination letter to provide the final decision on the qualification of your employee benefit plan.

Q: What should I do if my employee benefit plan is not qualified?

A: If your employee benefit plan is not qualified, you may have to make changes to meet the qualification requirements or consult with a tax professional for guidance.

Q: Can I appeal if my employee benefit plan is not qualified?

A: Yes, you have the right to appeal the IRS's decision regarding the qualification of your employee benefit plan.

Form Details:

- A 5-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5300 through the link below or browse more documents in our library of IRS Forms.