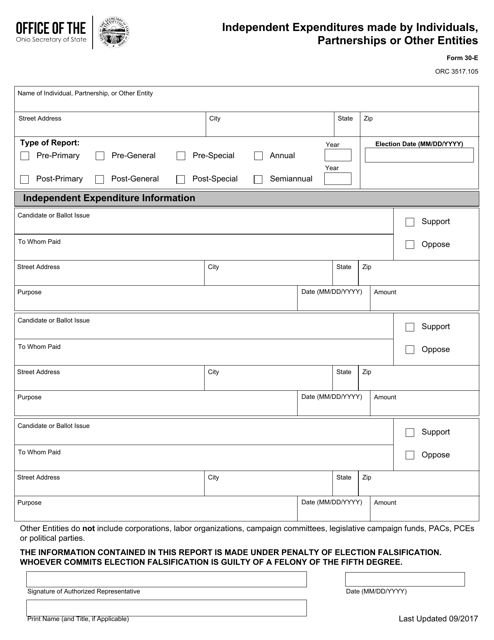

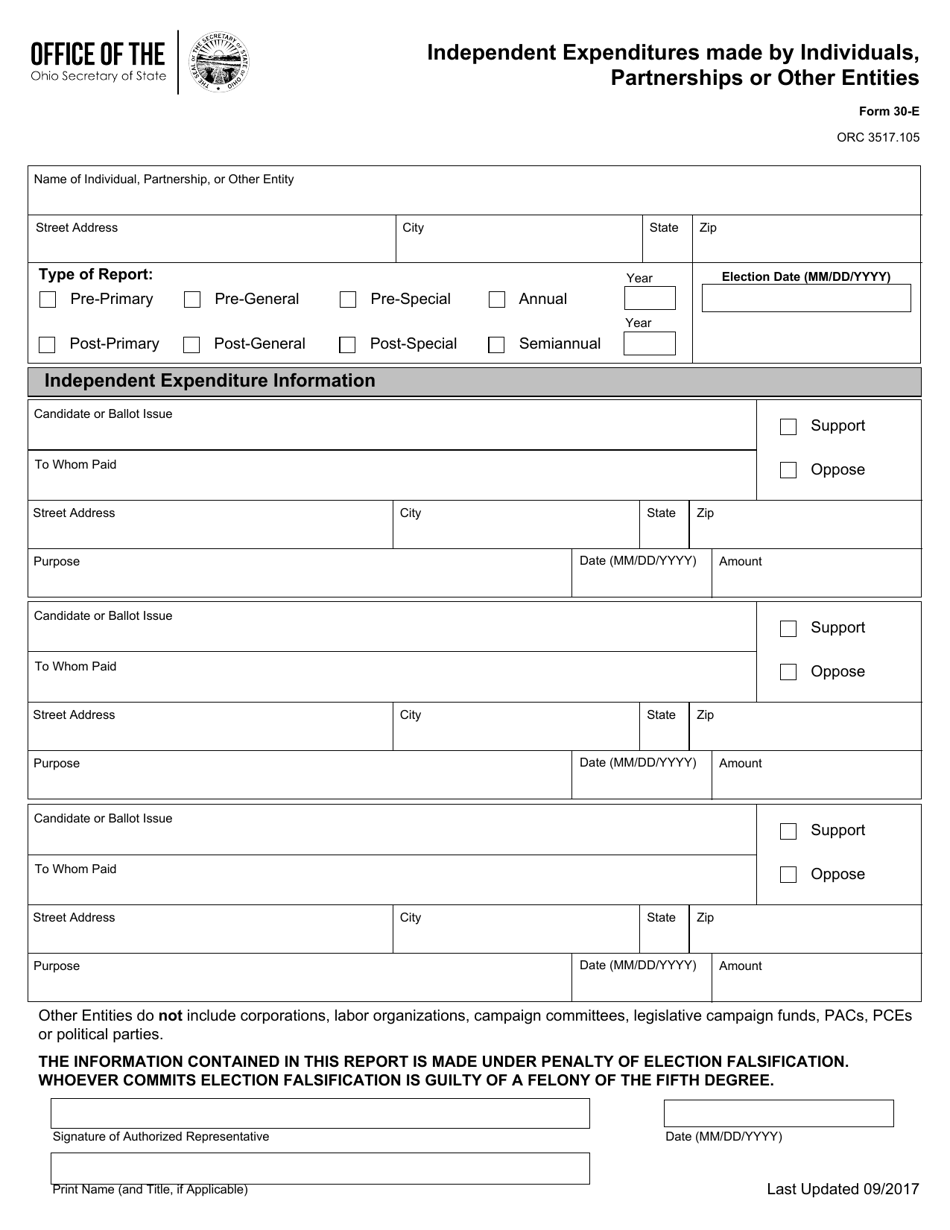

Form 30-E Independent Expenditures Made by Individuals, Partnerships or Other Entities - Ohio

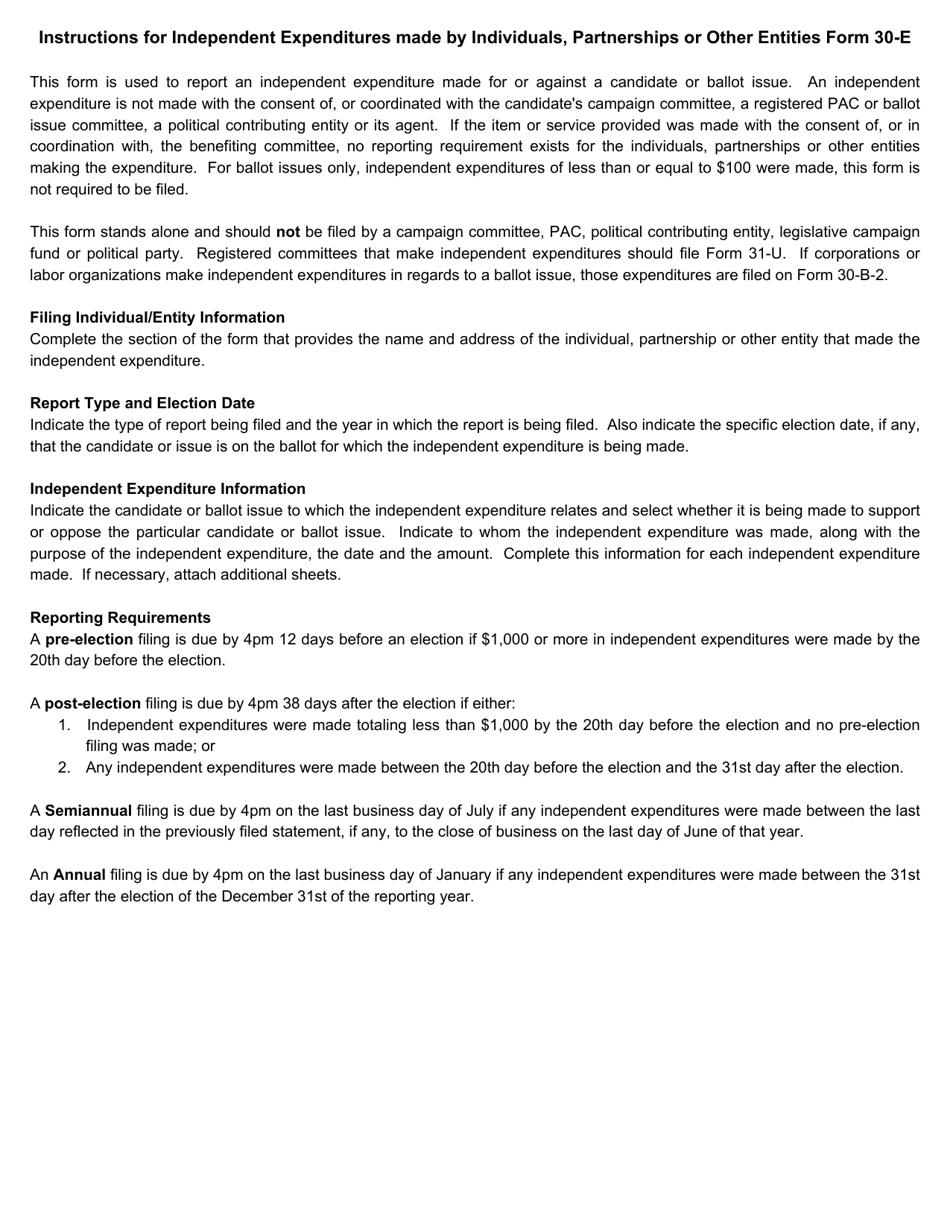

What Is Form 30-E?

This is a legal form that was released by the Ohio Secretary of State - a government authority operating within Ohio. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is form 30-E?

A: Form 30-E is a document used to report independent expenditures made by individuals, partnerships, or other entities in Ohio.

Q: Who is required to file form 30-E?

A: Individuals, partnerships, or other entities who make independent expenditures in Ohio are required to file form 30-E.

Q: What are independent expenditures?

A: Independent expenditures are expenditures made by individuals, partnerships, or other entities in support of or opposition to a candidate or issue without coordination with a candidate's campaign.

Q: Why are independent expenditures reported?

A: Independent expenditures are reported to promote transparency and provide information about the sources and amounts of money spent on political activities.

Q: When is form 30-E filed?

A: Form 30-E is typically filed within a certain timeframe before an election, as specified by the Ohio Secretary of State.

Q: What information is required on form 30-E?

A: Form 30-E requires information such as the name of the individual, partnership, or entity making the expenditure, the amount spent, and details about the candidate or issue supported or opposed.

Q: Are there any penalties for not filing form 30-E?

A: Failure to file form 30-E or filing false or incomplete information may result in penalties as determined by Ohio campaign finance laws.

Form Details:

- Released on September 1, 2017;

- The latest edition provided by the Ohio Secretary of State;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 30-E by clicking the link below or browse more documents and templates provided by the Ohio Secretary of State.