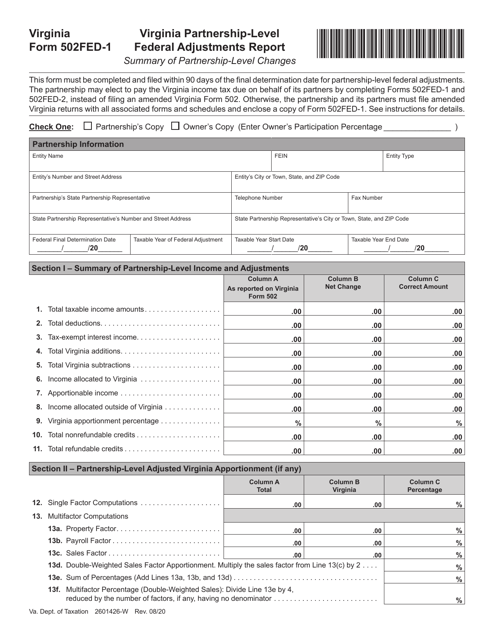

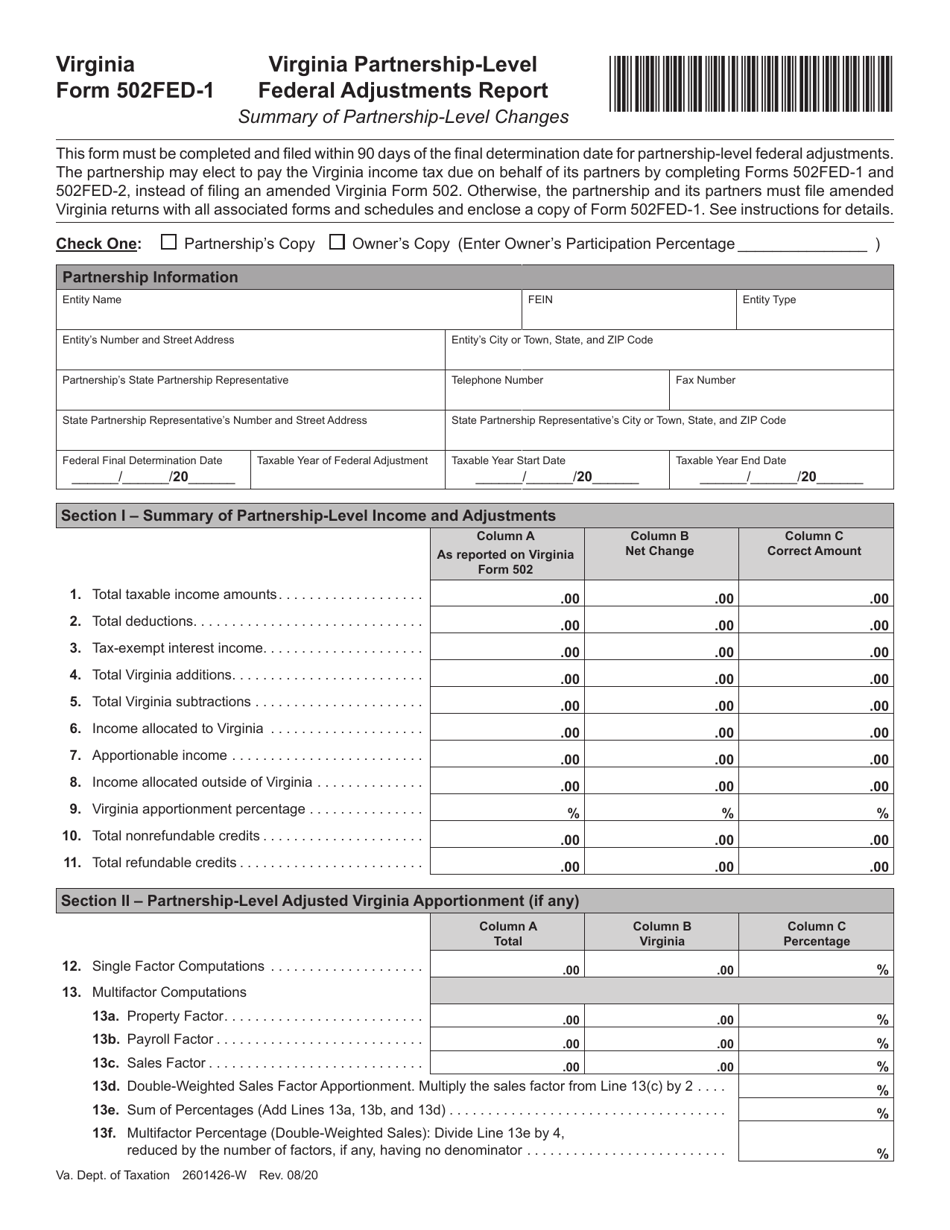

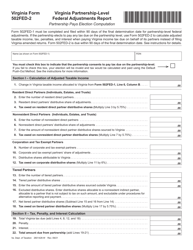

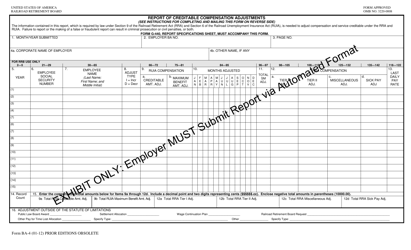

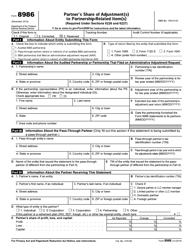

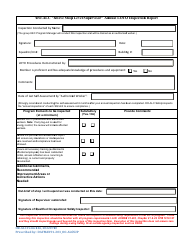

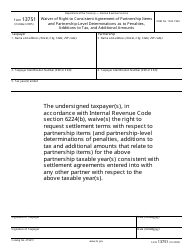

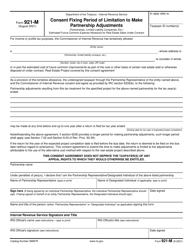

Form 502FED-1 Virginia Partnership-Level Federal Adjustments Report - Virginia

What Is Form 502FED-1?

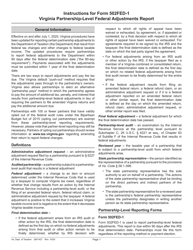

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 502FED-1?

A: Form 502FED-1 is the Virginia Partnership-Level Federal Adjustments Report.

Q: What is the purpose of Form 502FED-1?

A: The purpose of Form 502FED-1 is to report partnership federal adjustments and modifications made at the federal level.

Q: Who needs to file Form 502FED-1?

A: Partnerships in Virginia that have federal adjustments and modifications need to file Form 502FED-1.

Q: When is Form 502FED-1 due?

A: Form 502FED-1 is due on the 15th day of the 4th month following the close of the partnership's taxable year.

Form Details:

- Released on August 1, 2020;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 502FED-1 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.