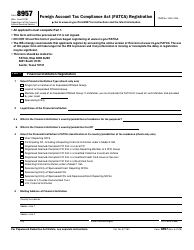

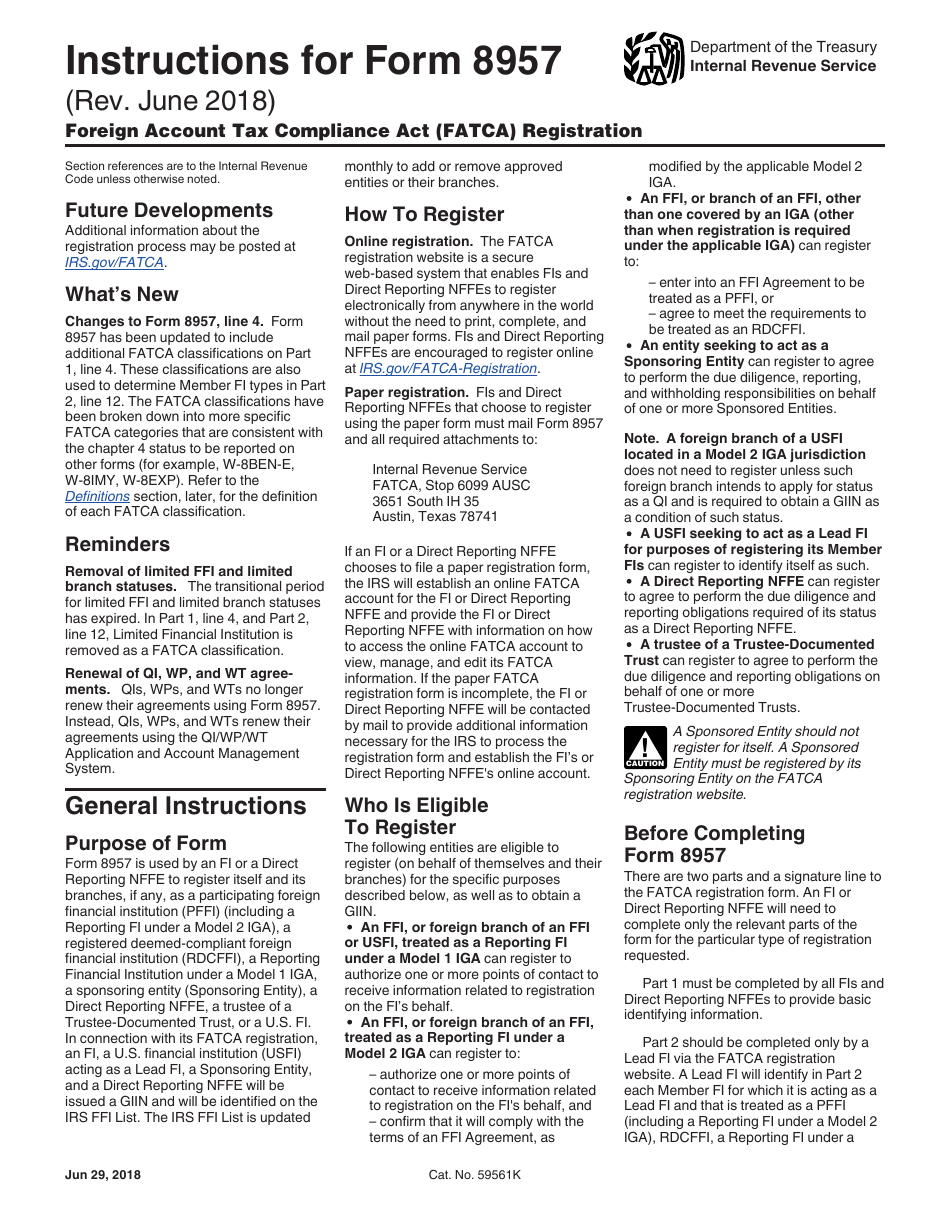

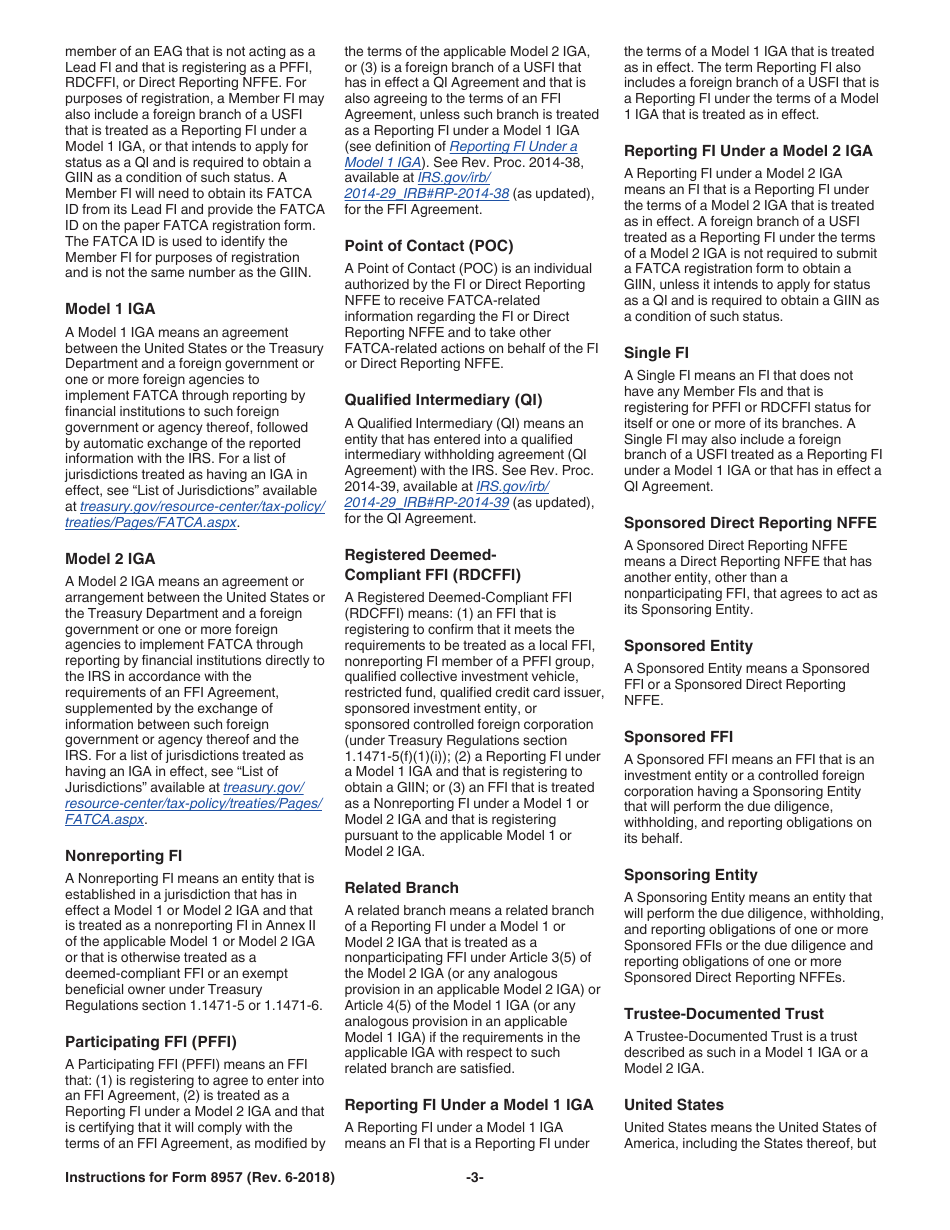

Instructions for IRS Form 8957 Foreign Account Tax Compliance Act (Fatca) Registration

This document contains official instructions for IRS Form 8957 , Foreign Account Tax Compliance Act (Fatca) Registration - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8957 is available for download through this link.

FAQ

Q: What is IRS Form 8957?

A: IRS Form 8957 is a form used for Foreign Account Tax Compliance Act (FATCA) registration.

Q: What is the Foreign Account Tax Compliance Act (FATCA)?

A: The Foreign Account Tax Compliance Act (FATCA) is a U.S. law that requires reporting of foreign financial accounts held by U.S. taxpayers.

Q: Who needs to file IRS Form 8957?

A: Financial institutions and other entities that are required to comply with FATCA regulations must file IRS Form 8957.

Q: What information is required on IRS Form 8957?

A: IRS Form 8957 requires information such as the entity's name, address, and taxpayer identification number.

Q: How do I submit IRS Form 8957?

A: IRS Form 8957 can be submitted electronically through the IRS FATCA Registration System.

Q: What are the penalties for not filing IRS Form 8957?

A: Penalties for not filing IRS Form 8957 can include fines and potential criminal charges.

Instruction Details:

- This 7-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.