This version of the form is not currently in use and is provided for reference only. Download this version of

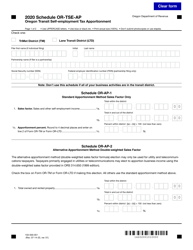

Instructions for Form 150-107-111 Schedule OR-21-AP

for the current year.

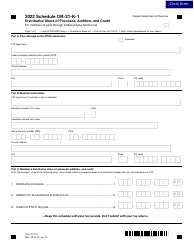

Instructions for Form 150-107-111 Schedule OR-21-AP Oregon Pass-Through Entity Elective Tax Apportionment of Income - Oregon

This document contains official instructions for Form 150-107-111 Schedule OR-21-AP, Oregon Pass-Through Entity Elective Tax Apportionment of Income - a form released and collected by the Oregon Department of Revenue.

FAQ

Q: What is Form 150-107-111?

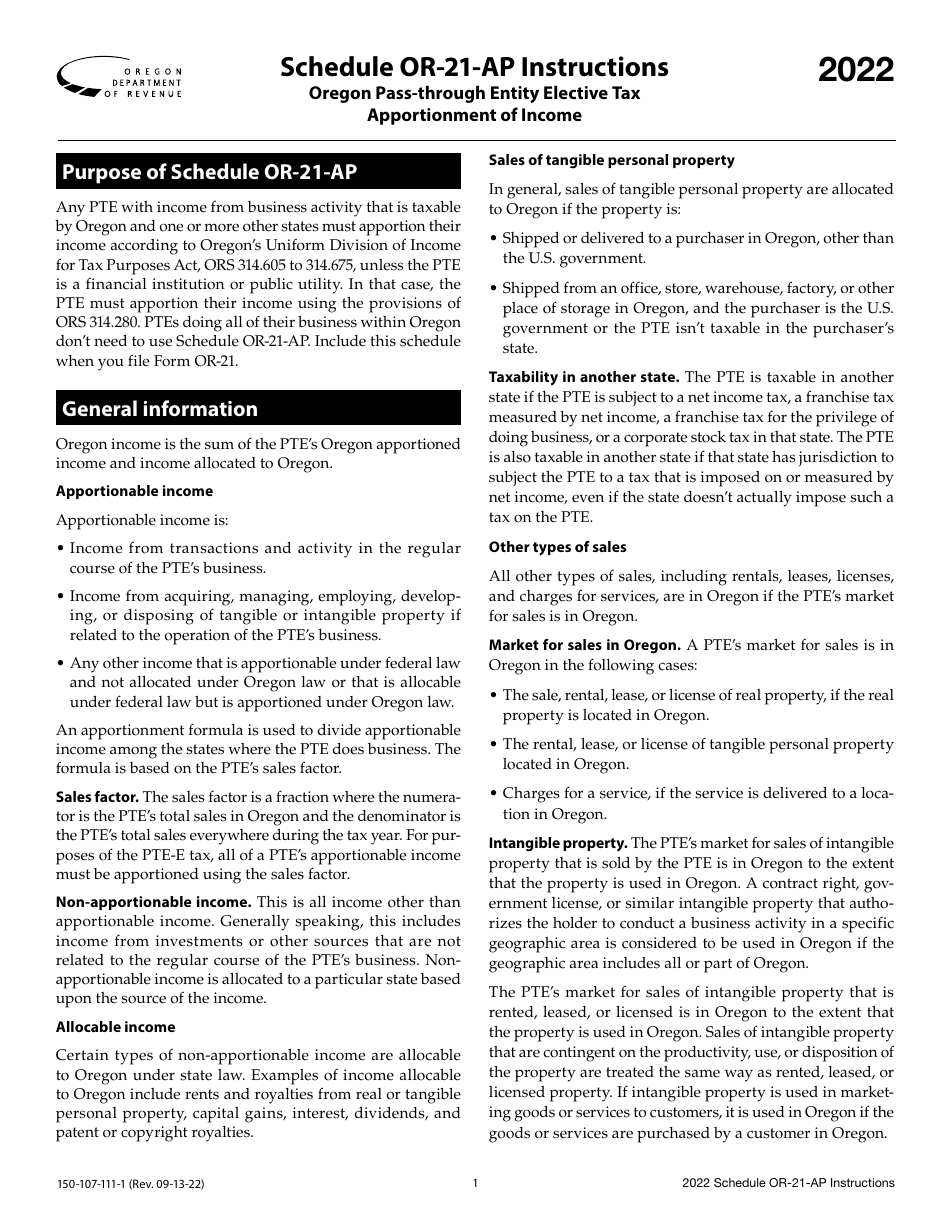

A: Form 150-107-111 is a schedule called OR-21-AP used for Oregon Pass-Through Entity Elective Tax Apportionment of Income.

Q: What does Schedule OR-21-AP do?

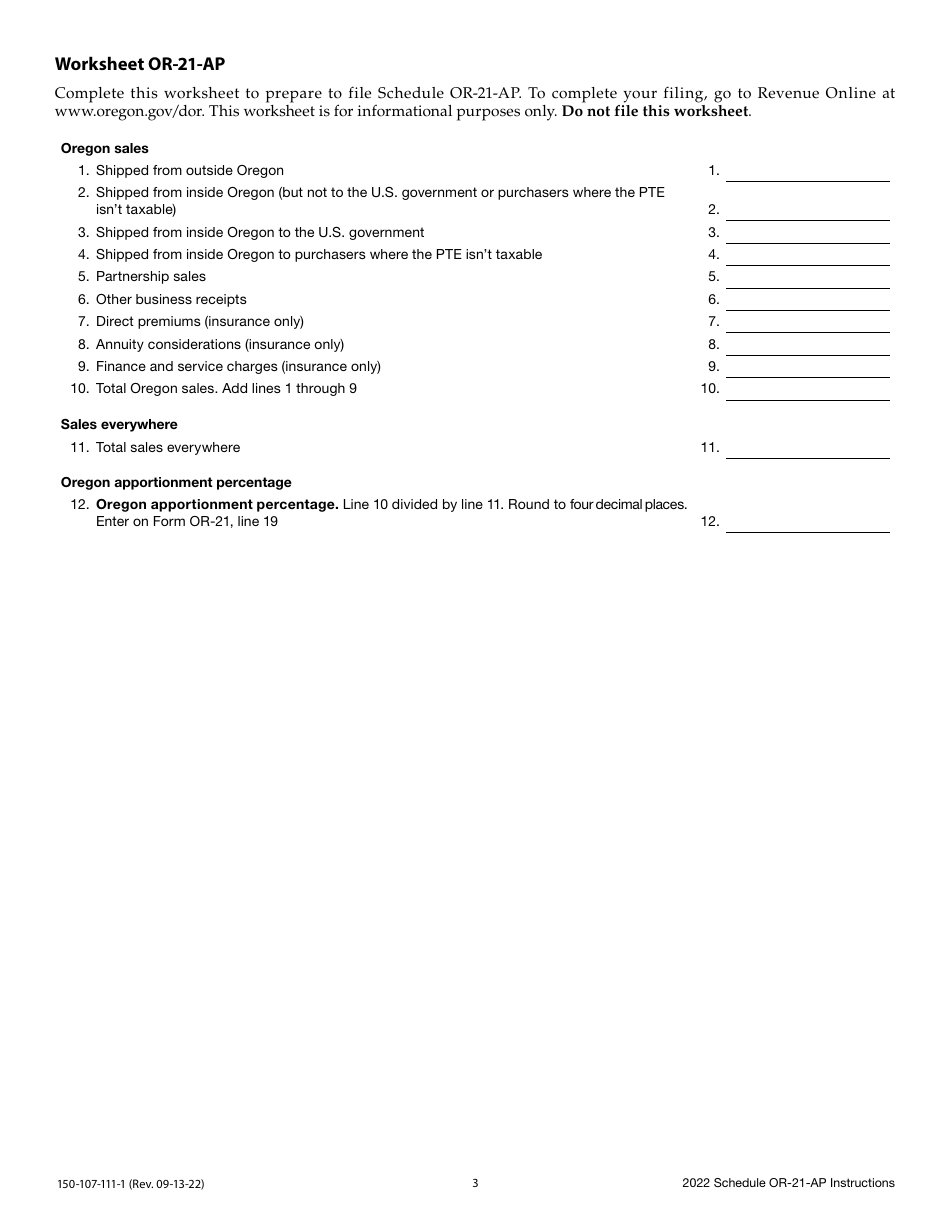

A: Schedule OR-21-AP is used to calculate and report the apportionment of income for pass-through entities in Oregon.

Q: Who needs to file Form 150-107-111?

A: Pass-through entities in Oregon who elect to apportion their income need to file Form 150-107-111.

Q: What is tax apportionment?

A: Tax apportionment is the method used to determine the portion of a business's income that is subject to taxation in a specific state.

Q: Is Form 150-107-111 required for all pass-through entities in Oregon?

A: No, only pass-through entities who elect to apportion their income need to file Form 150-107-111.

Q: When is Form 150-107-111 due?

A: The due date for Form 150-107-111 varies and is determined by the tax year of the pass-through entity. Check the instructions for the specific due date.

Q: What information do I need to complete Form 150-107-111?

A: You will need information about the pass-through entity's income, apportionment factors, and elections made for apportionment.

Q: What happens if I don't file Form 150-107-111?

A: If you are required to file Form 150-107-111 but fail to do so, you may be subject to penalties and interest charges by the Oregon Department of Revenue.

Instruction Details:

- This 3-page document is available for download in PDF;

- Actual and applicable for this year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Oregon Department of Revenue.