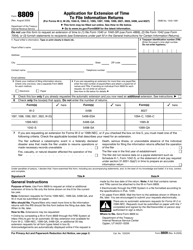

Instructions for IRS Form 8809-I Application for Extension of Time to File Fatca Form 8966

This document contains official instructions for IRS Form 8809-I , Application for Extension of Time to File Fatca Form 8966 - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form 8809-I is available for download through this link.

FAQ

Q: What is IRS Form 8809-I?

A: IRS Form 8809-I is the Application for Extension of Time to File FATCA Form 8966.

Q: What is FATCA Form 8966?

A: FATCA Form 8966 is the Report of Foreign Bank and Financial Accounts (FBAR) that certain taxpayers need to file.

Q: When do I need to file IRS Form 8809-I?

A: You need to file IRS Form 8809-I if you require an extension of time to file FATCA Form 8966.

Q: How do I fill out IRS Form 8809-I?

A: You need to provide your name, address, taxpayer identification number, the reason for the extension, and the length of the extension requested.

Q: How long of an extension can I request with IRS Form 8809-I?

A: You can request an extension of up to 90 days using IRS Form 8809-I.

Q: Is there a fee for filing IRS Form 8809-I?

A: No, there is no fee for filing IRS Form 8809-I.

Q: Can I file IRS Form 8809-I electronically?

A: No, you cannot file IRS Form 8809-I electronically. It must be filed by mail.

Instruction Details:

- This 2-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.