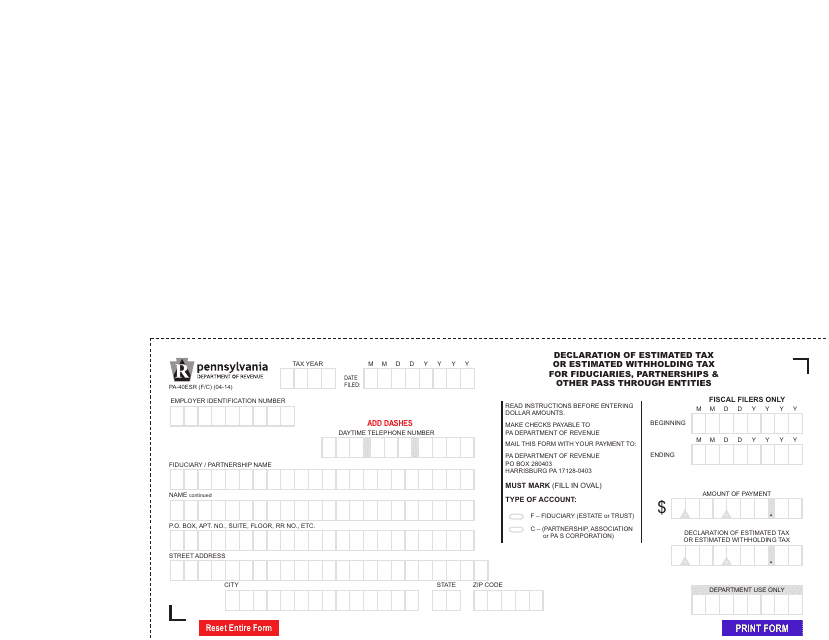

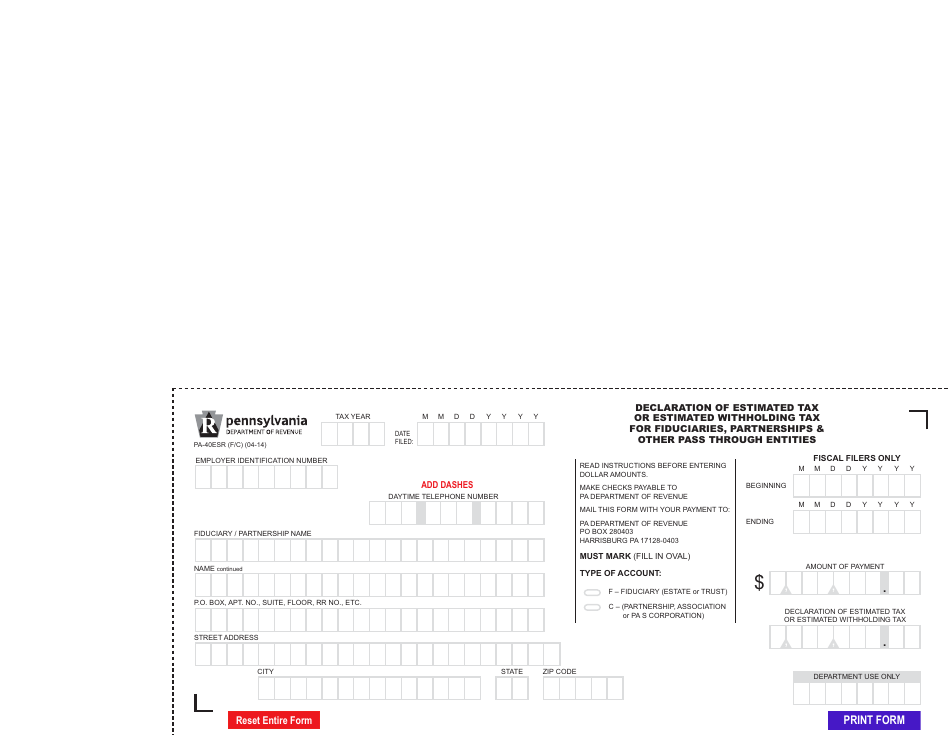

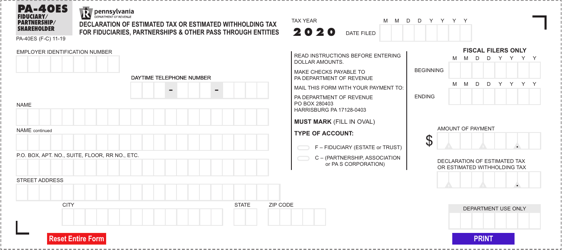

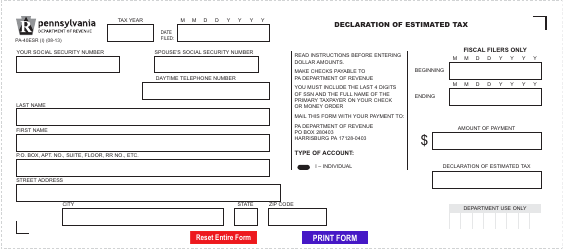

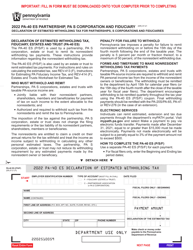

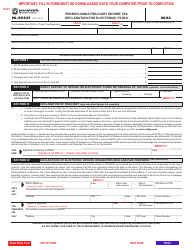

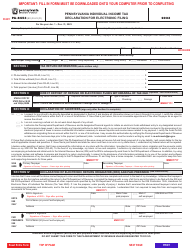

Form PA-40ESR (F / C) Declaration of Estimated Tax or Estimated Withholding Tax for Fiduciaries, Partnerships & Other Pass Through Entities - Pennsylvania

What Is Form PA-40ESR (F/C)?

This is a legal form that was released by the Pennsylvania Department of Revenue - a government authority operating within Pennsylvania. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form PA-40ESR (F/C)?

A: Form PA-40ESR (F/C) is a declaration form used by fiduciaries, partnerships, and other pass-through entities in Pennsylvania to report estimated tax or withholding tax.

Q: Who needs to file Form PA-40ESR (F/C)?

A: Fiduciaries, partnerships, and other pass-through entities in Pennsylvania need to file Form PA-40ESR (F/C) if they are required to pay estimated tax or withholding tax.

Q: What is the purpose of filing Form PA-40ESR (F/C)?

A: The purpose of filing Form PA-40ESR (F/C) is to report and pay estimated tax or withholding tax for fiduciaries, partnerships, and other pass-through entities in Pennsylvania.

Q: When is Form PA-40ESR (F/C) due?

A: Form PA-40ESR (F/C) is generally due on the 15th day of the 4th, 6th, 9th, and 12th months of the tax year for which the estimated tax or withholding tax is being reported.

Q: Is Form PA-40ESR (F/C) for individuals?

A: No, Form PA-40ESR (F/C) is not for individuals. It is specifically for fiduciaries, partnerships, and other pass-through entities in Pennsylvania.

Q: Are there any penalties for not filing Form PA-40ESR (F/C) on time?

A: Yes, there may be penalties for not filing Form PA-40ESR (F/C) on time. It is important to file and pay the estimated tax or withholding tax by the due date to avoid penalties.

Q: Can Form PA-40ESR (F/C) be filed electronically?

A: Yes, Form PA-40ESR (F/C) can be filed electronically through the Pennsylvania Department of Revenue's e-TIDES system or through authorized tax preparation software.

Q: Can I amend my Form PA-40ESR (F/C) if I make a mistake?

A: Yes, you can amend your Form PA-40ESR (F/C) if you make a mistake. You can file an amended Form PA-40ESR (F/C) to correct any errors or changes in your estimated tax or withholding tax.

Form Details:

- Released on April 1, 2014;

- The latest edition provided by the Pennsylvania Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form PA-40ESR (F/C) by clicking the link below or browse more documents and templates provided by the Pennsylvania Department of Revenue.