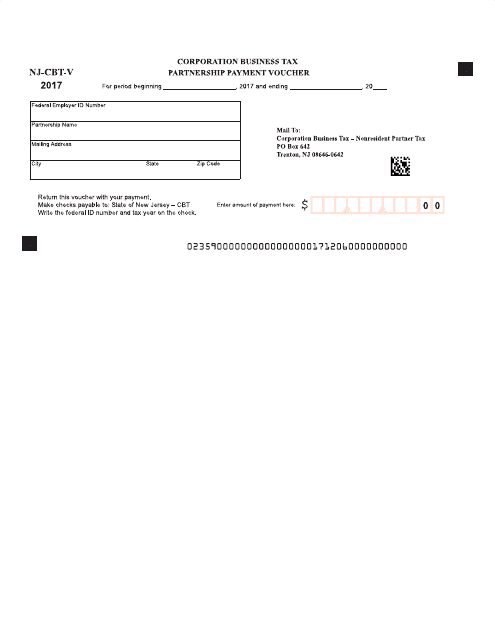

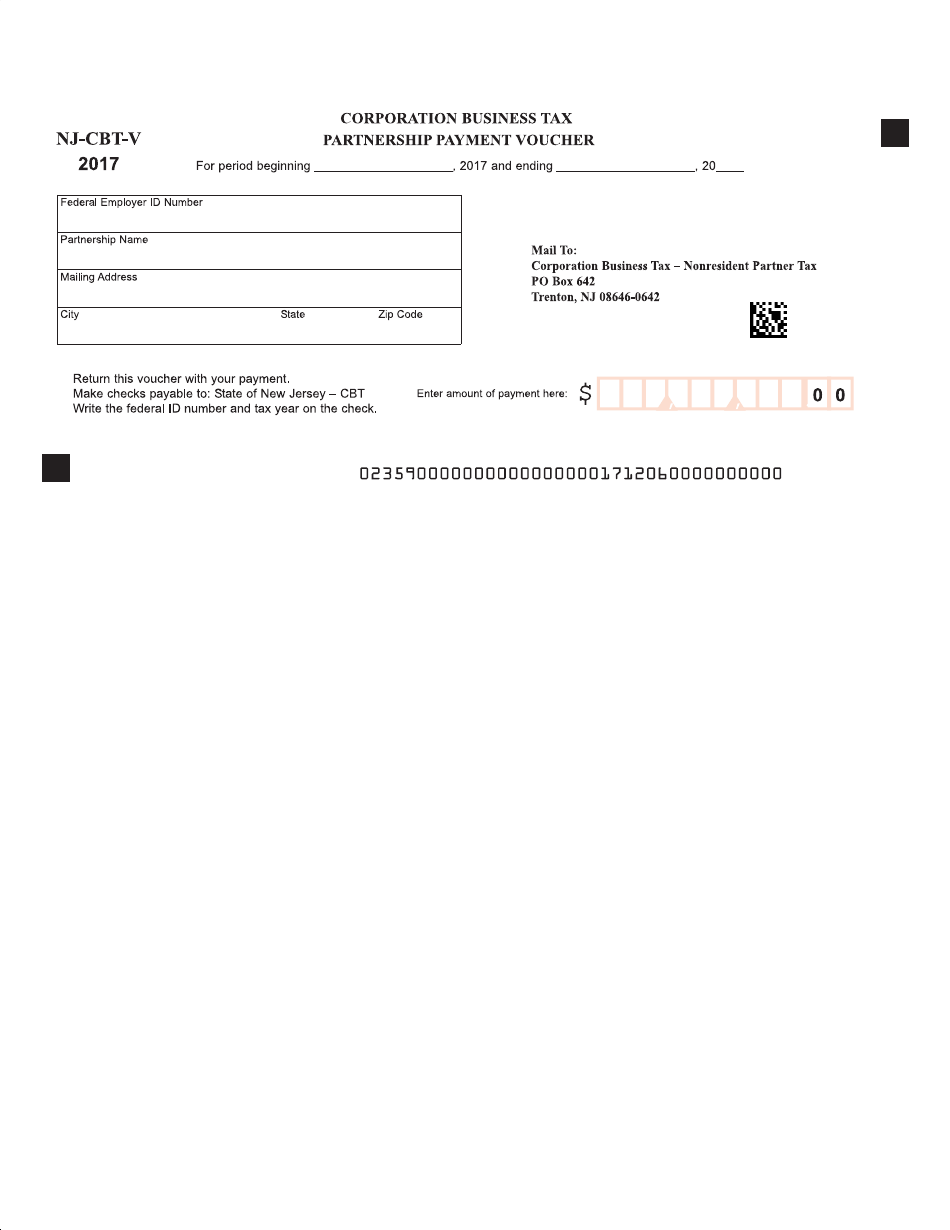

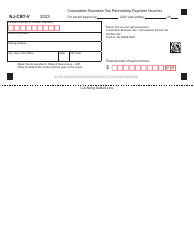

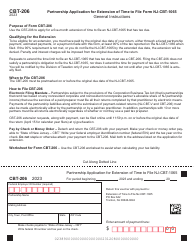

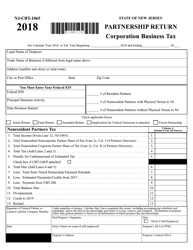

Form NJ-CBT-V Partnership Payment Voucher - New Jersey

What Is Form NJ-CBT-V?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is a Form NJ-CBT-V?

A: Form NJ-CBT-V is a payment voucher for partnership entities in New Jersey.

Q: What is the purpose of Form NJ-CBT-V?

A: The purpose of Form NJ-CBT-V is to remit payment for taxes owed by partnership entities in New Jersey.

Q: Who needs to file Form NJ-CBT-V?

A: Partnership entities in New Jersey who have taxes to pay need to file Form NJ-CBT-V.

Q: How do I fill out Form NJ-CBT-V?

A: To fill out Form NJ-CBT-V, you will need to provide your partnership's information, calculate the amount owed, and include a payment with the voucher.

Q: When is Form NJ-CBT-V due?

A: Form NJ-CBT-V is typically due on the 15th day of the fourth month following the close of the partnership's tax year.

Q: Are there any payment options available for Form NJ-CBT-V?

A: Yes, you can choose to pay by check or electronically through the New Jersey Division of Revenue and Enterprise Services.

Q: What happens if I don't file Form NJ-CBT-V?

A: If you don't file Form NJ-CBT-V, you may be subject to penalties and interest on the unpaid taxes.

Q: Is Form NJ-CBT-V only for partnership entities?

A: Yes, Form NJ-CBT-V is specifically for partnership entities in New Jersey.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-CBT-V by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.