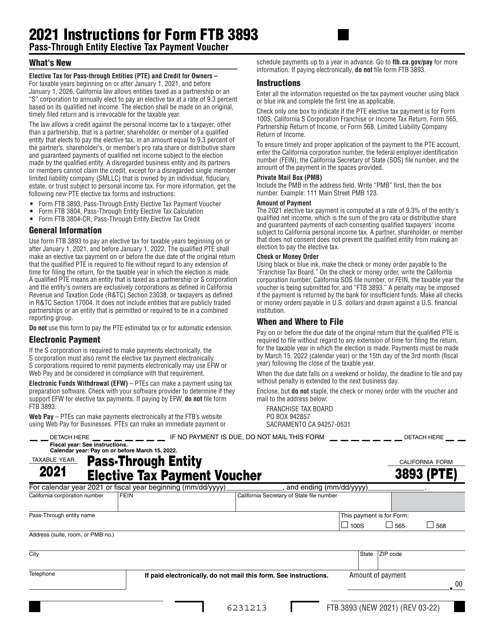

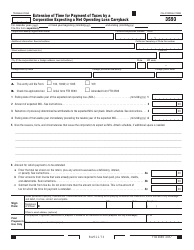

Form FTB3893 Pass-Through Entity Elective Tax Payment Voucher - California

What Is Form FTB3893?

This is a legal form that was released by the California Franchise Tax Board - a government authority operating within California. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form FTB3893?

A: Form FTB3893 is a Pass-Through Entity Elective Tax Payment Voucher for California.

Q: Who should use Form FTB3893?

A: Pass-through entities in California should use Form FTB3893.

Q: What is a pass-through entity?

A: A pass-through entity is a business entity (such as a partnership, limited liability company, or S corporation) where the income and deductions are passed through to the owners.

Q: What is the purpose of Form FTB3893?

A: The purpose of Form FTB3893 is to make an elective tax payment for pass-through entities.

Q: Do all pass-through entities need to make an elective tax payment?

A: No, elective tax payments are optional for pass-through entities.

Q: Is Form FTB3893 required even if no elective tax payment is made?

A: Yes, even if no payment is made, pass-through entities must still file Form FTB3893.

Q: When is Form FTB3893 due?

A: Form FTB3893 is due on or before the 15th day of the 3rd month following the close of the taxable year.

Q: Can Form FTB3893 be electronically filed?

A: Yes, pass-through entities can file Form FTB3893 electronically.

Q: Are there any penalties for late or incomplete filing of Form FTB3893?

A: Yes, there are penalties for late or incomplete filing of Form FTB3893. It is important to file on time and provide accurate information.

Form Details:

- Released on March 1, 2022;

- The latest edition provided by the California Franchise Tax Board;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form FTB3893 by clicking the link below or browse more documents and templates provided by the California Franchise Tax Board.