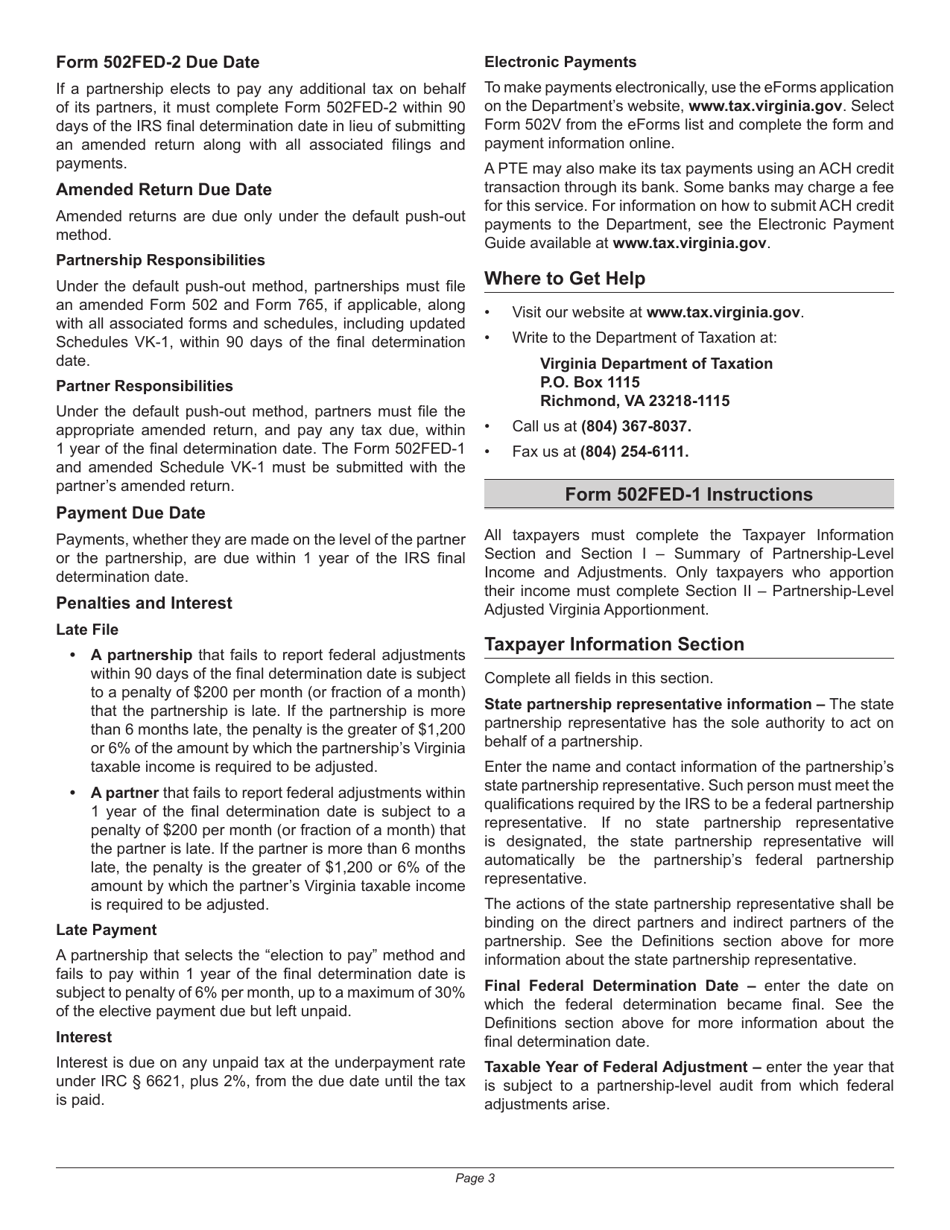

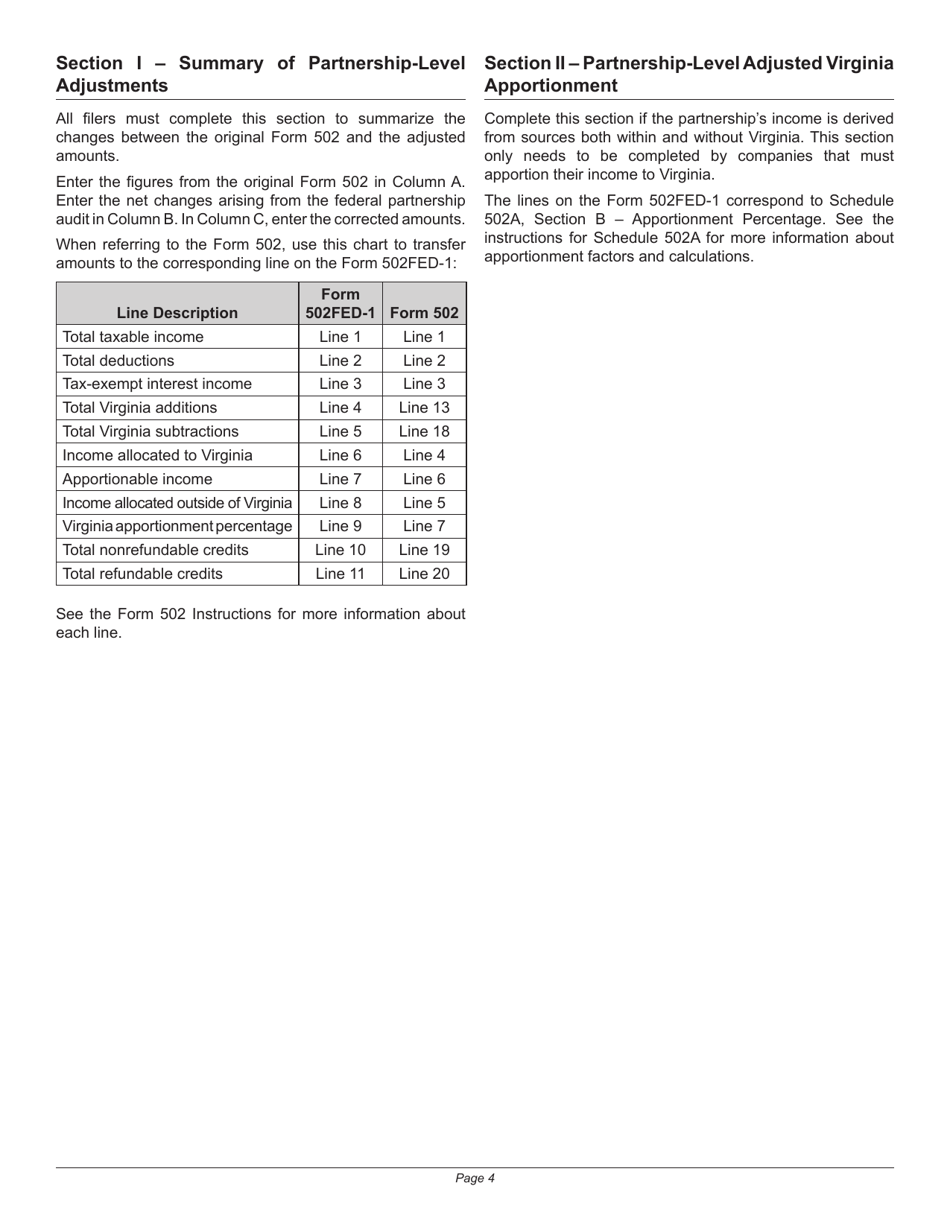

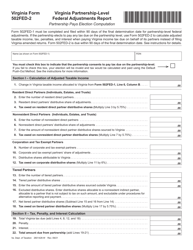

Instructions for Form 502FED-1 Virginia Partnership-Level Federal Adjustments Report - Virginia

This document contains official instructions for Form 502FED-1 , Virginia Partnership-Level Federal Adjustments Report - a form released and collected by the Virginia Department of Taxation. An up-to-date fillable Form 502FED-1 is available for download through this link.

FAQ

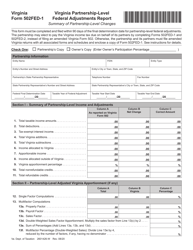

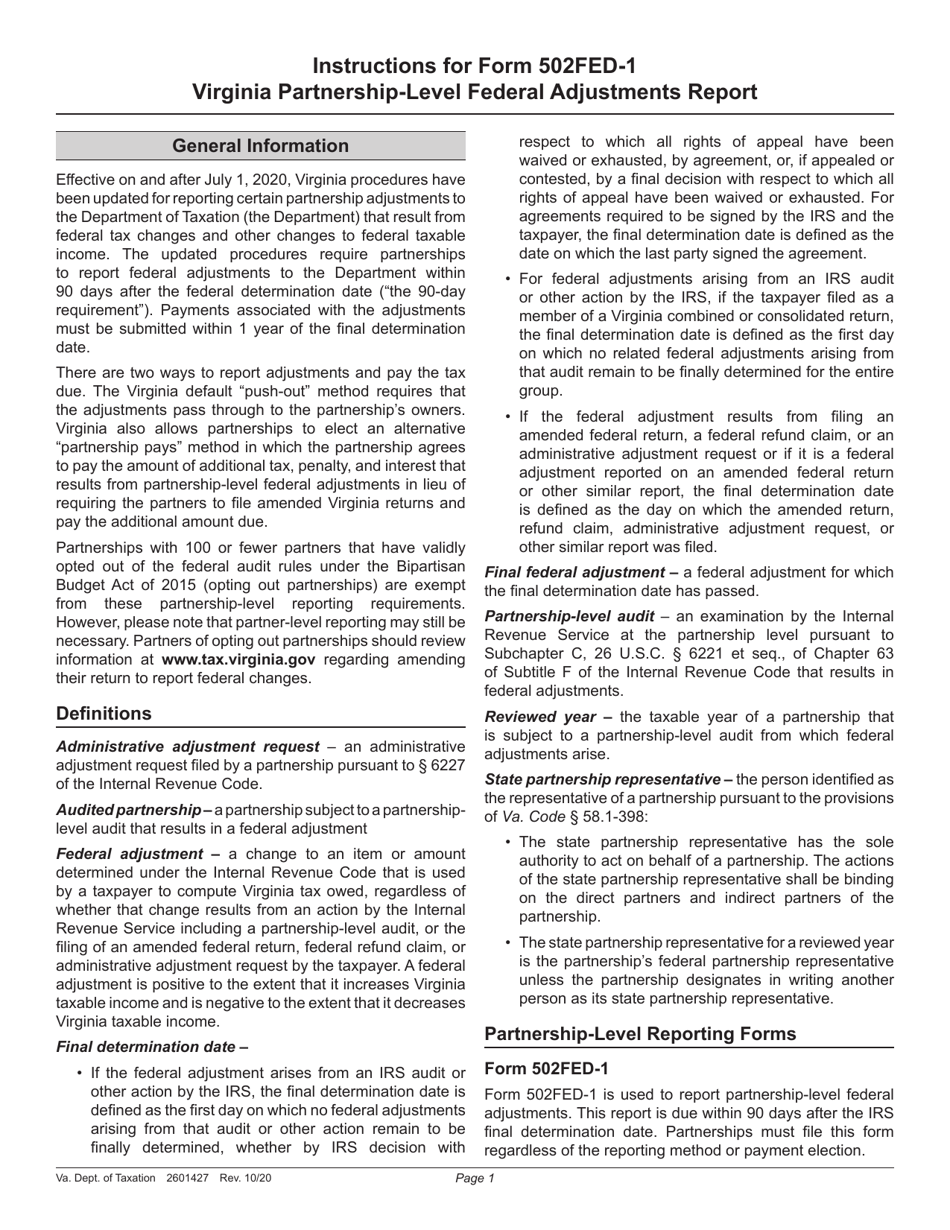

Q: What is Form 502FED-1?

A: Form 502FED-1 is the Virginia Partnership-Level Federal Adjustments Report.

Q: Who needs to file Form 502FED-1?

A: Partnerships in Virginia need to file Form 502FED-1.

Q: What is the purpose of Form 502FED-1?

A: Form 502FED-1 is used to report federal adjustments made at the partnership level in Virginia.

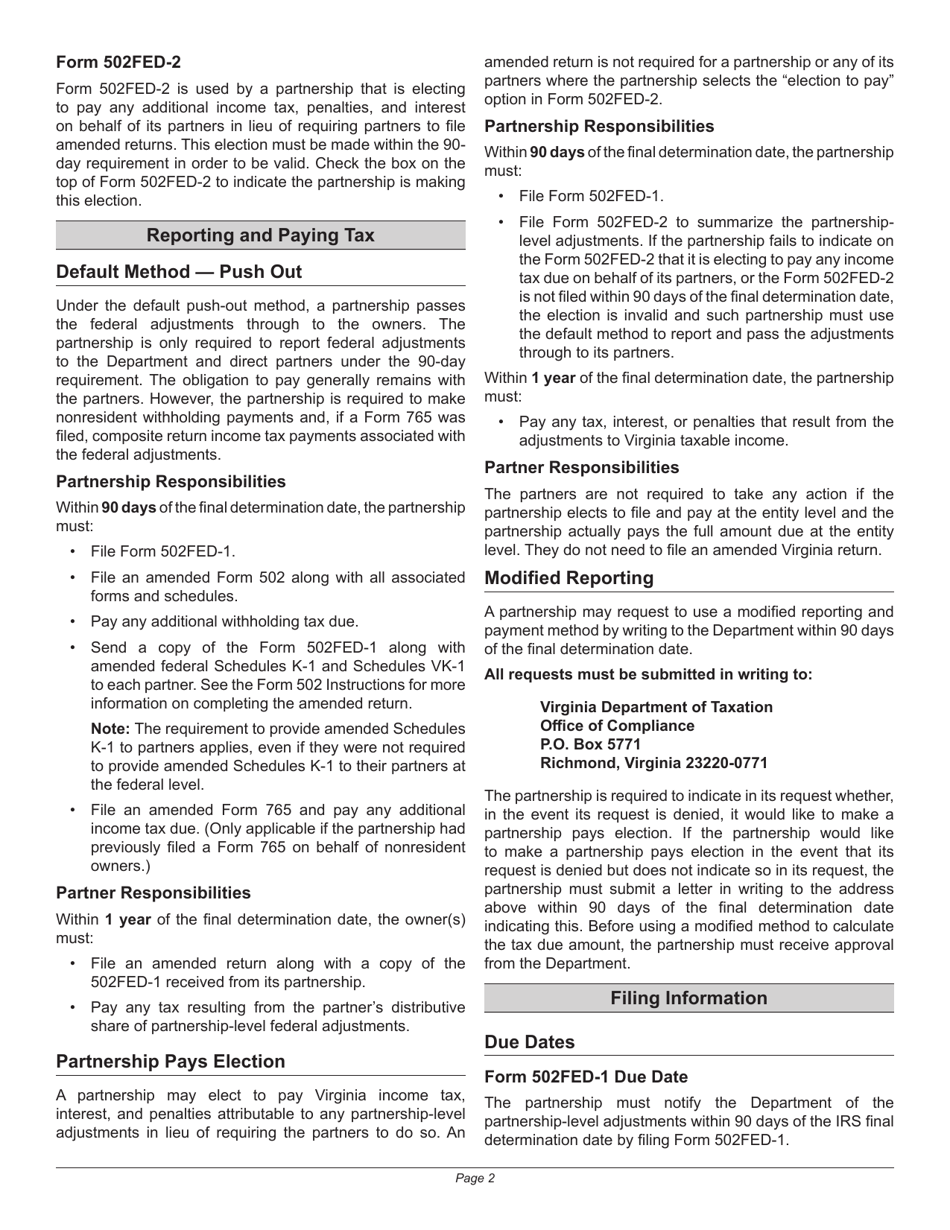

Q: When is the deadline for filing Form 502FED-1?

A: The deadline for filing Form 502FED-1 is the same as the federal partnership tax return deadline, which is usually done by the 15th day of the fourth month following the close of the tax year.

Q: Are there any fees associated with filing Form 502FED-1?

A: There are no specific filing fees associated with Form 502FED-1, but standard partnership tax return filing fees may apply.

Q: What are the consequences of not filing Form 502FED-1?

A: Failure to file Form 502FED-1 may result in penalties and interest charges imposed by the Virginia Department of Taxation.

Q: Do I need to include supporting documentation with Form 502FED-1?

A: Yes, you are required to include supporting documentation with Form 502FED-1 when filing.

Q: Can I file an amended Form 502FED-1?

A: Yes, you can file an amended Form 502FED-1 if there are changes or corrections to be made after the original filing.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Virginia Department of Taxation.