This version of the form is not currently in use and is provided for reference only. Download this version of

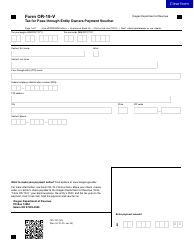

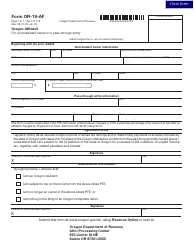

Form OR-21-V (150-107-172)

for the current year.

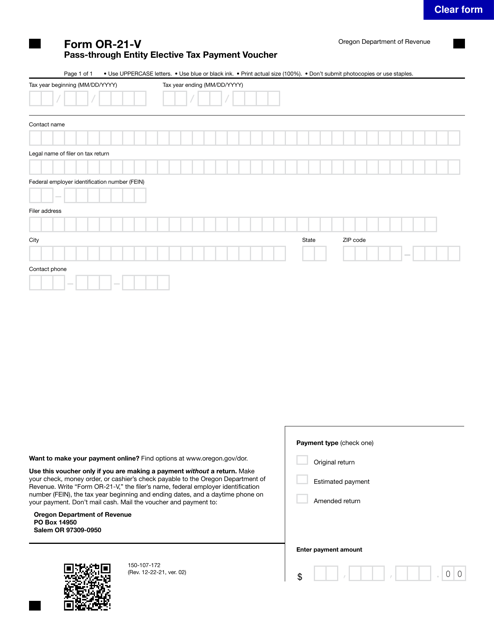

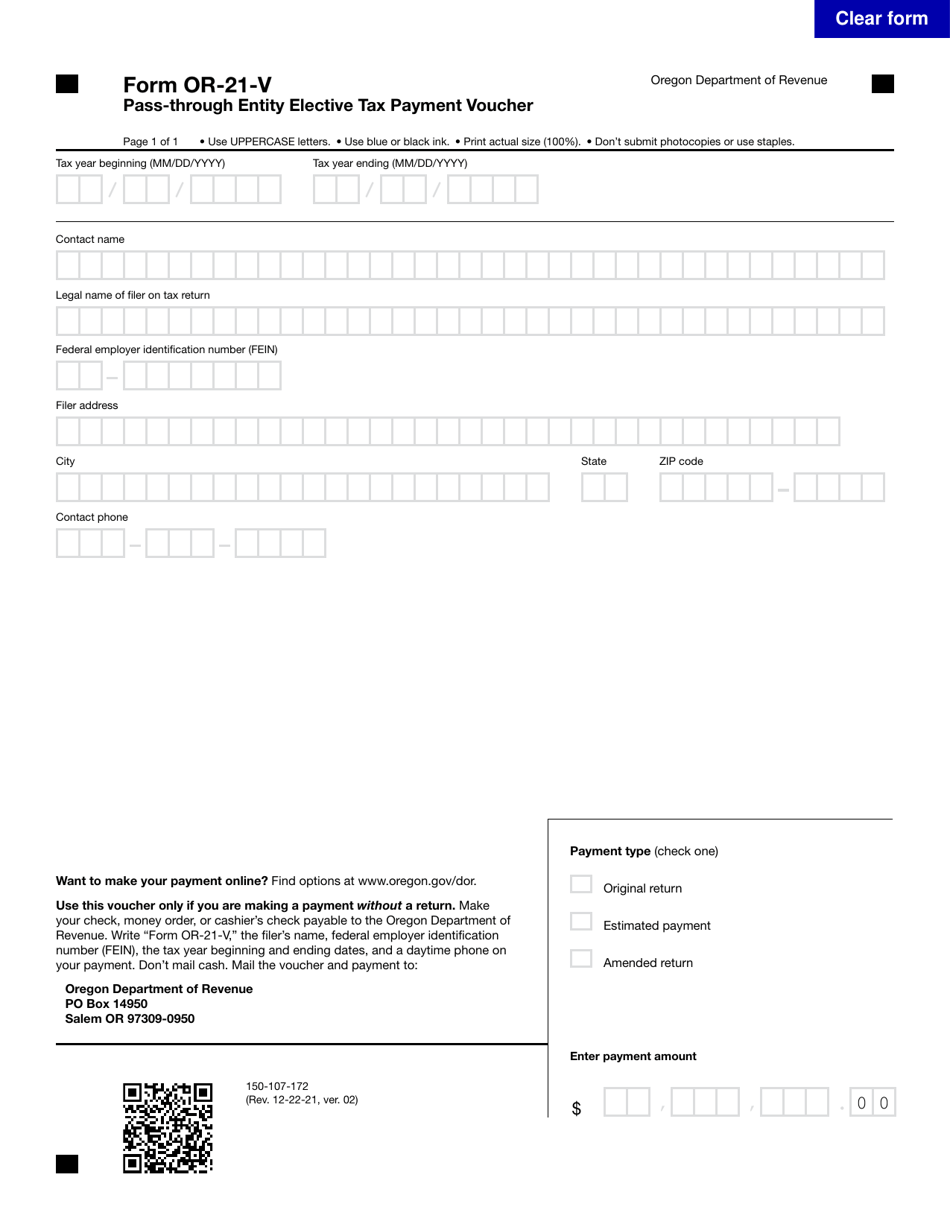

Form OR-21-V (150-107-172) Pass-Through Entity Elective Tax Payment Voucher - Oregon

What Is Form OR-21-V (150-107-172)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-21-V?

A: Form OR-21-V is a Pass-Through Entity Elective Tax Payment Voucher for the state of Oregon.

Q: What is the purpose of Form OR-21-V?

A: The purpose of Form OR-21-V is to make tax payments for pass-through entities in Oregon.

Q: What is a pass-through entity?

A: A pass-through entity is a business structure that does not pay federal income tax. Instead, the owners or shareholders report the business's income and expenses on their individual tax returns.

Q: Who needs to use Form OR-21-V?

A: Pass-through entities in Oregon need to use Form OR-21-V to make tax payments.

Q: Is Form OR-21-V mandatory?

A: No, Form OR-21-V is not mandatory. It is an elective tax payment voucher.

Q: What information is required on Form OR-21-V?

A: Form OR-21-V requires the pass-through entity's name, address, federal employer identification number (FEIN), tax year, and the amount being paid.

Q: When is Form OR-21-V due?

A: Form OR-21-V is due on or before the 15th day of the 3rd month after the end of the tax year.

Q: Are there any penalties for late filing of Form OR-21-V?

A: Yes, late filing of Form OR-21-V may result in penalties and interest being imposed by the Oregon Department of Revenue.

Form Details:

- Released on December 22, 2021;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form OR-21-V (150-107-172) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.