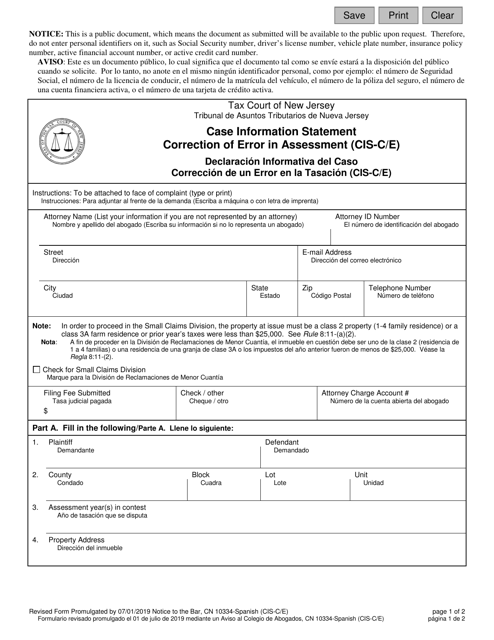

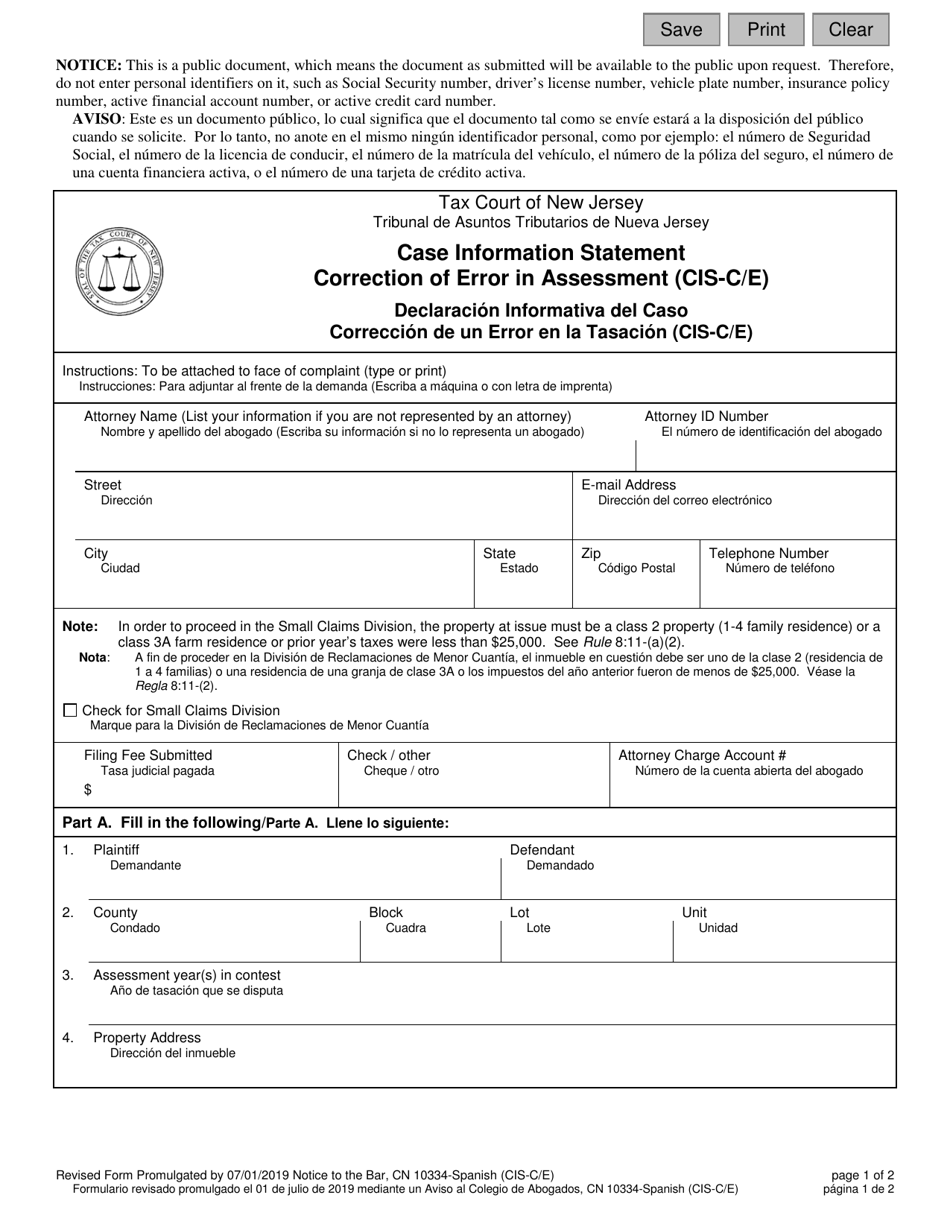

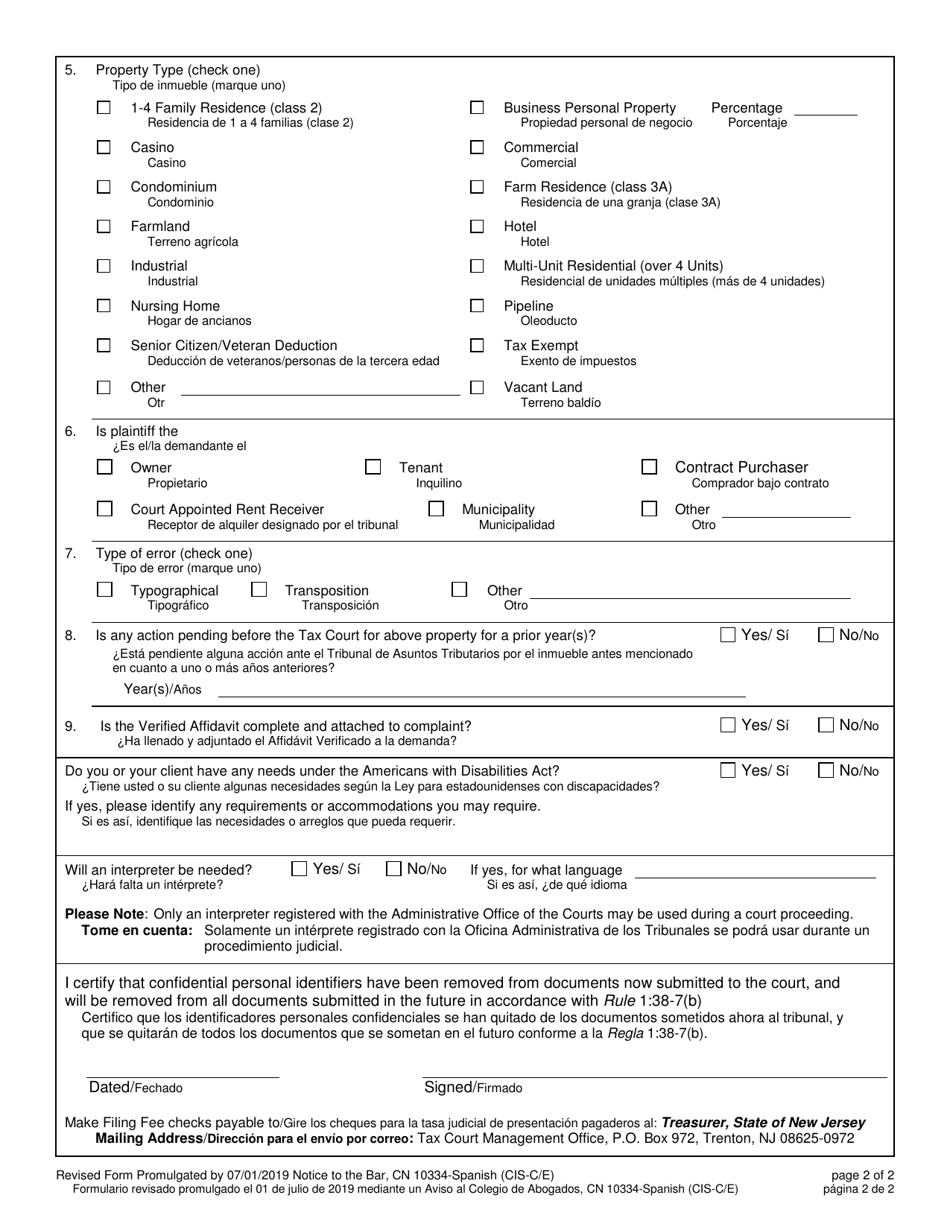

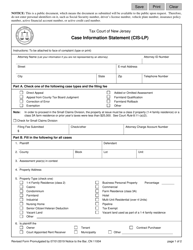

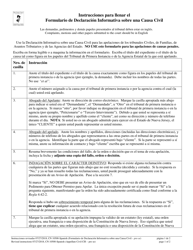

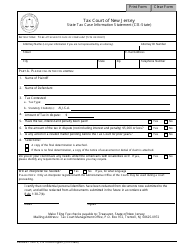

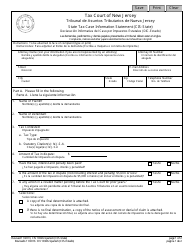

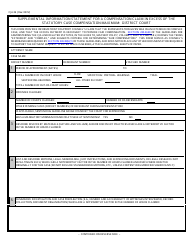

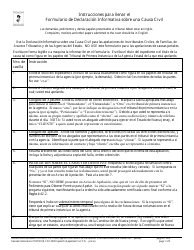

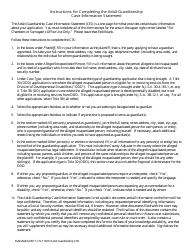

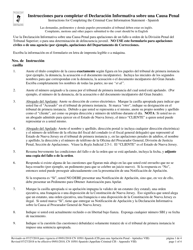

Form 10334 Case Information Statement Correction of Error in Assessment (Cis-C / E) - New Jersey (English / Spanish)

What Is Form 10334?

This is a legal form that was released by the Tax Court of New Jersey - a government authority operating within New Jersey. As of today, no separate filing guidelines for the form are provided by the issuing department.

FAQ

Q: What is Form 10334?

A: Form 10334 is the Case Information Statement Correction of Error in Assessment (CIS-C/E) form.

Q: What is the purpose of Form 10334?

A: The purpose of Form 10334 is to correct errors in property assessment in New Jersey.

Q: Who should use Form 10334?

A: Property owners in New Jersey who believe there is an error in their property assessment should use Form 10334.

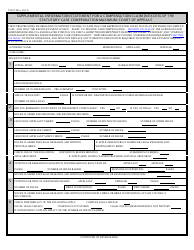

Q: Is Form 10334 available in multiple languages?

A: Yes, Form 10334 is available in both English and Spanish.

Q: What information is required on Form 10334?

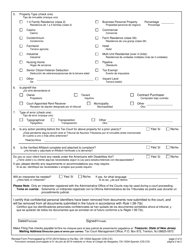

A: Form 10334 requires information such as property address, assessment information, and reason for the correction request.

Q: Is there a deadline for submitting Form 10334?

A: Yes, Form 10334 should be submitted within 45 days of the postmark date on the assessor's notice of valuation or when the error was discovered.

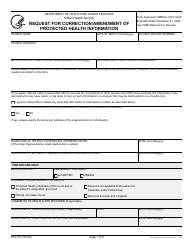

Q: What happens after submitting Form 10334?

A: After submitting Form 10334, the County Board of Taxation will review the request and make a determination.

Q: Can I appeal the decision made by the County Board of Taxation?

A: Yes, if you disagree with the decision made by the County Board of Taxation, you can file an appeal with the Tax Court of New Jersey.

Q: Are there any fees associated with filing Form 10334?

A: There are no fees associated with filing Form 10334.

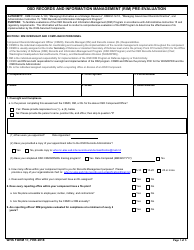

Form Details:

- Released on July 1, 2019;

- The latest edition provided by the Tax Court of New Jersey;

- Easy to use and ready to print;

- Quick to customize;

- Compatible with most PDF-viewing applications;

- Fill out the form in our online filing application.

Download a fillable version of Form 10334 by clicking the link below or browse more documents and templates provided by the Tax Court of New Jersey.