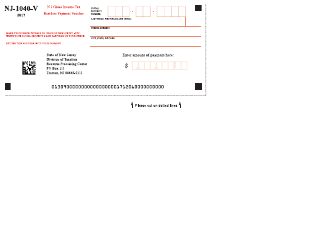

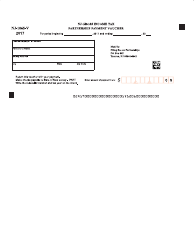

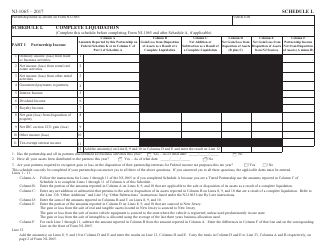

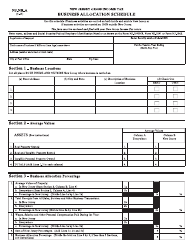

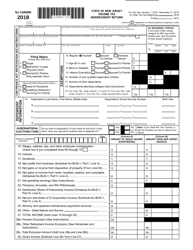

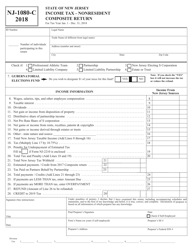

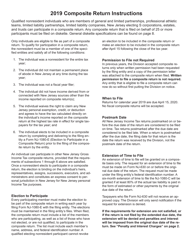

Instructions for Form NJ-1080-C, NJ-1080-E - New Jersey

This document contains official instructions for Form NJ-1080-C , and Form NJ-1080-E . Both forms are released and collected by the New Jersey Department of the Treasury.

FAQ

Q: What is Form NJ-1080-C?

A: Form NJ-1080-C is a document used in New Jersey for filing a Corporation Business Tax Return.

Q: What is Form NJ-1080-E?

A: Form NJ-1080-E is a document used in New Jersey for filing a Business Tax Telecommunications Return.

Q: Who needs to file Form NJ-1080-C?

A: Corporations that are required to pay New Jersey corporation business tax need to file Form NJ-1080-C.

Q: Who needs to file Form NJ-1080-E?

A: Telecommunication companies that are subject to the New Jersey Business Tax need to file Form NJ-1080-E.

Q: What information do I need to complete Form NJ-1080-C?

A: You will need information on your corporation's income, deductions, and credits, as well as other relevant financial information.

Q: What information do I need to complete Form NJ-1080-E?

A: You will need information on your telecommunications company's income, deductions, and credits, as well as other relevant financial information.

Q: When is the deadline to file Form NJ-1080-C?

A: Form NJ-1080-C is generally due on the 15th day of the fourth month following the close of the corporation's tax year.

Q: When is the deadline to file Form NJ-1080-E?

A: Form NJ-1080-E is generally due on the 15th day of the fourth month following the close of the tax year for telecommunications companies.

Instruction Details:

- This 8-page document is available for download in PDF;

- Might not be applicable for the current year. Choose a more recent version;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the New Jersey Department of the Treasury.