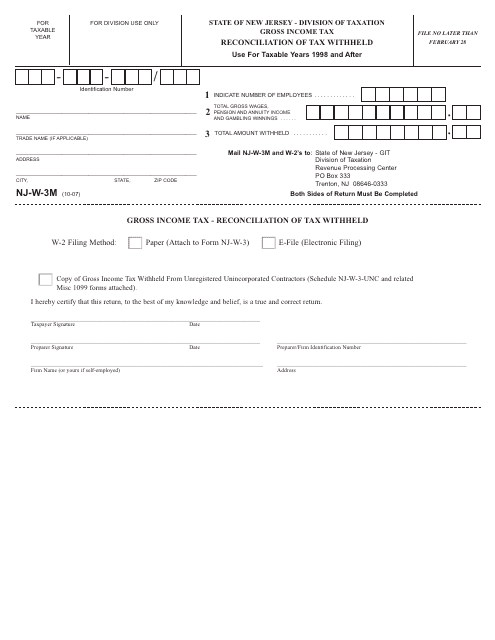

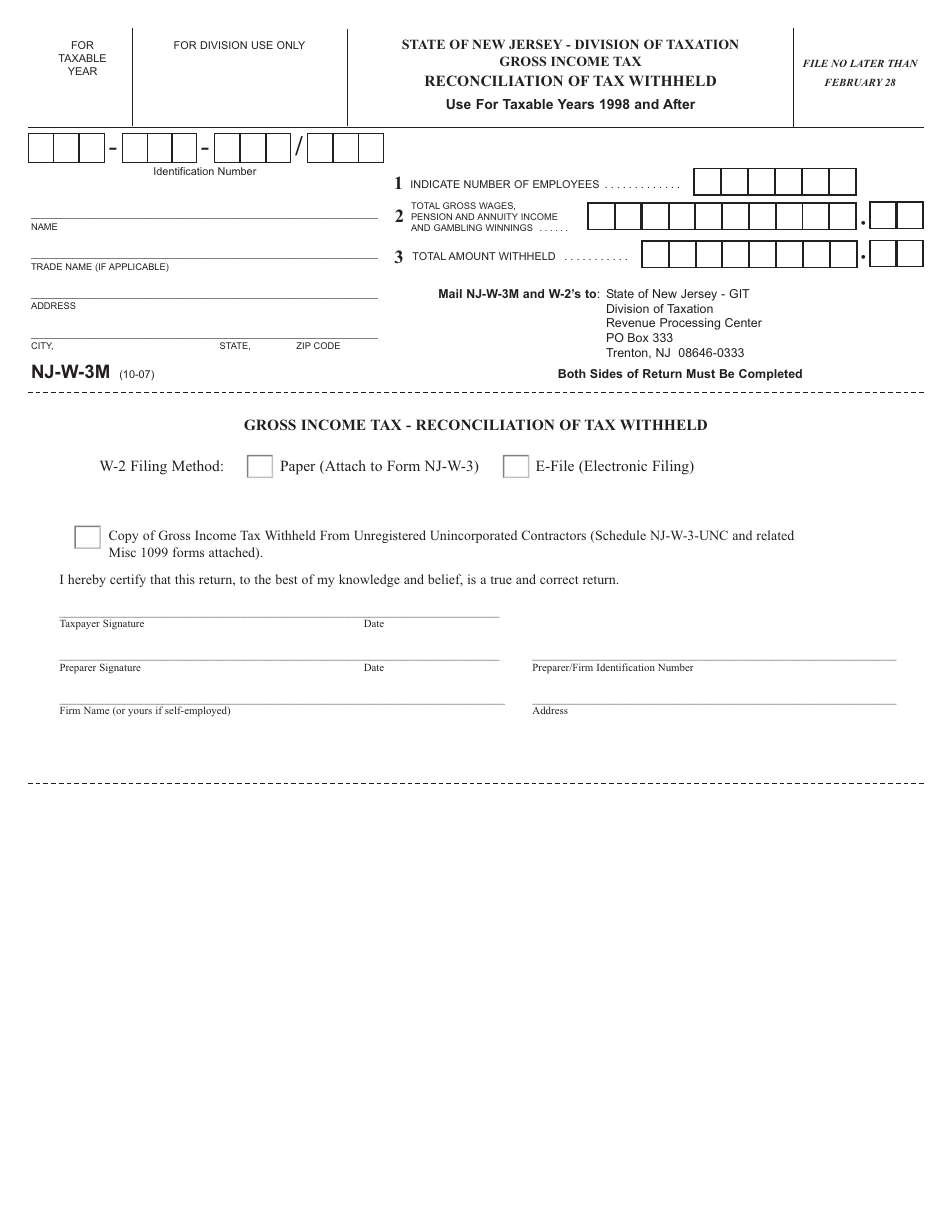

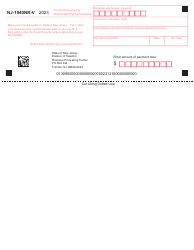

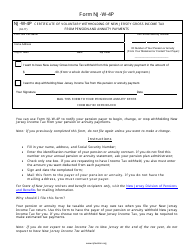

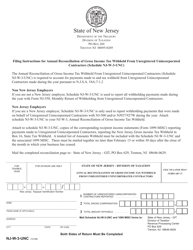

Form NJ-W-3M Reconciliation of Tax Withheld - New Jersey

What Is Form NJ-W-3M?

This is a legal form that was released by the New Jersey Department of the Treasury - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form NJ-W-3M?

A: Form NJ-W-3M is the Reconciliation of Tax Withheld specifically for New Jersey.

Q: Who needs to file Form NJ-W-3M?

A: Employers who withheld New Jersey income tax from their employees' wages during the tax year need to file Form NJ-W-3M.

Q: What is the purpose of Form NJ-W-3M?

A: Form NJ-W-3M is used to reconcile the total amount of New Jersey income tax withheld from employees' wages with the total amount of income tax reported on Form NJ-927.

Q: When is Form NJ-W-3M due?

A: Form NJ-W-3M is due on or before February 15 of the following year.

Q: Is Form NJ-W-3M the same as Form W-2?

A: No, Form NJ-W-3M is not the same as Form W-2. While Form W-2 reports wages and withholdings for federal taxes, Form NJ-W-3M specifically reconciles New Jersey income tax withholdings.

Q: Are there any penalties for not filing Form NJ-W-3M?

A: Yes, failure to file Form NJ-W-3M or filing it late may result in penalties and interest.

Q: Do I need to include copies of Form W-2 with Form NJ-W-3M?

A: No, you don't need to include copies of Form W-2 with Form NJ-W-3M. However, you must keep them for your records.

Q: What if I made an error on Form NJ-W-3M?

A: If you made an error on Form NJ-W-3M, you should file an amended Form NJ-W-3M as soon as possible to correct the mistake.

Form Details:

- Released on October 1, 2007;

- The latest edition provided by the New Jersey Department of the Treasury;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form NJ-W-3M by clicking the link below or browse more documents and templates provided by the New Jersey Department of the Treasury.