This version of the form is not currently in use and is provided for reference only. Download this version of

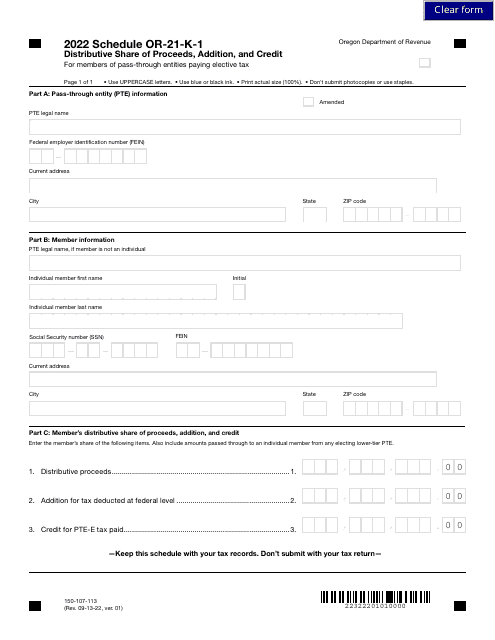

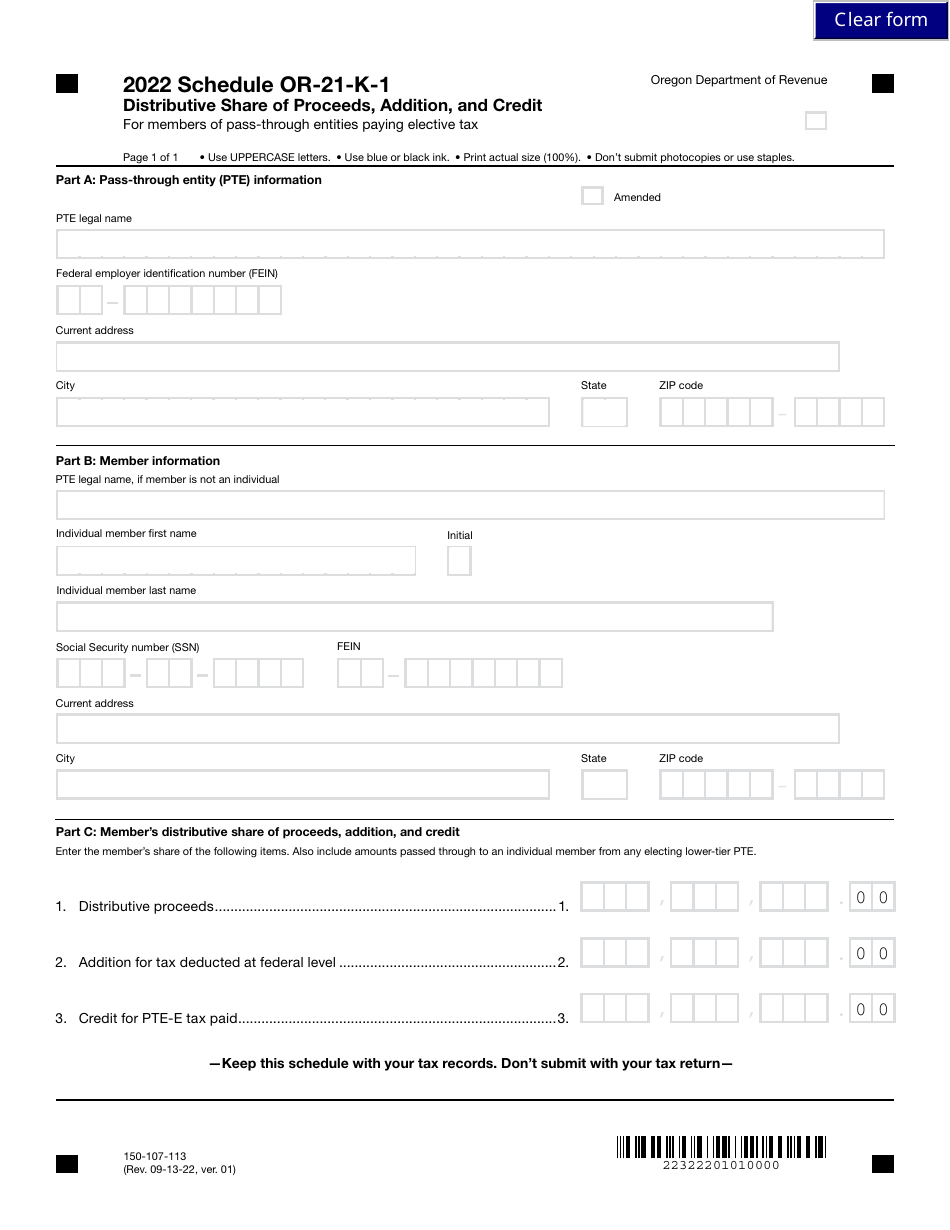

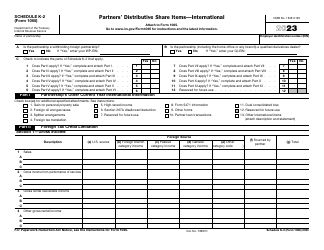

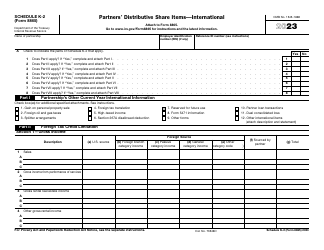

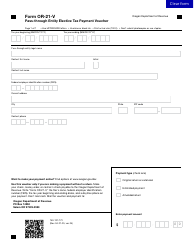

Form 150-107-113 Schedule OR-21-K-1

for the current year.

Form 150-107-113 Schedule OR-21-K-1 Distributive Share of Proceeds, Addition, and Credit for Members of Pass-Through Entities Paying Elective Tax - Oregon

What Is Form 150-107-113 Schedule OR-21-K-1?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 150-107-113?

A: Form 150-107-113 is a schedule in Oregon tax forms.

Q: What is the purpose of Schedule OR-21-K-1?

A: The purpose of Schedule OR-21-K-1 is to report the distributive share of income, additions, and credits for members of pass-through entities paying the elective tax in Oregon.

Q: Who should file Schedule OR-21-K-1?

A: Members of pass-through entities paying the elective tax in Oregon should file Schedule OR-21-K-1.

Q: What does the Schedule OR-21-K-1 report?

A: Schedule OR-21-K-1 reports the distributive share of proceeds, additions, and credits for members of pass-through entities.

Q: What is the Elective Tax in Oregon?

A: The Elective Tax is a tax paid by pass-through entities in Oregon that choose to be taxed at the entity level rather than passing income through to individual members.

Q: Are there any credits or additions reported on Schedule OR-21-K-1?

A: Yes, Schedule OR-21-K-1 reports both additions and credits for members of pass-through entities.

Q: Is Schedule OR-21-K-1 required for all pass-through entities in Oregon?

A: No, Schedule OR-21-K-1 is only required for pass-through entities that choose to pay the elective tax.

Form Details:

- Released on September 13, 2022;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 150-107-113 Schedule OR-21-K-1 by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.