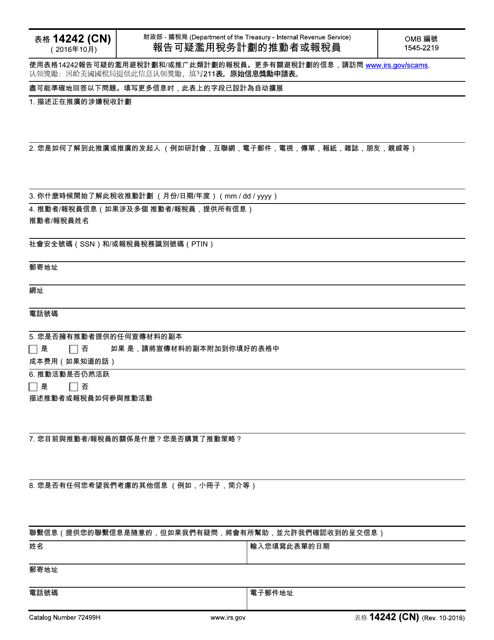

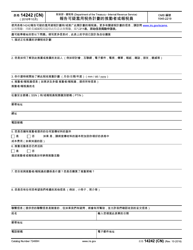

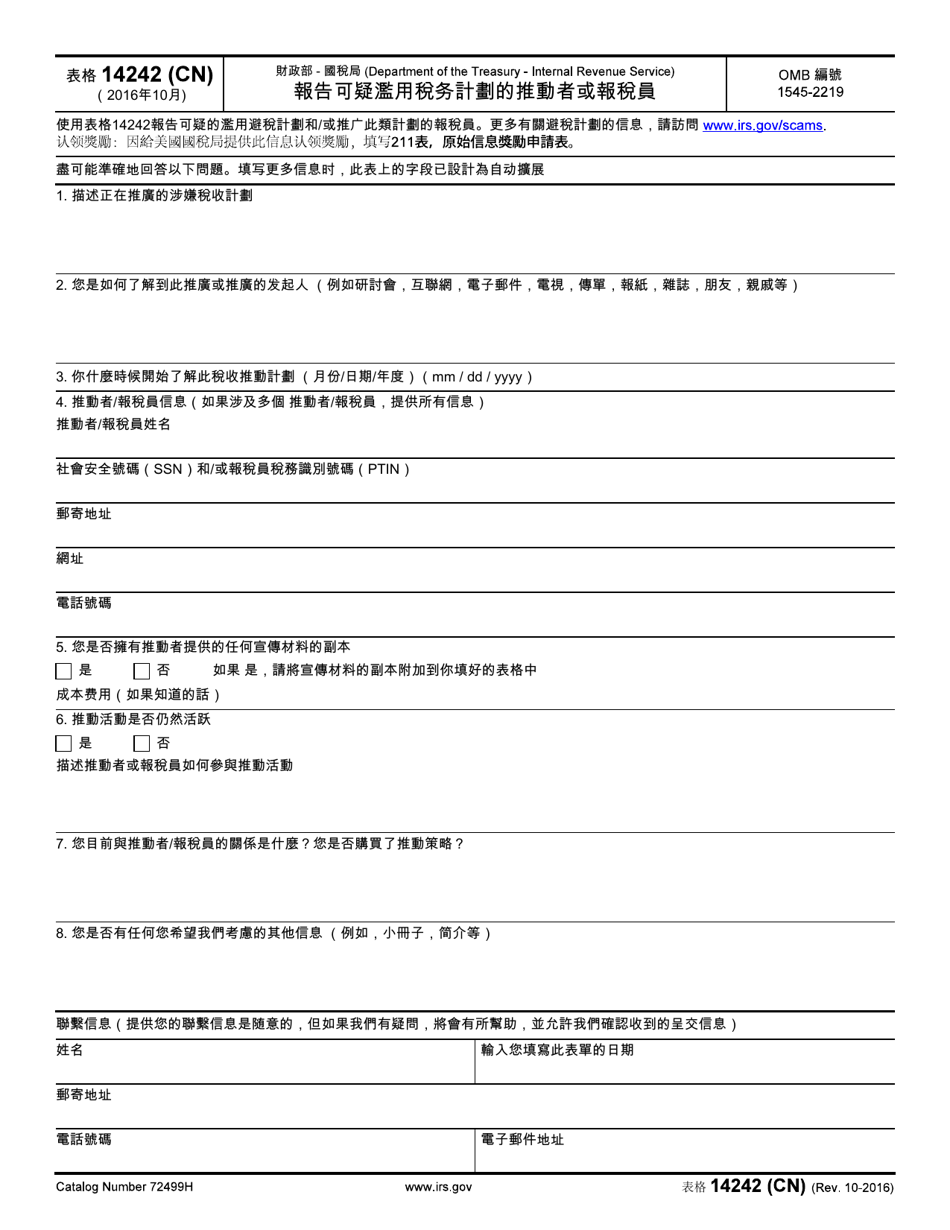

IRS Form 14242 (CN) Report Suspected Abusive Tax Promotions or Preparers (Mandarin (Chinese))

This " Irs Form 14242 (Cn) "report Suspected Abusive Tax Promotions or Preparers" (Mandarin (Chinese)) " is a document issued by the U.S. Department of the Treasury - Internal Revenue Service specifically for United States residents with its latest version released on October 1, 2016.

Download the up-to-date fillable PDF by clicking the link below or find it on the forms website of the U.S. Department of the Treasury - Internal Revenue Service.

FAQ

Q: What is IRS Form 14242?

A: IRS Form 14242 is a form used to report suspected abusive tax promotions or preparers.

Q: Who should use IRS Form 14242?

A: Anyone who suspects abusive tax promotions or preparers can use IRS Form 14242 to make a report.

Q: What is considered an abusive tax promotion?

A: An abusive tax promotion refers to any scheme that encourages taxpayers to unlawfully evade taxes.

Q: How can I report suspected abusive tax promotions or preparers?

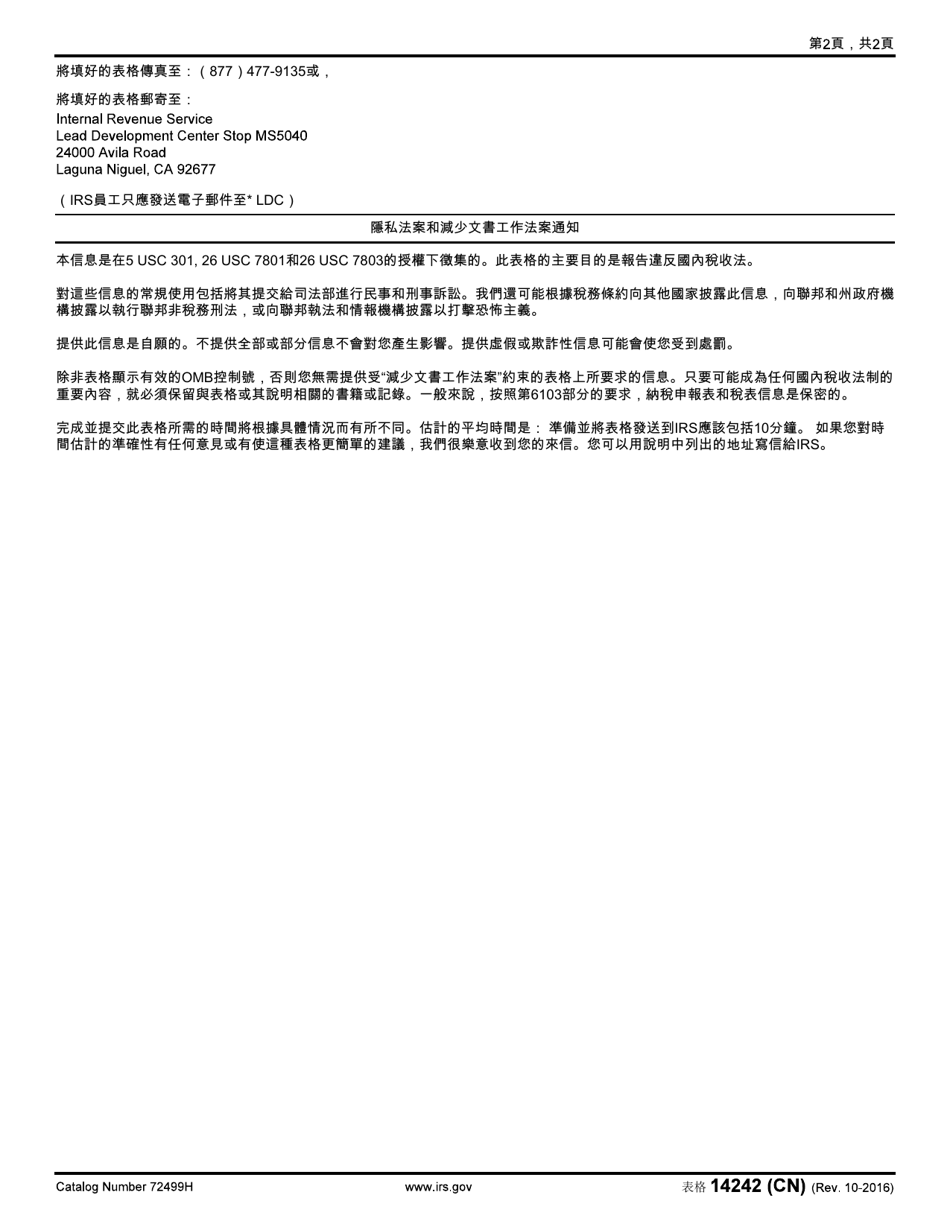

A: You can fill out IRS Form 14242 and submit it to the IRS.

Q: Can I submit IRS Form 14242 anonymously?

A: Yes, you can choose to remain anonymous when submitting IRS Form 14242.

Q: Is there a deadline for submitting IRS Form 14242?

A: There is no specific deadline for submitting IRS Form 14242, but it's recommended to report suspected abusive tax promotions or preparers as soon as possible.

Q: What should I include in my report on IRS Form 14242?

A: You should provide details about the suspected abusive tax promotion or preparer, including any supporting documentation or evidence that you may have.

Q: Can I report suspected abusive tax promotions or preparers in languages other than English?

A: Yes, IRS Form 14242 is available in multiple languages, including Mandarin (Chinese).

Q: Is there any penalty for filing a false report on IRS Form 14242?

A: Filing a false report on IRS Form 14242 can result in penalties and criminal prosecution.

Q: What happens after I submit IRS Form 14242?

A: The IRS will review the information provided and may take appropriate action against the suspected abusive tax promotions or preparers.