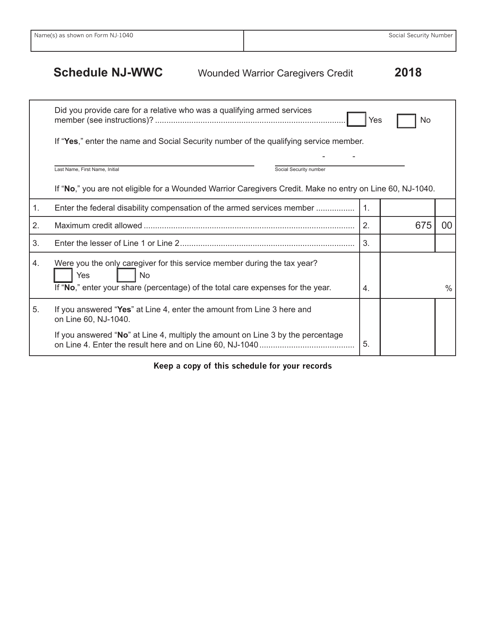

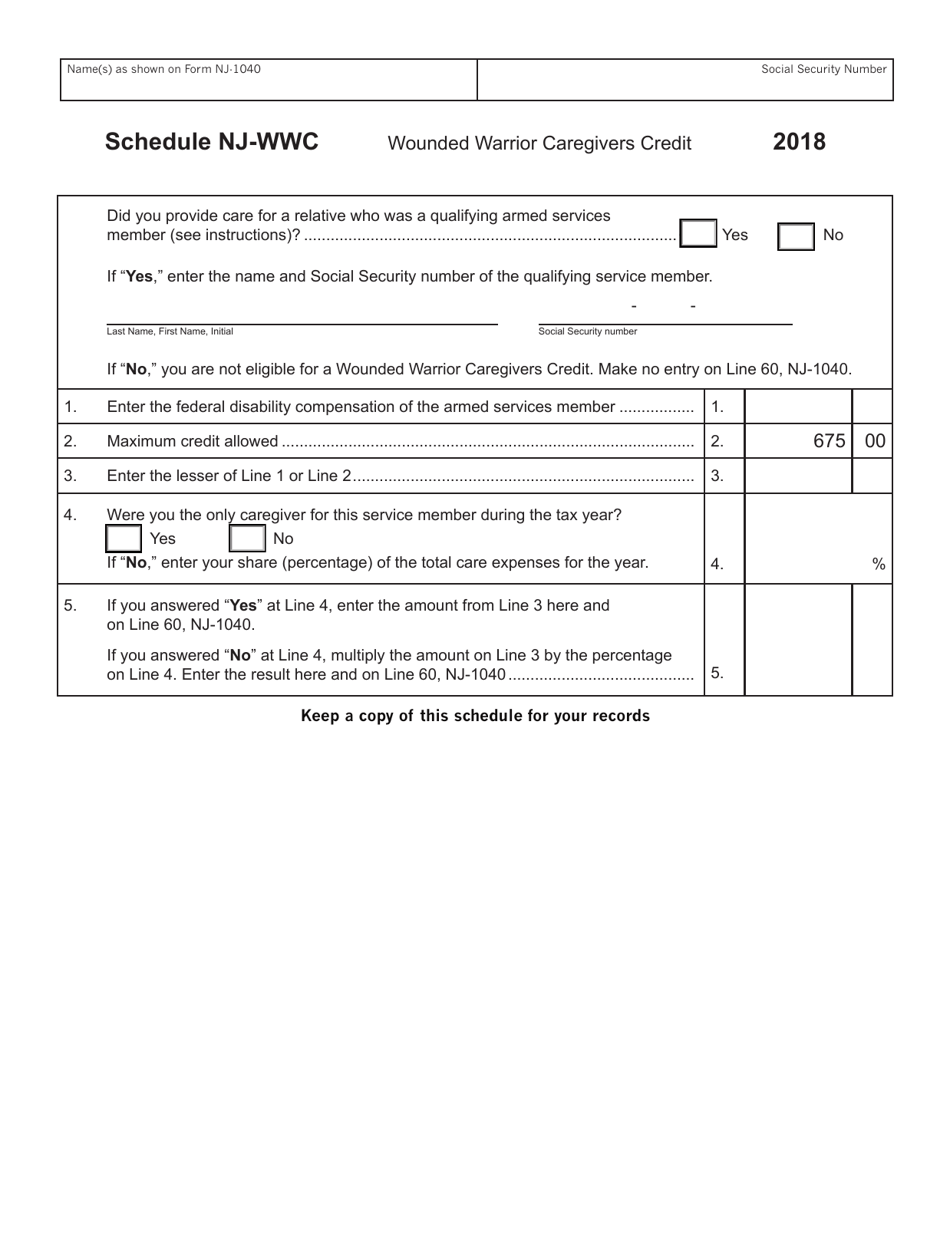

Form NJ-1040 Schedule NJ-WWC Wounded Warrior Caregivers Credit - New Jersey

What Is Form NJ-1040 Schedule NJ-WWC?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey.The document is a supplement to Form NJ-1040, Resident Income Tax Return. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is NJ-1040 Schedule NJ-WWC?

A: NJ-1040 Schedule NJ-WWC is a form used by residents of New Jersey to claim the Wounded Warrior Caregivers Credit.

Q: What is the Wounded Warrior Caregivers Credit?

A: The Wounded Warrior Caregivers Credit is a tax credit available to caregivers of certain US military veterans who were injured or disabled in the line of duty.

Q: Who is eligible for the Wounded Warrior Caregivers Credit?

A: To be eligible for the Wounded Warrior Caregivers Credit, you must be a resident of New Jersey and be the primary caregiver for a qualifying wounded warrior.

Q: What is a qualifying wounded warrior?

A: A qualifying wounded warrior is a US military veteran who was injured or disabled in the line of duty and has been certified as needing substantial ongoing assistance from a caregiver.

Q: How much is the Wounded Warrior Caregivers Credit?

A: The amount of the credit depends on the number of qualified caregivers. For tax year 2020, the credit is $140 per qualified caregiver.

Q: How do I claim the Wounded Warrior Caregivers Credit?

A: To claim the Wounded Warrior Caregivers Credit, you must complete NJ-1040 Schedule NJ-WWC and attach it to your New Jersey income tax return. You will also need to provide supporting documentation, such as a letter from the US Department of Veterans Affairs certifying the need for a caregiver.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1040 Schedule NJ-WWC by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.