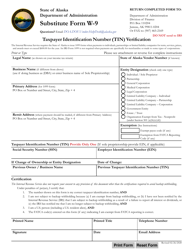

This version of the form is not currently in use and is provided for reference only. Download this version of

Instructions for IRS Form W-9

for the current year.

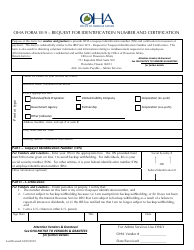

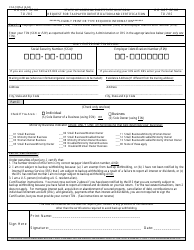

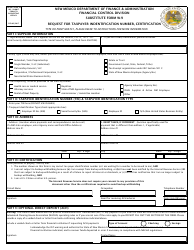

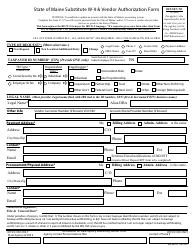

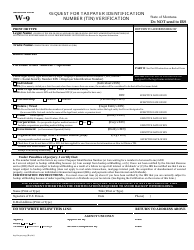

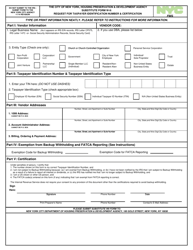

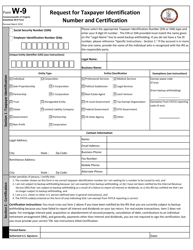

Instructions for IRS Form W-9 Request for Taxpayer Identification Number and Certification

This document contains official instructions for IRS Form W-9 , Request for Taxpayer Identification Number and Certification - a tax form released and collected by the Internal Revenue Service (IRS), a subdivision of the U.S. Department of the Treasury. An up-to-date fillable IRS Form W-9 is available for download through this link.

FAQ

Q: What is IRS Form W-9?

A: IRS Form W-9 is a form used to request the taxpayer identification number and certification from a US resident or US entity.

Q: Who needs to fill out IRS Form W-9?

A: US residents or US entities who are being paid for their services or other income-generating activities need to fill out IRS Form W-9.

Q: What is the purpose of IRS Form W-9?

A: The purpose of IRS Form W-9 is to provide the requester with the necessary information they need to prepare an information return, such as a Form 1099, for the taxpayer.

Q: What information is required on IRS Form W-9?

A: IRS Form W-9 requires the taxpayer to provide their name, business name, taxpayer identification number (such as a Social Security Number or Employer Identification Number), address, and whether they are exempt from backup withholding.

Q: When should I submit IRS Form W-9?

A: You should submit IRS Form W-9 to the requester as soon as possible to ensure timely processing of any applicable tax forms and to avoid backup withholding.

Q: Do I need to include any supporting documents with IRS Form W-9?

A: No, you do not need to include any supporting documents with IRS Form W-9. The form is typically submitted on its own.

Q: What happens after I submit IRS Form W-9?

A: After you submit IRS Form W-9, the requester will use the information provided to prepare any necessary tax forms, such as a Form 1099, and report the income you received.

Q: Do I need to keep a copy of IRS Form W-9 for my records?

A: Yes, it is recommended to keep a copy of IRS Form W-9 for your records in case you need to refer to it in the future.

Q: Is IRS Form W-9 used for filing tax returns?

A: No, IRS Form W-9 is not used for filing tax returns. It is used by the requester to gather information about the taxpayer for reporting purposes.

Instruction Details:

- This 4-page document is available for download in PDF;

- Actual and applicable for filing 2023 taxes;

- Complete, printable, and free.

Download your copy of the instructions by clicking the link below or browse hundreds of other forms in our library of IRS-released tax documents.