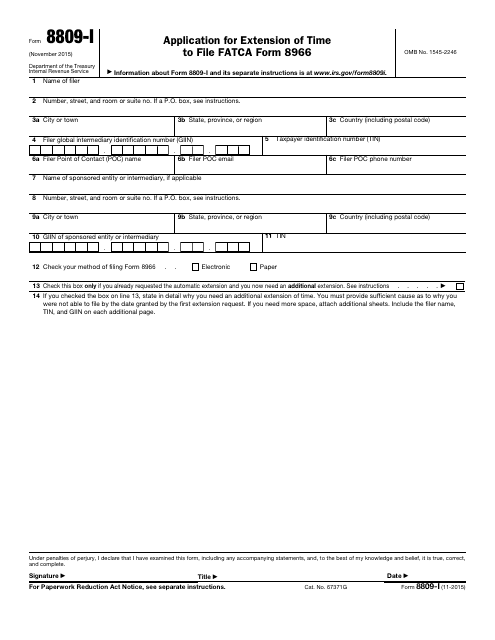

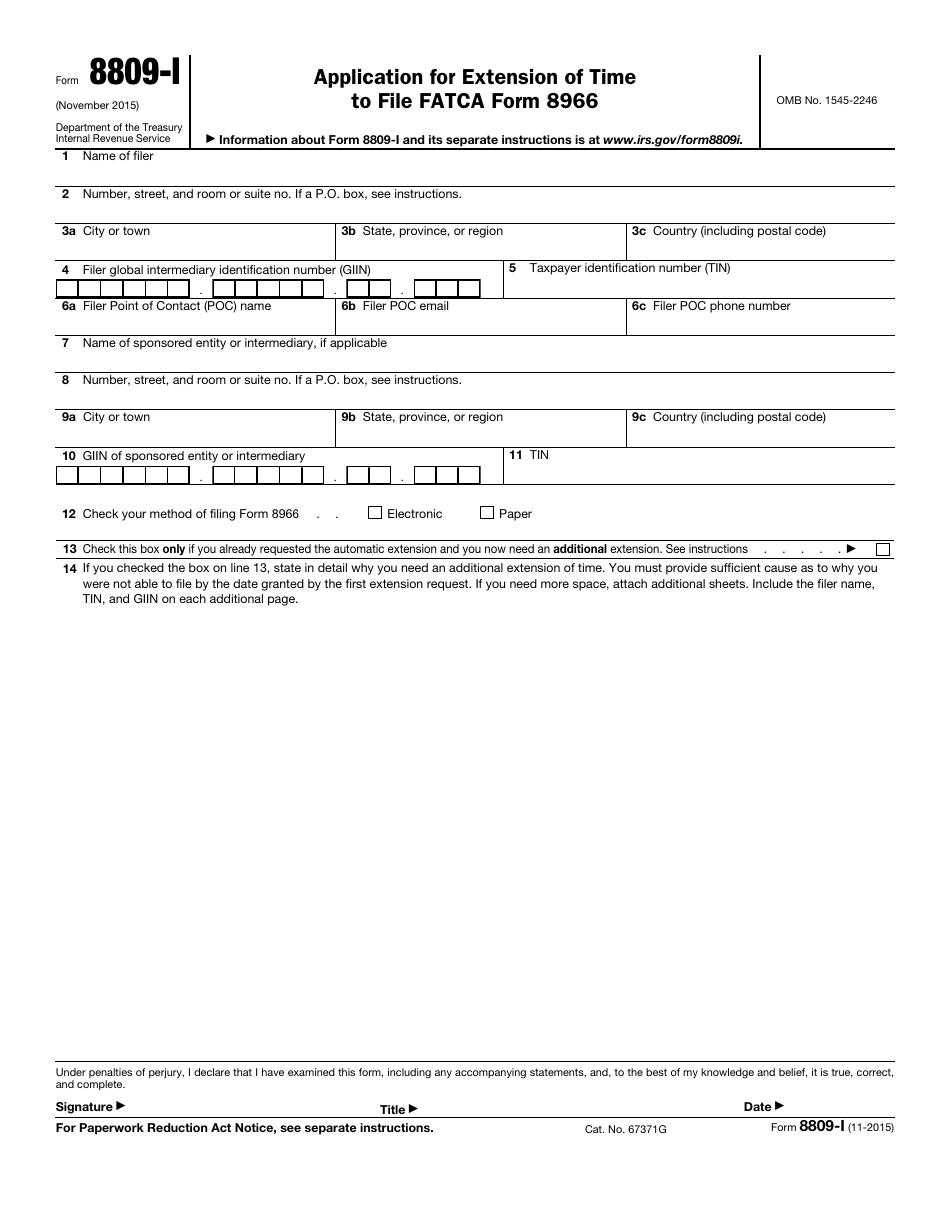

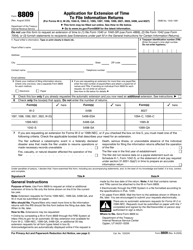

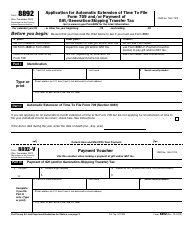

IRS Form 8809-I Application for Extension of Time to File Fatca Form 8966

What Is IRS Form 8809-I?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on November 1, 2015. Check the official IRS-issued instructions before completing and submitting the form.

FAQ

Q: What is IRS Form 8809-I?

A: IRS Form 8809-I is an application for an extension of time to file FATCA Form 8966.

Q: What is FATCA Form 8966?

A: FATCA Form 8966 is a form used to report information about certain U.S. accounts held by foreign financial institutions to the Internal Revenue Service (IRS).

Q: Who needs to file IRS Form 8809-I?

A: Anyone who needs additional time to file FATCA Form 8966 can file IRS Form 8809-I to request an extension.

Q: How do I file IRS Form 8809-I?

A: You can file IRS Form 8809-I electronically through the IRS Filing Information Returns Electronically (FIRE) system.

Q: How long is the extension period granted by Form 8809-I?

A: IRS Form 8809-I generally grants an automatic 90-day extension to file FATCA Form 8966, but additional extensions may be granted upon request.

Q: What happens if I don't file IRS Form 8809-I?

A: If you don't file IRS Form 8809-I and fail to timely file FATCA Form 8966, you may be subject to penalties imposed by the IRS.

Form Details:

- A 1-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 8809-I through the link below or browse more documents in our library of IRS Forms.