This version of the form is not currently in use and is provided for reference only. Download this version of

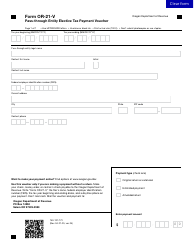

Form OR-21-EST (150-107-115)

for the current year.

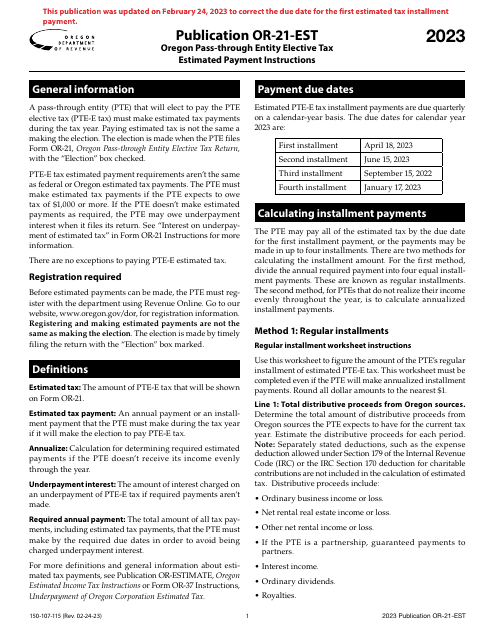

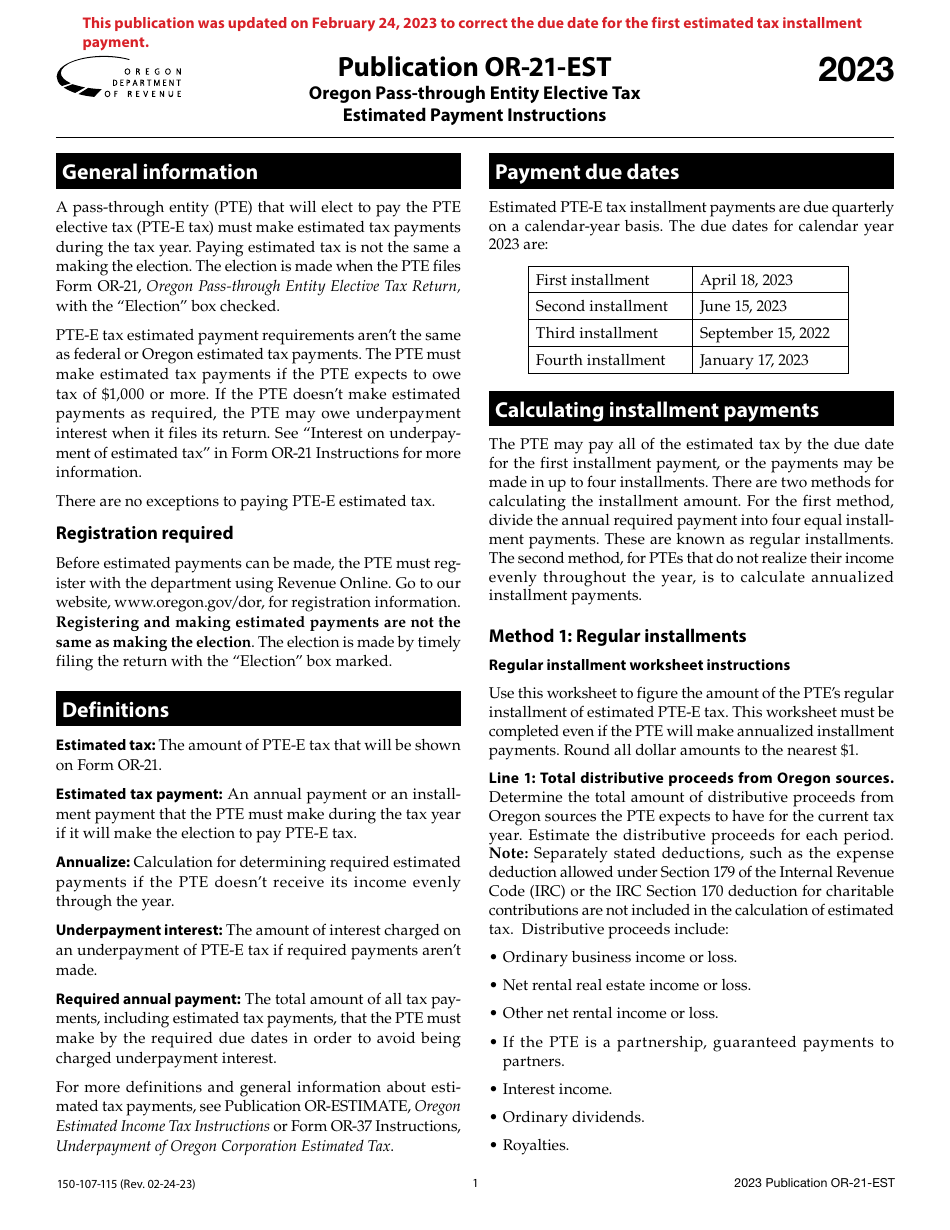

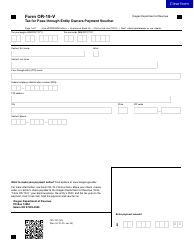

Form OR-21-EST (150-107-115) Oregon Pass-Through Entity Elective Tax Estimated Payment Instructions - Oregon

What Is Form OR-21-EST (150-107-115)?

This is a legal form that was released by the Oregon Department of Revenue - a government authority operating within Oregon. Check the official instructions before completing and submitting the form.

FAQ

Q: What is Form OR-21-EST?

A: Form OR-21-EST is the Oregon Pass-Through Entity Elective Tax Estimated Payment form.

Q: What is the purpose of Form OR-21-EST?

A: The purpose of Form OR-21-EST is to make estimated tax payments for pass-through entities in Oregon.

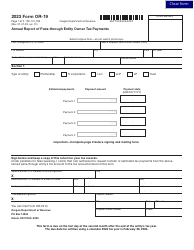

Q: Who needs to file Form OR-21-EST?

A: Pass-through entities in Oregon who elected to be taxed at the entity level need to file Form OR-21-EST.

Q: What information is required on Form OR-21-EST?

A: Form OR-21-EST requires information such as the entity's name, FEIN, estimated taxable income, and estimated tax liability.

Q: When is Form OR-21-EST due?

A: Form OR-21-EST is due on or before the 15th day of the 4th, 6th, 9th, and 12th months of the tax year.

Q: Are there penalties for not filing Form OR-21-EST?

A: Yes, there may be penalties for failure to timely file Form OR-21-EST or for underpaying estimated taxes.

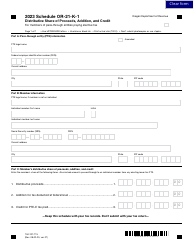

Form Details:

- Released on February 24, 2023;

- The latest edition provided by the Oregon Department of Revenue;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a printable version of Form OR-21-EST (150-107-115) by clicking the link below or browse more documents and templates provided by the Oregon Department of Revenue.