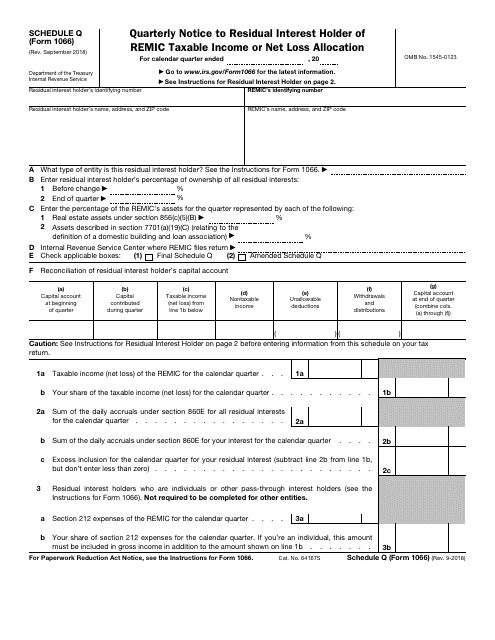

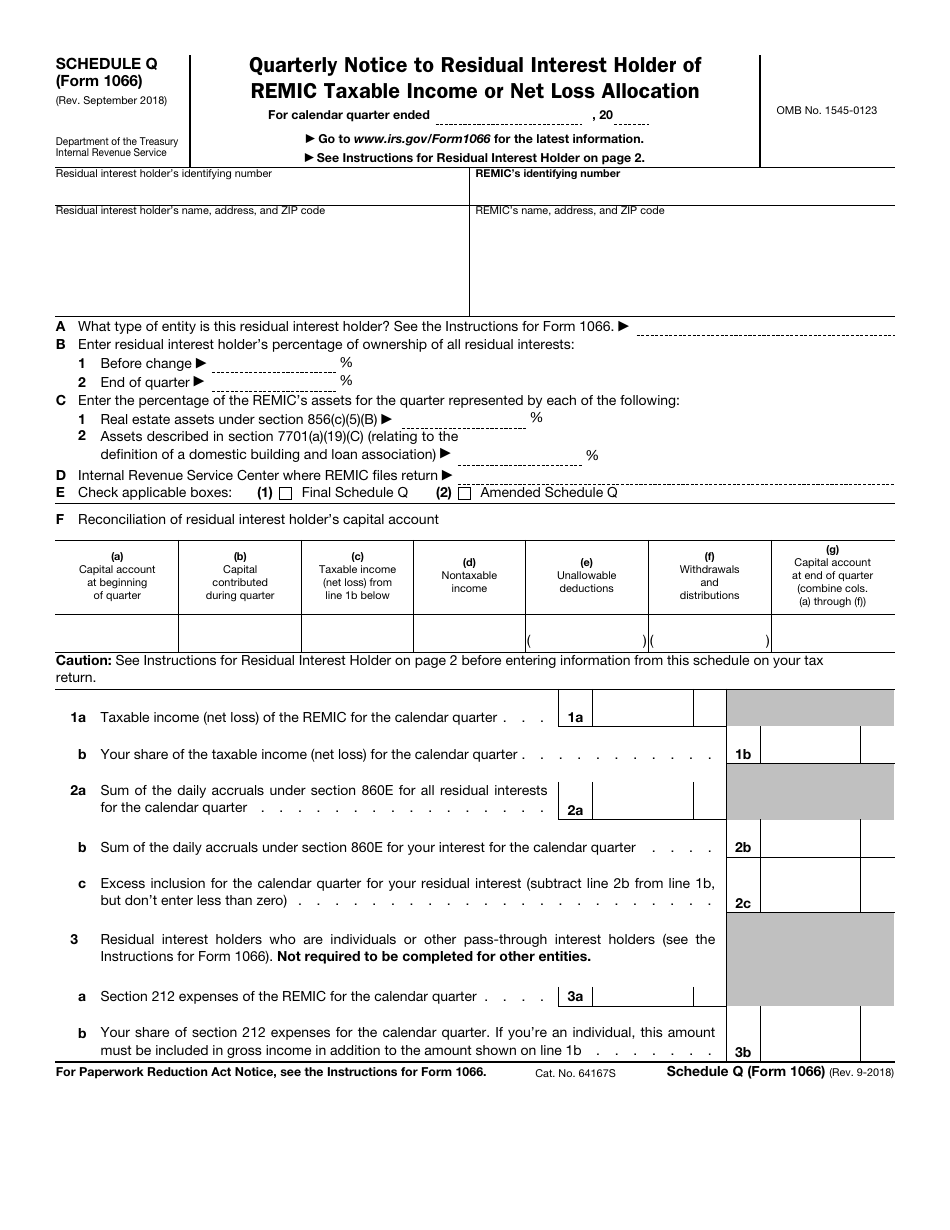

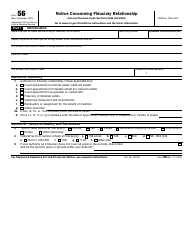

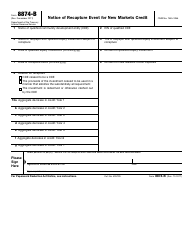

IRS Form 1066 Schedule Q Quarterly Notice to Residual Interest Holder of REMIC Taxable Income or Net Loss Allocation

What Is IRS Form 1066 Schedule Q?

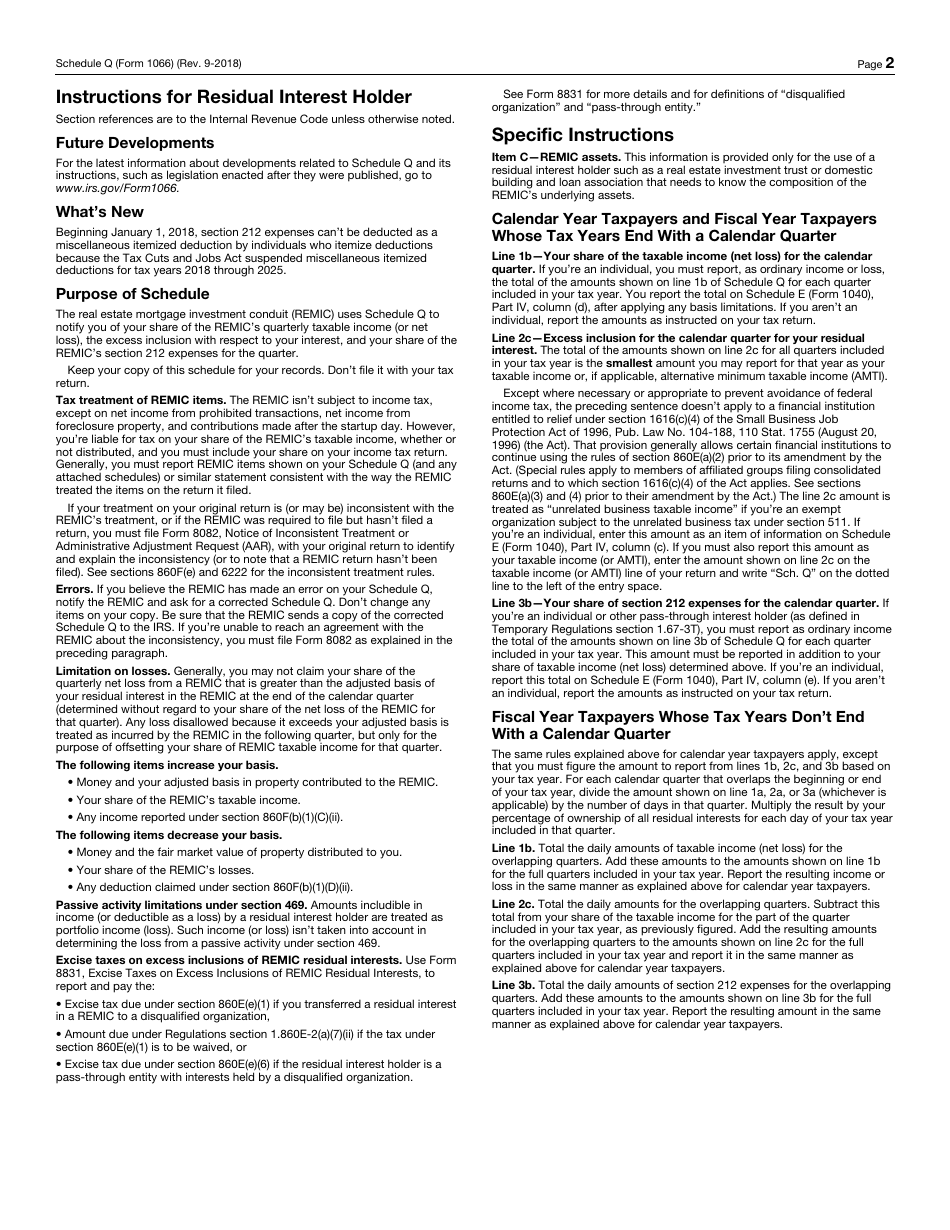

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on September 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 1066 Schedule Q?

A: IRS Form 1066 Schedule Q is a form used to provide a quarterly notice to the residual interest holder of a REMIC (Real Estate Mortgage Investment Conduit) regarding taxable income or net loss allocation.

Q: Who uses IRS Form 1066 Schedule Q?

A: Residual interest holders of REMICs use IRS Form 1066 Schedule Q to receive quarterly notices about taxable income or net loss allocation.

Q: What is a REMIC?

A: A REMIC is a type of entity that holds a pool of mortgages or other real estate loans and issues securities backed by the income from those loans.

Q: What information does IRS Form 1066 Schedule Q provide?

A: IRS Form 1066 Schedule Q provides information about the taxable income or net loss allocation of a REMIC to the residual interest holder.

Q: How often is IRS Form 1066 Schedule Q filed?

A: IRS Form 1066 Schedule Q is filed quarterly.

Form Details:

- A 2-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 1066 Schedule Q through the link below or browse more documents in our library of IRS Forms.