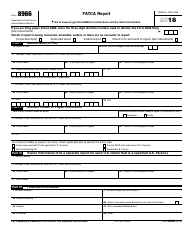

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form 8966

for the current year.

Instructions for IRS Form 8966 Fatca Report

This document contains official instructions for IRS Form 8966 , Fatca Report - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury.

FAQ

Q: What is IRS Form 8966?

A: IRS Form 8966, also known as FATCA Report, is a form used by financial institutions to report information about their foreign account holders.

Q: Who needs to file IRS Form 8966?

A: Financial institutions, including banks and other financial entities, that have foreign account holders need to file IRS Form 8966.

Q: What information needs to be reported on IRS Form 8966?

A: IRS Form 8966 requires financial institutions to report information about their foreign account holders, including their name, address, taxpayer identification number, and account balance.

Q: When is the deadline to file IRS Form 8966?

A: The deadline to file IRS Form 8966 is March 31st of each year.

Q: Can IRS Form 8966 be filed electronically?

A: Yes, financial institutions can file IRS Form 8966 electronically through the IRS's International Data Exchange Service (IDES).

Q: What are the penalties for not filing IRS Form 8966?

A: Financial institutions may face penalties for failing to file IRS Form 8966, including monetary penalties and potential loss of their Foreign Financial Institution (FFI) status.

Instruction Details:

- This 13-page document is available for download in PDF;

- Not applicable for the current tax year. Choose a more recent version to file this year's taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.