This version of the form is not currently in use and is provided for reference only. Download this version of

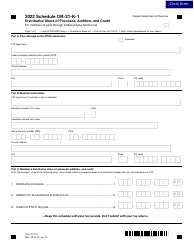

Instructions for Form 150-107-112 Schedule OR-21-MD

for the current year.

Instructions for Form 150-107-112 Schedule OR-21-MD Oregon Pass-Through Entity Elective Tax Member Directory - Oregon

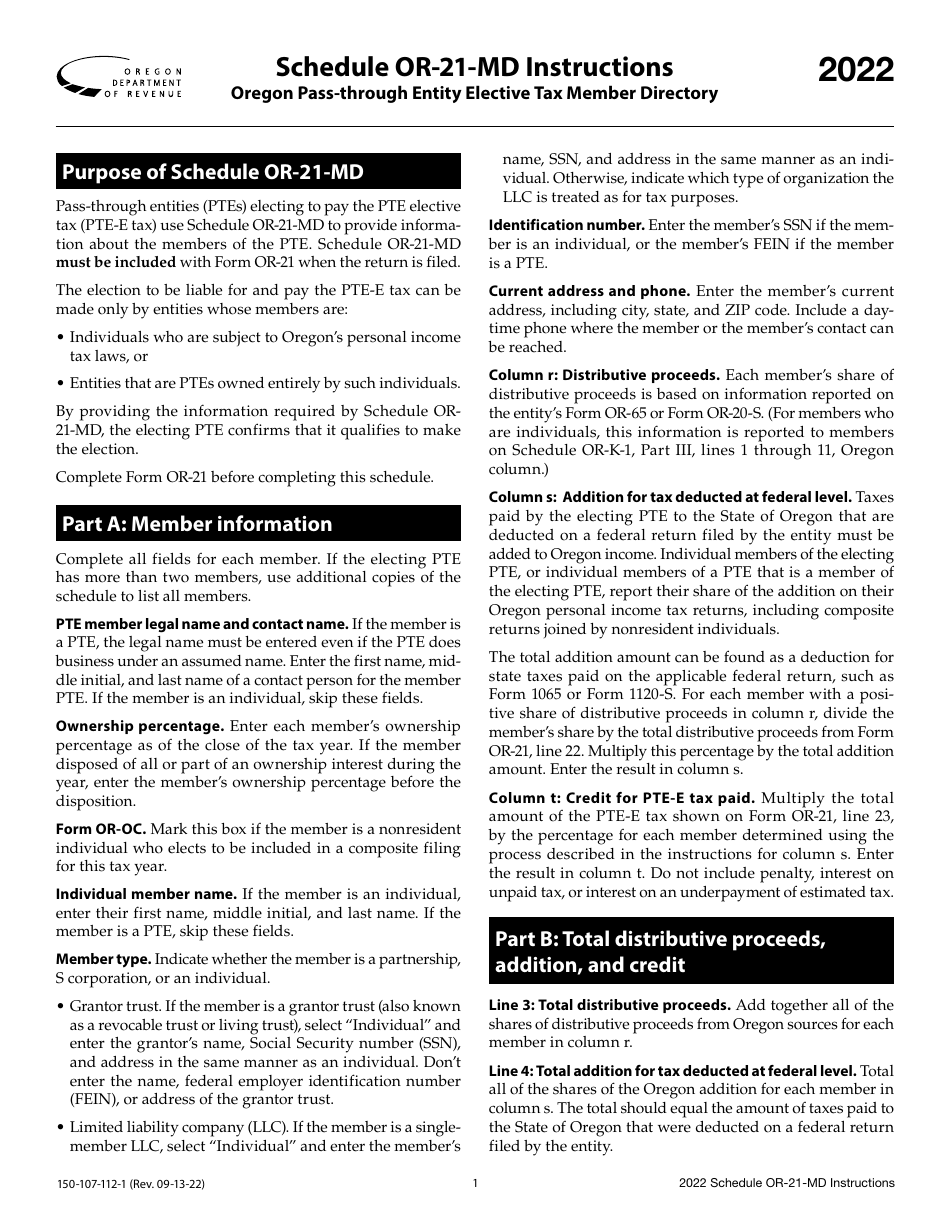

This document contains official instructions for Form 150-107-112 Schedule OR-21-MD, Oregon Pass-Through Entity Elective Tax Member Directory - a form released and collected by the Oregon Department of Revenue.

FAQ

Q: What is Form 150-107-112 Schedule OR-21-MD?

A: Form 150-107-112 Schedule OR-21-MD is a tax form used in Oregon for pass-through entities to report member details.

Q: What is a pass-through entity?

A: A pass-through entity is a business structure (such as a partnership or S corporation) that doesn't pay taxes itself. Instead, the profits and losses are passed through to the owners, who report them on their personal tax returns.

Q: What is the purpose of Schedule OR-21-MD?

A: The purpose of Schedule OR-21-MD is to provide the Oregon Department of Revenue with detailed information about the members of a pass-through entity.

Q: Who needs to file Schedule OR-21-MD?

A: Pass-through entities operating in Oregon need to file Schedule OR-21-MD.

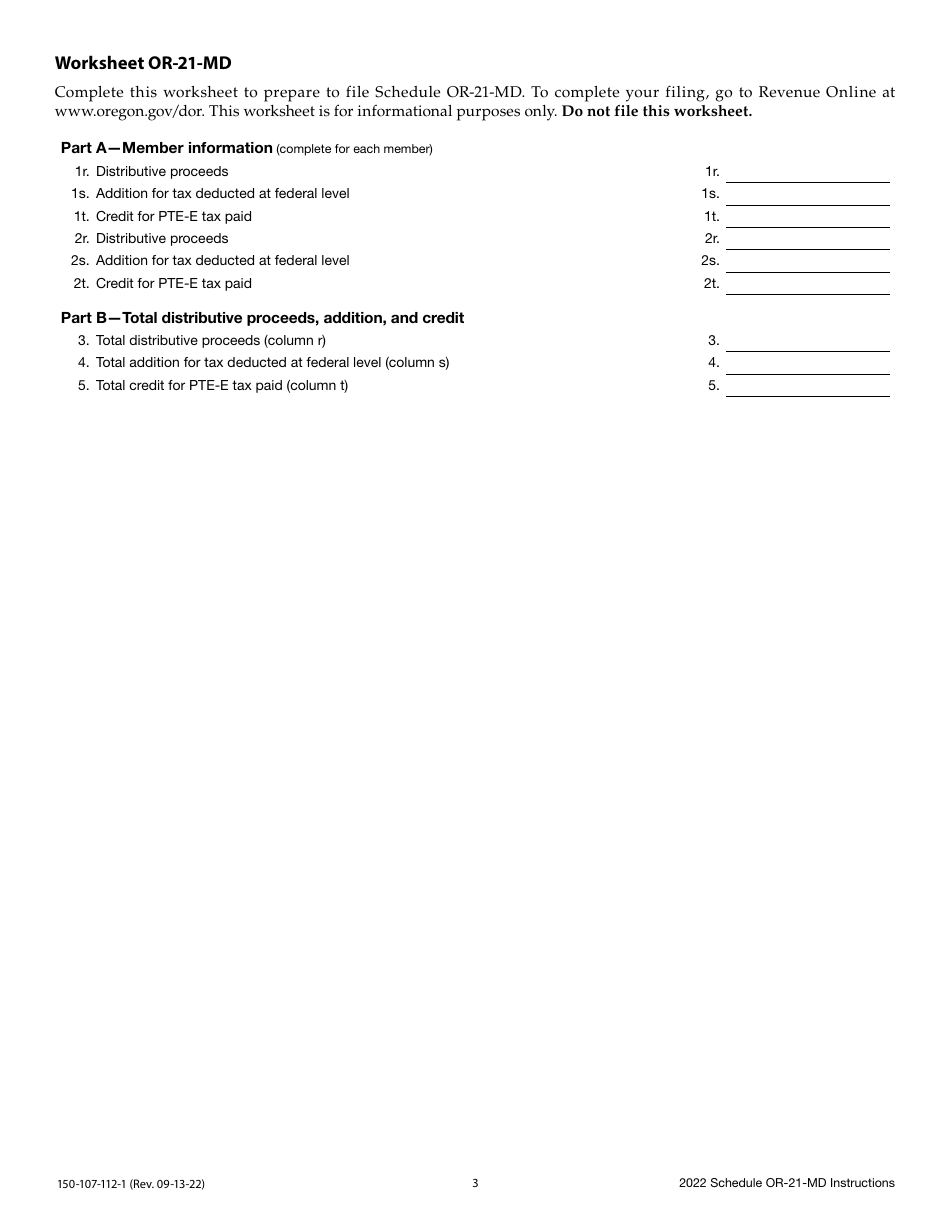

Q: What information is required on Schedule OR-21-MD?

A: Schedule OR-21-MD requires information about each member of the pass-through entity, including their names, addresses, ownership percentages, and tax identification numbers.

Q: When is the deadline to file Schedule OR-21-MD?

A: The deadline to file Schedule OR-21-MD is generally the same as the deadline for filing the pass-through entity's tax return, which is typically March 15th.

Q: Are there any penalties for not filing Schedule OR-21-MD?

A: Yes, there can be penalties for not filing Schedule OR-21-MD or for filing it late. It's important to meet the deadline and provide accurate information.

Q: Do I need to include attachments with Schedule OR-21-MD?

A: You may need to include certain attachments with Schedule OR-21-MD, such as supporting schedules or documentation. Check the instructions for the form to determine if any attachments are required.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.