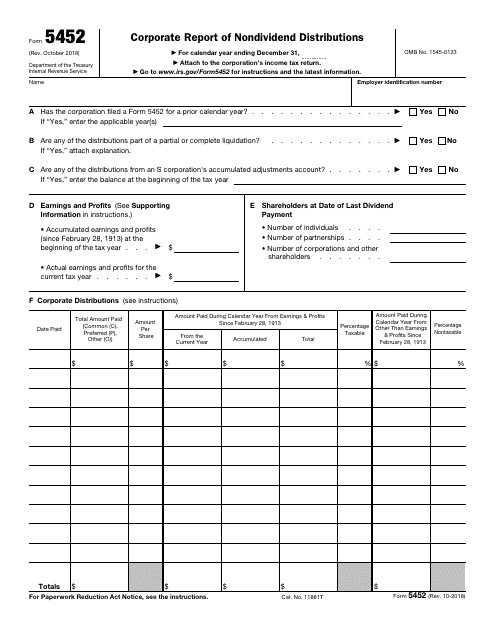

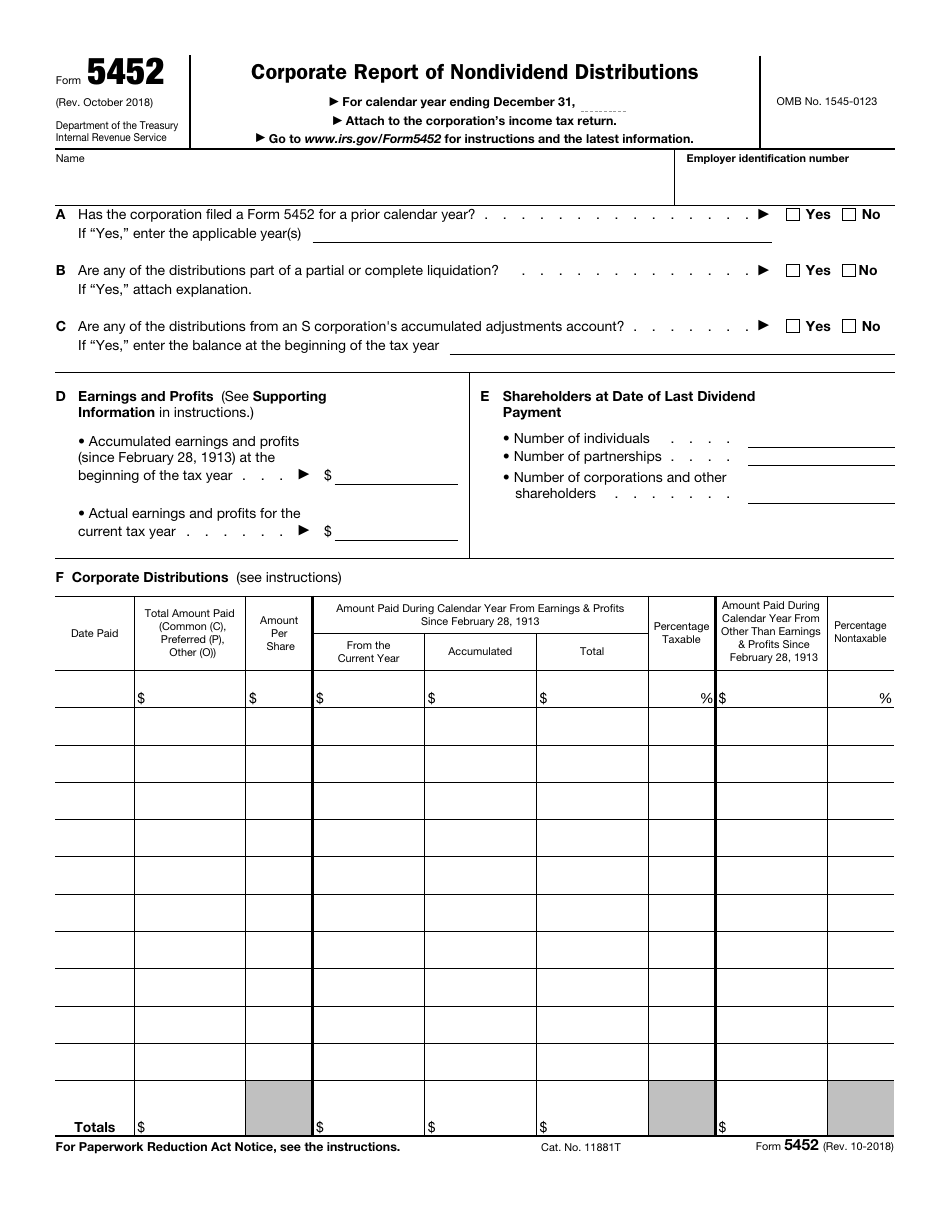

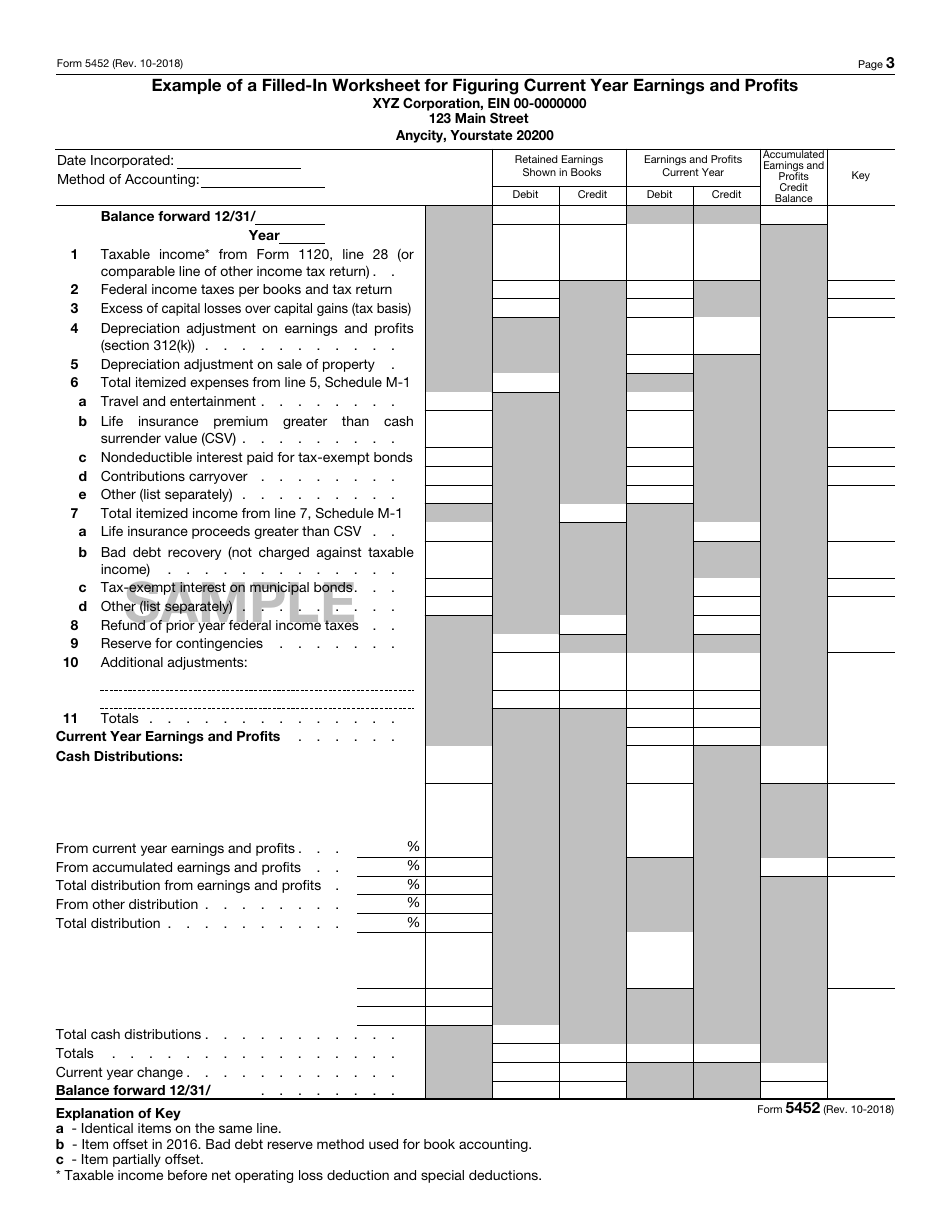

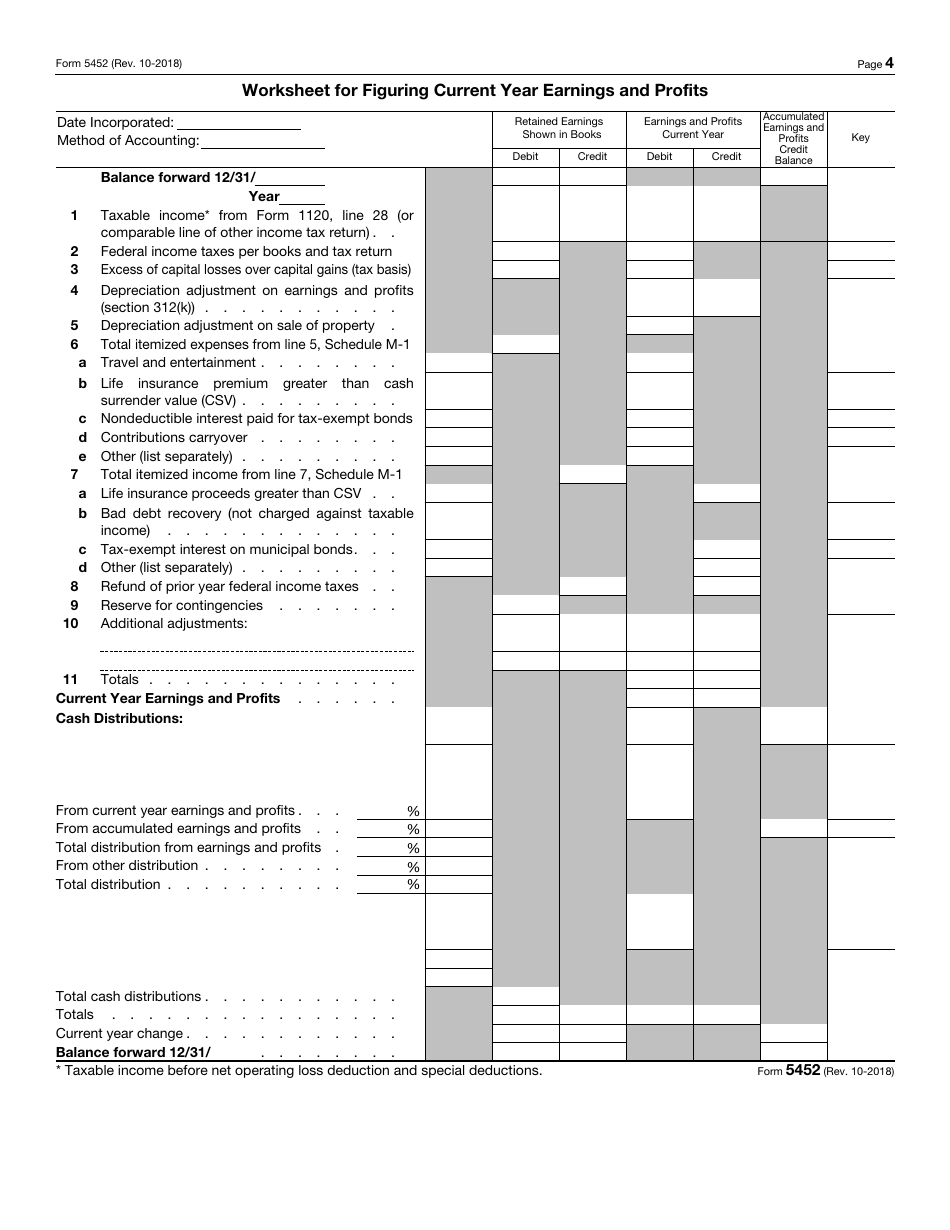

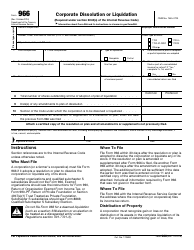

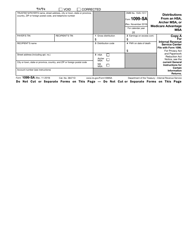

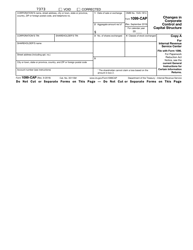

IRS Form 5452 Corporate Report of Nondividend Distributions

What Is IRS Form 5452?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2018. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 5452?

A: IRS Form 5452 is the Corporate Report of Nondividend Distributions.

Q: Who needs to file IRS Form 5452?

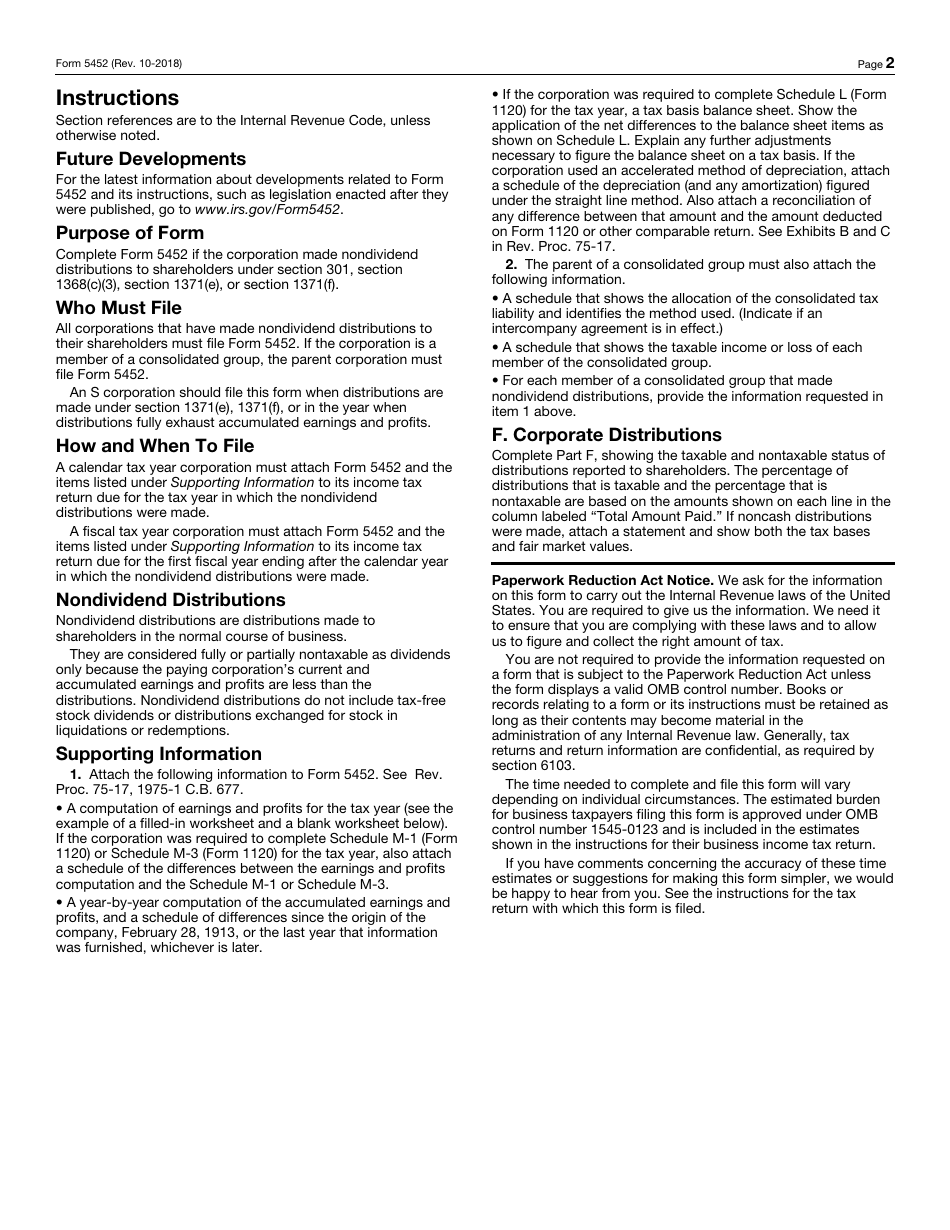

A: Corporations need to file IRS Form 5452 if they made nondividend distributions during the tax year.

Q: What are nondividend distributions?

A: Nondividend distributions are distributions made by a corporation to its shareholders that are not classified as dividends.

Q: What information is required on IRS Form 5452?

A: IRS Form 5452 requires the corporation to provide details about the nondividend distributions made during the tax year.

Q: When is the deadline for filing IRS Form 5452?

A: The deadline for filing IRS Form 5452 is the same as the corporation's tax return deadline, typically March 15th for calendar year corporations.

Form Details:

- A 4-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 5452 through the link below or browse more documents in our library of IRS Forms.