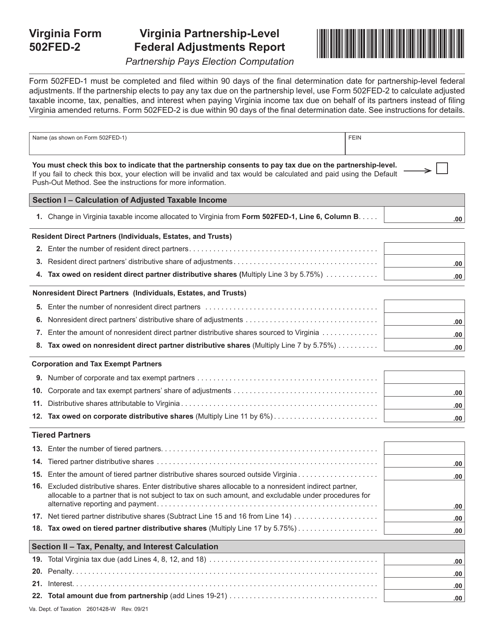

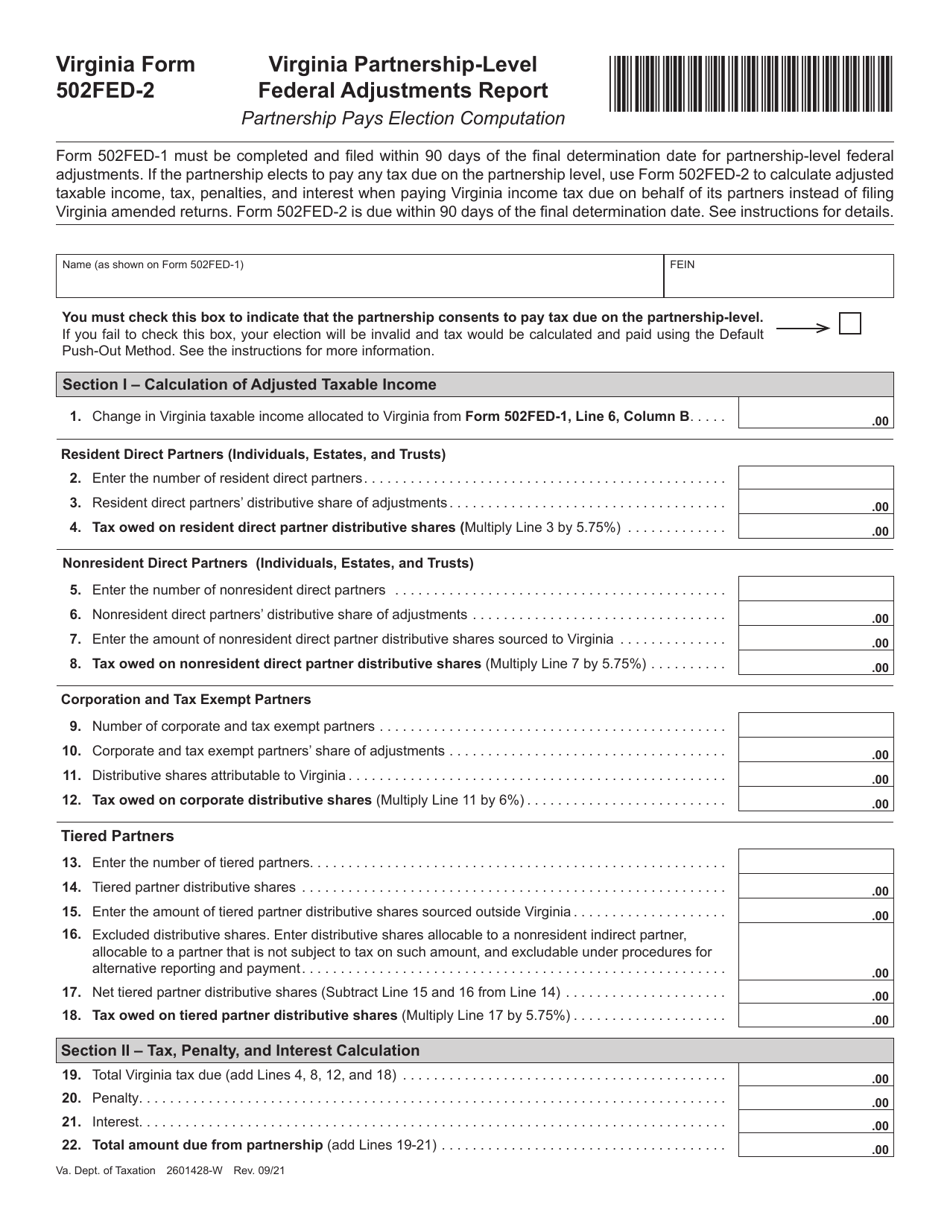

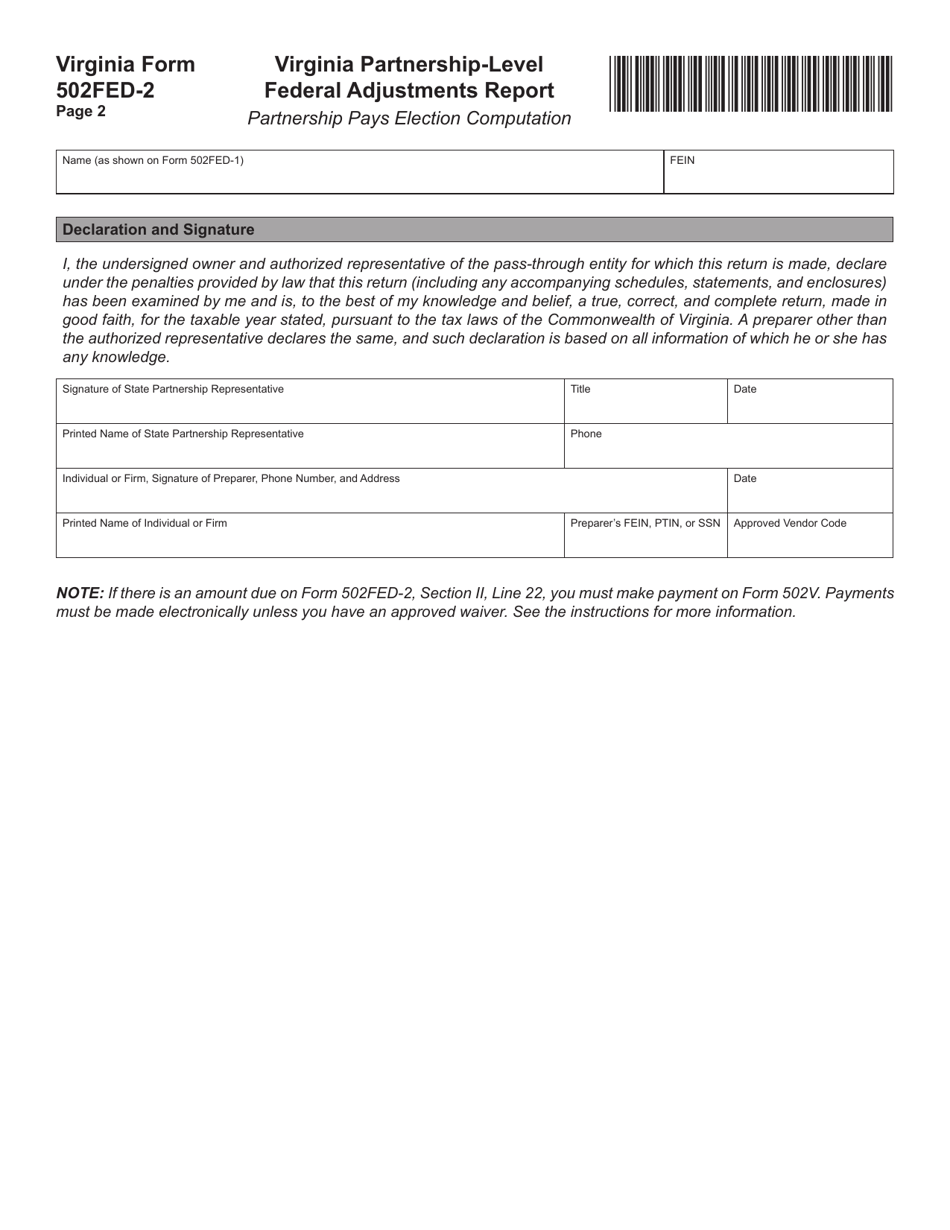

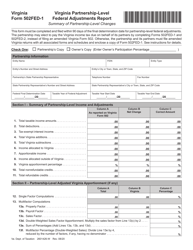

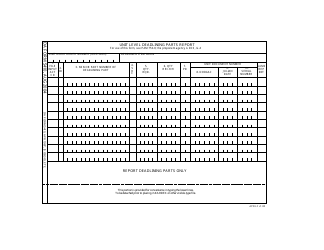

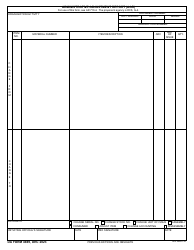

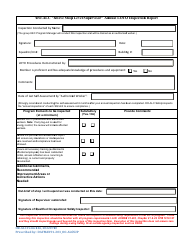

Form 502FED-2 Virginia Partnership-Level Federal Adjustments Report - Virginia

What Is Form 502FED-2?

This is a legal form that was released by the Virginia Department of Taxation - a government authority operating within Virginia. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form 502FED-2?

A: Form 502FED-2 is the Virginia Partnership-Level Federal Adjustments Report.

Q: What is the purpose of Form 502FED-2?

A: The purpose of Form 502FED-2 is to report federal adjustments at the partnership level for Virginia tax purposes.

Q: Who needs to file Form 502FED-2?

A: Partnerships who have made federal adjustments that impact their Virginia tax liability need to file Form 502FED-2.

Q: When is the deadline for filing Form 502FED-2?

A: The deadline for filing Form 502FED-2 is the same as the Virginia partnership tax return deadline, which is generally the 15th day of the fourth month following the close of the taxable year.

Form Details:

- Released on September 1, 2021;

- The latest edition provided by the Virginia Department of Taxation;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 502FED-2 by clicking the link below or browse more documents and templates provided by the Virginia Department of Taxation.