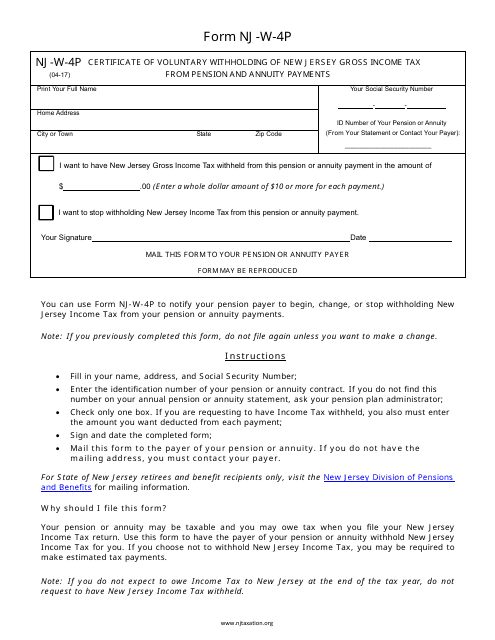

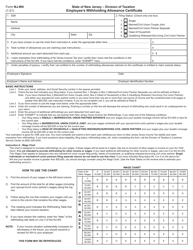

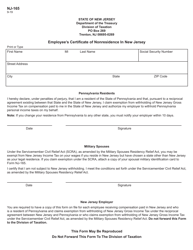

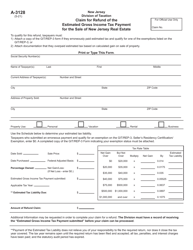

Form NJ-W-4P Certificate of Voluntary Withholding of New Jersey Gross Income Tax From Pension and Annuity Payments - New Jersey

What Is Form NJ-W-4P?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-W-4P?

A: Form NJ-W-4P is a certificate used to voluntarily withhold New Jersey Gross Income Tax from pension and annuity payments.

Q: Who should use Form NJ-W-4P?

A: Individuals receiving pension and annuity payments who want to voluntarily withhold New Jersey Gross Income Tax should use Form NJ-W-4P.

Q: What is the purpose of Form NJ-W-4P?

A: The purpose of Form NJ-W-4P is to allow individuals to request voluntary withholding of New Jersey Gross Income Tax from their pension and annuity payments.

Q: Is withholding of New Jersey Gross Income Tax mandatory?

A: No, withholding New Jersey Gross Income Tax from pension and annuity payments is voluntary.

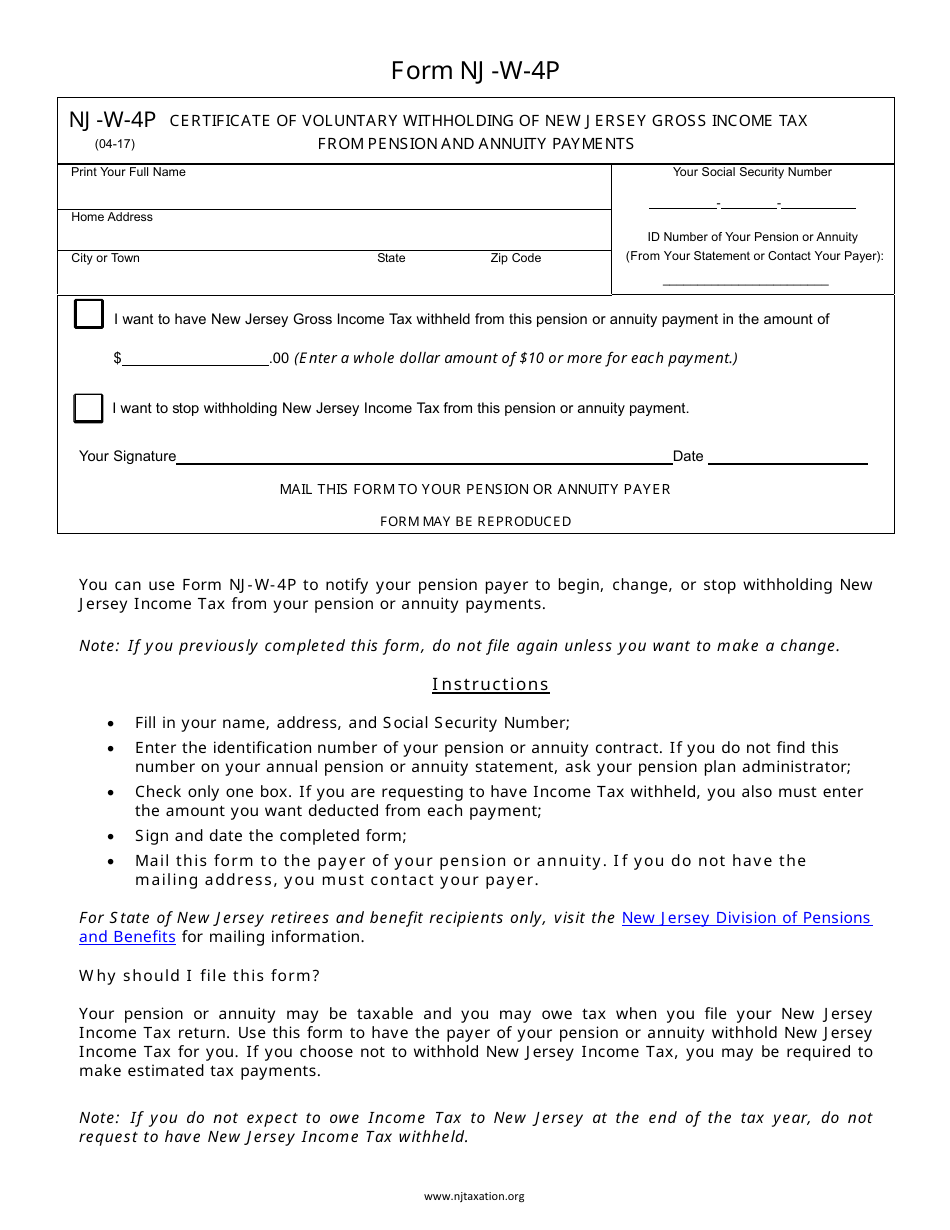

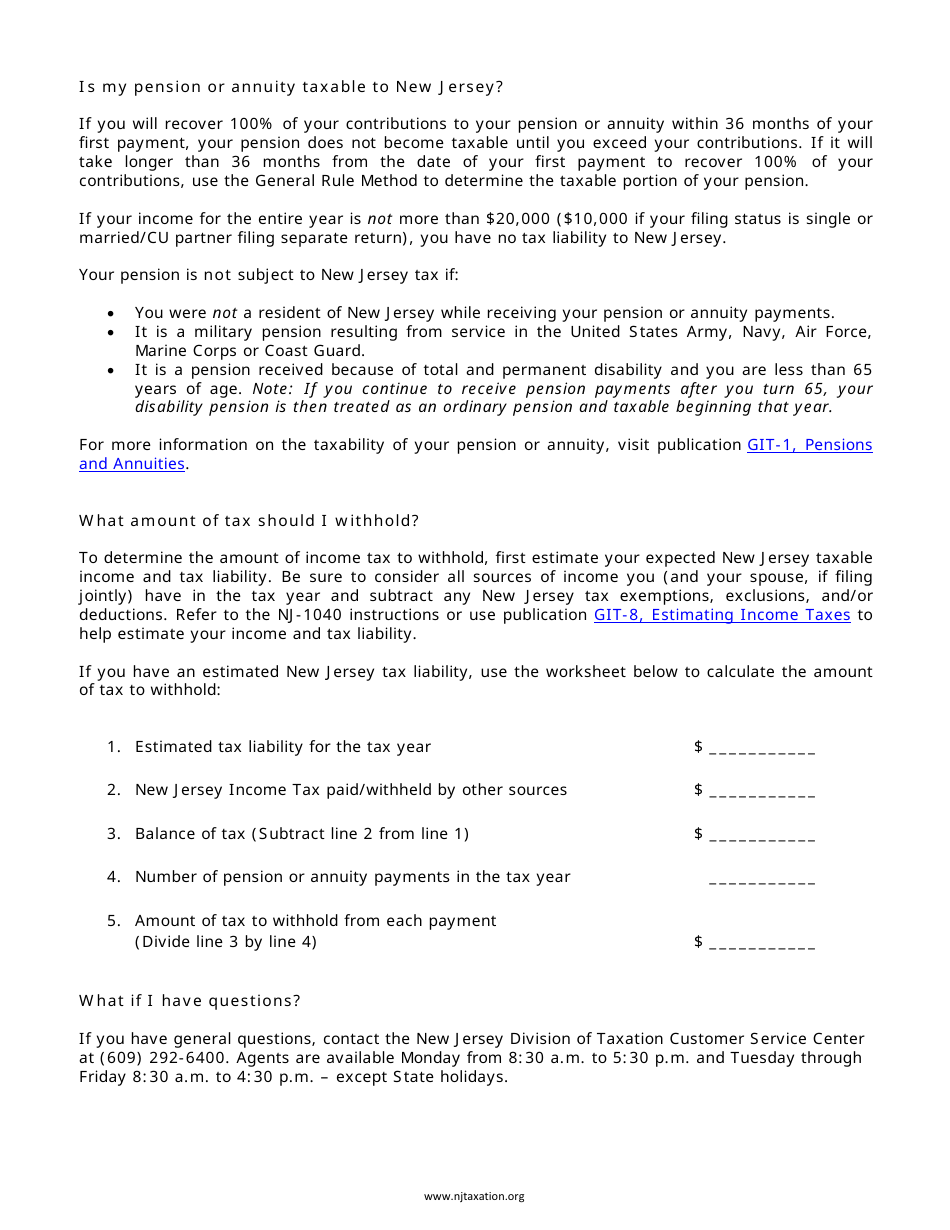

Q: How do I complete Form NJ-W-4P?

A: You need to provide your personal information and make selections regarding the amount you want withheld and any exemptions you may qualify for.

Q: When should I submit Form NJ-W-4P?

A: Submit Form NJ-W-4P to your pension or annuity payer as soon as possible to request voluntary withholding.

Q: Will I receive a copy of Form NJ-W-4P after submission?

A: Yes, you should receive a copy of Form NJ-W-4P for your records after submitting it to your pension or annuity payer.

Form Details:

- Released on April 1, 2017;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-W-4P by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.