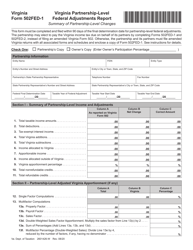

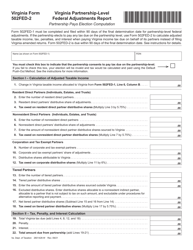

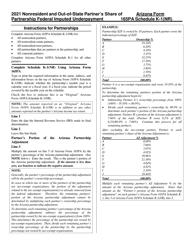

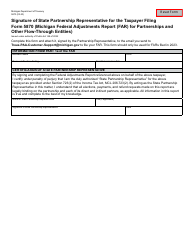

Instructions for Form 5870 Michigan Federal Adjustments Report (Far) for Partnerships and Other Flow-Through Entities - Michigan

This document contains official instructions for Form 5870 , Michigan Federal Adjustments Report (Far) for Partnerships and Other Flow-Through Entities - a form released and collected by the Michigan Department of Treasury.

FAQ

Q: What is Form 5870?

A: Form 5870 is the Michigan Federal Adjustments Report (FAR) for Partnerships and Other Flow-Through Entities.

Q: Who needs to file Form 5870?

A: Partnerships and other flow-through entities in Michigan need to file Form 5870.

Q: What is the purpose of Form 5870?

A: The purpose of Form 5870 is to report any federal adjustments made by the Internal Revenue Service (IRS) that affect a flow-through entity’s Michigan income tax.

Q: When is Form 5870 due?

A: Form 5870 is due on or before the 15th day of the 4th month following the close of the entity's tax year.

Q: Are there any penalties for late or incorrect filing?

A: Yes, there are penalties for late or incorrect filing. It is important to file Form 5870 accurately and on time to avoid penalties.

Instruction Details:

- This 8-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Michigan Department of Treasury.