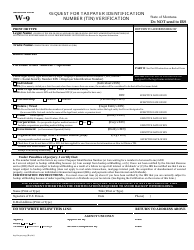

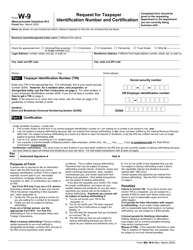

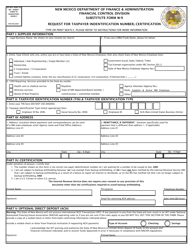

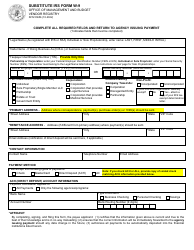

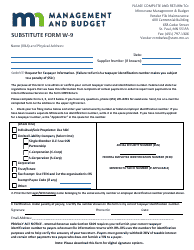

Instructions for Form W-9 Substitute Form - Massachusetts

This document contains official instructions for Form W-9 , Substitute Form - a form released and collected by the Massachusetts Department of Correction.

FAQ

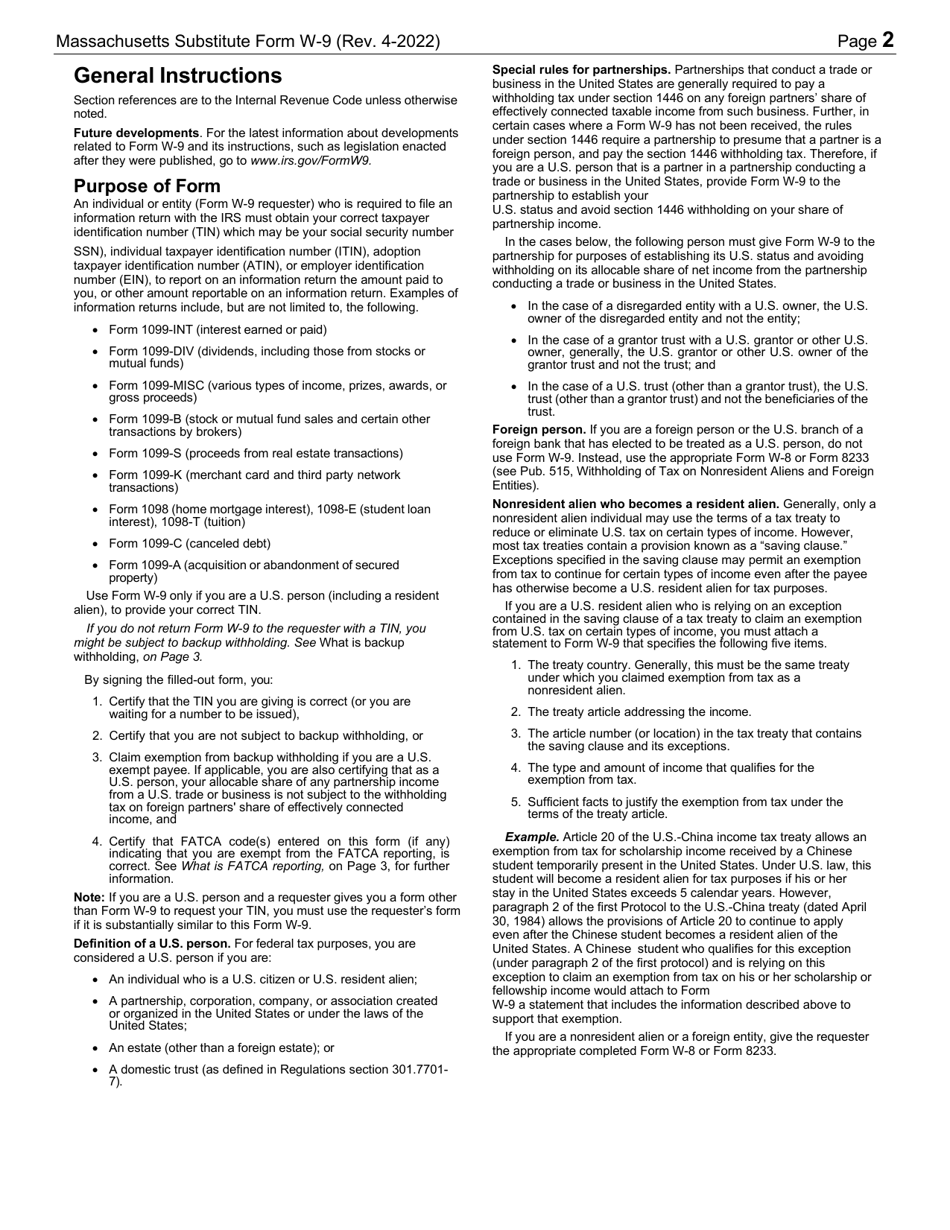

Q: What is Form W-9?

A: Form W-9 is a tax form used to provide your taxpayer identification number (TIN) to a person who is required to file an information return with the Internal Revenue Service (IRS).

Q: Why is Form W-9 required?

A: Form W-9 is required to ensure that the person or entity paying you meets their reporting obligations to the IRS.

Q: Who needs to fill out Form W-9?

A: You need to fill out Form W-9 if you are a U.S. citizen or resident alien, and you are being asked to provide your TIN to a person or entity for tax reporting purposes.

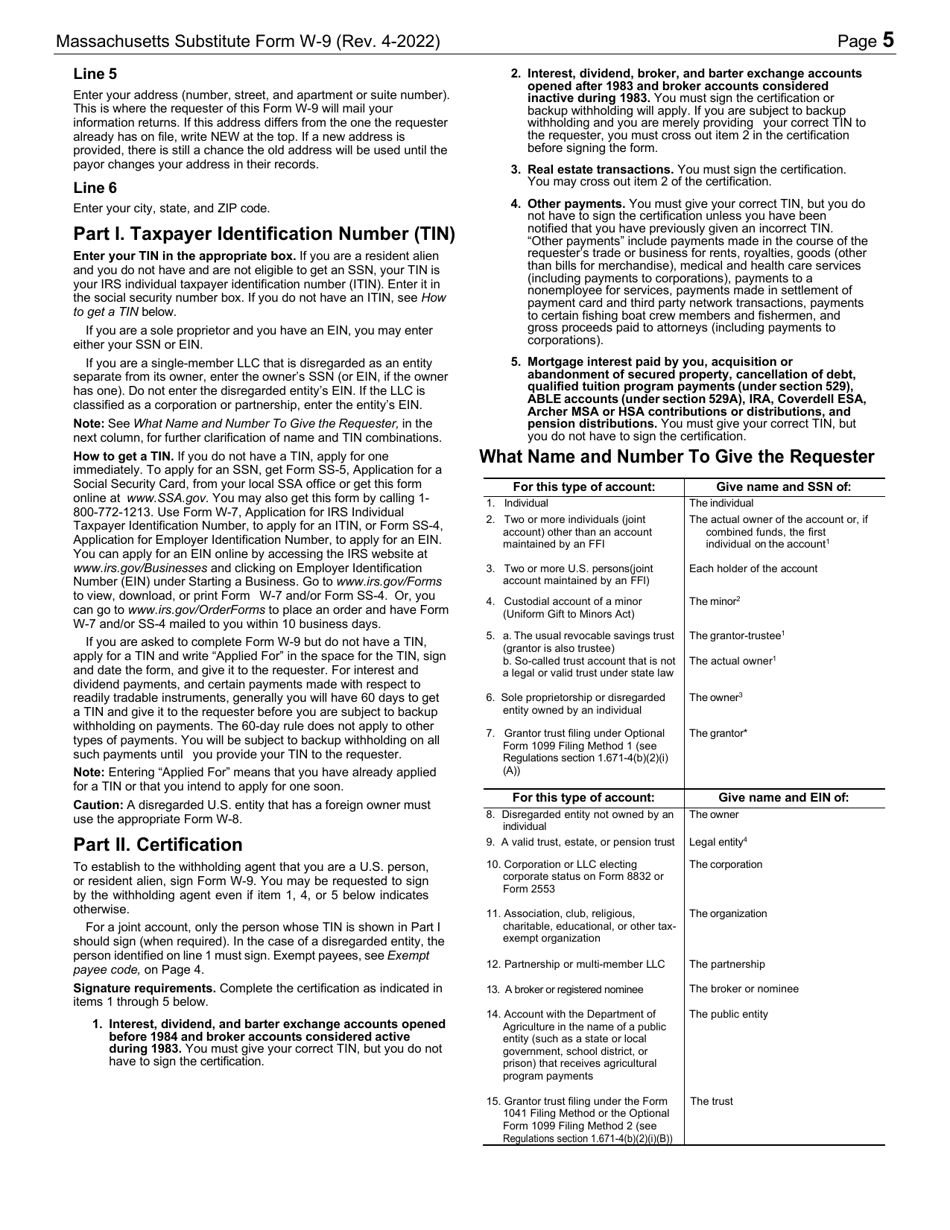

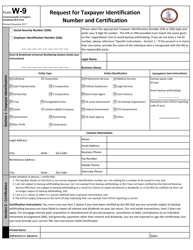

Q: How do I fill out Form W-9?

A: Fill out your name, address, business name if applicable, and your TIN (Social Security Number or Employer Identification Number). Sign and date the form.

Q: What happens after I fill out Form W-9?

A: After you fill out Form W-9, the person or entity requesting the form will use the information to prepare their information returns, such as Form 1099, to report payments made to you to the IRS.

Q: Does Form W-9 need to be sent to the IRS?

A: No, you do not need to send Form W-9 to the IRS unless specifically asked to do so.

Instruction Details:

- This 5-page document is available for download in PDF;

- Actual and applicable for the current year;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of forms released by the Massachusetts Department of Correction.