This version of the form is not currently in use and is provided for reference only. Download this version of

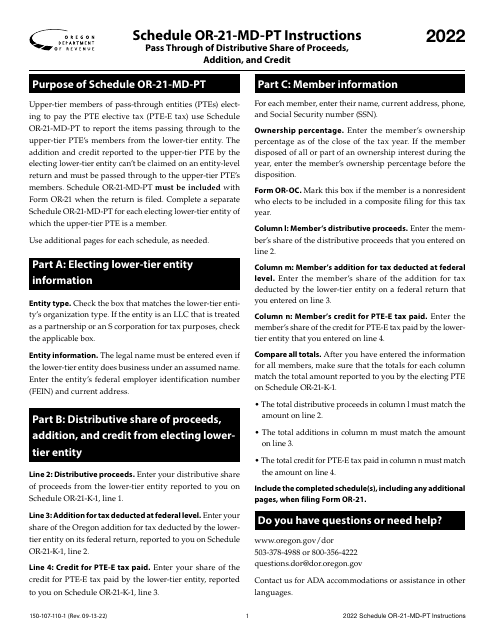

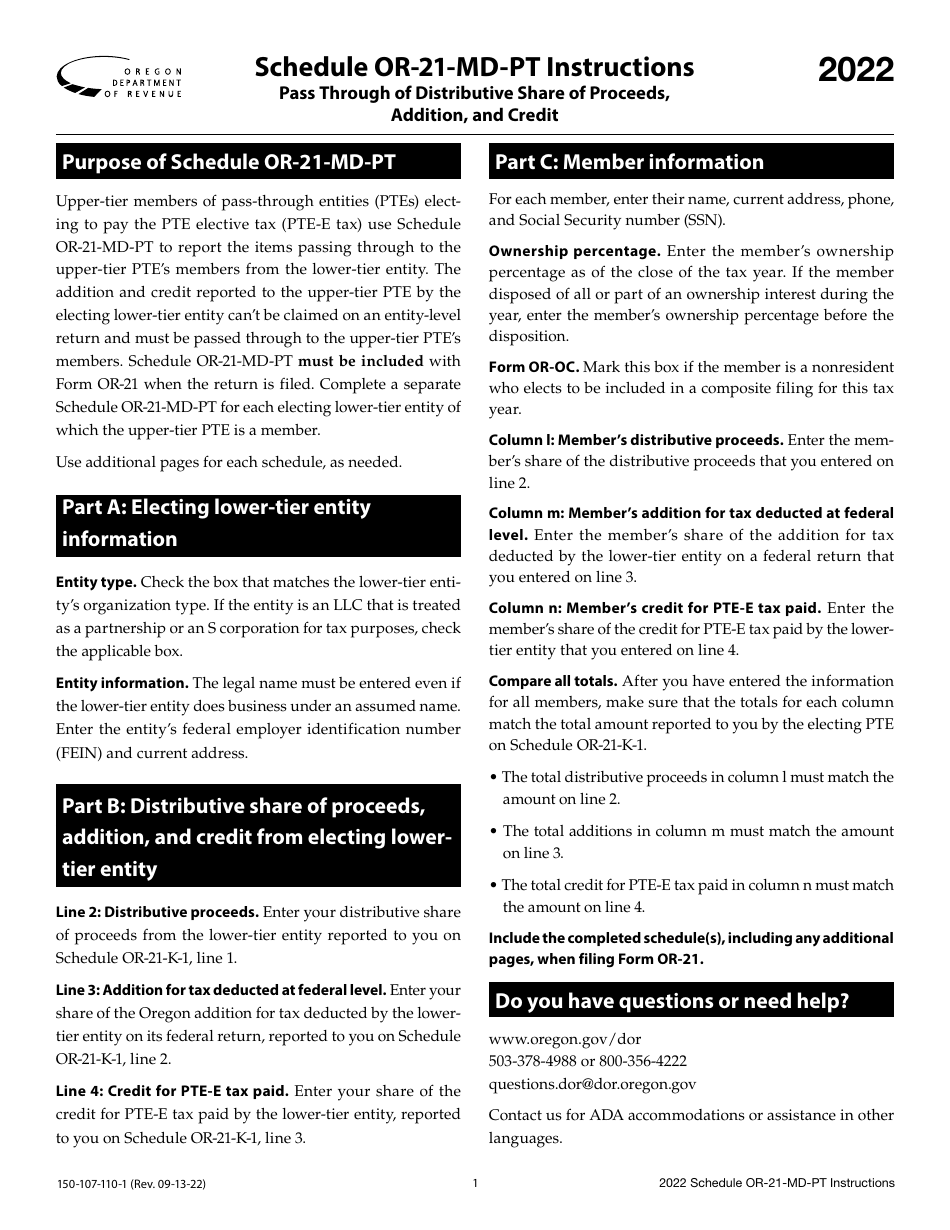

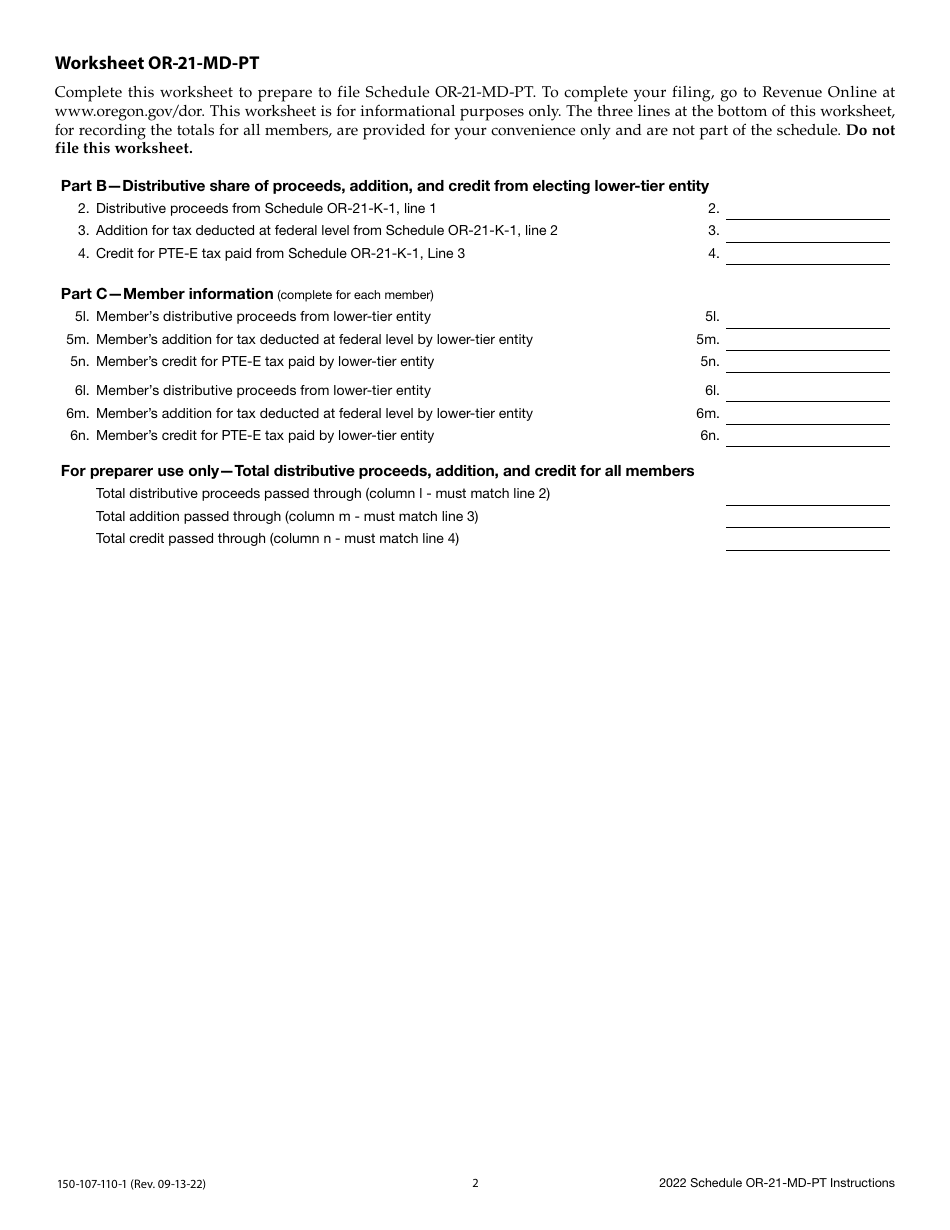

Instructions for Form 150-107-110 Schedule OR-21-MD-PT

for the current year.

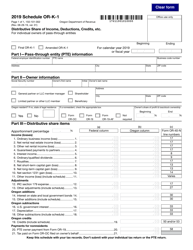

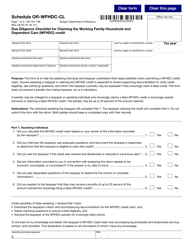

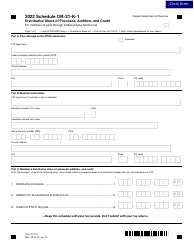

Instructions for Form 150-107-110 Schedule OR-21-MD-PT Pass Through of Distributive Share of Proceeds, Addition, and Credit - Oregon

This document contains official instructions for Form 150-107-110 Schedule OR-21-MD-PT, Pass Through of Distributive Share of Proceeds, Addition, and Credit - a form released and collected by the Oregon Department of Revenue.

FAQ

Q: What is Form 150-107-110?

A: Form 150-107-110 is a form used in Oregon to report the pass-through of distributive share of proceeds, addition, and credit.

Q: What is Schedule OR-21-MD-PT?

A: Schedule OR-21-MD-PT is a schedule that is part of Form 150-107-110. It is used to report the details of the pass-through of distributive share of proceeds, addition, and credit.

Q: Who needs to file Form 150-107-110?

A: Individuals or entities in Oregon who have pass-through income from partnerships, S corporations, estates, or trusts need to file Form 150-107-110.

Q: What information is required on Form 150-107-110?

A: Form 150-107-110 requires information about the pass-through income, deductions, credits, and additions from partnerships, S corporations, estates, or trusts.

Q: How do I file Form 150-107-110?

A: Form 150-107-110 can be filed electronically or by mail. The instructions on the form provide detailed information on how to fill it out and where to send it.

Q: When is the deadline to file Form 150-107-110?

A: The deadline to file Form 150-107-110 is usually April 15th of the following year. However, it may vary depending on certain circumstances, so it's important to check the specific deadline for each tax year.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.