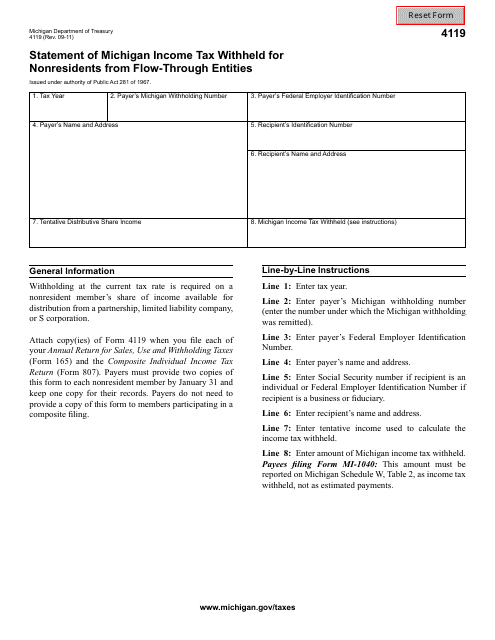

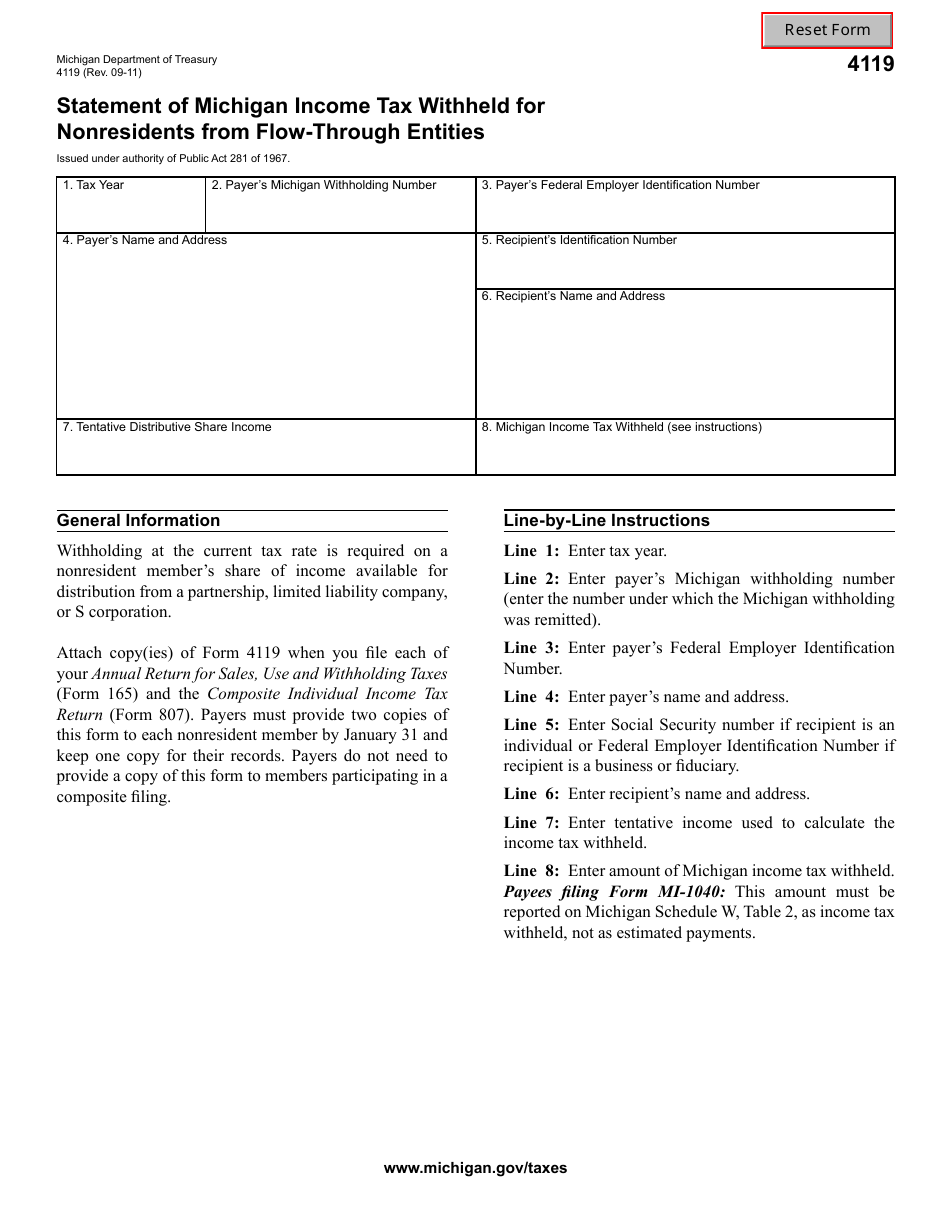

Form 4119 Statement of Michigan Income Tax Withheld for Nonresidents From Flow-Through Entities - Michigan

What Is Form 4119?

This is a legal form that was released by the Michigan Department of Treasury - a government authority operating within Michigan. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 4119?

A: Form 4119 is the Statement of Michigan Income Tax Withheld for Nonresidents From Flow-Through Entities.

Q: Who needs to file Form 4119?

A: Flow-through entities that have withheld Michigan income tax on behalf of nonresident owners or beneficiaries need to file Form 4119.

Q: What is the purpose of Form 4119?

A: The purpose of Form 4119 is to report the Michigan income tax withheld by flow-through entities and allocate the tax to the nonresident owners or beneficiaries.

Q: When is Form 4119 due?

A: Form 4119 is due on or before the last day of the month following the close of the entity's taxable year.

Form Details:

- Released on September 1, 2011;

- The latest edition provided by the Michigan Department of Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 4119 by clicking the link below or browse more documents and templates provided by the Michigan Department of Treasury.