This version of the form is not currently in use and is provided for reference only. Download this version of

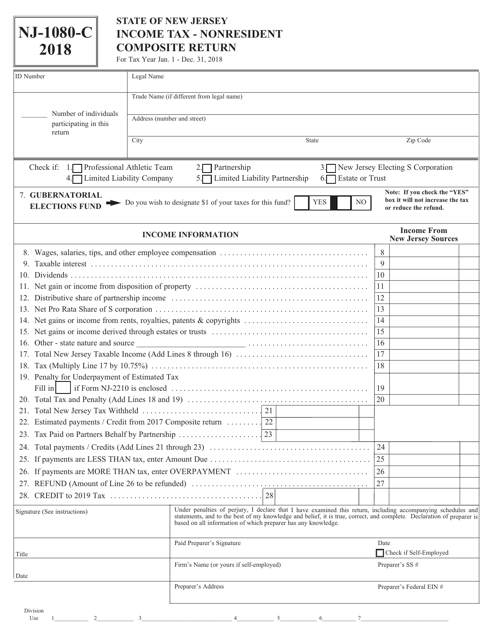

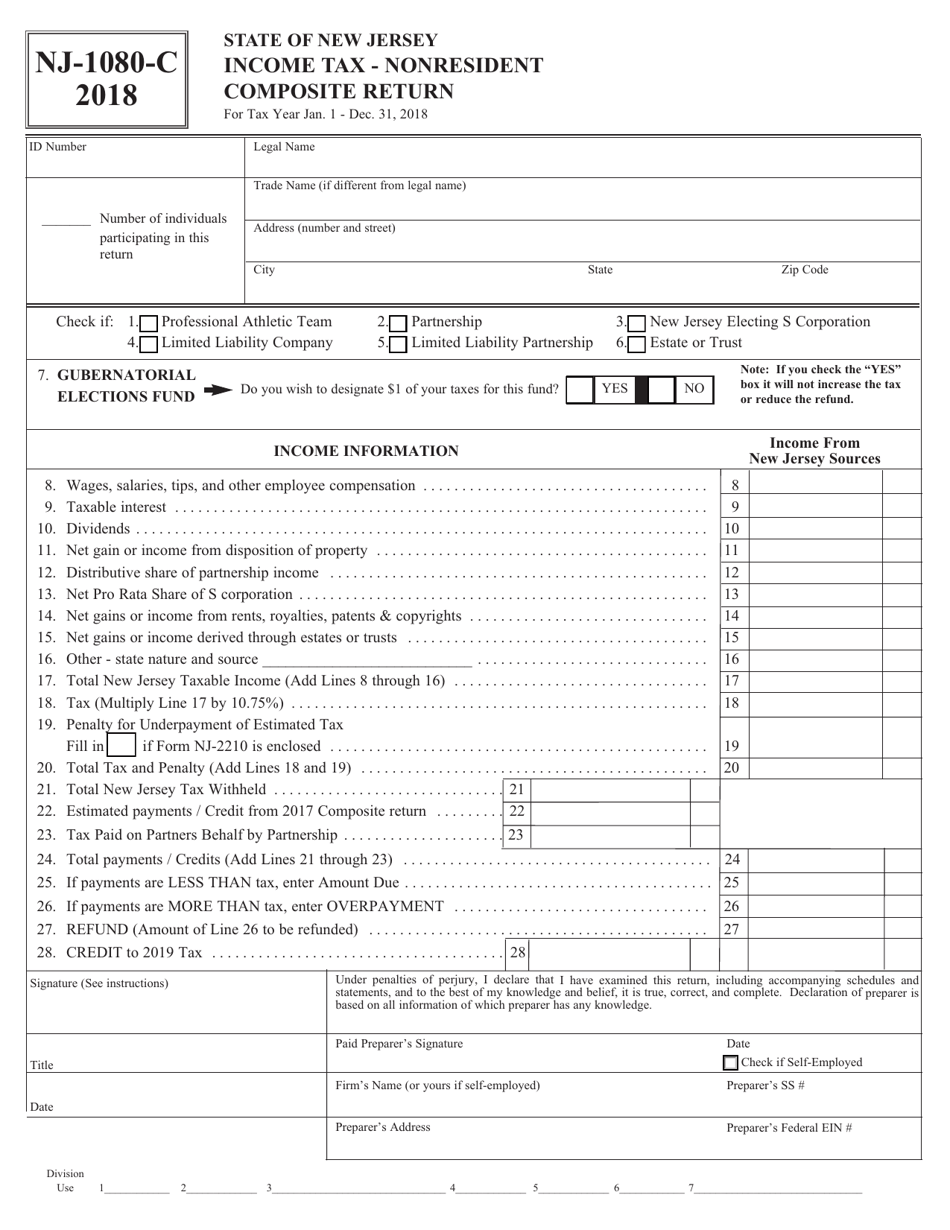

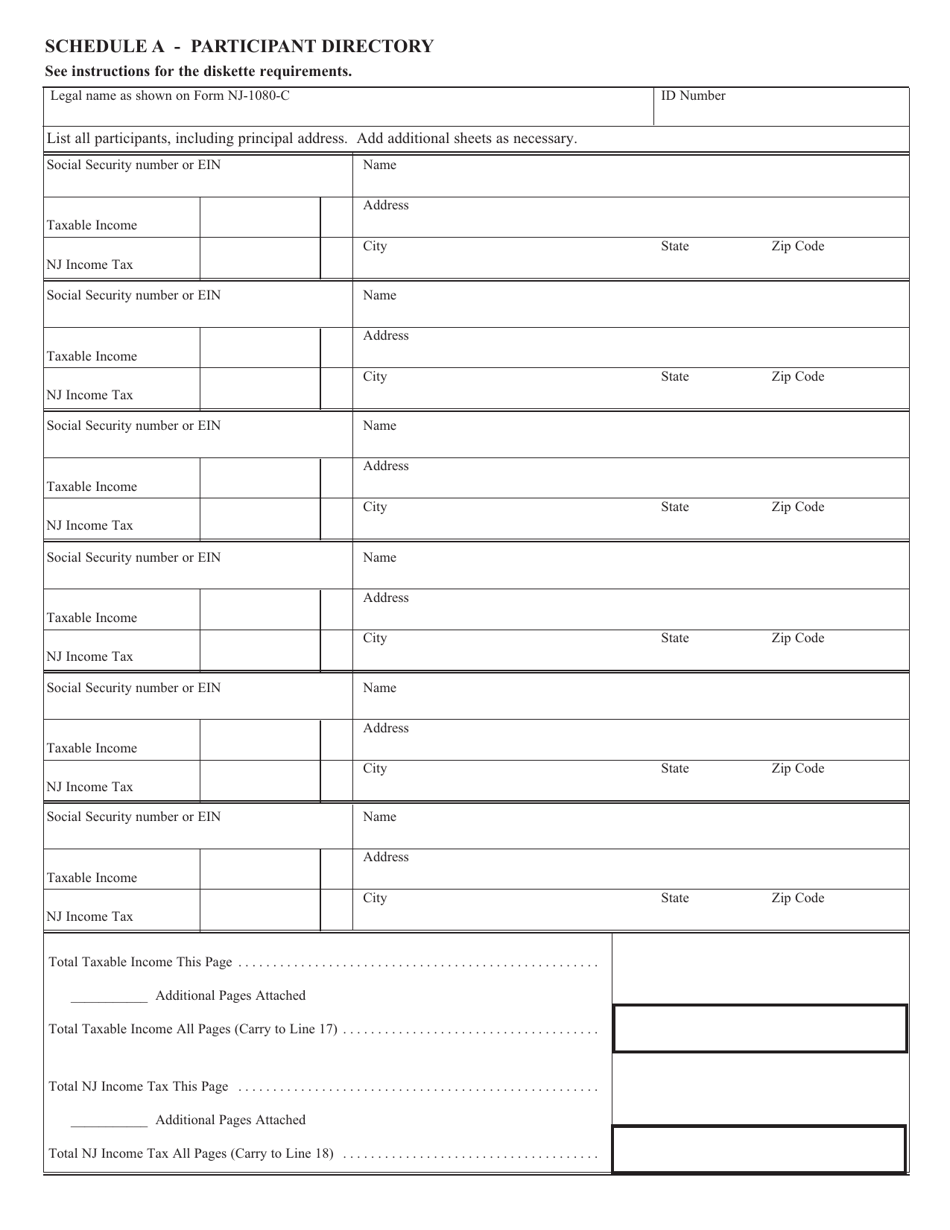

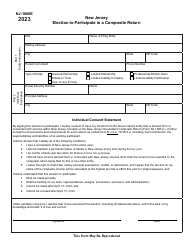

Form NJ-1080-C

for the current year.

Form NJ-1080-C Nonresident Composite Return - New Jersey

What Is Form NJ-1080-C?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-1080-C?

A: Form NJ-1080-C is a Nonresident Composite Return for New Jersey.

Q: Who should file Form NJ-1080-C?

A: Nonresident taxpayers who are part of a composite return for New Jersey should file Form NJ-1080-C.

Q: What is a composite return?

A: A composite return is a combined tax return filed on behalf of nonresident taxpayers.

Q: What is the purpose of Form NJ-1080-C?

A: Form NJ-1080-C is used to report and pay New Jersey income tax for nonresident taxpayers.

Q: When is the deadline to file Form NJ-1080-C?

A: The deadline to file Form NJ-1080-C is generally the same as the deadline for individual income tax returns, which is April 15th.

Q: Are there any exceptions to the filing deadline?

A: Yes, there may be exceptions for certain situations. It's best to consult the instructions for Form NJ-1080-C or the New Jersey Division of Taxation for specific details.

Q: Are there any penalties for late filing?

A: Yes, there may be penalties for late filing. It's important to file Form NJ-1080-C by the deadline to avoid any potential penalties.

Form Details:

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-1080-C by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.