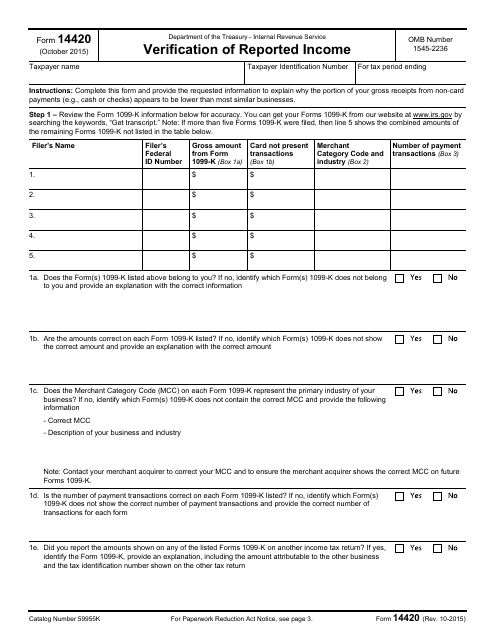

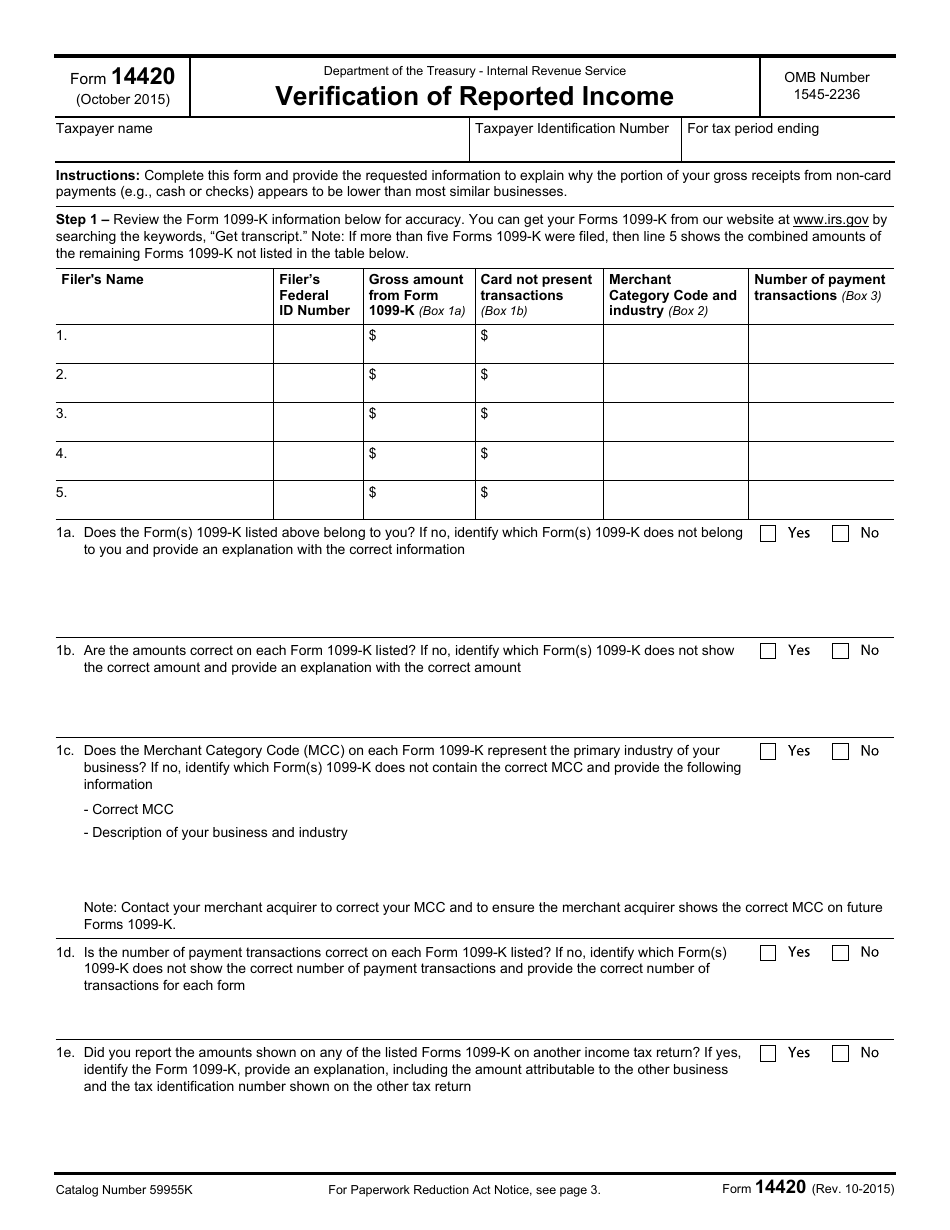

IRS Form 14420 Verification of Reported Income

What Is IRS Form 14420?

This is a tax form that was released by the Internal Revenue Service (IRS) - a subdivision of the U.S. Department of the Treasury on October 1, 2015. As of today, no separate filing guidelines for the form are provided by the IRS.

FAQ

Q: What is IRS Form 14420?

A: IRS Form 14420 is used to verify reported income.

Q: When is IRS Form 14420 used?

A: IRS Form 14420 is used when there is a need to verify reported income.

Q: Who is required to fill out IRS Form 14420?

A: Individuals or businesses may be required to fill out IRS Form 14420 if their reported income needs to be verified.

Q: What information is required on IRS Form 14420?

A: IRS Form 14420 requires basic information such as name, address, and Social Security number (or Employer Identification Number for businesses), as well as income details and supporting documentation.

Q: Can IRS Form 14420 be filed electronically?

A: No, IRS Form 14420 cannot be filed electronically. It must be printed and mailed to the designated IRS address.

Q: Are there any fees associated with filing IRS Form 14420?

A: There are no fees associated with filing IRS Form 14420.

Q: What should I do if I make a mistake on IRS Form 14420?

A: If you make a mistake on IRS Form 14420, you should contact the IRS for guidance on how to correct it.

Q: How long does it take to process IRS Form 14420?

A: The processing time for IRS Form 14420 can vary, but it generally takes several weeks.

Q: What happens after IRS Form 14420 is processed?

A: After IRS Form 14420 is processed, you will receive notification from the IRS regarding the verification of your reported income.

Form Details:

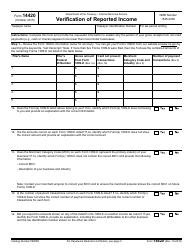

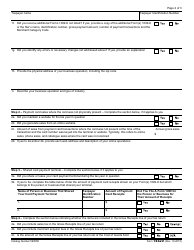

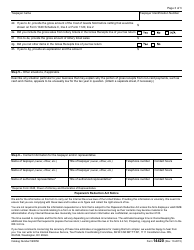

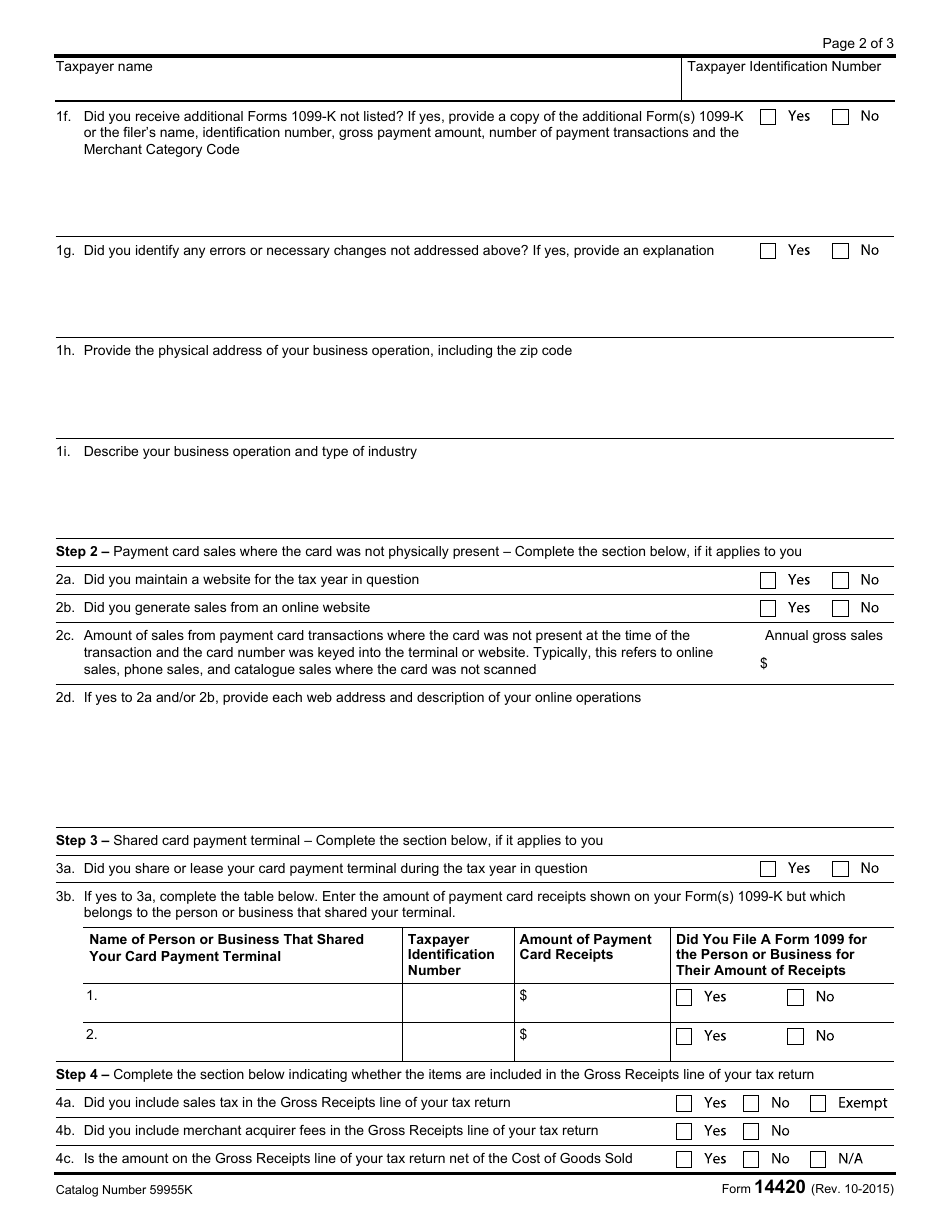

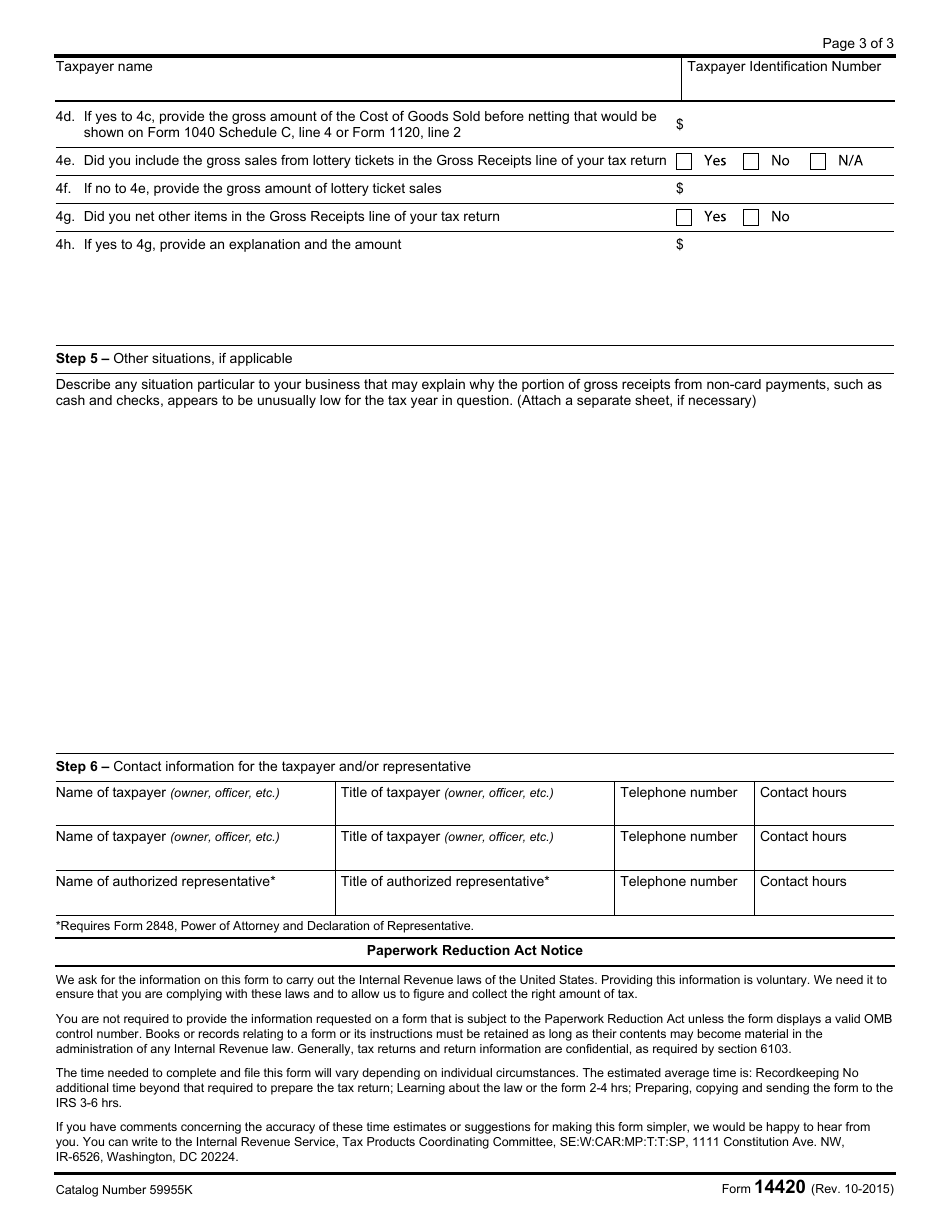

- A 3-page form available for download in PDF;

- Actual and valid for filing 2023 taxes;

- Editable, printable, and free;

- Fill out the form in our online filing application.

Download a fillable version of IRS Form 14420 through the link below or browse more documents in our library of IRS Forms.